China’s economic recovery is becoming broader and more sustainable; annual real GDP growth is expected to average 8.3% in 2021 due to rebounding global demand, base effects, and pent-up demand domestically.

Proactive fiscal policy stance and neutral monetary conditions will provide support to the economy, yet emergency measures are no longer needed.

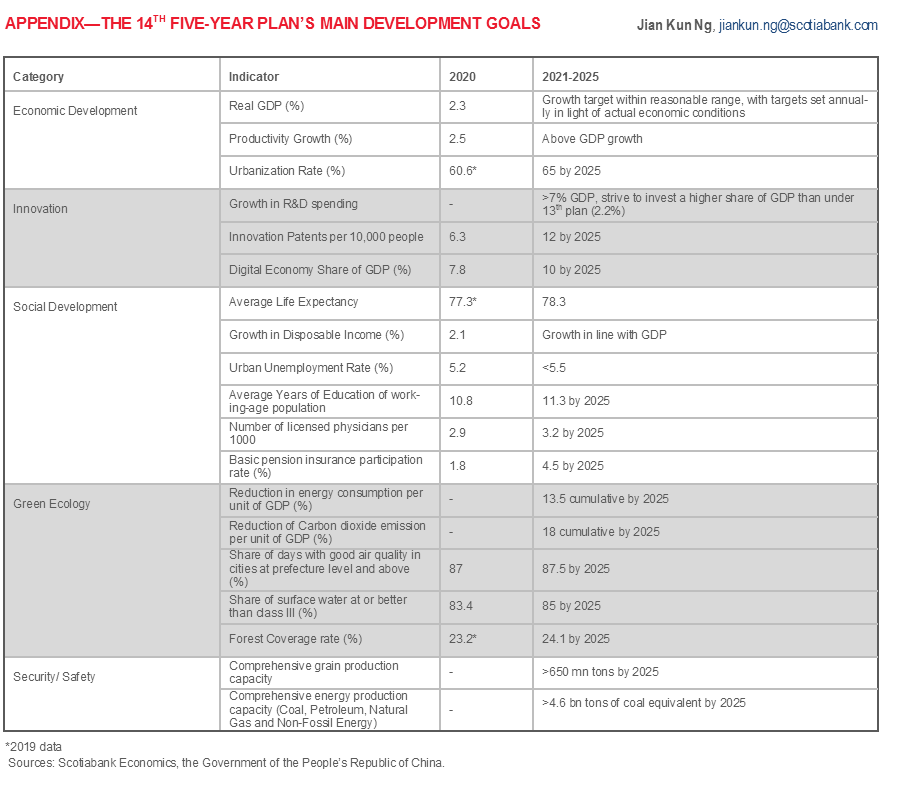

The government’s development plan through 2025 focuses on innovation-driven development, industrial modernization, domestic demand enhancement, and further trade and investment integration with the rest of the world.

The US-China tensions are unlikely to face a significant escalation despite persistent differences in the two countries’ economic and governance structures as well as social and political views.

