Next Week's Risk Dashboard

- Mean reversion on the Canada-US inflation spread is getting overdue

- Canadian CPI could face upside risk

- The BoC should be far more patient

- Will China further compress a key loan spread?

- FOMC minutes likely to be stale on arrival

- Eurozone negotiated wages to inform ECB pricing

- UK CPI one of two prints before the June BoE

- Tumbling Japanese core inflation is a warning sign to the BoJ

- Canadian retail sales are not that bad

- A light week for US macro risk

- Chile’s economy is expected to rebound

- Chile’s central bank could follow the downshifting LatAm pattern

- RBNZ may lean against market pricing

- BoK could stare down won gains

- BI likely to hold after surprise hike

- Turkey’s volatile central bank expected to hold

- PMIs: EZ, UK, Japan, Au, US, India

- Global macro

Chart of the Week

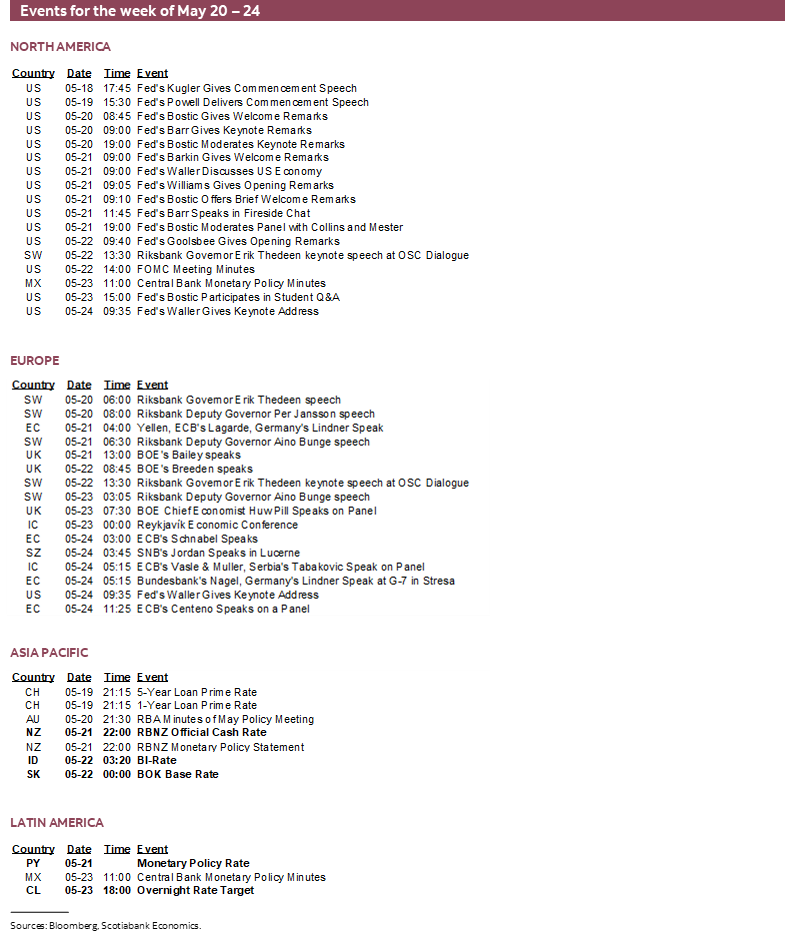

With each passing week or month the debate over what central bank may buckle next and when intensifies. This week will bring a potentially key Canadian inflation report to inform timing and probabilities for easing by the Bank of Canada. It shouldn’t be so key, but it feels like an exceptionally low bar is set in Canada to dangerously over react to what may be a very temporary and short-lived soft patch on core inflation.

UK CPI may play the same role by informing timing next steps by the Bank of England. So could important Eurozone negotiated wage figures. Another update on Japanese core inflation is likely to intensify warning signs that the BoJ is off base tightening as the economy tanks, core inflation tumbles, and two years of Shunto wage gains are not lifting average wages.

Central bank watching will also include monitoring potentially stale FOMC minutes, any further action by the PBOC to compress loan spreads in the property market, and a series of decisions by regional central banks. Macro data risk will exist across multiple markets.

CANADIAN INFLATION—MORE EVIDENCE REQUIRED!!

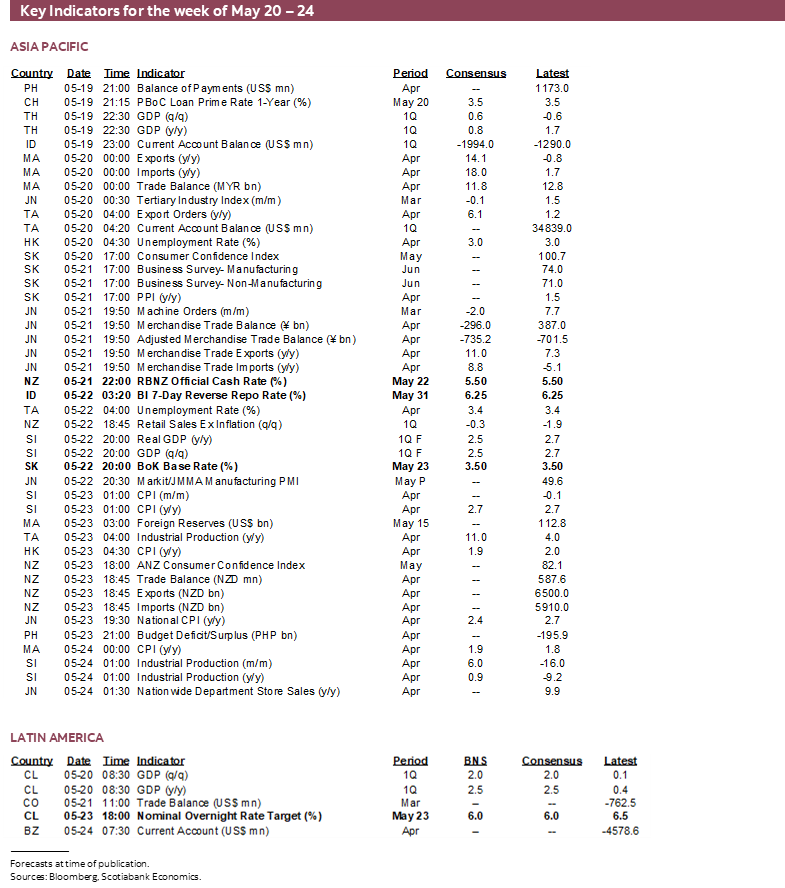

Canada updates CPI inflation figures for April on Tuesday. It’s the last inflation reading before the June 5th BoC decision with markets assigning less than 50% odds to a cut.

