ECONOMIC OVERVIEW

- Next week’s relatively quiet calendar in Latin America and on the global stage follows turbulent trading.

- In Latam, we’ll watch Brazil and Colombia economic activity, Peru (Lima) unemployment, Mexican retail sales, and Colombian international trade data.

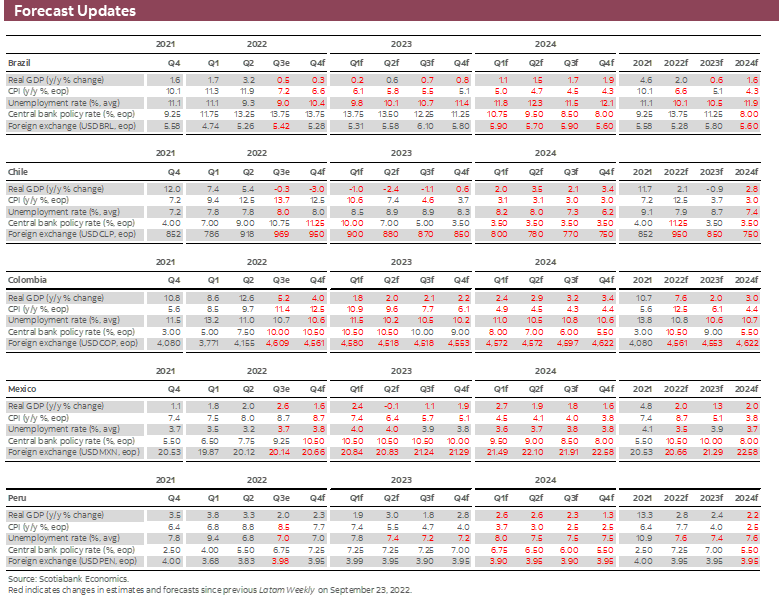

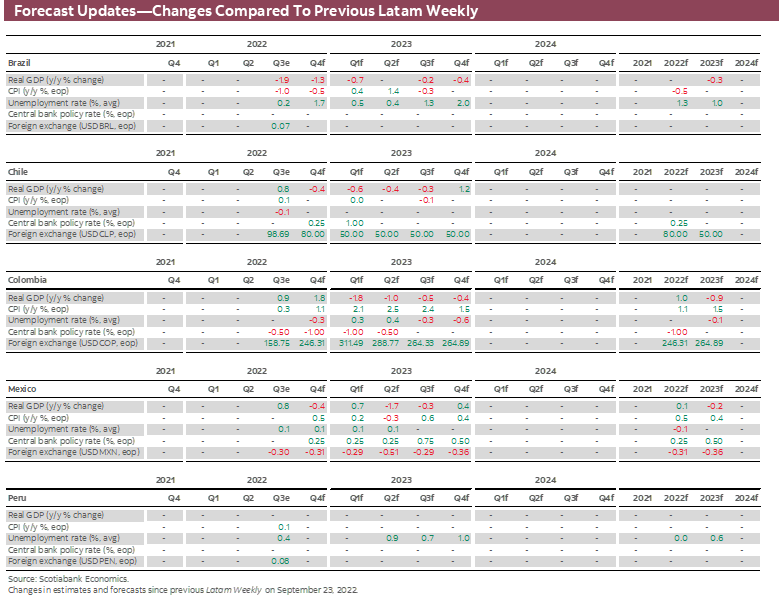

- In this edition of the Latam Weekly, we present updated forecasts for the core economies and extend our projection horizon to 2024.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

