ON DECK FOR TUESDAY, FEBRUARY 2

KEY POINTS:

- Groundhog Day brings another rise in risk appetite

- Vaccine pessimism remains excessive…

- ..as 78% of world’s population could be inoculated this year…

- ...while the US, UK and Canada achieve critical crossover points

- The RBA unexpectedly expanded stimulus…

- …only to discover that markets didn’t much care

- Why the RBA decision is an outlier in central banking

INTERNATIONAL

It’s Groundhog Day (again…) and North America’s famed gophers are collectively divided on the outlook. Ah, they’d make good economists. For that matter, maybe they’d do well at any profession marked by considerable uncertainty and hence worth pursuing in the first place. Such uncertainty is nevertheless absent in today’s markets, however, as a solid global risk-on bias continues but absent any major new cross-market catalysts overnight.

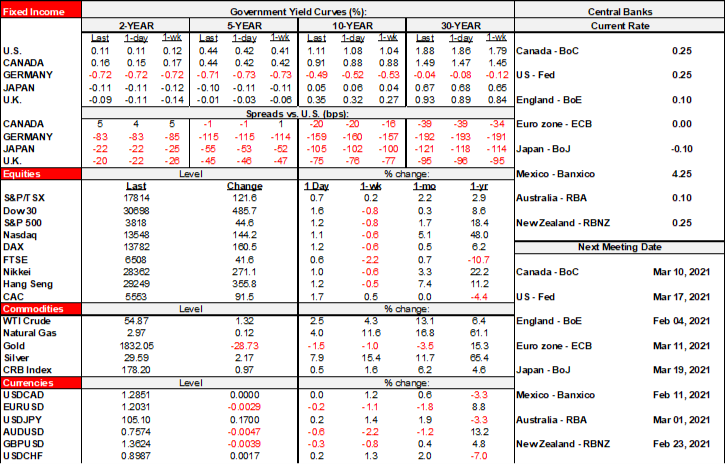

- Stocks are up by between about ¾% (London, Toronto) and 1¾% across the US and most of Europe.

- Sovereign bonds are again not feeling the love as 10s cheapen by 2–3bps across major markets.

- The USD is slightly firmer on balance with the weakest cross being the A$ but on a general up day for the greenback.

The RBA surprised markets by adding another A$100 billion of purchases of bonds issued by the Australian Government and states and territories at a pace of $5 billion per week starting when the current program expires after mid-April and slated to end by September if this pace is unchanged. The A$ immediately fell by a quarter cent and would gravitate lower by over half a cent as the day wore on. The 10 year yield initially fell by about 6bps but subsequently reversed much of that to wind up only about 1.5bps dearer.

All things considered, for a surprise announcement, the market effects were rather trivial. $100 billion in a modestly sized market only buys you a half cent these days when seeking to weaken the currency is among RBA goals? Why such a limited response?

- A first candidate for the explanation is that markets may have partly anticipated an eventual extension of the program, just not quite yet.

- Another possibility is that a modest sized central bank has limited ability to control its currency against far more powerful global forces and there have been sound drivers behind A$ appreciation anyway.

- The diminishing marginal usefulness of bond purchase programs may be another consideration as when the Fed’s LSAP1–3 resulted in diminishing effects upon term premia.

- Another may be that at this point in the cycle, markets take back any such expansions through inflation expectations and hence why the 10 year Australian breakeven increased by about 2bps post-announcement. With vaccines arriving and global cases dwindling, is a pre-emptive advance commitment to doubling bond purchases appropriate?

- A further reason may be that perhaps markets are uncertain about whether the RBA will make full use of the additional $100 billion commitment; a parallel here is to the ECB that expanded the PEPP but took back some of the market effects by saying they might not use it all. I don’t believe the RBA indicated as much overnight, but it’s not inconceivable markets are thinking that at some point before September we might hear a taper whisper.