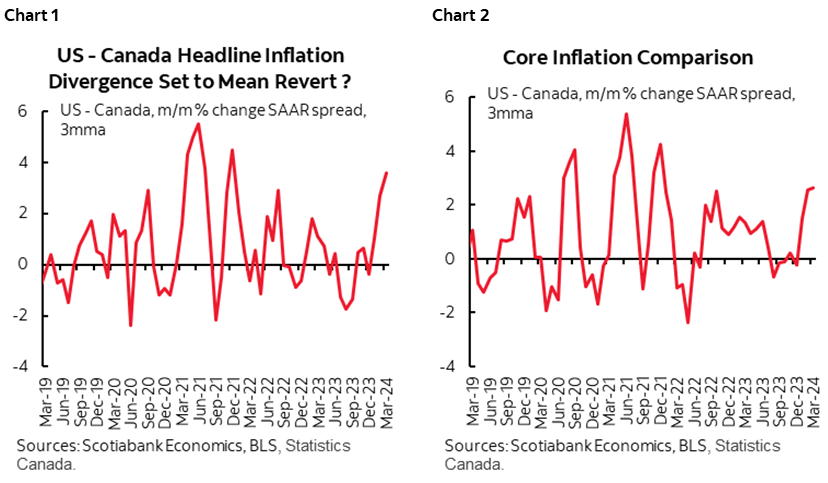

Key is whether the unusual spread between US and Canadian headline inflation (chart 1) and core inflation (chart 2) will mean revert as it has tended to do many times in the past when temporary deviations unfold and given the integration of the two economies. By this argument we’re getting due for an upside surprise from Canada.

I’ve estimated a soft gain of 0.4% m/m NSA that translates into about 0.1% m/m seasonally adjusted change in overall prices. There is probably more upside risk than downside risk to this estimate, but it’s also not the reading that will matter most.

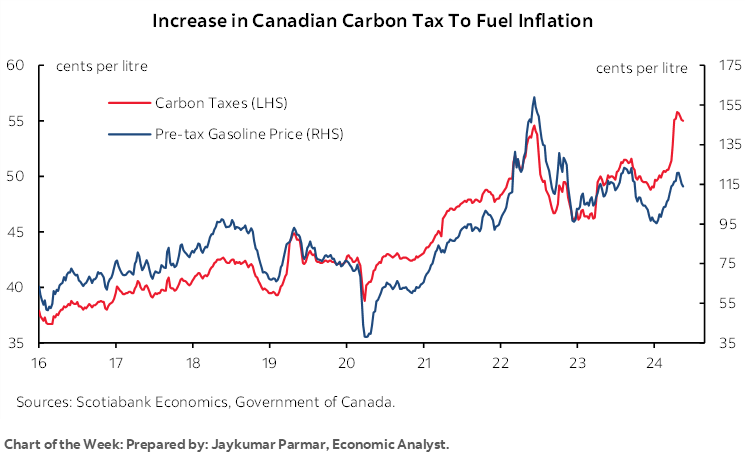

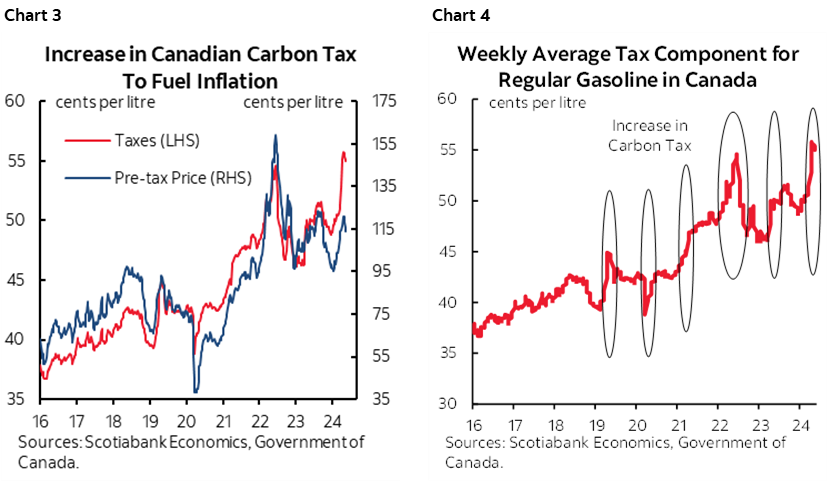

Among the drivers is that April is usually a fairly soft month for seasonal price effects that would affect the NSA number. Gas prices were up by 7.7% NSA in April primarily because of higher prices ex-taxes but also due to a hike in the carbon tax (chart 3). A brief history of support for carbon levies and caps across provinces and both the federal Conservative and Liberal parties is here lest anyone try to erase their history. The Trudeau administration has delivered multiple hikes in the carbon tax to date (chart 4) and with years of gains ahead. The higher carbon tax will also have a smaller effect on other fuels like diesel and home heating costs. Food prices are estimated to offer little weighted contribution to month-over-month inflation but could face modest upside.