MARKET EVENTS & INDICATORS

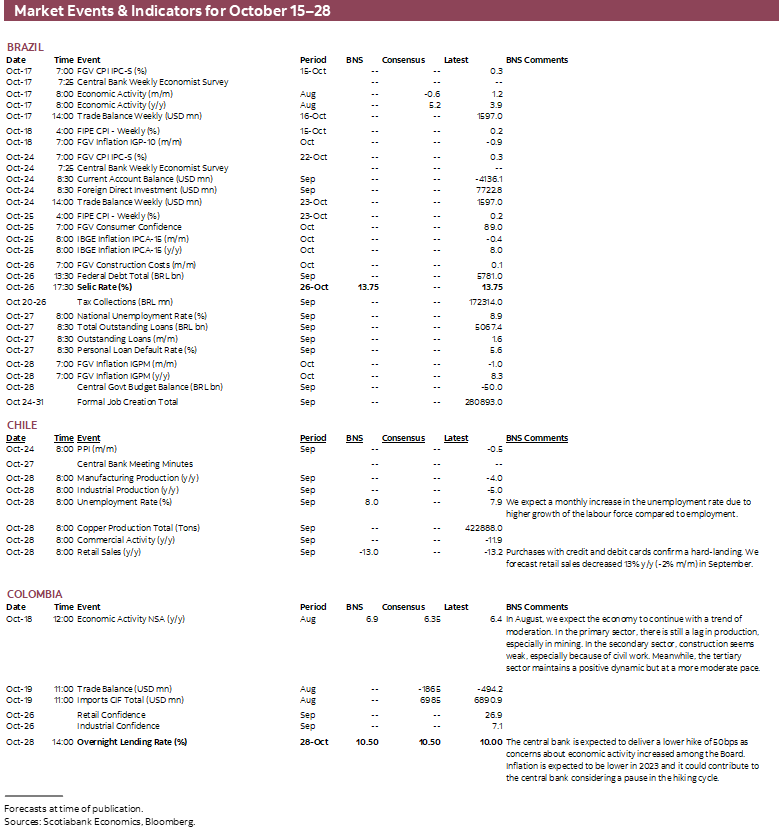

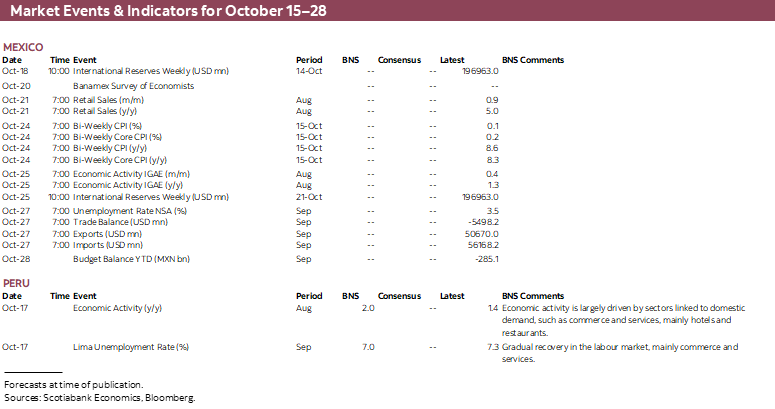

- A comprehensive risk calendar with selected highlights for the period October 15–28 across the Pacific Alliance countries and Brazil.

Economic Overview: Forecast Updates See Weaker Latam Economies

Juan Manuel Herrera, Senior Economist/Strategist

+44.207.826.5654

Scotiabank GBM

juanmanuel.herrera@scotiabank.com

- Next week’s relatively quiet calendar in Latin America and on the global stage follows turbulent trading.

- In Latam, we’ll watch Brazil and Colombia economic activity, Peru (Lima) unemployment, Mexican retail sales, and Colombian international trade data.

- In this edition of the Latam Weekly, we present updated forecasts for the core economies and extend our projection horizon to 2024.

Next week’s relatively quiet calendar in Latin America and on the global stage follows turbulent trading ahead of and following the US CPI release, with UK political developments stealing the limelight, and amid Russian bombardments of Ukrainian cities that weakened risk sentiment.

In Latam, we’ll watch Brazil and Colombia economic activity, Peru (Lima) unemployment, Mexican retail sales, and Colombian international trade data. We’ll pay particular attention to Colombia’s activity figures to gauge an economic deceleration that would justify an end to BanRep’s hiking cycle as soon as its October 28 meeting, when we project a 50bps increase. Peruvian lawmakers have received requests from the Attorney General’s office to process a Constitutional Accusation against President Castillo, and counter-requests to accuse the Attorney General for operating outside of legal bounds. Next week will be key in judging how these requests will be handled by Congress.

China’s Q3 GDP and the country’s 20th Party Congress are the main events to monitor outside of the Latam region while we watch how the game of musical chairs in UK government plays out after the dismissal of Chancellor Kwarteng. UK and Canadian CPI, US housing and construction data, and central bank speakers round out the ex-Latam schedule.

In this edition of the Latam Weekly, we present updated forecasts for the core economies and extend our projection horizon to 2024.

