- Australia’s economy has so far withstood global supply chain issues, the adverse repercussions of war in Ukraine, a severe Omicron outbreak, and flooding, and we expect it to advance by a still-strong 4% in 2022.

- Key contributors to the forecast expansion include: the external sector with support from strong prices for staple commodities, solid labour market conditions, still-high real estate wealth, and a growth-supportive federal budget.

- However, we expect residential investment’s contribution to economic growth to moderate over the next two years as real estate sales are held back by stretched affordability and rising borrowing costs.

- Price pressures are building but we do not foresee runaway inflation; rather, we anticipate that the Reserve Bank of Australia (RBA) will raise rates only gradually, keeping monetary conditions accommodative for the foreseeable future.

ECONOMIC GROWTH OUTLOOK

The Australian economy has proven resilient despite several headwinds, such as global supply chain issues, the war in Ukraine and its adverse repercussions, Australia’s Omicron outbreak in early-2022, and flooding in the nation’s east coast. Favourable terms of trade (chart 1) are boosting Australia’s external sector. Meanwhile, domestic economic activity is underpinned by pent-up demand as well as supportive monetary and fiscal policies. We expect Australia’s real GDP to grow by slightly over 4% in 2022, following a 4.8% advance in 2021. In 2023, output growth will likely normalize to 2¾%, in line with the average gain recorded over the decade preceding the COVID-19 crisis.

Australia’s external sector should remain a source of growth, with help from staple commodities and a recovery in travel activity following border reopening. We expect iron ore and coal prices to ease over 2022–23 but stay high relative to historical norms. First yield is expected at Fortescue’s Iron Bridge project later this year at a time when other major producers struggle to ramp up. Demand for both commodities should benefit from solid ex-China steel production over the forecast period, though China’s ban on Australian coal imports remains in place. The wildcard is Chinese steel. China’s output continues to fall year-over-year amid COVID-19 lockdowns and there is a risk that further environmental rules will be imposed on producers. Yet, Beijing’s planned infrastructure spending push and efforts to prop up the housing market are broadly positive for steelmaking activity.

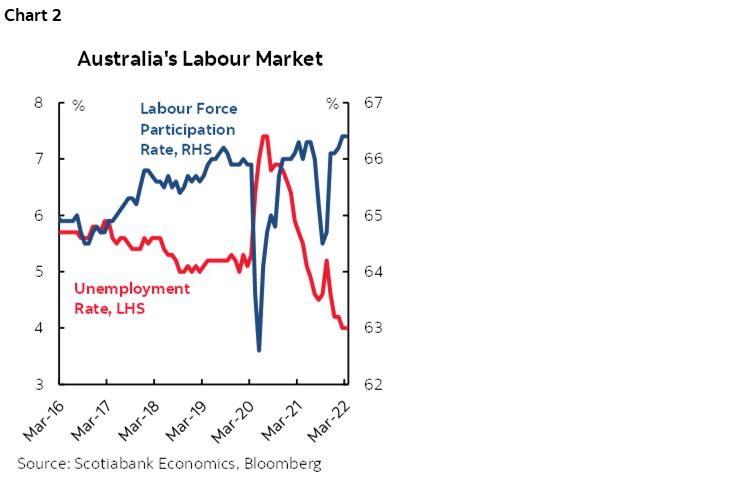

Solid labour market conditions and high real estate prices are supporting household wealth and spending prospects. Nevertheless, consumer confidence (chart 1 again) is dampened by global uncertainties and a squeeze on spending power amid higher prices. Australia’s labour market has reached full employment—as of March 2022, the unemployment rate has dropped to 4.0% despite record-high labour force participation (chart 2). The Reserve Bank of Australia (RBA) assesses that full employment has been reached when the jobless rate is around 4%. Considering that firms are reporting labour shortages and Australia’s border restrictions have been preventing them from accessing the global labour pool, wages will likely drift higher. Until now, nominal wage growth has remained subdued with wages increasing by 2.3% y/y in Q4-2021. We assess that wage inflation will gradually accelerate and reach 3.0% y/y by mid-2022. Nevertheless, in real terms, wage gains over the medium-term are set to remain negative given high inflation.

