- Australia’s central bank raised its cash target rate by 25 bps to 0.35%—the first hike since 2010 and the first move in its monetary policy normalization process—with inflation accelerating and a strong economic recovery well underway.

- The decision implies a more hawkish tightening path than we previously anticipated, but we still suspect that the RBA will remain cautious relative to international peers when raising rates.

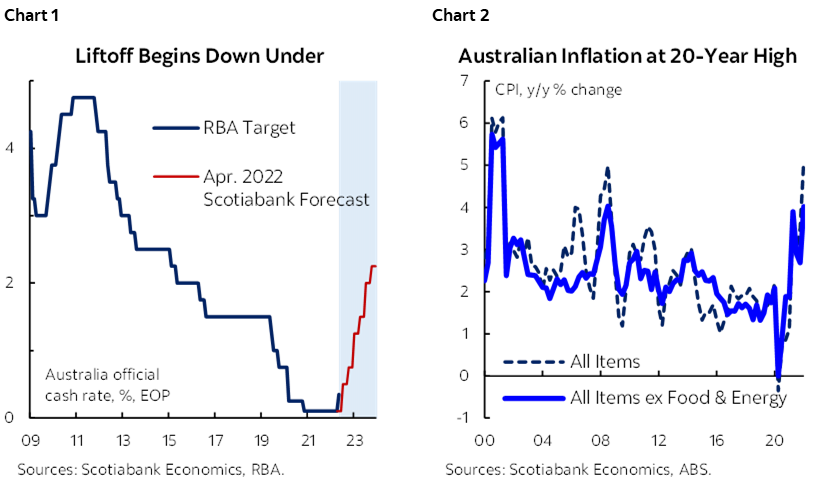

The Reserve Bank of Australia (RBA) raised its cash target rate by 25 bps to 0.35% on Tuesday—its first hike since late 2010 (chart 1). That was larger than the 15 bps expected by markets. Citing strong inflationary pressures (chart 2) and broad and resilient economic growth, the Bank deemed that it was time to begin withdrawing the emergency levels of monetary stimulus. Though topline real GDP growth forecasts were in line with those published in February—before Russia invaded Ukraine—unemployment rate projections were cut by ¼ ppts to 3½% by early 2023—which would represent the lowest rate in some 50 years. The RBA also noted rising wages and business investment, still-high construction activity, and the boost from higher commodity prices on Australia’s resource-intensive economy. The forecast for underlying inflation was lifted to 4¾% in 2022 from 3¼% in mid-2022 in the February projections.

The RBA Board stated that it “does not plan to reinvest the proceeds of maturing government bonds and expects the Bank’s balance sheet to decline significantly over the next couple of years as the Term Funding Facility comes to an end.” The Board does not currently plan to sell government bonds that the RBA bought during the pandemic.

The need to begin efforts to stabilize inflation plus the strength of the economic recovery outweighed the two key concerns previously raised about a May hike. The first of these was a fear that the first rate hike in over a decade would impact the outcome of the Australian general election set for May 21, 2022. The second was that Q1 wage data will not be released for another two weeks; with Aussie earnings growth thus far muted relative to inflation, the bank might have opted to await more evidence of a budding wage-price spiral before lifting borrowing costs. On this latter point, the statement cited timelier data from the Bank’s liaison and business surveys, which suggests that larger wage increases are now occurring in the private sector as firms seek to attract and retain staff amid a sharply rising cost of living.

This decision suggests a more aggressive tightening path than we previously projected, but we still suspect that the RBA will remain cautious relative to international peers when raising rates. Significant increases to underlying inflation projections support this view, as does the Bank’s expectation of stronger wage gains ahead of the Q1-2022 data release. Wage dynamics are crucial to RBA decision-making and we previously noted a lack of official evidence of sufficiently strong earnings growth as one reason for wariness of liftoff. Still, upward price pressures in Australia remain more subdued than in many other G10 economies. The RBA’s pledge to “continue to closely monitor the incoming information and evolving balance of risks as it determines the timing and extent of future interest rate increases” also implies some circumspection going forward.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.