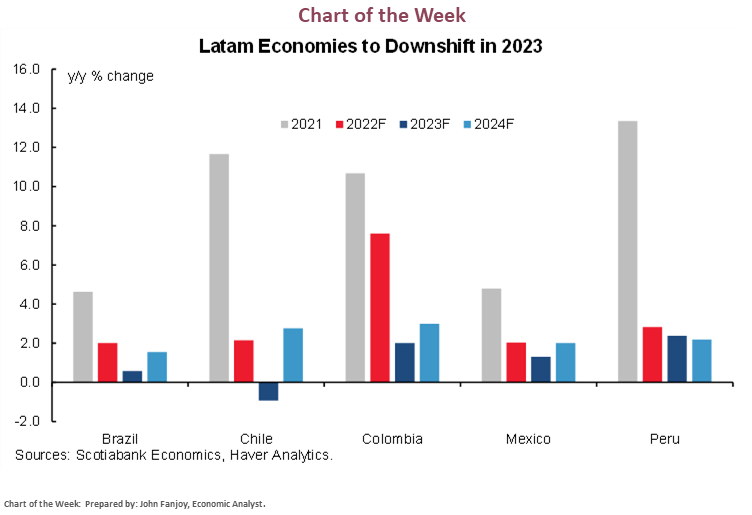

The main changes to our forecasts in relation to our previous Latam Weekly are:

- An additional 25bps to our BCCh outlook in line with the latest rate increase, which we see as the last, accompanied by a weaker CLP profile.

- Stronger growth in Colombia in 2022 offset by weaker growth in 2023 than previously projected, with a reduction in our year-end target for BanRep amid growth concerns. We now also project a weaker COP over the current and the following four quarters.

- A similar, but smaller, adjustment in Mexican GDP growth this year and next, with a higher inflation profile, while lifting our Banxico terminal rate forecast combined with a slower easing path beyond—and thus a relatively stronger (but still depreciating) MXN.

- A higher unemployment rate forecast in Peru for 2023, with all other projected variables left practically unchanged.

- Softer GDP growth in Brazil next year, in tandem with a higher unemployment rate as well as a different inflation profile (which ultimately results in an unchanged annual CPI forecast).

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Moderate Economic Expansion in 2022 and Recession in 2023; Back to Normal in 2024

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

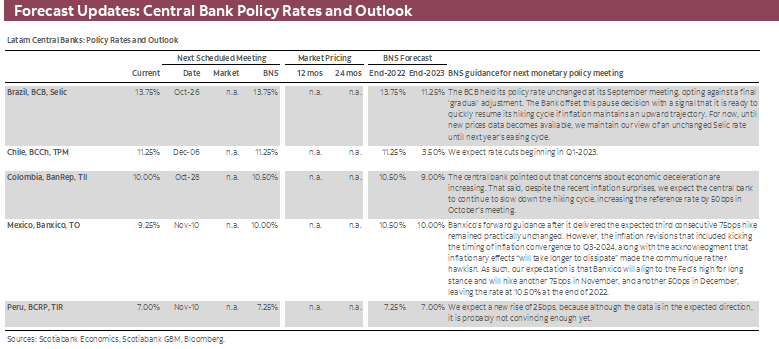

We maintain our GDP forecast of a 2.1% expansion in 2022 followed by a 0.9% contraction in 2023. Year-on-year declines in economic activity are expected from Q3-2022 continuing until Q3-2023. As for the Chilean peso (CLP), we have revised our USDCLP forecast upwards to 950 for end-2022 and to 850 for end-2023, taking into account the political uncertainty related to the constituent process. The CLP continues to reflect a discount compared to its emerging market peers. With this, annual CPI inflation would continue to slow towards 12.5% y/y as of December 2022, due to a deceleration in volatile prices this year. By December 2023, inflation would decline to 3.7% y/y, driven by the slowdown in domestic demand and an appreciation of the CLP. In this context, the central bank (BCCh) ends its tightening cycle at the present reference rate of 11.25%. For next year, we think the BCCh will be forced to cut the rate quickly and aggressively upon the first signs of disinflation amid a negative output gap and an economy heading towards a full recession. We anticipate cuts of “no less” than 100bps during Q1-2023.

In our view, 2024 will be a year in which the evolution of the main macroeconomic variables will return to normal, leaving the COVID-19 economic crisis behind. We expect a GDP expansion of 2.8% and annual inflation to end at 3%. With this in mind, the monetary policy rate would maintain its neutral level, at 3.5% in nominal terms (0.5% in real terms).

