Argentina: IP took a pause, construction continued to heal in October

Brazil: BCB held at 2.00%, tweaked forward guidance

Chile: Monetary policy report delivered the dovish bias we expected in the statement

Colombia: November’s consumer confidence improved to its best level in nine months

Mexico: November inflation eased more than expected

ARGENTINA: IP TOOK A PAUSE, CONSTRUCTION CONTINUED TO HEAL IN OCTOBER

Argentina’s recovery in industrial production (IP) took a pause in October while construction activity continued to heal from the nadir of Q2’s lockdowns, according to data released by INDEC on Wednesday, December 9.

- IP pulled back by about -2.5% m/m sa in October, which took annual growth down from 3.66% y/y in September, its first positive reading of the re-opening period, to -2.94% y/y (chart 1). Breadth was poor as 11 out of 16 sectors notched up year-on-year losses, with the worst decline in transportation equipment (-31.5% y/y) while machinery and equipment production, up 27.3% y/y, led the gainers. We expect IP’s performance to improve in November given the month’s strong vehicle production numbers.

- In contrast, construction activity grew by about 4.3% m/m sa, taking annual growth up from -3.9% y/y to -0.9% y/y (chart 1, again).

Compared with the pre-pandemic activity levels observed in January 2020, both industrial production (up 31%) and construction activity (up 17%) have now recovered from this year’s lockdowns (chart 2), even if they haven’t yet sustained seasonal levels from a year ago (chart 1, again). Economic activity as a whole, however, remains off by -4.1% from January as labour-intensive service sectors continue to suffer under public-health restrictions and mixed domestic demand.

—Brett House

BRAZIL: BCB HELD AT 2.00%, TWEAKED FORWARD GUIDANCE

The BCB’s Copom voted unanimously on Wednesday, December 9, to hold the headline Selic rate at its record low of 2.00% for a fourth straight meeting (chart 3), as had been universally expected. In its statement, the Copom observed that inflation expectations have risen since its last meeting, but remain below target over the monetary-policy horizon; in the meantime, fiscal settings have remained unchanged since the Committee’s last meeting.

The Copom did, however, tweak its forward guidance with a more hawkish bent, noting that:

“… over the coming months, the 2021 calendar-year should become less relevant than the 2022 calendar-year, for which projections and expected inflation are around the target. A scenario of inflation expectations converging to the target suggests that the conditions for maintaining the forward guidance may soon no longer apply, which does not mechanically imply interest rate increases, since economic conditions still prescribe an extraordinarily strong monetary stimulus”.

This new language points toward less constrained, data-dependent moves over the next few meetings.

The Copom’s characterization of the balance of risks contained few surprises, though it did note some uncertainty related to short-term economic activity owing to the recent resurgence in the pandemic in developed markets. The Copom also maintained its view that Brazil faces an uneven domestic recovery, though this is expected to smooth out as we move into mid-2021.

The minutes from this Copom meeting are due to be published by the BCB on Tuesday, December 15.

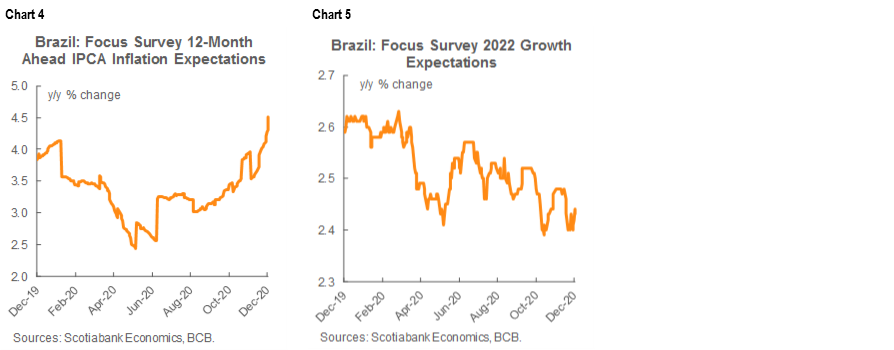

Wednesday also saw the release of the BCB’s Focus Survey, where the recent price spike seems to have contaminated expectations for IPCA inflation 12 months from now (chart 4), even if longer term forecasts remain more anchored at 3.5% y/y for end-2022. Expectations for end-2021 inflation have been rising steadily, with a 19 bps increase over the past 4 weeks alone. At the same time, consensus expectations for growth in 2022 have been converging to potential around 2.0% y/y (chart 5), after experiencing a bounce in the Focus consensus for 2021 to 3.5% y/y.