But does the RBA move contain any lessons of significance to watcher of other mid-sized central banks like the Bank of Canada? Not really in my view. For one thing, no one else was running a bond program that was slated to come to a full stop as soon as April and so extending the program only puts the RBA on the same footings as other central banks. Second, the BoC is closer to its inflation goal of 2% in terms of average core as the operational guide than the RBA is to its higher 2–3% inflation target range.

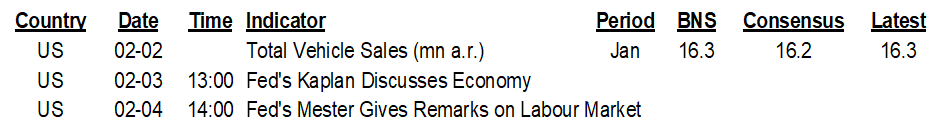

On a separate note, the extreme pessimism encountered in much of the daily coverage toward vaccine roll-outs is in need of constant counter points. While progress may not be fast enough everywhere given the exigency of the crisis, bear in mind that up until November we weren’t talking about any progress being achieved by this early point. Second, there is greater progress than indicated in the cynical efforts that seem to dominate political circles and media newsrooms today. Chart 1 is a reminder that by year-end, updated production schedules could see almost 6 billion people inoculated with the full dosage requirements by the main vaccine candidates. Being forecasts from the companies (albeit with market and regulatory guidance checks) there is of course uncertainty around the numbers, but there could well be upside if expanded production agreements continue to be signed as well as downside if kinks in production schedules persist. If achieved, however, then 78% of the world’s 7.7 billion people could be inoculated by the end of this year if all goes just peachy. The tone of much of the current coverage is fixated upon delays measure in days and weeks thus far which is understandable to a point, but misses the grander picture of where we are probably rapidly headed over the course of this year. Prior to November’s first trial results, that number was, oh, let’s see now….well, zero!! From zero to 6 billion by year-end within about three months is not cause for such cynicism.

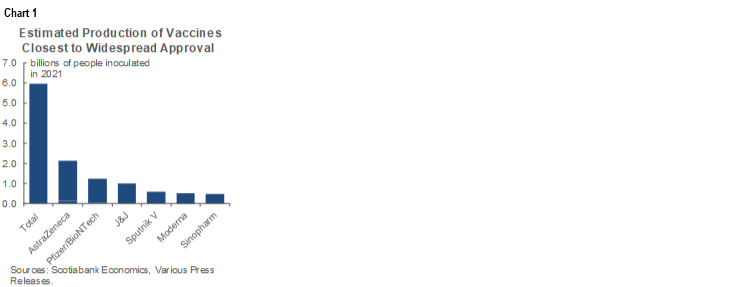

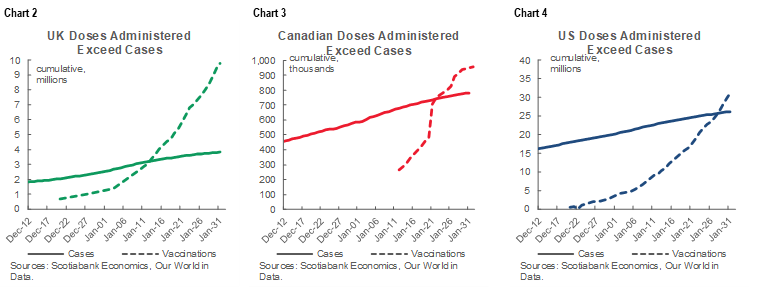

Secondly, we’re moving well past the critical crossover points that I’ve previously referenced to be something to monitor as a turning point in the COVID-19 pandemic. Chart 2 shows the superb job that the UK government and the pharmaceuticals industry has been doing by driving 2½ times as many doses administered as there are cumulative COVID-19 cases from day one of the pandemic. Charts 3 and 4 show more recent progress toward cross over points in the US and Canada.

The US calendar will only include vehicle sales during January later in the day and they are expected to be little changed from the rise to 16.3 million (annualized) the month before. There is nothing due out in Canada.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.