The Chinese economy is firmly on a recovery path, assisted by the government’s stimulus efforts and successful containment of the initial COVID-19 outbreak.

The outlook is clouded by two substantial risks: a potential new large wave of COVID-19 infections and an escalation of tensions between the US and China.

Fiscal and monetary policies will remain growth-supportive, yet we see limited scope for further stimulus announcements unless the economic recovery suffers a setback.

ECONOMIC GROWTH OUTLOOK

The Chinese economy is leading the global recovery, reflecting the fact that it was the first to enter into and emerge out of the COVID-19 shock. China’s real GDP rebounded in the second quarter of 2020 after the first quarter slump caused by virus-related lockdowns and disruptions of activity; real GDP grew by 3.2% y/y following a 6.8% drop in the January–March period (chart 1). In quarter-over-quarter terms, the economy more than offset the first quarter declines.

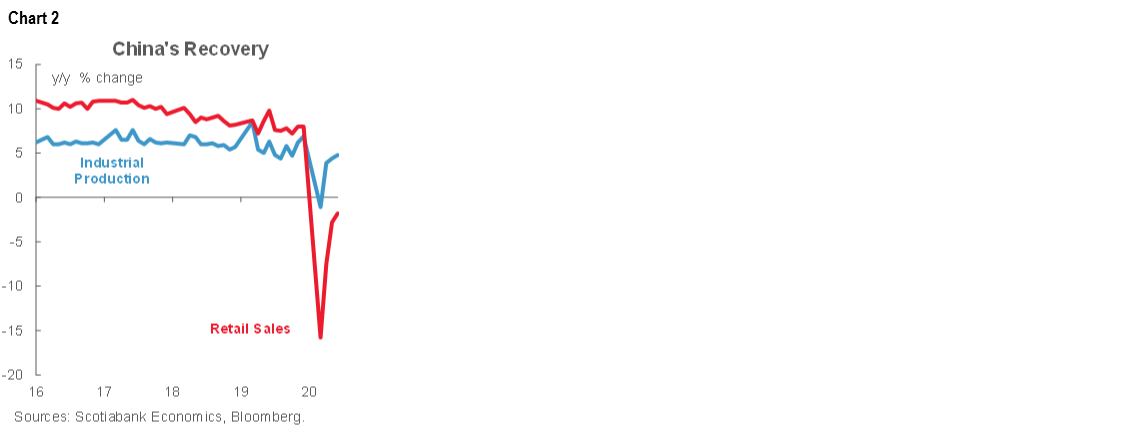

The industrial sector is leading the economic recovery with output already above year-earlier levels (chart 2). Similarly, electricity production and rail freight traffic volumes have rebounded, while Chinese exports are showing nascent signs of revival. The sectoral breakdown of the second quarter GDP confirms the dynamics; the secondary sector—i.e. industry—was driving the rebound with a 4.7% y/y growth in Q2. The tertiary sector—services—recorded a more muted gain of 1.9% y/y. This partially reflects the fact that consumer confidence has been slower to strengthen, causing retail sales to trail the overall recovery (chart 2).

We expect China’s economic rebound to continue in the second half of 2020, assisted by fiscal and monetary stimulus measures, with the nation’s real GDP growth estimated to average 2.1% y/y in 2020 as a whole. The forecast represents an improvement from our April and June projections of 1.6% y/y expansion. Pent-up demand and base effects will likely push the growth rate to 8.5% y/y in 2021.

The economic outlook continues to be highly uncertain. Another large wave of COVID-19 infections continues to be a significant downside risk considering persistent challenges to contain the virus outbreak in many parts of the world. Meanwhile, the bilateral China-US relationship has continued to deteriorate following China’s decision to impose the National Security Law on Hong Kong. Indeed, the conflict has evolved from a trade and technology dispute and now includes ideological overtones. We expect tensions to remain elevated ahead of the US presidential election in November 2020. Moreover, given the still-soft economic backdrop, we assess that it will be challenging for China to meet its purchase commitment of US goods as agreed in the “phase one” trade deal in mid-January. By the end of June, China’s year-to-date purchases amounted to 23% of the 2020 target of USD 170 billion.