—Eduardo Suárez

CHILE: MONETARY POLICY REPORT DELIVERED THE DOVISH BIAS WE EXPECTED IN THE STATEMENT

The BCCh’s release on Wednesday, December 9 of its latest Monetary Policy Report (MPR or IPoM in Spanish) delivered the new dovish bias that we looked for, but didn’t get, in the statement that followed the decision on Monday, December 7, to hold the key monetary-policy rate at its so-called “technical minimum” of 0.5%, where it has been since end-March. The new Report outlined important adjustments to the Bank’s September baseline forecasts, with a recognition that external demand has strengthened mixed with caution on the recovery in domestic investment.

The domestic and international landscapes continue to evolve with the pandemic and its impact on activity; notably:

- In Chile, new infection numbers have decreased, but mobility and activity have improved more slowly than the central bank anticipated in its September outlook. This has been especially the case for those sectors most affected by physical distancing, such as construction and large swaths of services;

- The withdrawal of pension assets has, however, generated temporary increases in consumption, particularly in imported goods, which has boosted activity in the wholesale and retail sectors, but also increased inflationary pressures;

- Investment, beyond the reactivation of public and private projects, is being affected by the financial situation of companies and persistent political uncertainty; and

- Labour markets have seen some recovery, with an increase in job creation compared to numbers we saw at the middle of the year.

The BCCh’s new baseline scenario foresees that the economy will keep improving in the coming quarters, that mobility restrictions will not return to the intensities that we saw in mid-2020, and that fiscal and monetary support to the economy will continue.

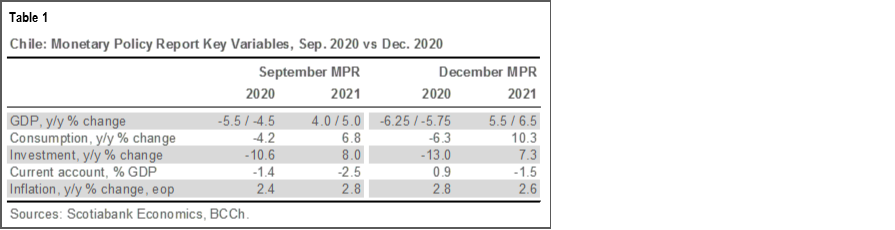

The strong impulse to the consumption of durable goods from fiscal measures and pension withdrawals has led to a significant reduction in inventories in some product lines, putting pressure on their prices. This has occurred in a context in which imports have been down in 2020. Consumption will continue to be underpinned during the first months of 2021 by the second round of pension-fund withdrawals, although the impact of this set of pension drawdowns is expected to be smaller than under the first round. Combining the effects of the recovery of labour income, government transfers, and pension withdrawals, private consumption is now expected to grow by 10.3% y/y in 2021 after falling by -6.3% y/y in 2020 (table 1). The higher growth forecasts for 2021 in the December MPR were driven mainly by this upgraded outlook for consumption since expectations for investment’s performance were downgraded in both 2020 and 2021 (table 1, again). It is also worth providing some background on the central bank’s forecast current account surplus for 2020: the number reflects some rebound in imports owing to the end-year boost in demand expected from the pension withdrawals. The BCCh’s projections have been repeatedly adjusted upward and downward since March, so we should not take this new baseline scenario as written in stone.