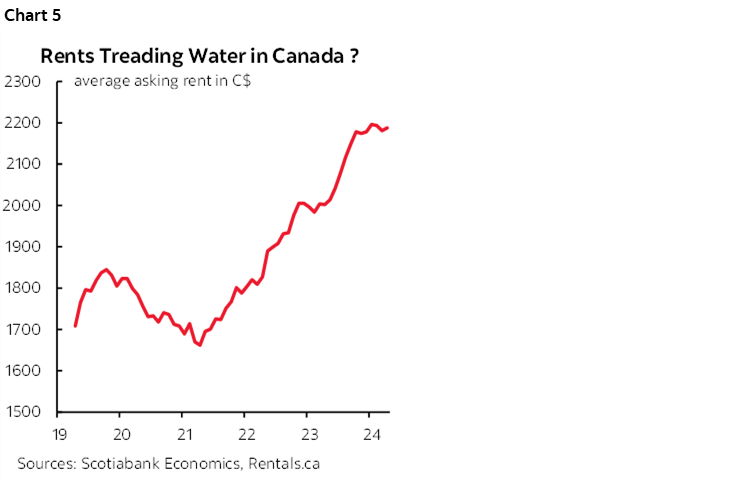

Shelter cost inflation excluding the effects of mortgage interest likely remained firm and this accounts for a quarter of the basket. Proxies for national rent continued to exert pressure; what is often a down month for seasonal rent pressures looks to have held firm (chart 5). The BoC is mandated to target total inflation at a 2% pace and so it’s silly for other shops to argue that a quarter of the basket should be ignored by the BoC. Some of those same shops from what I hear continue to advance nonsense about how the BoC’s is being fooled by mortgage interest contributions to inflation when mortgage interest hasn’t even been included in either of the BoC’s two preferred core readings at any time in the pandemic.

Key, however, will be the trimmed mean and weighted median CPI readings in m/m SAAR terms and on a smoothed three month moving average basis. They have weakened over Q1, but with solid reason to think that this is temporary as explained in prior notes (here). It’s unclear if we’ll start to see firmer core prices just yet or over the coming months, but it’s possible this time around.

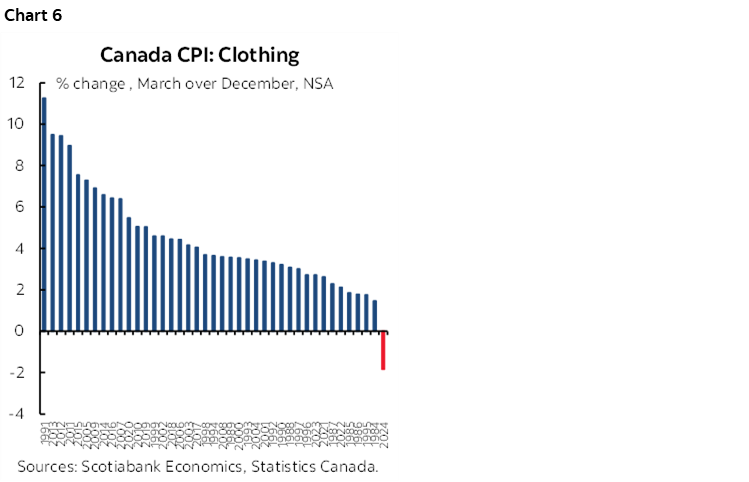

For one thing, there is only one single quarter on record when q/q clothing prices fell in Q1 and that was this year (chart 6). Why? I think it’s because El Nino drove a milder and drier than usual winter that fed less demand for winter clothing and hence more price discounting to make way for Spring and Summer apparel. That should be temporary. Other weather-related categories like airfare and travel tour prices were also softer than seasonally normal.

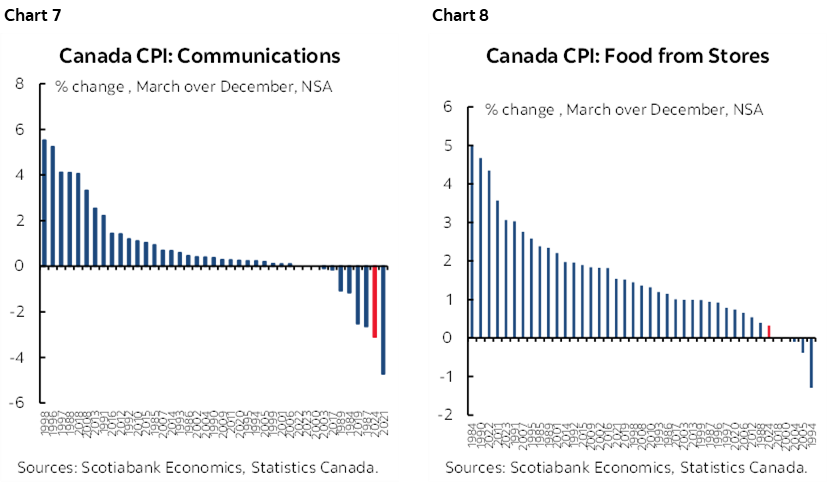

Quasi-regulated prices also explained some of the disinflation. The CEOs of telecom and grocery companies were hauled in front of parliamentary committees that wagged a finger at them for price hikes and threatened them with industry-specific levies into the Budget. That’s easier than government blaming itself for spending too much, thereby driving a considerable portion of the inflation and rate hikes we’ve had. Regardless, what this did was to drive unusual price softness in categories like communications and groceries (charts 7, 8).

If these factors shake out and revert higher, then they may pop back into headline and core measures of inflation. Timing it is very difficult since we can’t judge most of the prices that guide extremely sensitive m/m SAAR calculations for trimmed mean and weighted median CPI in advance of each report.

Mean reversion would restore the connection between US and Canadian CPI inflation that are typically highly correlated to one another. That correlation broke down over the past six months when US core inflation was soft but Canadian core inflation was hot in 2023Q4, only to reverse the pattern with soft Canadian core and hot US core into 2024Q1.

In a longer-run sense, I continue to believe that inflation risk is higher in Canada than the US. The latest delivery of that thesis was during a series of meetings with fixed income and equity clients in Montreal and Toronto. If I had my druthers, the BoC would not change its policy rate at all this year and it certainly would not front-run the Fed.