ECONOMIC GROWTH OUTLOOK

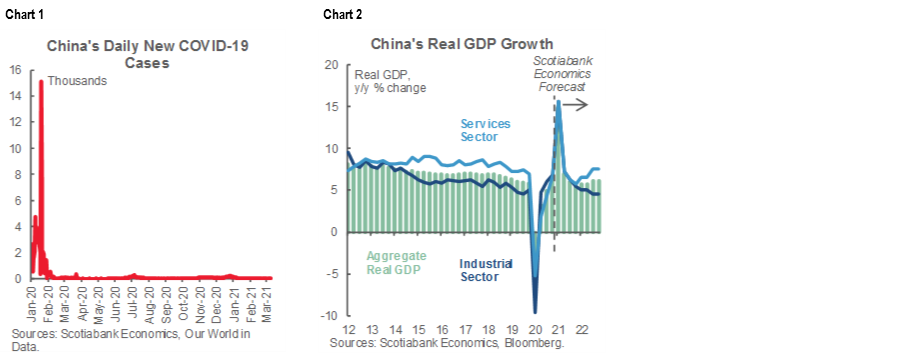

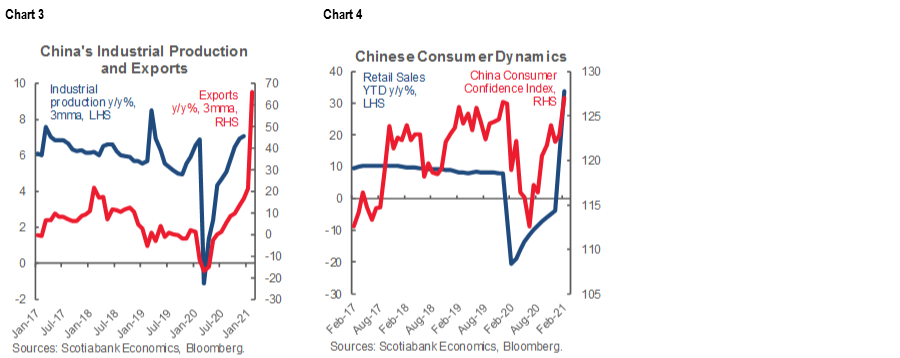

The Chinese economy continues to recover from the COVID-19 crisis, assisted by supportive fiscal and monetary policies and effective containment of the virus (chart 1). After the economy rebounded to positive growth territory in the second quarter of 2020, the recovery has gradually become more broadly-based. Indeed, China’s industrial sector is no longer the primary source of growth as momentum is also underpinned by solid services sector activity (chart 2). In 2020, China was an exception among the world’s major economies as it was able to grow its GDP; its output expanded by 2.3%.

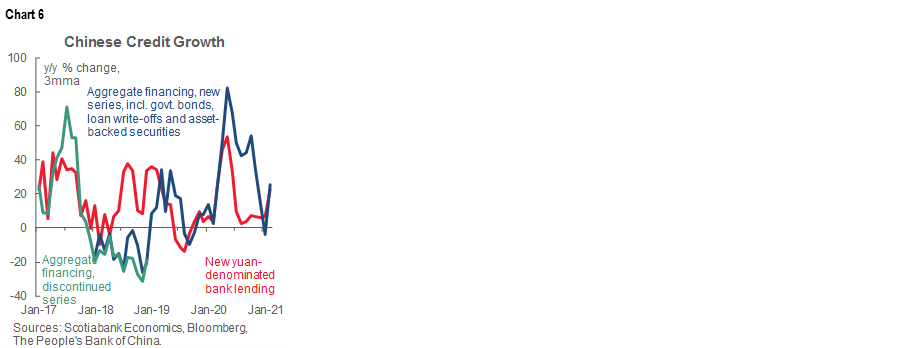

High frequency data show that China’s industrial, manufacturing and export-oriented parts of the economy got back on their feet relatively quickly (chart 3) and face a favourable outlook given rebounding global demand. Meanwhile, strengthening consumer confidence and recovering retail trade (chart 4) imply that domestic demand dynamics are catching up as well. We forecast China’s real GDP growth to average 8.3% y/y in 2021, supported by the recovering global economy, pent-up demand and a low base of comparison. In 2022, the pace of growth will likely return to a more sustainable trajectory, with output gains expected to average 5.9% y/y.

The annual session of the National People’s Congress (NPC) was held in March. The NPC is the highest body of state power in China with the ability to enact legislation, approve the government’s budget and ratify development plans. Sustained fast economic growth continues to be important for China, although the announced 2021 economic growth target of “more than 6%” is less ambitious than in prior years; we expect it to be surpassed by a comfortable margin. The government will maintain a proactive fiscal policy stance in 2021. The central government’s budget deficit will narrow only somewhat this year to 3.2% of GDP from 3.6% in 2020, while the issuance of special local government bonds will remain sizable at CNY 3.65 trillion, equivalent to around 3½% GDP (vs. CNY 3.75 trillion in 2020 and CNY 2.15 trillion in 2019); the bonds are typically used for large infrastructure projects and are not included in the government’s fiscal deficit target. Over the coming quarters, China’s infrastructure outlays will primarily focus on transportation networks and technology. While China’s planned public outlays are decreasing from the peak crisis levels, we assess that China’s fiscal policy stance remains growth-supportive in 2021.

China’s 14th Five-Year Plan, covering the years from 2021 to the end of 2025, was tabled at this year’s NPC (please see the Appendix for China’s economic development goals for 2021–2025). The Chinese government opted not to set an average annual growth target for the next five years; instead, policymakers expressed commitment to keeping economic growth within a reasonable range. We assess that this change provides policymakers with greater flexibility, enabling them to ensure sustainable leverage in the economy and implement structural reforms. The Five-Year Plan centers around the “Dual Circulation” development strategy, in which internal and international sides of the Chinese economy complement each other (chart 5). On the internal side, the strategy focuses on innovation-driven development and industrial modernization as China seeks to reduce its reliance on exports for technology products. Simultaneously, policymakers will focus on supporting Chinese consumers, employment and private sector investment in order to increase the importance of domestic demand to the overall economy. The government’s international goals encompass further trade and investment integration and structural reforms, steps that will help increase China’s relevance in the global economy. For further details on the “Dual Circulation” strategy, please refer to this report.