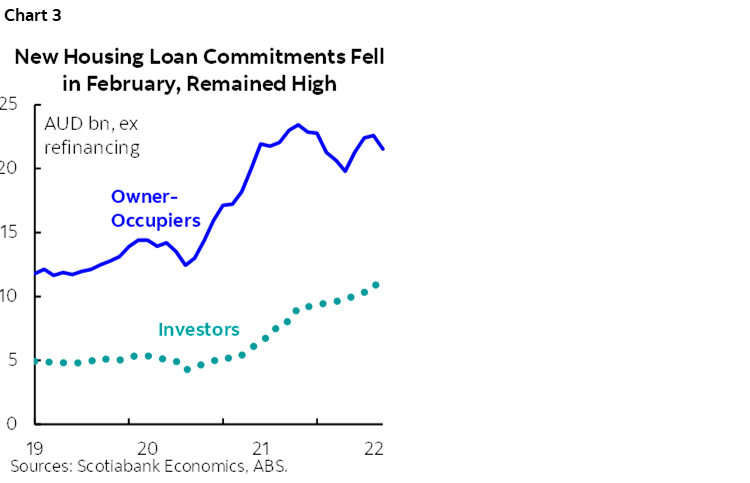

We expect residential investment’s contribution to economic growth to moderate over the next two years. With borrowing costs set to rise and housing affordability stretched across the country after a steep price run-up during the pandemic, we see more modest homebuying demand as inevitable to some extent. Indeed, in February, new loan commitments for housing fell by 4% m/m (chart 3), while sales values declined marginally in March on a m/m basis in Sydney and Melbourne—Australia’s two priciest markets. Still, reopening of international borders and release of pent-up demand after last year’s Delta variant restrictions will likely put a floor under demand. As well, dwelling approval rates remained solid as of February and should sustain homebuilding activity in the next several quarters alongside residential construction work that began in 2021.

Australia’s 2022–2023 Federal Budget, released at the end of March, is a growth-supportive package, which is unsurprising given the approaching Federal Election on May 21. While the time for emergency fiscal support has passed, Australia will refrain from fiscal consolidation in the new fiscal year that starts on July 1, as the economy’s recovery remains a priority. The fiscal deficit is projected to remain virtually unchanged, narrowing from 3.5% of GDP in FY2021–22 to 3.4% in FY2022–23. The shortfall will be narrowed gradually from FY2023–24 onwards. Meanwhile, gross public debt is set to increase from 39.5% of GDP this year to 42.5% of GDP in FY2022–23. Nevertheless, we note that Australia’s public debt is low when compared to its advanced economy peers. To help Australians cope with rising prices, the budget includes a one-off payment to welfare recipients and pensioners as well as a cost-of-living tax offset for low- and middle-income earners. In addition, a temporary six-month cut in petrol taxes will be implemented. Defense spending will also get a significant boost, focusing on cyber capabilities. The Australian government will also be investing in apprenticeship programmes to help build a more productive workforce. Other fiscal measures include support to small businesses and first-home buyers.

INFLATION, MONETARY POLICY AND THE AUSTRALIAN DOLLAR OUTLOOK

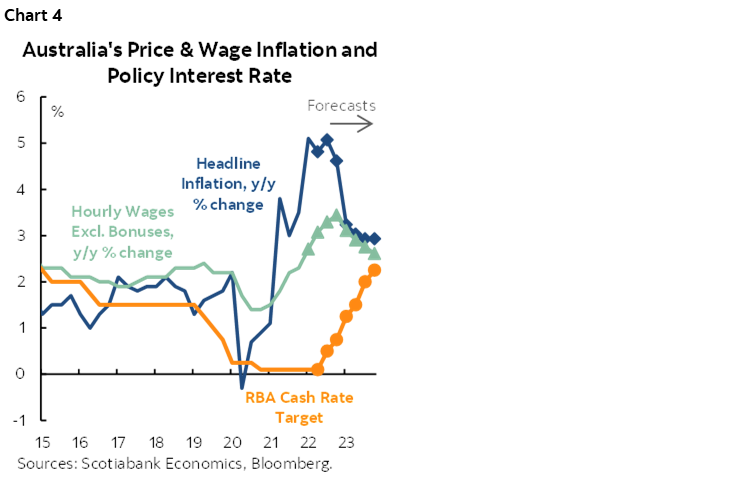

Australia’s inflationary pressures are intensifying, prompting the RBA to re-assess its monetary policy stance. In Q1-2022, Australia’s headline inflation accelerated to 5.1% y/y (chart 4), while core inflation picked up to 3.7% y/y, well over the RBA’s 2–3% inflation target. We assess that price pressures are becoming more broad-based and persistent. Accordingly, we forecast headline inflation closing 2022 at 4½% y/y and returning towards the 3% mark by the end of 2023.

A monetary normalization phase is approaching in Australia, yet monetary conditions will remain accommodative in the foreseeable future given elevated inflation. We expect the RBA to change its assessment on the economic and inflation outlook in the near term and turn more hawkish. Nevertheless, we believe that the RBA will stay on the sidelines in the very near term and keep the Cash Rate Target at 0.1%, awaiting the Federal Election on May 21. Moreover, wage dynamics play a crucial element in the RBA’s decision process, and Q1 wage data will not be released until May 18. We expect the RBA to start raising the benchmark interest rate at the July meeting, yet we note that higher-than-expected wage inflation data for Q1 would likely bring the first hike forward to June. Nonetheless, we highlight that we do not foresee runaway inflation in Australia and wage gains are likely to remain relatively low. Accordingly, the RBA’s hiking cycle is set to be gradual, taking the policy rate to 2.25% by the end of 2023.

The Australian dollar (AUD) has depreciated versus the US dollar (USD) (chart 5), reflecting the US Federal Reserve’s hawkish policy stance and investor concerns that China’s economic slowdown could impact Australia’s outlook. As we consider market pricing for the RBA’s rate hikes to be too aggressive, we note that the AUD is subject to a further weakening bias in the near term. Still, we expect the AUD to find renewed support in the second half of 2022 on the back of expected stabilization in the Chinese economy, the RBA’s catch-up, and fading of the broad USD strength. We forecast AUDUSD to close 2022 at 74.0 but with risk clearly tilted to the downside due to overextended RBA pricing.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.