- Australia’s central bank gets serious about inflation. It raised the cash rate target by 50 bps to 0.85% and promised further rate hikes in the near future.

- The front-loading of rate hikes implies that monetary authorities are increasingly concerned about the country’s inflation outlook.

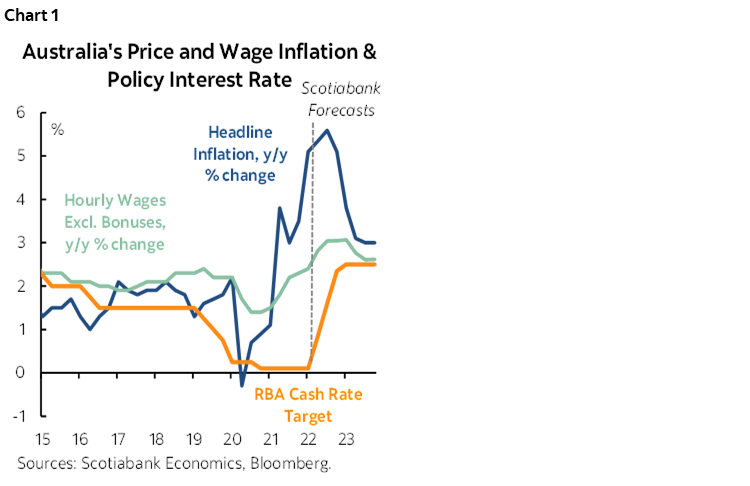

The Reserve Bank of Australia (RBA) raised its cash rate target by 50 bps to 0.85% following the June 7 monetary policy meeting (chart 1), marking the second hike in the monetary normalization phase that commenced in May. The analyst consensus—including Scotiabank—had projected a 25 bps increase. The larger-than-anticipated move reflects Australian policymakers’ increased discomfort regarding accelerating inflation. The RBA assesses that the economy is resilient and no longer needs extraordinary monetary policy support; this allows the central bank to focus on its efforts to bring inflation back to the RBA’s 2–3% target over time. Indeed, the policymakers promised that further monetary normalization is in sight, yet the size and timing of interest rate increases will be guided by incoming data. We expect the RBA to raise the benchmark rate again at the next policy meeting on July 5.

Australia’s inflationary pressures are intensifying, prompting the RBA to re-calibrate its monetary normalization trajectory. Indeed, by front-loading rate hikes the central bank has adopted a notably more hawkish stance; in this respect, it highlighted its commitment to “doing what is necessary” to bring inflation back to the target. Headline and core inflation reached 5.1% y/y and 3.7% y/y, respectively, in the first quarter of 2022. The RBA expects inflation to accelerate further, pushed up by global factors—such as supply chain disruptions and the war in Ukraine—as well as by domestic capacity constraints and the tight labour market. We assess that price pressures in Australia have become more broadly-based and persistent. Accordingly, we forecast headline inflation closing 2022 at around 5% y/y and returning towards the 3% mark by the end of 2023.

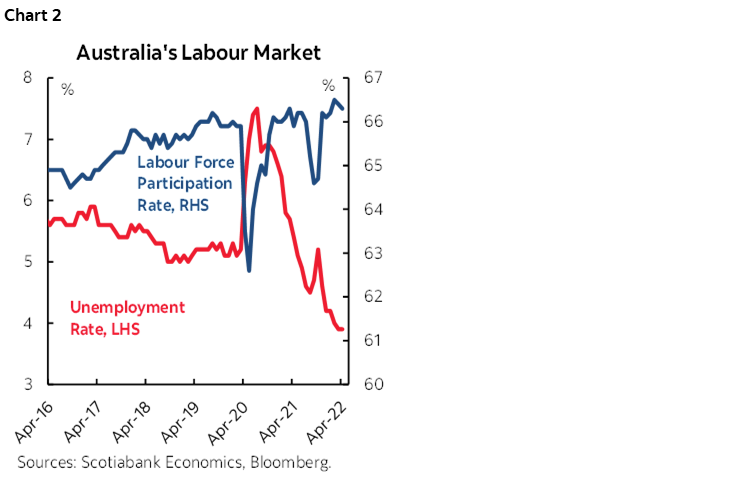

Labour market developments are important for the RBA’s decision-making process; the central bank projects rising wages to put additional pressure on prices. Australia’s labour market has reached full employment—as of April 2022, the unemployment rate has dropped to 3.9% despite very high labour force participation (chart 2). The RBA assesses that full employment has been reached when the jobless rate is around 4%. Considering that firms are reporting labour shortages and Australia’s border restrictions have been preventing them from accessing the global labour pool, wages will likely drift higher. Until now, nominal wage growth has remained relatively subdued with wages increasing by 2.4% y/y in Q1-2022. We assess that wage inflation will gradually accelerate and reach 3.0% y/y in the near future. Nevertheless, in real terms, wage gains over the medium-term are set to remain negative given high inflation.

Faster monetary normalization is possible on the back of the Australian economy that has proven resilient despite several headwinds, such as global supply chain issues, the war in Ukraine and its adverse repercussions, Australia’s Omicron outbreak in early-2022, and flooding in the nation’s east coast. Economic activity is underpinned by the nation’s favourable terms of trade, pent-up demand, as well as still-supportive monetary and fiscal policies. Nevertheless, the RBA highlights uncertainties regarding the consumer spending outlook; household confidence and purchasing power are under downward pressure due to the rising cost of living, higher interest rates, and lower house prices. We expect Australia’s real GDP to grow by slightly over 4% in 2022, following a 4.9% advance in 2021. In 2023, output growth will likely normalize to 2¾%, in line with the average gain recorded over the decade preceding the COVID-19 crisis.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.