MONETARY POLICY, INFLATION AND YUAN OUTLOOK

The People’s Bank of China (PBoC) will likely maintain a prudent and neutral monetary policy stance this year and avoid making sharp policy adjustments. While the economic recovery is well underway, we assess that it is not sustainable enough for a near-term monetary tightening via traditional policy levers. Accordingly, we expect the Chinese benchmark Loan Prime Rates (LPR) to remain unchanged in the foreseeable future; the 1-year and 5-year LPRs have remained at their current levels of 3.85% and 4.65%, respectively, since April 2020. We also expect banks’ reserve requirement ratios (RRR) to remain unchanged over the coming months.

In response to the pandemic, the Chinese financial system increased credit supply substantially in 2020 (chart 6) as the PBoC directed banks to increase lending to affected industries. The credit boom—combined with banks’ ability to extend loan maturities because of the pandemic—has triggered our concerns regarding China’s loan quality. We assess that financial instability is set to increase over the coming quarters, especially in 2022 and beyond as the impact of stimulus measures fades and the country’s economic growth steadies at a lower level. Indeed, the International Monetary Fund has noted that credit quality in China has deteriorated due to repayment holidays and relaxed rules for handling bad loans. Accordingly, the Fund has urged Chinese authorities to strengthen bank transparency and governance. As the worst of the economic crisis is now over, Chinese monetary authorities will likely be increasingly focusing on addressing financial risks and imbalances that may have resulted from inefficient allocation of credit during the pandemic. Indeed, the PBoC is now encouraging lenders to rein in credit supply. According to the NPC, China’s money supply and total social financing growth will be in line with nominal GDP gains this year, which we forecast to be around 10% y/y. Last year, annual broad money supply (M2) and aggregate financing growth averaged 10.3% and 38.0%, respectively, compared with nominal GDP growth of 3.0% y/y.

The Chinese government has set the nation’s annual consumer price inflation target at “around 3%” for 2021. Inflationary pressures remain low for the time being; in fact, the consumer price index dipped into deflation in early 2021 (chart 7), though we expect this to be a temporary phenomenon. We forecast headline inflation to accelerate towards 2% y/y by the end of 2021 on the back of base effects, strengthening demand dynamics and higher commodity prices. Price pressures further up the distribution chain are already building as implied by the producer price index that has resumed an upward trajectory after being in deflationary territory for most of 2020 (chart 7 again).

The Chinese yuan (CNY) appreciated significantly against the US dollar (USD) in the second half of 2020 on the back of attractive yield differentials, China’s fast economic recovery and resultant capital inflows. While the CNY has reversed some of the gains in recent weeks, it is still about 10% stronger than at the end of May 2020 (chart 8). We expect broader dollar movements to influence the CNY in the near term, yet the currency should find medium-term support from China’s economic growth outperformance, relatively high yields and advances in bond market liberalization, as well as a less tumultuous US-China relationship. Against this backdrop, we expect USDCNY to close 2021 at 6.40. The expected scaling back of the US Federal Reserve’s bond purchase program in 2022 will likely trigger a modest weakening bias for the CNY in 2022, taking USDCNY to 6.60 by the end of the year.

CHINA IN GLOBAL CONTEXT

The Regional Comprehensive Economic Partnership (RCEP)—which was signed in November 2020 and will likely be ratified by the member countries over the course of 2021—is set to increase China’s influence in Asia-Pacific’s regional trade and geopolitical affairs over the coming years. The pact consists of China, Japan, South Korea, Australia, New Zealand, as well as the ten ASEAN countries. The RCEP is the largest free trade agreement in the world, encompassing about 30% of the world’s GDP and population. Deeper regional supply chain integration is one of the key objectives of the agreement; as such, it is expected to help China to diversify its sources for materials and intermediate inputs while shifting the country’s focus to higher-end manufacturing. China’s aspirations for further trade and investment integration go beyond the Asia-Pacific region, as evidenced by the proposed EU-China Comprehensive Agreement on Investment (CAI) and the Chinese government’s expression of interest of joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

The Chinese government has indicated that it is seeking to work toward an improved bilateral relationship with the US. While the economic and political structures of the two economies differ substantially, we believe that the change in the US administration is set to bring about a period of relative stability to the economic relationship between the US and China, as implied by a recent resumption of bilateral dialogue. While there appears to be bipartisan consensus in the US Congress on being tough on China, we expect the Biden Administration to restore more traditional forms of diplomacy in its engagement with China, thus preventing the relationship from deteriorating further. Nevertheless, we do not foresee a notable improvement in the state of affairs and expect that the US import tariffs on Chinese goods will be kept in place over the coming months. In our view, the two countries could potentially find common ground for collaboration in such areas as the global economic recovery, the COVID-19 pandemic, and climate change. However, we note that substantial differences in views will persist regarding political developments in Hong Kong and human rights violations, for instance. While these issues have strained China’s diplomatic relations with various countries globally, we do not expect them to significantly hinder China’s continued economic outperformance, the government’s goal of further trade and investment integration, and the resultant increase in China’s global economic might.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.