- The Bank of Korea continued to normalize monetary conditions by increasing the benchmark interest rate by 25 basis points to 1.50%.

- Inflation containment is a policy priority, yet global uncertainties warrant a gradual path of interest rate increases through the rest of 2022.

The Bank of Korea (BoK) raised its benchmark interest rate by 25 basis points to 1.50% following the April 14 monetary policy meeting (chart 1), in line with our expectation. The decision marks the fourth hike in the ongoing monetary normalization phase, which began in August 2021. The prior rate increase took place at the January meeting. Today’s decision was exceptional as the Monetary Policy Board is without a governor. Mr. Rhee Chang-yong has been nominated as the new BoK Governor, but he is not holding the position yet as he is still in the process of parliamentary confirmation hearings (scheduled for April 19). Nonetheless, the decision among the six present board members was unanimous, highlighting the sense of urgency in the BoK’s fight against rising inflation.

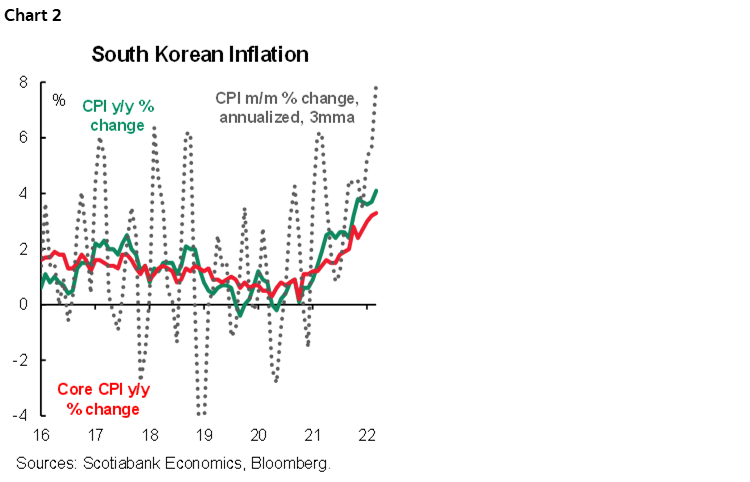

Inflationary pressures are building in South Korea, requiring a monetary policy response. Prices at the headline level increased by 4.1% y/y in March, while annualized monthly price gains (which allow us to see the current trend in inflation without the impact of year-ago base effects) show that “true” price pressures are twice as high (chart 2). The central bank expects headline inflation to remain “high in the 4% range for some time”. Indeed, our estimations point to 4.5–5% y/y inflation through the third quarter of 2022, after which we expect inflation to ease slightly to 3.7% y/y by the end of the year. Similarly, core inflation, at 3.3% y/y in March, remains well above the BoK’s 2% inflation target. The BoK expects it to “remain around 3% for a considerable time”. We assess that South Korea’s fight against inflation will not be short-lived, as prices pressures will likely persist due to elevated core prices, higher inflation expectations by the general public, as well as firms’ price-setting behaviour that is likely to pass some of the elevated input costs to consumers. Accordingly, we do not foresee headline inflation returning to the BoK’s 2% target before 2024.

Financial stability considerations continue to play a role in the BoK’s monetary policy decisions. The US Federal Reserve’s monetary tightening has triggered some portfolio outflows from South Korea and the won’s weakening bias against the US dollar. Nonetheless, the BoK’s Monetary Policy Board member Joo Sang-yong pointed out at today’s press conference that South Korea’s sound economic fundamentals are set to protect the economy from large scale capital outflows. Considering global economic uncertainties that can have an adverse impact on the export-oriented South Korean economy, we do not expect the BoK to aim for “tight” monetary conditions. We forecast that the BoK will maintain its gradual monetary normalization path over the coming months, taking the benchmark rate to 2.0% by the end of the year. As such, South Korea’s real interest rates are set to remain negative in the foreseeable future.

The BoK’s policymakers seem confident that South Korea’s economic recovery remains on track despite uncertainties related to the pandemic and the war in Ukraine. Household spending prospects are favourable on the back of a strong labour market, but fixed asset investment will likely be affected by higher materials prices and global supply chain disruptions. South Korean exports continue to perform strongly, yet we expect some softening in the months ahead. The BoK expects the nation’s real GDP growth to be somewhat below 3% in 2022.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.