Pending Tuesday’s outcome and maybe what happens to GDP figures toward the end of the month, I think Governor Macklem sent a strong signal on May 2nd that he was not leaning toward a June cut. One way in which he did so was by saying that they wanted to evaluate “months” of further data in a plural sense. May 2nd was one month before June 5th and there was only one month of CPI data ahead of him when he issued that comment. If the central bank chooses its words carefully, then it would not have had such a reference if June was a live meeting.

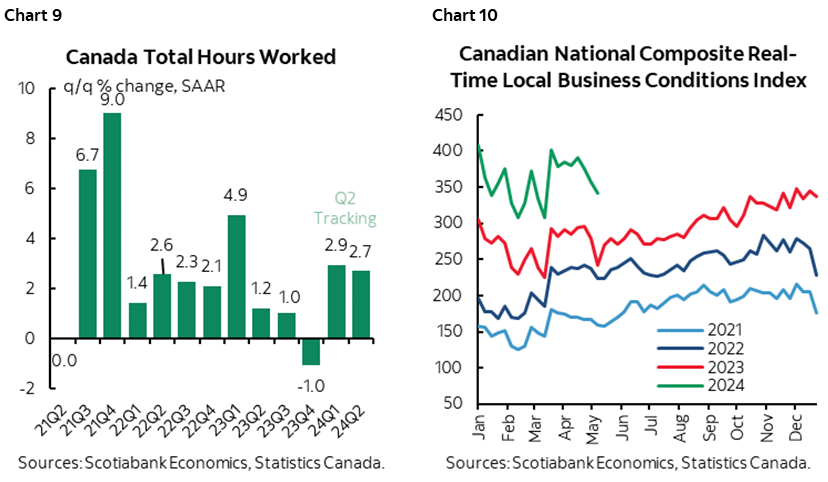

In any event, after totally blowing it on inflation, the BoC would be setting a very low bar to be convinced that core inflation has been licked if it only required a few lousy months of evidence. The economy is rebounding and outpacing BoC expectations coming into the start of the year for each of 2023Q4, 2024Q1, and possibly Q2 based on very limited evidence like gains in hours worked (chart 9) and alt-data readings that are showcasing more activity this year than throughout the pandemic (chart 10). The BoC’s prior estimates of slack in the economy and how it would build are arguably suffering a set back that should lessen its confidence toward being on a glide path to sustainably achieving 2% inflation.

CENTRAL BANKS—FOMC MINUTES, CHINESE LOAN SPREADS IN FOCUS

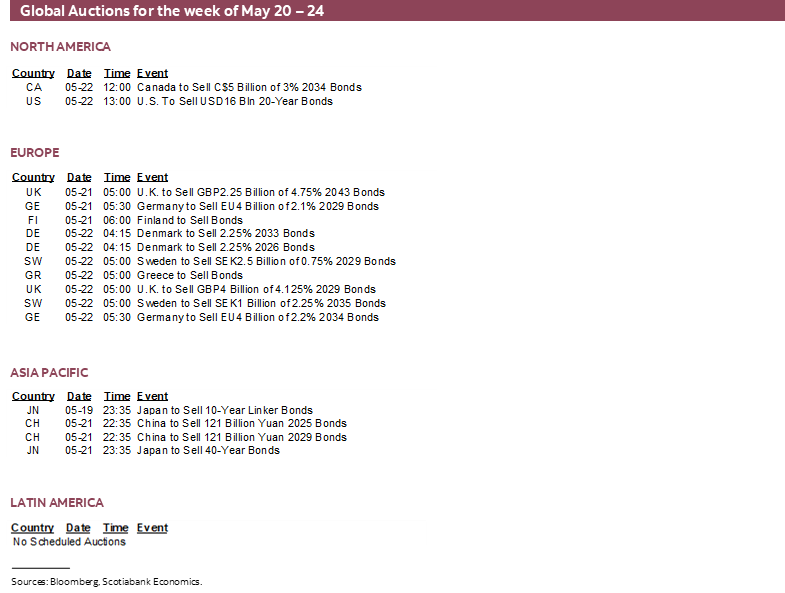

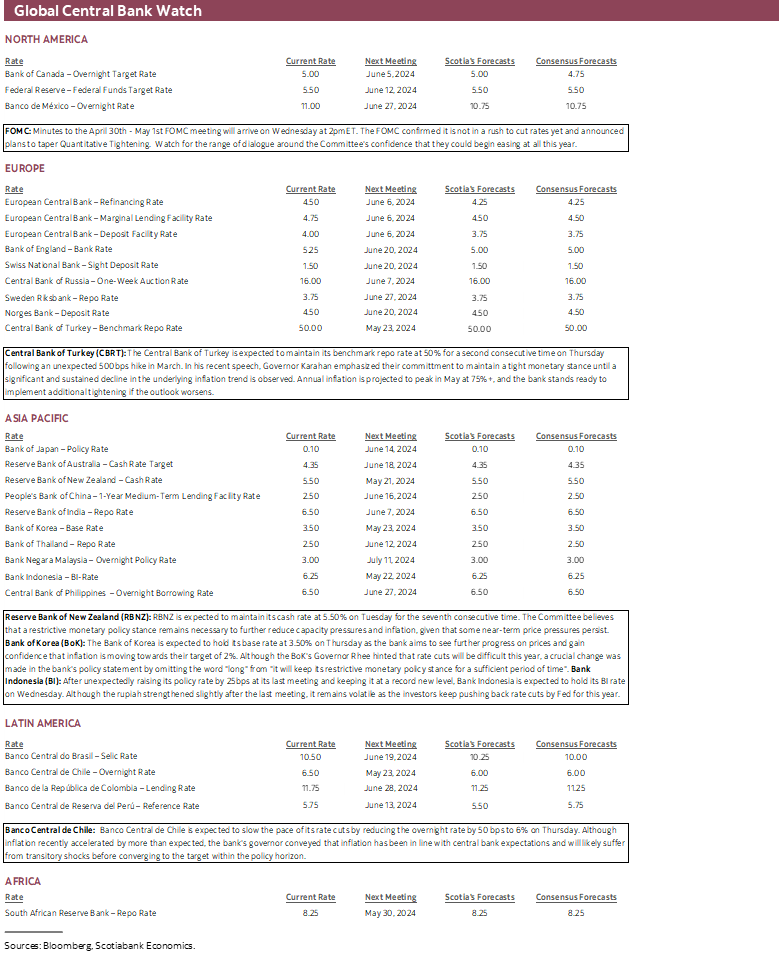

No central banks with the potential to impact world markets will be offering policy rate decisions this week. There could still be some action in the space, however, as FOMC minutes land, China might further pressure loan spreads, and several regional central banks weigh in.