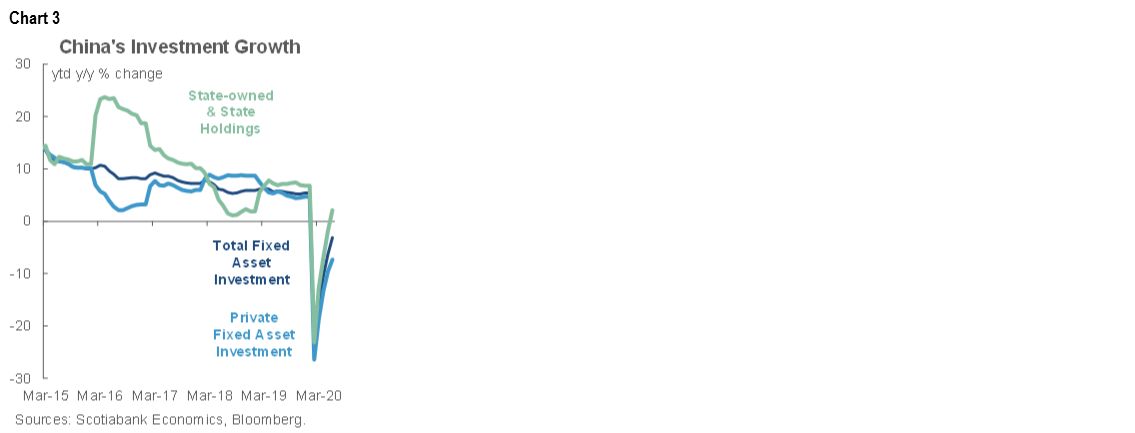

Public spending will play a key role in supporting the economy’s recovery; indeed, the Chinese administration has highlighted that fiscal policy will be more proactive in the second half of 2020. In May, the National People’s Congress raised the 2020 fiscal deficit target to 3.6% of GDP from 2.8% in 2019 and continued with a targeted approach to fiscal stimulus that underpins businesses via tax and fee cuts and social insurance savings. In addition, notable public outlays that largely fall outside of the government’s headline deficit have been announced: the government will issue an additional CNY 1 trillion of special treasury bonds (equivalent to 1.0% of GDP) for public health initiatives, while the 2020 issuance target for special purpose local government bonds—to be used for funding of infrastructure projects in areas such as transportation, utilities facilities, and rural development—was raised to CNY 3.75 trillion (equivalent to 3.8% of GDP) from CNY 2.15 trillion in 2019. Correspondingly, approvals for infrastructure projects have accelerated recently, leading to a pickup in fixed asset investment (chart 3). We assess that the Chinese administration has further fiscal space left should the economy need an additional boost.

MONETARY POLICY, INFLATION AND YUAN OUTLOOK

Accommodative monetary conditions will remain in place over the foreseeable future, complementing the government’s fiscal stimulus efforts. Nevertheless, we see limited additional monetary easing by the People’s Bank of China (PBoC) as the economy is on the path to recovery. Chinese benchmark Loan Prime Rates (LPR) have remained unchanged since April when the 1-year LPR was lowered by 20 basis points to 3.85%. The rate has been cut by 40 bps since August 2019. Similarly, we expect banks’ reserve requirement ratios (RRR) to remain unchanged over the coming months unless the economic outlook deteriorates. The PBoC has lowered the RRR for major banks by 100 bps to 12.5% over the past year, with the latest cut in January. In addition to the conventional monetary easing steps, policymakers have also advised Chinese banks to lower their profit targets in order to support struggling companies via lower lending rates, reduced fees, and deferred loan repayments.

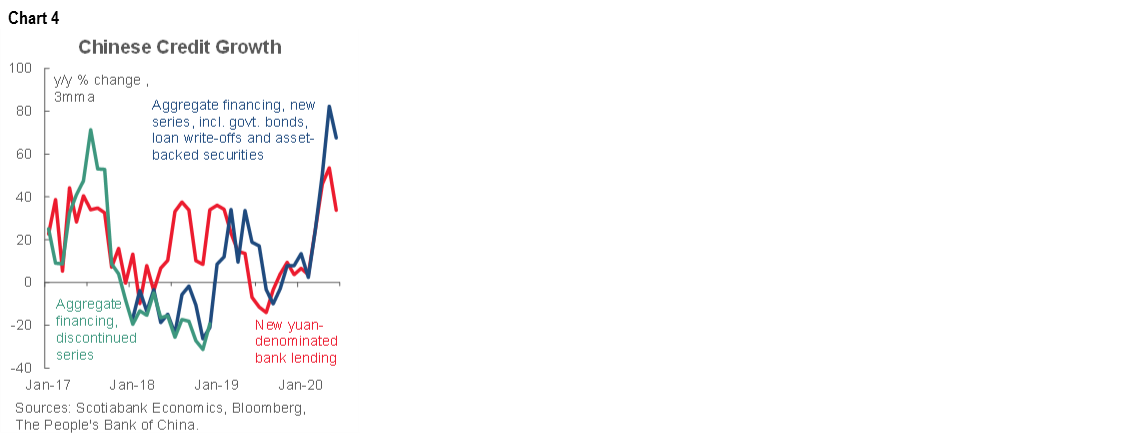

According to the PBoC, monetary policy will remain flexible and be more targeted in the second half of 2020, focusing on supporting enterprises and employment. Chinese policymakers have indicated that ample liquidity in the banking system will be maintained and that money supply and social financing will continue to grow faster than in 2019. Meanwhile, credit support will be enhanced for the manufacturing sector as well as for small and micro firms. These policy directions are apparent in bank lending and aggregate financing indicators, as growth rates have spiked in recent months (chart 4). Nevertheless, the PBoC’s policymakers seem aware of the risks related to credit-fuelled recovery dynamics, such as rising speculative behaviour and inefficient credit allocation. Indeed, monetary authorities have recently emphasized their commitment to continuing to address and prevent financial risks. Against this backdrop, we expect the boom in credit growth to remain in place only during the early stages of the economy’s revival.

China’s headline inflation has eased notably in recent months on the back of smaller increases in food prices; annual inflation was 2.5% y/y in June compared with the January peak of 5.4%. We expect consumer price pressures to remain contained through 2020 with headline inflation forecasted to close the year at 1.7% y/y. Moreover, inflation further up the distribution chain remains non-existent, with annual producer price gains currently residing in negative territory; in June, the producer price index dropped by 3% y/y.

The Chinese yuan (CNY) has appreciated by around 3% against the US dollar (USD) since the end of May on the back of China’s economic recovery and a broader weakening trend of the USD, dipping below the USDCNY7.0 mark. The CNY will continue to reflect developments in the US-China bilateral relationship over the coming months. Accordingly, the currency will likely lose some of its recent gains by year-end, yet the PBoC will prioritize yuan stability in the foreseeable future; we expect USDCNY to close the year at USDCNY 7.05.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.