ON DECK FOR TUESDAY, JULY 21

KEY POINTS:

- · Stocks up as EU acts, US talks

- · EU approves recovery fund

- · CDN retail sales on tap

- · A$ leads on fiscal extension and RBA jawboning

- · US quiet

INTERNATIONAL

The EU passed its stimulus act and at least they’re talking about doing so in the US before the August recess although President Trump appears unfocused in his stimulus targets which may limit success. Both considerations are at least partly behind another risk-on move across global markets. The A$ is outperforming on fiscal extensions and RBA jawboning. Canada updates a couple of months of retail sales figures that should provide a tentatively complete Q2 picture of a substantial rebound. The US calendar should be quiet.

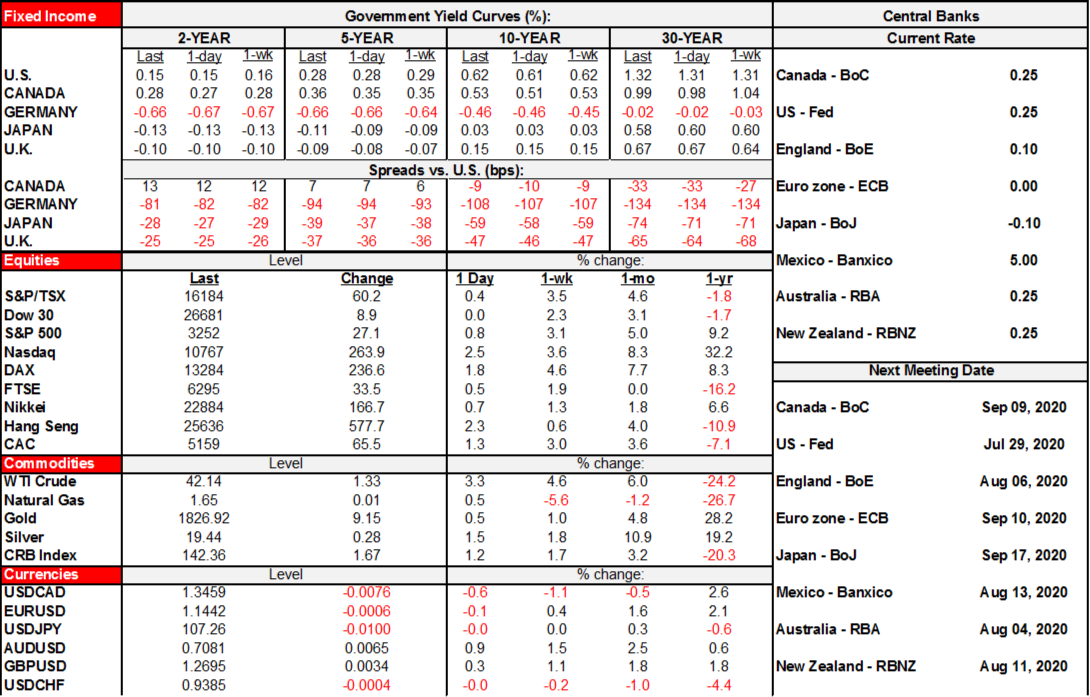

- US and Canadian equity futures are up by about ¾% on balance. European cash markets are up by as much as 2% in Italy given that country’s status as the biggest beneficiary of the EU fund.

- Sovereign yields are generally little changed with Italian spreads over bunds narrowing a bit further because of the EU agreement that was reached overnight.

- Oil prices are up by about 3% in terms of Brent and WTI. Western Canada Select—a proxy for heavy crude—is holding in around the US$31½ range compared to the low of under $4 in late April and the mid-30s range before widespread shut downs in March.

- The USD is little changed as the biggest currency movers are either guided by idiosyncratic factors (A$) or higher commodities (CAD, Mexican peso, krone etc).

The EU approved the €750B Next Generation EU fund overnight. The loans versus grants portion is roughly even at €360B versus €390B respectively. That’s less than initially proposed when the grants component was supposed to be €500B but it was watered down somewhat to appease opponents like Sweden, Austria, the Netherlands and Denmark. Of the €390B in grants, €312B is comprised of the Recovery and Resilience Facility that requires reform plans as the quid pro quo for disbursements tied to harm done by the covid-19 virus. To bring the northern states onside, a mechanism was added to allow them to object to disbursements that would require an EU leaders review and a maximum three month delay. Debt to finance the program will be repayable by 2058 and financed in part by new environmental and digital taxes.

RBA Governor Lowe’s overnight speech (here) combined with the minutes to the July 7th meeting (here) leaned against negative rates, A$ intervention and direct financing of government and resisted putting a range to the 0.25% 3 yr target that would result in bond buying to enforce the target by instead saying it was a judgement call. The government extended the wage subsidy program from the end of September to the end of March. The A$ was among the strongest overnight currency pairs to the USD.

CANADA

In N.A., the main focus will be upon Canadian retail sales (8:30amET). Not only will we get May’s results, we should also get a preliminary estimate for June that would give us a fresher overall reading. See last night’s Closing Points (here) and the Global Week Ahead (here) for more detail on the retail estimates.

US markets only get the Chicago Fed’s National Activity index (8:30amET) that only a few folks pay attention to; it’s a lagging composite of no fewer than 85 already released data.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.