FOMC Minutes—Stale on Arrival

Minutes to the April 30th – May 1st FOMC meeting arrive on Wednesday afternoon 2pmET. A recap of that meeting is here. This will be a stale account of thinking on the policy rate risks. It may reveal limited further information on the dialogue surrounding the decision to reduce quantitative tightening.

Why stale? Because of market developments, data and FOMC remarks that have evolved since then. Like mildly renewed optimism that rate cuts could well be delivered as the two-year yield has fallen by about a quarter of a percentage point so far this month. Like core CPI at 0.3% mm/m SA that, while a touch cooler, was not cool (recap here). How that shows up in core PCE on May 31st matters, but that too has been too hot for the Federal Reserve with m/m SAAR rates of increase of 6.2% in January, 3.2% in February, and 3.9% in March. Or like unit labour costs that grew by 4.7% q/q SAAR in Q1. Payrolls were softer at +175k, but not soft.

Also watch for more Fed-speak, like maybe rib sauce recipes for the coming long weekend. Chair Powell—recently diagnosed with Covid—will deliver pre-taped comments at Georgetown’s commencement on Sunday. Atlanta Fed President Bostic will be rather verbose this week as he appears no less than five times! Some like the mic more than others I suppose. Governor Kugler (Saturday) delivers a commencement speech, Vice Chair Barr speaks on Monday, Richmond Fed President Barkin speaks Tuesday, NY Fed President Williams speaks on Tuesday and Governor Waller speaks on Friday about the neutral rate.

Chinese Lending Rates—More Spread Pressure?

The PBOC announces the 1- and 5-year Loan Prime Rates on Sunday night (ET). Most expect no change given that the central bank kept its 1-year Medium-Term Lending Facility Rate unchanged at 2.5% this past week. There is mild risk that the 5-year LPR could be reduced which they have done before without altering the MTLFR policy rate. Imposing tighter spreads through the key rate benchmark for China’s property market would fit the bill on the heels of the recently announced policy action applied to property markets.

China’s property market measures included the following steps:

- minimum down payments were cut by five percentage points to 15% for first-time home buyers and 25% for second homes.

- the minimum mortgage rate floor has been eliminated. Progressive steps to lower the floor have contributed to lowering the rate from about 5½% in early 2022 to 3.7% in 2024Q1 and it may go lower yet.

- Local governments are advised to buy unsold new homes and convert them to affordable housing. The PBOC will provide 300 billion yuan (about US$42B) of funding to 21 state lenders at 1.75% in order to lend to regional state-owned enterprises across local governments.

Will it work? Does it pose inflation risk to the world economy as some headlines are screaming? We’ll see, but I’m skeptical. When combined with earlier efforts to pressure banks to lower their loan spreads, a risk is that the willingness to lend will erode as the reward goes down and the risk goes up.

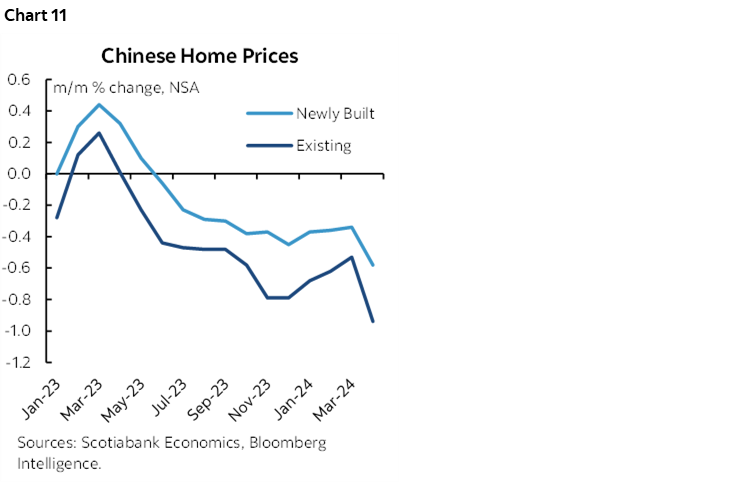

A second risk is whether potential buyers will take the bait which depends upon their outlook for Chinese property prices and their broader financial health. Chinese new home prices have fallen for 11 consecutive months in m/m terms and resale home prices have fallen for twelve straight months, presenting the catch-a-falling-knife dilemma for homebuyer sentiment (chart 11).

The impact on loan quality is another matter.

Further, if local governments do indeed start buying a material number of unsold homes, then it could further pressure their struggles with heavy debt loads with assets of uncertain value and spark more concern toward that space. That said, the size of the PBOC program to encourage state lenders to provide funding to local governments to buy homes is pretty modest in a bigger picture sense.

I’m also not sure that I understand what they are trying to do in engineering a paper swap to buy unsold new homes and convert them into, umm, other unsold ‘affordable’ homes?

BCCh—Another Downshifting LatAm Central Bank

Banco Central de Chile is expected to cut its overnight rate by another 50bps to 6% on Thursday. The limited consensus is unanimous. That would be a further slowing of the cut pace after a 100bps reduction in January and then a 75bps cut in April. It would also fit the pattern across LatAm central banks that also saw Brazil’s central bank downshift to a 25bps cut from a steady stream of prior 50bps reductions while dropping forward guidance, and Banxico that recently held after cutting at the prior meeting. One reason for downshifting is uncertainty toward if and when the Federal Reserve may commence easing and the concomitant currency risks. Another is that CPI recently surprised higher by increasing back to 4% y/y.