Colombia—Headwinds Ahead for 2023

Sergio Olarte, Head Economist, Colombia

+57.1.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

María Mejía, Economist

+57.1.745.6300 (Colombia)

maria1.mejia@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.1.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

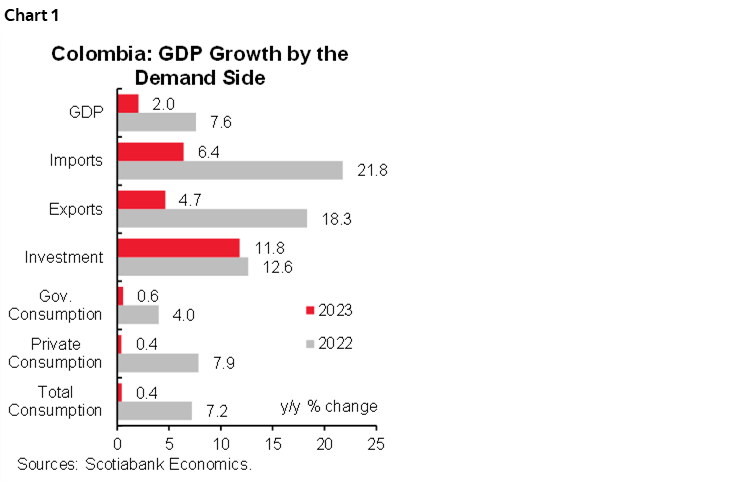

2022 has been a year of consolidation for the economic recovery in Colombia. In the first quarter of the year Colombia started a full normalization of in-person activities (schools and offices). This progress led to a 10.6% pace of growth in H1-2022, exceeding market expectations due to stronger-than-expected private demand. However, recent activity data have shown that the impulse of reopening is vanishing. Either way, as Colombia is still showing positive inertia in the services sector, thus we have revised our economic growth projection for 2022 to the upside to 7.6% from 6.6%. Looking ahead to 2023, the challenging context of still high inflation, higher rates, tax reform, and expected headwinds from the global economy, lead us to think that economic activity will soften to a 2% pace (chart 1), which is still higher than the 0.7% growth expected by the central bank. A moderation in private consumption along with more moderate investment activity explains the change in our outlook, which previously saw a 2.9% expansion in 2023.

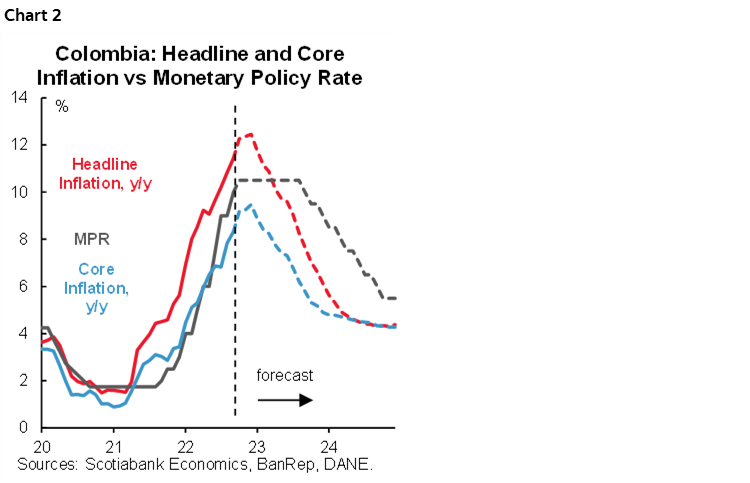

Inflation has also surprised to the upside in 2022. In September, annual headline inflation rose to its highest since 1999, and we expect it to hover around 12.5% through the remainder of the year. In the YTD, 37% of total inflation was explained by food inflation, in relation to supply-side shocks. Core inflation has also exhibited upside pressure, reflecting the impact of higher international costs and FX depreciation as tradable goods (ex-food and regulated prices) posted an 11.82% increase in prices, while services (non-tradable) inflation accelerated from 2.18% by the end of 2021 to 5.93%, showing that demand pressures exist. In Q1-2023 we expect inflation to begin to moderate, owing to a normalization in food inflation and a high statistical base effect. By end-2023, we expect 6.11% headline inflation (chart 2), remaining above from BanRep target range (between 2% and 4%). In the case of core inflation, the reduction is more moderate than in the case of the headline, we expect core inflation at 9.47% by the end of 2022 and 4.89% by the end of 2023, showing that prices will continue to be impacted by indexation effects but will moderate as a result of weaker demand.

