Australia’s successful containment of COVID-19 and supportive policy environment play key roles in its economic recovery.

Consumer spending is underpinned by rebounding labour and housing markets while the outlook for business investment remains more cautious. External sector prospects remain largely dependent on developments in China.

Monetary policy is set to stay ultra-loose for an extended period of time as wage increases and inflationary pressures remain mild.

ECONOMIC GROWTH OUTLOOK

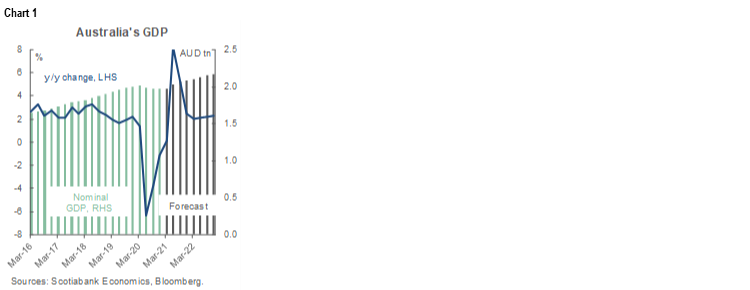

Australia’s economic prospects continue to brighten, thanks to successful containment of COVID-19 combined with a supportive policy backdrop. The economy has been recovering since mid-2020 (chart 1) with the nation’s output expected to reach pre-pandemic levels before mid-2021. Following a contraction of 2.4% in 2020, we expect Australia’s real GDP to grow by 4.0% in 2021. In 2022, growth will likely decelerate to 2.2% as the recession-related base effect fades away.

Australia’s domestic demand is rebounding along with strengthening consumer and business confidence. Consumer spending will remain an important driver of economic activity, yet the outlook is dampened by Australia’s slow vaccination progress and the continued absence of international tourists. Nevertheless, recuperating labour and housing markets as well as pent-up demand will provide support to consumption. Indeed, the country’s employment gains have been encouraging in recent months (chart 2), with the unemployment rate dropping to 5.6% in March from the July 2020 peak of 7.5%. Part-time jobs have returned to pre-pandemic levels, while full-time employment has yet to rebound fully. The Reserve Bank of Australia (RBA) estimates that the government’s “JobKeeper” employment support program prevented 700,000 additional jobs from being lost during the pandemic. As the economy continues to recover, the labour market will likely solidify further over the medium term, though the expiration of the “JobKeeper” scheme at the end of March is set to temporarily halt the favourable progress.

Private sector investment will play a critical role in taking Australia’s economic recovery onto a sustainable footing. Non-mining investment as a share of GDP was already trending downward before the pandemic; as such, recent muted gains in private sector outlays point to longer-term capital stock and productivity issues. While we expect business investment to pick up over the coming quarters on the back of a supportive policy environment and strengthening confidence, the rebound will likely only be gradual.

Public spending will continue to underpin Australia’s economic activity. Treasurer Josh Frydenberg is expected to deliver the Federal Budget for Fiscal Year 2021–22 (July–June) on May 11. Australia entered the COVID-19 crisis with healthy public finances; despite significant fiscal measures unveiled during the pandemic (equivalent to over 19% of GDP), we assess that the country remains in a solid position to be able to continue to provide a supportive fiscal policy backdrop. Forthcoming public outlays are expected to focus on supporting employment and the areas of the economy hit hard by the pandemic, with any significant fiscal consolidation pushed back until the economy is fully back on its feet.

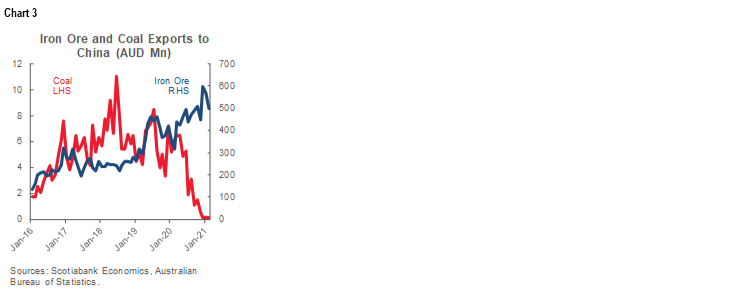

Favourable terms of trade support the Australian external sector, yet a shift is expected in 2022 in line with our forecast for lower iron ore prices. Meanwhile, elevated diplomatic tensions with China—Australia’s main export destination—will continue to adversely affect the country’s exporters. While iron ore shipments to China remain underpinned by China’s robust steel demand, the conflict has resulted in a dramatic drop in coal exports (chart 3). Meanwhile, pandemic-related travel restrictions continue to depress Australia’s tourism and education services exports. Accordingly, we expect net exports to remain a drag on Australia’s real GDP growth over the coming quarters.

MONETARY POLICY, INFLATION AND AUSTRALIAN DOLLAR OUTLOOK

The RBA will maintain an accommodative monetary policy stance for an extended period, reflecting persisting slack in the Australian economy and muted inflationary pressures. In February 2021, the central bank announced an extension to its bond buying program. The RBA will buy an additional AUD 100 bn of bonds issued by the Australian government as well as by the states and territories following the mid-April completion of its previous program of AUD 100 bn (introduced in November 2020). Meanwhile, the RBA has left the benchmark cash rate and the target yield on the 3-year Australian Government bond unchanged at 0.10% since they were lowered to their current level last November. While we do not expect the bond purchase program to be extended beyond 2021, we do not foresee any changes to the cash rate and the target yield within the next few years. Nevertheless, the RBA’s decision on whether to maintain the April 2024 bond as the target or switch to the November 2024 bond is still pending; the central bank has communicated that the decision is forthcoming later in the year and is dependent on economic data and evolving prospects for inflation and the labour market.

Despite the improving economic outlook, the RBA has repeatedly emphasized that for inflation to pick up in a sustainable way, wage growth would need to accelerate notably (wages rose by 1.3% y/y in Q4 2020; chart 4), which would require significant further gains in employment combined with a return to a tight labour market. The RBA expects such conditions to be met in 2024 at the earliest. We assess that inflation will remain muted in Australia through 2022, reflecting significant spare capacity in the economy and our expectation for continued low wage gains. We estimate that headline inflation remained close to 1.0% y/y in Q1, well below the RBA’s 2–3% inflation target. While pandemic-related base effects are likely to push the Q2 inflation rate significantly higher, it will be a transitory phenomenon with headline inflation expected to close 2021 at 1.8% y/y and to hover at 2% y/y in 2022.

The Australian dollar (AUD) has steadily regained ground vis-à-vis the US dollar (USD) since the low point in March 2020 (chart 5), as the global economy has continued to recover. We expect AUDUSD to reach 0.80 by the third quarter of this year in keeping with a generally weaker USD tone, relatively steady bilateral relations between Canberra and Beijing, firm commodity prices as global output and trade rebound, and strengthening domestic real GDP growth that will increase the odds of a conclusion to the RBA’s bond buying program by the end of 2021. Nevertheless, given our expectation of the RBA raising its benchmark interest rate later than the US Federal Reserve, the AUD will likely stabilize in the final months of 2021. The AUD is expected to face a mild weakening bias in 2022 as iron ore prices respond to rising Brazilian output. We expect AUDUSD to close 2022 at 0.78.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.