- The Reserve Bank of New Zealand raised the Official Cash Rate by 50 basis points to 2.0% and pointed to swift monetary tightening ahead.

- Stabilizing inflation is the central bank’s priority as rising inflation expectations risk triggering persistent price pressures.

- The central bank expects the policy rate to reach 3.4% by the end of the year; we foresee another 50 bps increase in July, followed by a more gradual hiking path through the rest of the year.

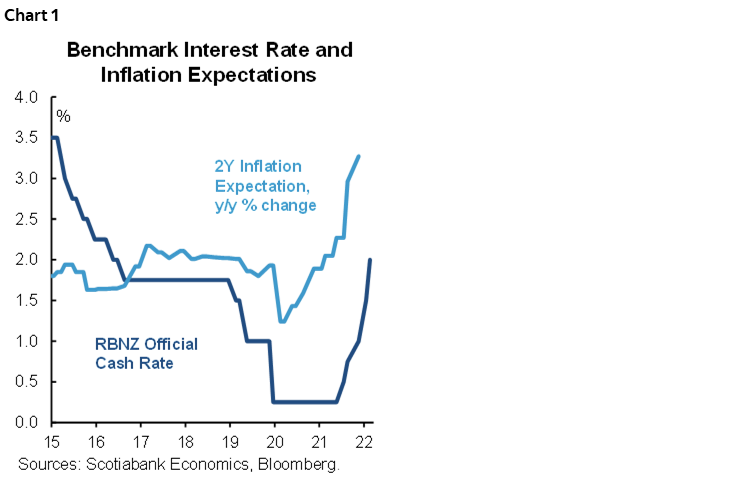

The Reserve Bank of New Zealand’s (RBNZ) Monetary Policy Committee increased the Official Cash Rate (OCR) by 50 basis points to 2.00% following the May 25 policy meeting (chart 1), in line with expectations. The RBNZ has raised the benchmark interest rate by a total of 175 bps since the beginning of the hiking cycle in October 2021, and more rate increases are in sight. The Committee highlighted that monetary conditions need to be tightened “more and sooner” to meet the central bank’s goals of price stability and maximum sustainable employment. Moreover, the RBNZ sees that hiking more aggressively now builds policy buffers for the future given global economic uncertainties.

The RBNZ published an updated Monetary Policy Statement today and revised the forecast for the OCR notably higher. It foresees the key rate reaching 3.4% by the end of this year vs. the February projection of 2.2%. The policy rate is expected to rise further in the first half of 2023, reaching the cyclical peak of 3.9% by June. In contrast, the RBNZ’s February assessment depicted the OCR reaching a peak of 3.4% in Q3 2024. The main driver of the RBNZ’s shift to a more aggressive monetary tightening trajectory is the country’s inflation outlook. Indeed, RBNZ Governor Adrian Orr noted that in the context of rising inflation expectations and the risk of inflation becoming persistent, “we have to risk doing too much too soon, rather than risk doing too little too late”. Accordingly, we assess that another 50 bps hike will be implemented in July.

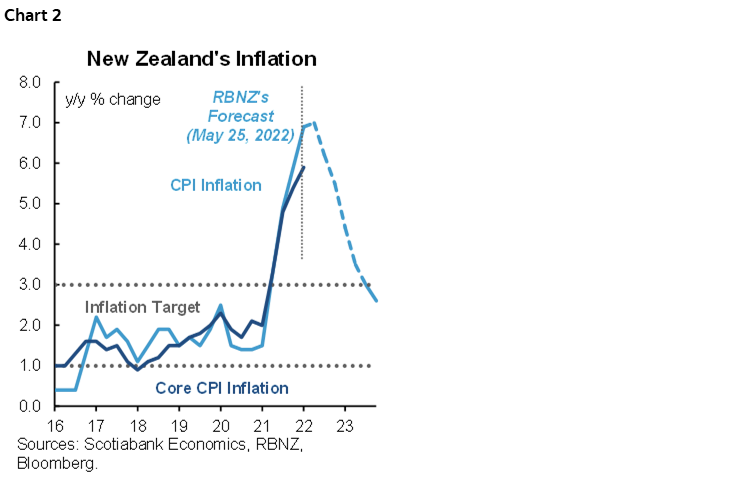

New Zealand’s inflation has been accelerating notably and is exceeding the RBNZ’s 1–3% inflation target by a significant margin (chart 2). Headline prices rose 6.9% y/y in Q1 following a 5.9% gain in Q4 2021. Price pressures have intensified also at the core level, with the CPI excluding food, household energy, and vehicle fuels increasing by 5.9% y/y in Q1. Prices are rising rapidly on the back of an even contribution of imported inflationary pressures—caused by global commodity prices and supply chain bottlenecks—and domestic price pressures. According to the central bank, tight labour market conditions and associated wage gains, as well as rising housing-related costs are the key sources of domestic inflation. We expect inflation to remain elevated in the medium-term. Tighter monetary conditions and some cooling in economic activity will allow demand-driven price pressures to start easing in the second half of the year, with headline inflation forecasted to close 2022 at slightly above 5% y/y.

New Zealand’s economy is still performing strongly on the back of solid balance sheets of households and businesses, supportive fiscal policy, as well as elevated prices for the nation’s exports. Nevertheless, economic activity is expected to soften somewhat due to global uncertainties, weaker consumer confidence, elevated inflation that is dampening consumers’ spending power, rising interest rates, and lower house prices. We expect New Zealand’s real GDP to grow by around 3% in 2022 following a 5.4% gain last year. Such cooling is welcome, as the RBNZ assesses that employment is currently above its maximum sustainable level. The economy is facing labour shortages, with access to labour being the key constraint on firms’ productive capacity. Accordingly, wage inflation is expected to accelerate further from the 5.3% y/y pace recorded in Q1.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.