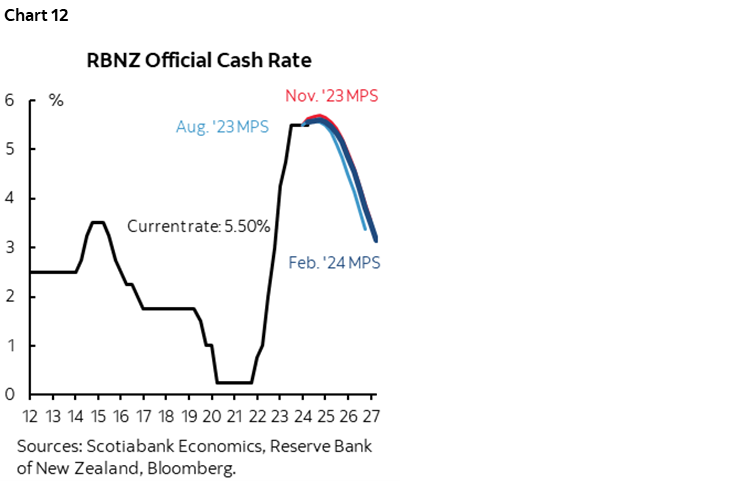

RBNZ—Updated Forward Guidance to Lean Against Market Pricing

The Reserve Bank of New Zealand delivers another decision on Tuesday. This will be a full set of communications including the quarterly Monetary Policy Statement with updated explicit forward rate guidance and a press conference held by Governor Adrian Orr.

The RBNZ is unanimously expected to stay on hold at a cash rate of 5.5%. Markets are priced for no chance at a cut until at least the August meeting but with most of a quarter point reduction priced for the October meeting. The last explicit forward guidance leaned toward no policy rate change until well into 2025 (chart 12). Expect a similar bias this time in the wake of an up-tick in headline CPI inflation to 0.6% q/q SA nonannualized in Q1 led by a half percentage point acceleration in the more closely watched non tradeable CPI measure to 1.6%.

Bank of Korea—From ‘Long’ to ‘Maybe’?

Consensus unanimously expects no change to the BoK’s base rate of 3.5% when it decides on Thursday. The won has been appreciating to the USD since about mid-April and core inflation continued to ebb toward 2.3% y/y in April. These developments could strengthen the rationale behind the prior meeting’s tweak. Although Governor Rhee hinted that rate cuts will be difficult this year, a crucial change was made in the bank's policy statement by omitting the word "long" from "it will keep its restrictive monetary policy stance for a sufficient period of time".

Bank Indonesia—Still Watching the Rupiah

Bank Indonesia is universally expected to remain on hold on Wednesday after surprising with a 25bps hike on April 24th. One consideration is that while the rupiah has appreciated by about 2% to the USD so far this month, more recent softening shows that the risks to inflation and financial stability have not gone away.

Turkey’s Central Bank—Don’t Bet the Farm on this One

You never quite know what this one’s up to, but consensus universally expects the Central Bank of Turkey to hold at a 50% one-week repo rate on Thursday. In his recent speech, Governor Karahan emphasized their commitment to maintain a tight monetary stance until a significant and sustained decline in the underlying inflation trend is observed. Annual inflation is projected to peak in May at 75% – 76%, and the bank stands ready to implement additional tightening if the outlook worsens.

ONE OF TWO UK CPI REPORTS BEFORE THE JUNE BoE DECISION

The first of two UK CPI inflation readings before the June 20th decision by the Bank of England will arrive on Wednesday. Markets are pricing roughly 60% odds of a cut at that meeting and 100% odds of a cut by the August 1st meeting. The pair of inflation reports could make or break June.

Headline CPI is expected to be soft in month-over-month terms. In year-ago terms, base effects are expected to drop the rate from 3.2% y/y in March down to around 2% in April. That would not surprise the BoE that said in its recent communications that “CPI inflation is expected to return to close to the 2% target in the near term, but to increase slightly in the second half of this year, to around 2½%, owing to the unwinding of energy-related base effects.” Key, however, will be the core CPI reading especially in m/m terms while base effects are expected to drive more modest y/y disinflation than for total CPI.

Friday’s retail sales volumes will also matter. The April reading ex-fuel is expected to fall sharply.