All in all, monetary policy is balancing a scenario of weakening economic activity against still high inflation. BanRep has increased the key rate by 825bps since September 2021, taking the rate from 1.75% to the current 10.00%. In September, the central bank expressed concerns over economic activity and Governor Villar highlighted that the effect of the hiking cycle would be reflected in forthcoming months. We interpret his comments as a sign that BanRep is close to the end of the hiking cycle. In light of this, we have changed our call to a 50bps hike at October’s meeting and a potential pause in December subject to a further weakening in the economic activity indicators and a stabilization in inflation. The pause would last for around 10 to 12 months in 2023 (chart 2 again) which indicates that the real monetary policy rate will be restrictive through most of the year. By the end of 2023, we forecast the monetary policy rate at 9%.

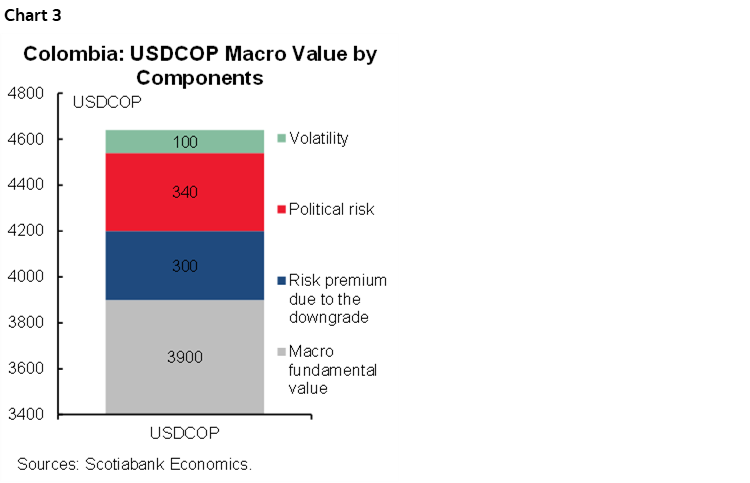

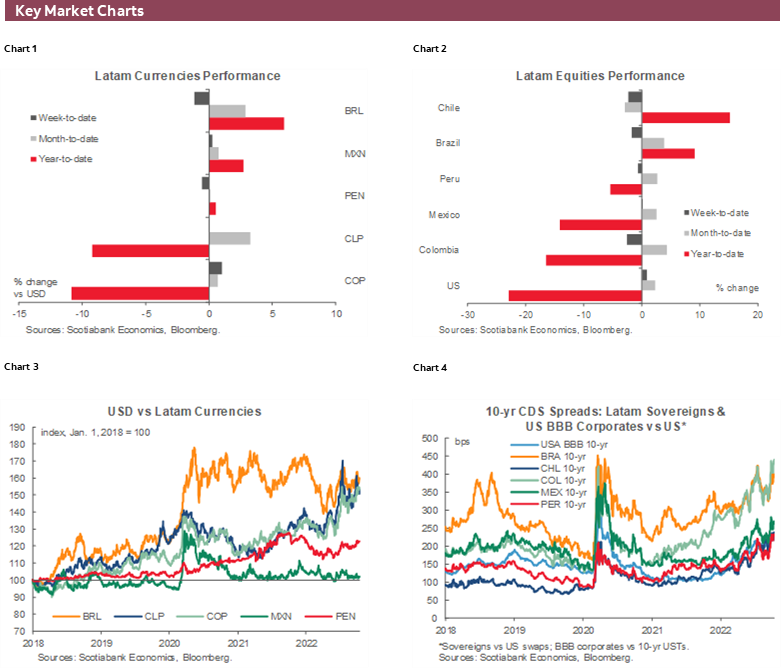

In the case of the currency, traditional macro fundamentals suggest the Colombian peso should be trading around 4,150 pesos, which includes a risk premium component—which surged after the credit rating downgrade in mid-2021. However, we identify a new risk premium that involves a higher sensitivity to political announcements that looks more structural than the initial estimate. Thus, we expect and equilibrium exchange rate around USDCOP4,550 in the medium term (chart 3).