The most important part of this MPR lies in the introduction of greater conditionality in the process of normalizing the policy rate. Indeed, after the statement last Monday, there is an impression that the BCCh was inclined to start raising the monetary-policy rate toward the end of the forecast horizon, but this MPR has shown that the Board’s future moves are likely to be much more conditional and subject to downside risks than the market interpreted in September or more recently. In this sense, we have seen the materialization of our longstanding view that the central bank would be more cautious and contingent in its normalization process than the market consensus has inferred. We expect rates to decline across the curve, which should mitigate some of the CLP’s appreciation that has followed the increase in copper prices, USD softening, portfolio effects from the divestment of pension assets, and sales of USDs by Chile’s authorities to finance the strong expansion of public spending in 2020 and 2021.

—Jorge Selaive

COLOMBIA: NOVEMBER’S CONSUMER CONFIDENCE IMPROVED TO ITS BEST LEVEL IN NINE MONTHS

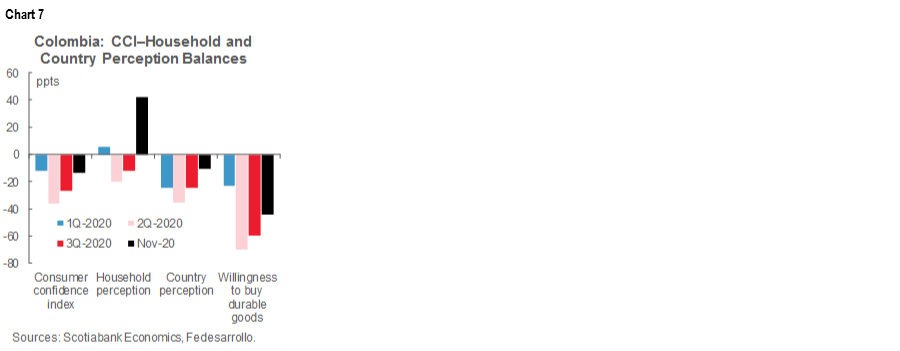

November’s Consumer Confidence Index (CCI), released on Wednesday, December 9, stood at -13.6 ppts, 5 ppts higher than October’s level (-18.3 ppts) and the best print in nine months (chart 6). In November, the CCI improved at its quickest pace in three months and showed us an improving picture of Colombians’ sentiments since both the assessment of current conditions and the index of expectations for the future improved (chart 6, again). This confirms that the re-opening is consolidating and translating into better consumer sentiment that is more aligned with recent improvements in business confidence surveys.

Looking at November’s details, the Current Conditions Index strengthened from October’s -47.3 ppts to -43.9 ppts. Similarly, the Expectations Index rose by 6 ppts to 6.5 ppts, marking the best level since August 2018 and a smooth rise since the re-opening began.

November’s consumer confidence numbers improved in the five cities surveyed, with Bucaramanga and Barranquilla leading the gains in perceptions, while Bogota and Cali saw the smallest increases. On the other hand, consumers’ willingness to buy houses fell by -1.1 ppts owing to a deterioration in sentiment in Cali (-30 ppts) to -21.4 ppts, which offset gains in the other cities.

By socio-economic levels, November’s indices painted an unbalanced picture. Low-income earners’ confidence worsened, while that of high-income and middle-income populations improved. It is worth noting that willingness to buy houses decreased amongst both low-income and high-income populations by -11 ppts and -10.9 ppts, respectively.

In contrast, consumers’ inclination to buy vehicles and durable goods—such as furniture and home appliances—improved significantly by 8.7 ppts to -44.6 ppts (chart 7), the best level since February, though still worse than pre-pandemic readings. Consumers’ willingness—or lack thereof—to buy durable goods is one of the significant challenges for the economic recovery. November confidence numbers show that consumers are gradually normalizing their consumption habits, but with still-high levels of unemployment further reversion to mean behaviour will likely take some time.

All in all, November’s recovery in consumer confidence is good news. Consumers’ caution about the future is moderating as re-opening keeps consolidating; we expect confidence to continue improving, although at a slowing pace, in line with labour-market dynamics.

