- At today’s monetary policy meeting, the Bank of Korea increased the benchmark Base Rate by 25 basis points to 1.75%.

- Inflation containment has become the central bank’s priority, prompting continued monetary normalization in the months ahead.

- We forecast the next rate increase of 25 basis points to take place in July, with the benchmark rate climbing to 2.50% by the end of the year.

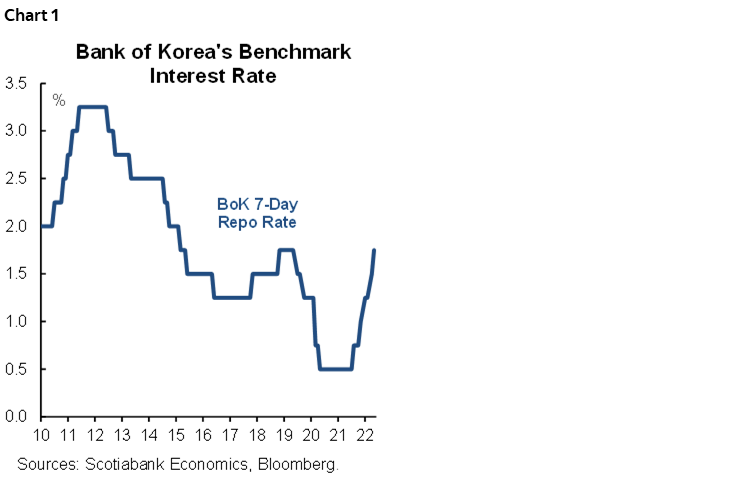

The Bank of Korea (BoK) raised its benchmark Base Rate by 25 basis points to 1.75% following the May 26 monetary policy meeting (chart 1), in line with our expectation. The decision marks the fifth hike in the ongoing monetary normalization phase, which began in August 2021. The prior rate increase took place at the April meeting; as such, the pace of rate hikes is picking up. The decision among the BoK’s Monetary Policy Board was unanimous, highlighting the sense of urgency in the central bank’s fight against accelerating inflation. We foresee further rate increases over the coming months, taking the Base Rate to 2.50% by the end of the year. Nevertheless, with elevated inflation, South Korea’s real interest rates are set to remain negative in the foreseeable future. The next monetary policy meeting is scheduled for July 13.

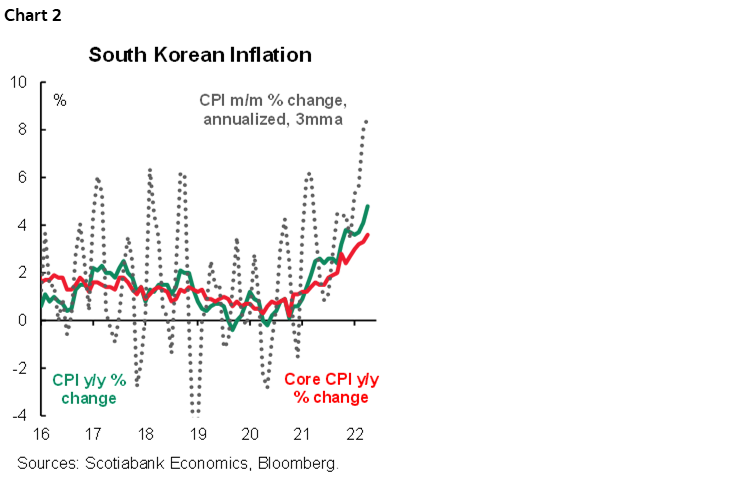

This was BoK Governor Rhee Chang-yong’s first monetary policy announcement after taking office at the end of April. His guidance was very clear; the BoK will prioritize inflation containment over the economy for now. Governor Rhee highlighted that there is need for a pre-emptive response to the negative ripple effects of inflation, such as declining real wages and financial instability. Indeed, inflationary pressures are building in South Korea. Prices at the headline level increased by 4.8% y/y in April, while annualized monthly price gains (which allow us to see the current trend in inflation without the impact of year-ago base effects) show that underlying price pressures are very strong (chart 2).

While efforts to fight inflation will anchor policy, the BoK will also monitor financial stability concerns by tracking the risk of domestic financial imbalances, monetary policy in other countries, and external economic developments. The bank noted the recent depreciation of the Korean won relative to the US dollar, as well as drops in stock prices and volatility in long-term market interest rates—developments it linked to ongoing monetary tightening by the US Federal Reserve and slowing growth in China.

The BoK revised its inflation forecasts up significantly, expecting headline inflation to remain “high in the 5% range for some time”. Indeed, our estimations point to above-5% y/y inflation through the third quarter of 2022, after which we expect inflation to ease slightly to 4.1% y/y by the end of the year. Similarly, core inflation—at 3.6% y/y in April—remains well above the BoK’s 2% inflation target. We assess that South Korea’s fight against inflation will not be short-lived, as price pressures will likely persist due to elevated core prices, higher inflation expectations by the general public, as well as firms’ price-setting behaviour that is likely to pass some of the elevated input costs to consumers. Accordingly, we do not foresee headline inflation returning to the BoK’s 2% target before 2024.

The BoK’s policymakers assess that the South Korean economy will sustain its recovery path despite tighter monetary conditions and global uncertainties. Real GDP growth will be underpinned by improving private consumption prospects. Meanwhile, fixed investment will continue to be adversely impacted by global supply chain bottlenecks, and export sector momentum will ease due to moderating global demand. The BoK foresees the country’s real GDP growth to be “at the upper-2% level” in 2022, slightly below its February forecast of 3%.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.