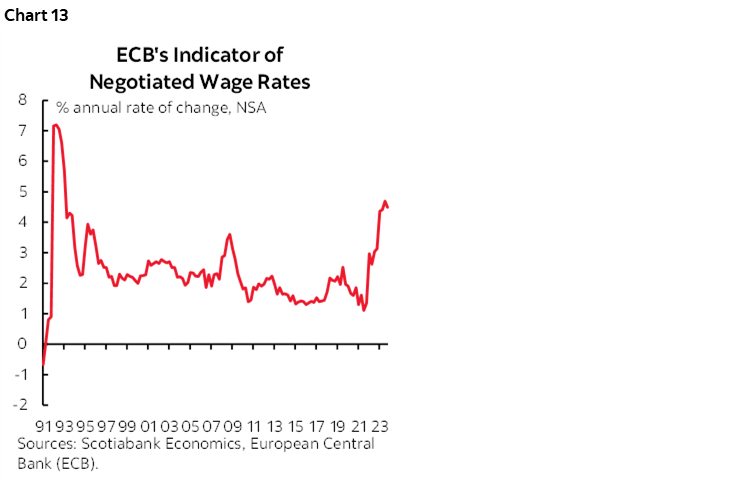

EUROZONE NEGOTIATED WAGES TO INFORM THE ECB’S STANCE

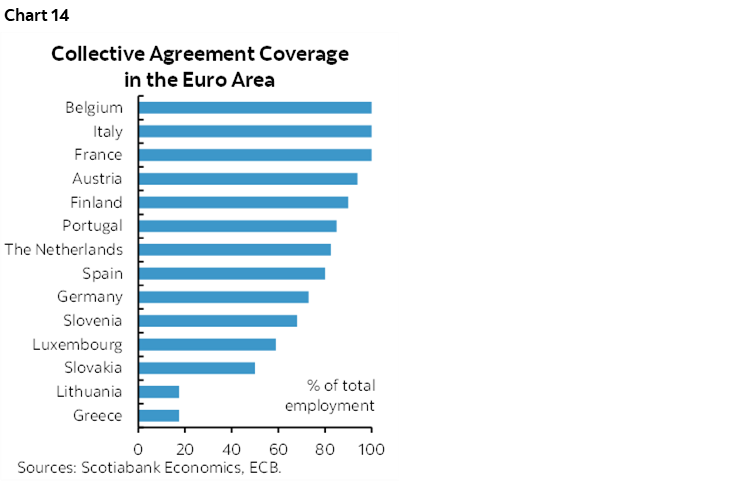

The ECB has said all along that its June 6th decision would be partly informed by negotiated wage growth in Q1 stemming from collective bargaining exercises that are concentrated in that quarter. We’ll get the tally on Thursday.

Street estimates are significantly different even with some countries having already reported. They range from 4–4.5% y/y. The upper end of that range would show high persistence compared to the prior quarters and would be significantly faster than the Q1 gain from last year (chart 13).

The role of collective bargaining dominates wage setting exercises in the Eurozone with very high proportions of the workforce covered by such agreements (chart 14). Wage gains in excess of productivity gains present upside risk to inflation that merit a cautious approach to monetary policy.

OTHER GLOBAL MACRO—PMIs THE MAIN FOCUS

A few other global macro reports are worth flagging.

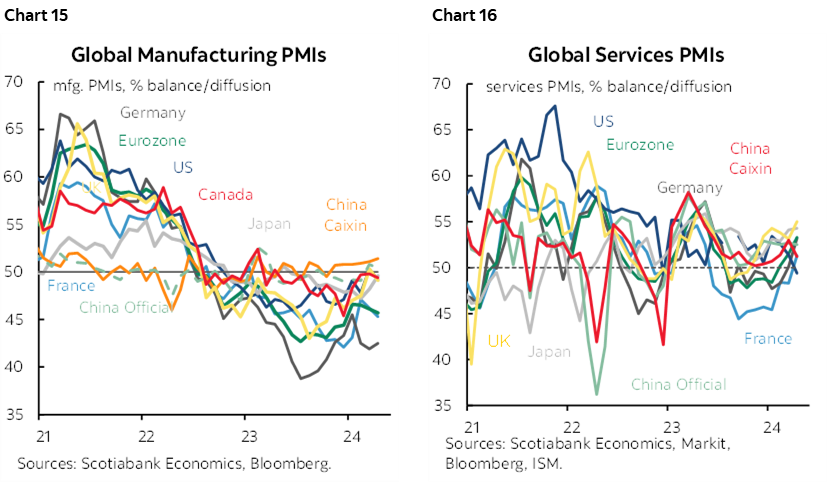

PMIs Signal Ongoing Global Growth

The monthly march of purchasing managers’ indices for May arrives this week. Australia kicks it off on Tuesday followed by Japan on Wednesday and then each of the Eurozone, UK, US and India on Thursday. Most of the readings are showing weakness in manufacturing (chart 15) offset by relative strength in services (chart 16). In all cases, the composite PMIs are signaling positive growth momentum.

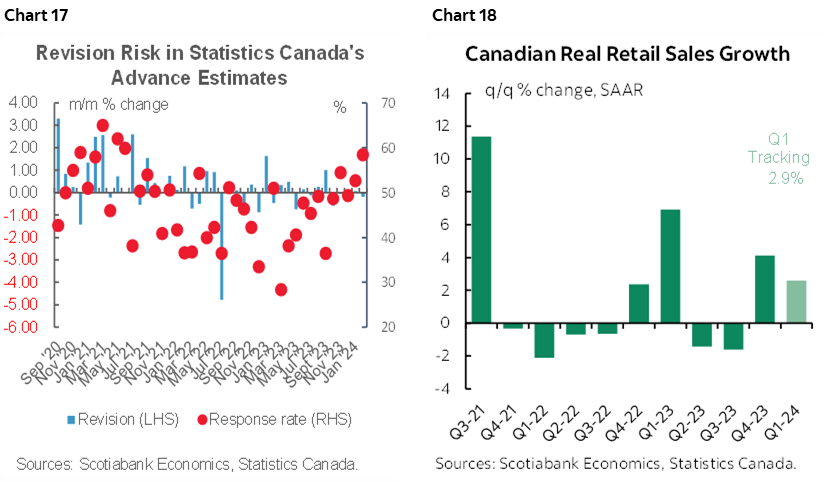

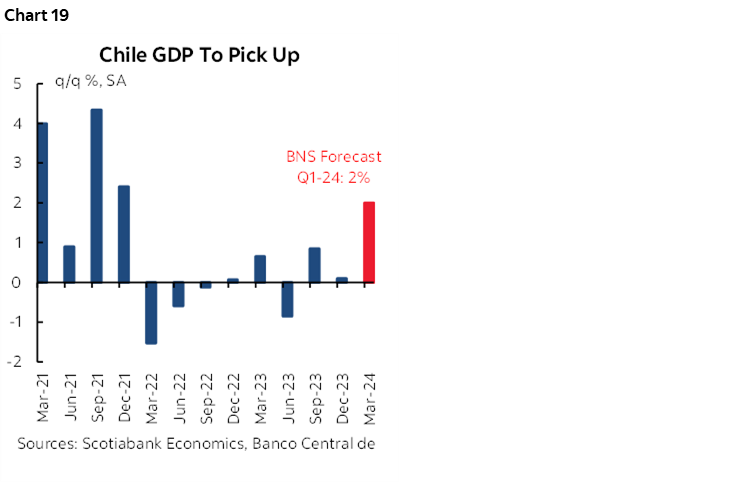

Canadian Consumers Are Still Spending

Canada updates retail sales for March on Friday and will provide preliminary guidance for April. Unusually timed Good Friday and Easter holidays may require waiting until reports from May onward to get a cleaner reading free of question marks surrounding whether seasonal adjustments are capably compensating for this. Guidance that was provided on April 24th pointed to ‘unchanged’ sales in March and based on the highest preliminary response rate in about three years. The guidance isn’t worth much. High tracking error over time which suggests revision risk is always present; four out of the past five months have seen retail sales come in lighter than initially guided and the history of revisions to the initial guidance offers further evidence (chart 17). Canada is tracking about a 2½% q/q SAAR gain in retail sales volumes in Q1 after a 4.1% gain in Q4 as the consumer continues to spend regardless of distorted headlines to the contrary (chart 18).