—Sergio Olarte & Jackeline Piraján

MEXICO: NOVEMBER INFLATION EASED MORE THAN EXPECTED

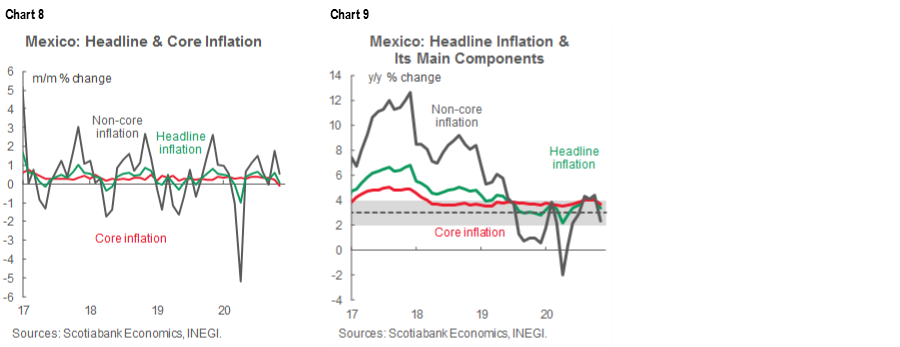

In data released on Wednesday, December 9, headline inflation for November eased more than expected from October’s 0.61% m/m to 0.08% m/m (chart 8), below the 0.15% m/m in the Bloomberg consensus. This brought headline annual inflation down from 4.09% y/y in October to 3.33% y/y in November (chart 9), versus the consensus expectation of 3.41% y/y. November’s print left headline annual inflation at its slowest pace in five months and returned it to the 2–4% y/y target range for the first time since July.

By component, both core and non-core price inflation slowed in November.

- Core inflation fell from 0.24% m/m in October into negative territory at -0.08% m/m (chart 8, again), a sharper drop than expected by the Bloomberg survey (-0.04% m/m). This left sequential core inflation at its slowest pace since at least 1988. In annual terms, core inflation eased from 3.98% y/y in October to 3.66% y/y (versus 3.65% y/y a year earlier, chart 9, again).

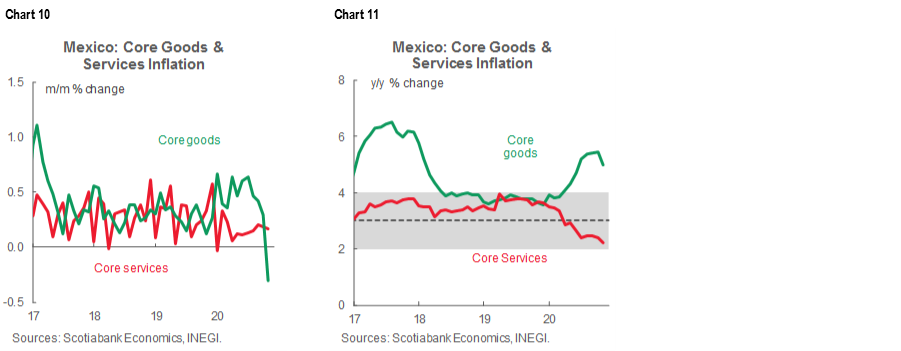

- Goods prices led the decline in core inflation, coming down from 0.29% m/m in October to -0.31% m/m (chart 10), which pulled annual core goods inflation down from 5.44% y/y in October to 4.99% y/y (chart 11). November’s slowing in core goods inflation likely reflects, at least in part, the temporary effects of the “Buen Fin” promotional sales period during November 9 to 20, an extension from 2019’s four-day period to 12 days this year. Core services inflation moderated more mildly, from 0.18% m/m in October to 0.16% m/m (chart 10, again), and in annual terms, from 2.40% y/y in October to 2.22% y/y (chart 11, again).

- Non-core inflation pulled back from October’s 1.77% m/m to 0.56% m/m (chart 8, again), which brought the annual non-core measure down from 4.42% y/y to 2.33% y/y (chart 9, again). This slowdown was driven by milder growth in energy prices (down from 2.03% m/m in October to 1.32% m/m in November), the Government’s Authorized Tariffs (1.32% m/m versus 2.03% m/m in October), and agricultural products’ prices (down -0.40% m/m in November from the previous month’s 1.45% m/m), which were mainly affected by the fruits and vegetables sub-component (-3.10% m/m).

—Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.