Mexico—2023 Looks Set to Be a Challenging Year

Eduardo Suárez, VP, Latin America Economics

+52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

At present, consensus in Mexico still looks for growth north of 1.0% for 2023 (the Bloomberg consensus is 1.2%, while our call is for 1.3%), despite expectations for US growth falling below 1.0% (0.7% in the Bloomberg consensus). We see material risks that the US slowdown will pull Mexico’s expansion south of 1.0% (maybe even 0.5%) but, for now, we keep this as a downside risk rather than our baseline scenario. Behind the Mexican economic outperformance are two main drivers: 1) net exports remaining relatively strong (at risk if we see a strong slowdown in the US, Europe, and China), and 2) still resilient domestic consumption. Up to this point, and over the past two years, one of the primary drivers of consumption has been abnormally strong remittance flows, but these are likely to come under pressure as employment in the US slows due to aggressive rate hikes amid still high inflation.

Some of the optimism is likely driven by expectations of nearshoring, but we see two risks to this expectation: 1) very high interest rates, alongside a slowing economy, are likely to dampen some investment flows, and 2) Mexico’s capacity to absorb investment (including from nearshoring) is still capped from the country’s limitations in access to energy, water, security costs, and availability of quality labour. We think nearshoring will be a force, but it’s a story more likely to be seen in micro numbers (regional growth in parts of the country such as the Bajio and the North as well as in sectors such as logistics, manufacturing, etc.). In this context, it’s worth recalling that Mexico’s 2023 budget is built on a 3.0% growth assumption, which likely means either a miss of fiscal targets (saving depletion or higher debt issuance) or spending cuts.

On the inflation front, we do see a peak near end-2022, but the decline in inflation could be slow. Banxico’s Report of Regional Economies (analogous to the Fed’s Beige Book) still has roughly 50% of manufacturing and 60% of services companies planning to increase their prices at a similar or stronger rate than current—suggesting some price stickiness. On the other hand, to comply with new labour regulations under USMCA, Mexican sectoral wage contracts must now comply with more open and transparent wage settlements, and all sectoral contracts must adhere to this mechanism by summer 2023. High inflation, combined with deadline-related pressures skewing bargaining power in favour of workers suggests that wage hikes over the next nine months will likely be close to or above 10%, imposing cost pressures on firms. We thus see a slow convergence of inflation back to target, which in turn means that Banxico’s policy easing will also be somewhat slow and limited.

For the exchange rate, we have a slightly more constructive view for the peso than what is currently discounted in the FX swaps market. There are three primary reasons for this: 1) we anticipate that Banxico will be cautious and will keep a 550bps–600bps spread over the Fed, thus serving to anchor the peso; 2) with foreign investors having materially reduced their exposure to M-bonos (foreign holdings dropped from above 65% to closer to 35%), there is now relatively lower demand for buying USDMXN to hedge this exposure during periods of uncertainty; 3) despite the risk that Mexico will once again be an electoral piñata for the US election in 2024, we think rhetoric against Mexico will likely not touch NAFTA/USMCA this time around, as the new agreement seems to enjoy bilateral support, and the aforementioned labour chapter will likely keep pressure from unions north of the border at bay.

Peru—Slowing Growth is a Secular Trend

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Peru’s GDP used to grow at a 6% to 7% pace up until a decade ago. Now, the country counts anything close to 3% as robust. We do not foresee strong growth in the years ahead—not in the current global environment, and certainly not in the current local political environment. We maintain our 2.8% GDP growth forecast for 2022 and 2.4% for 2023, with 2.2% penciled in for 2024. During this period, growth is likely to rely on exports while domestic demand, and especially private investment, languishes. Output from the new Quellaveco copper mine alone will add half a percentage point to growth in 2023. Without this factor, GDP growth would be below 2%.

As a result, we expect the employment picture to stagnate, with unemployment deteriorating mildly to a 7.5% to 8.0% range—not all that high—but persistently higher than the pre-COVID-19 levels of under 7.0%.

We maintain our projection of a very slow decline in inflation, with levels above the BCRP’s 3.0% target range ceiling until mid-2024. The BCRP will need to keep its reference rate relatively high in the meantime, with the first decline in rates occurring in late 2023. We expect the BCRP to increase its reference rate one final time, by 25bps, in November but, regardless of whether it does hike, we expect the terminal rate to stay in place for a full year’s time.

The PEN is much more difficult to gauge, and the relative stability in our forecast numbers is deceiving. The PEN will balance external fundamentals, copper prices in particular, which are likely to continue to be sufficiently favourable, the strength of USD and its impact on USDPEN positioning, the spread between Peru and US interest rates, and the BCRP’s determination to provide currency stability. This means interim instability as the balance of determinant fluctuates but over the long-run, the case can be made that these factors will largely balance out.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.