Australia’s expansionary budget focuses on economic revival and job creation in the short-term.

Forward guidance for the medium-to-long term points to fiscal consolidation once the nation’s unemployment rate drops below 6%.

Australia’s Treasurer Josh Frydenberg delivered the Federal Budget for Fiscal Year 2020–21 (July–June) on October 6, 2020. The nation’s budget is normally unveiled in May, but it was delayed this year due to the COVID-19 pandemic. The Budget 2020–21 is highly expansionary, focusing on building a foundation for Australia’s economic recovery after the pandemic triggered a deep, yet brief, recession in the first half of 2020. The Budget prioritizes measures that support job creation and sustainable private sector-driven economic growth.

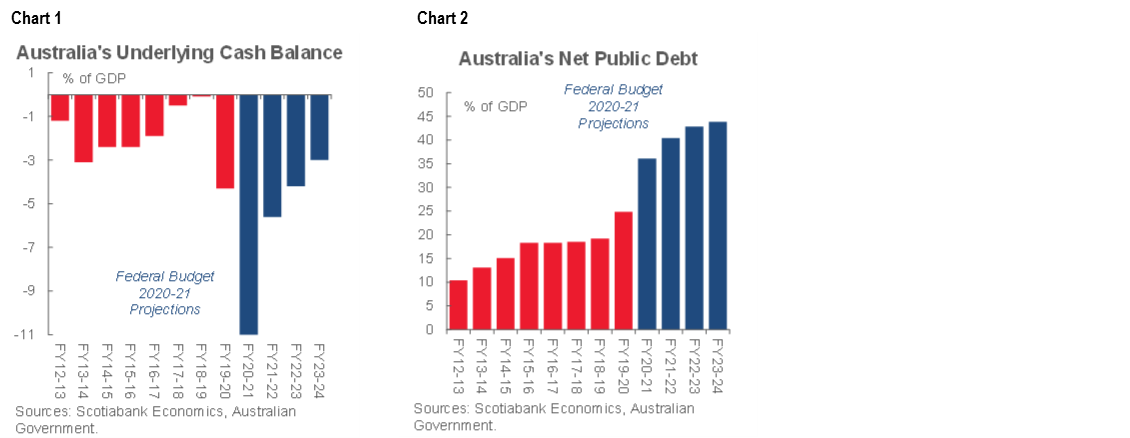

The Budget includes new pandemic-related measures worth AUD 98 billion, taking the administration’s COVID-19 support to AUD 507 bn (which includes balance sheet measures), equivalent to around 25% of GDP. Roughly half of the amount, AUD 257 bn, consists of direct economic support measures. Australia’s budget deficit (i.e. the underlying cash balance) is expected to be AUD 213.7 bn this fiscal year, equivalent to 11.0% of GDP, and it is forecasted to diminish gradually over the coming years (chart 1). Gross debt is expected to rise to 44.8% of GDP by the end of the current fiscal year (vs. 34.5% of GDP in FY2019–20) and to stabilize around 55% of GDP over the medium term, while net debt will likely close FY2020–21 at 36.1% of GDP and peak at 43.8% at the end of FY2023–24 (chart 2). Despite the fact that Australia’s public debt burden will be significantly higher than in the past, we note that it compares favourably with the debt levels of other advanced economies. Moreover, debt servicing costs are set to remain manageable over the coming years on the back of the low global interest rate environment.

The Australian government’s fiscal strategy has two clear phases; at first the focus will be on economic recovery with measures that support employment and confidence. The second phase will emphasize reforms and fiscal discipline in order to bring public finances back to a sustainable footing.

The expansionary measures of the first phase include personal income tax reductions, investment incentives and cash flow support (such as tax relief) for businesses, significant investment in road, rail and community infrastructure, incentives for first home buyers and R&D, handouts to pensioners, child care support, various labour market incentives—such as an extension to the JobKeeper program and a five-year JobMaker program that entails hiring credits—as well as a broader Modern Manufacturing Strategy to boost Australia’s manufacturing sector prospects.

The government explicitly set a goal for the nation’s fiscal stance; the second phase, fiscal consolidation, will begin after Australia’s unemployment rate has dropped “comfortably below” 6%. The jobless rate was 6.8% in September, but it is expected to rise over the coming months. Once the economy regains growth momentum, the labour market will strengthen over the course of multiple years. Indeed, the government expects the unemployment rate to reach the 6% mark in FY2022–23. At that point the administration’s focus will shift to strengthening the country’s fiscal position, first by stabilizing and then by reducing public debt, through fiscal discipline and economic reforms.

The government expects Australia’s real GDP to decline by 3¾% in calendar year 2020; the forecast is virtually in line with our estimate of a 3.6% contraction. Nevertheless, Australian policymakers expect economic growth to rebound to 4¼% y/y in 2021, which we assess to be an optimistic projection given that the pandemic is nowhere close to being over and international travel is set to remain muted well into next year. We expect Australia’s 2021 real GDP growth to average 2.7% y/y; accordingly, we point out that the medium-term deficit and debt trajectories may turn out to be less favourable, potentially putting downward pressure on Australia’s sovereign credit ratings. The nation’s creditworthiness is ranked triple-A by Moody’s, Standard & Poor’s and Fitch Ratings, yet the latter two have assigned a “negative” outlook to Australia’s ratings. Simultaneously, it is worth highlighting that Australia’s solid economic fundamentals, a track record of fiscal responsibility, and a strong institutional backdrop support the nation’s sovereign creditworthiness.

Australia entered the COVID-19 crisis with healthy public finances and a sound economy that had not experienced a recession in almost 30 years. While significant fiscal stimulus was unveiled already earlier this year, we assess that Australia is in a solid position to provide further support to the economy. In our view, fiscal policy is more effective than monetary policy in underpinning Australian economic activity during the current phase of the pandemic, given that fiscal stimulus can be more targeted to those parts of the economy that need it the most. Accordingly, we expect the Budget 2020–21 to play a key role in helping the Australian economy get back on its feet. Complementing the government’s fiscal stimulus efforts, the Reserve Bank of Australia has responded to the COVID-19 crisis with notable conventional and unconventional monetary easing measures. While the central bank will likely leave monetary policy on hold in the near future as it assesses how the economy’s recovery unfolds, it may inject further monetary stimulus into the economy at a later stage. Nevertheless, we expect such action to be mostly cosmetic, aimed at strengthening confidence and reinforcing policymakers’ commitment to supporting the economy.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.