A Light Week for the US

With the possible exception of the FOMC minutes, the US is entering into a quiet stretch ahead of the following week’s Memorial Day long weekend. There will only be a few semi-notable releases on tap as follows:

- Existing home sales (Wednesday): April’s tally is expected to be little changed amid a slight gain in pending home sales.

- New home sales (Thursday): Some give back could happen to April’s tally after a large gain of about 9% m/m SA in March. Model home foot traffic is ebbing in May which may indicate further softening.

- Durable goods orders (Friday): April’s orders will probably post a significant decline. Boeing’s orders fell back to just 7 planes in April from 113 in March, and zero ordered by US airlines. Core capital goods orders (ex-defence and air) are likely to remain soft after declining in two of the three months this year.

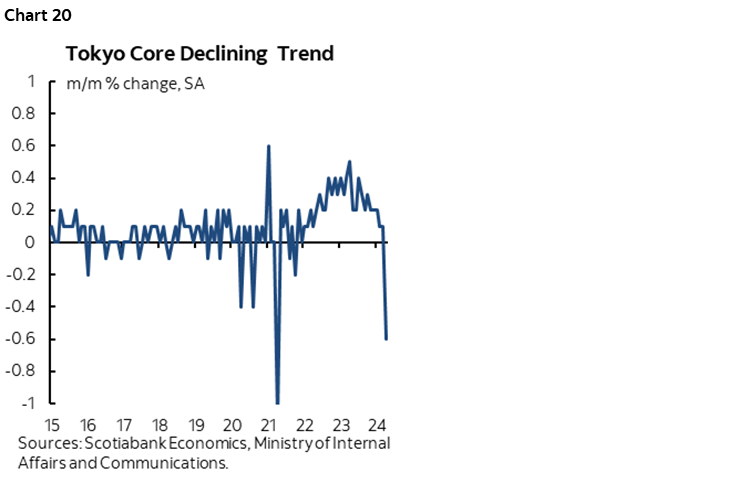

Chile’s Economy in Focus

Chile’s economy is expected to accelerate when Q1 GDP figures land on Monday. After posting essentially no growth in Q4, the economy is forecast to grow by 2% q/q SA nonannualized according to our Santiago-based economists. If they’re right, then it would be the strongest quarter growth since 2021Q4 (chart 19).

Mexico updates a few readings including retail sales for March (Monday), possible revisions to Q1 GDP growth of 0.2% q/q SA (Thursday), bi-weekly CPI for the first half of May (Thursday) and trade figures for April (Friday).

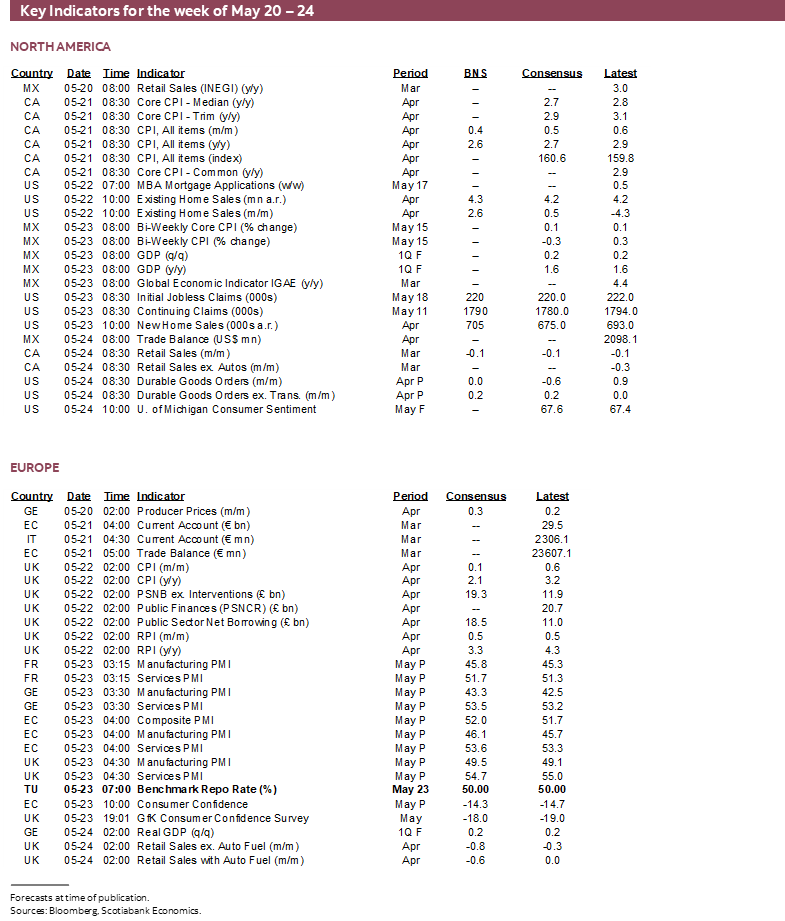

Soft Japanese Inflation

Japan updates national CPI for April (Thursday) that is expected to follow the already released Tokyo city gauge that has been on a decelerating path (chart 20).

Other Asia-Pacific releases will include Q1 retail sales (Wednesday) and trade (Thursday) from New Zealand, Thai Q1 GDP (Sunday) and Malaysian CPI (Friday).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.