ON DECK FOR MONDAY, JULY 27

KEY POINTS:

- Markets mixed to start the week

- US fiscal stimulus talks inching forward

- German business confidence has fully recovered

- US durables on a temporary upswing

- Gold, the USD and real rates

- Global Week Ahead (here)

INTERNATIONAL

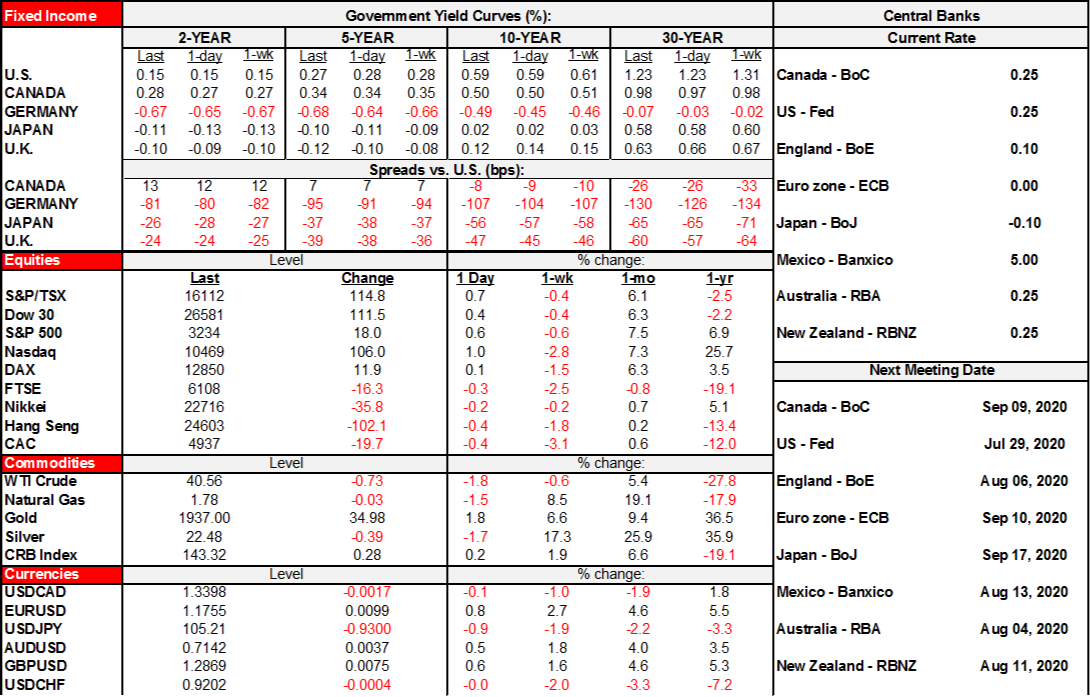

Global asset classes are sending somewhat mixed signals to start the week. The eco-calendar is fairly light to start the week with nothing materially informing risk appetite. German business confidence has recovered while a rebound in US cap-ex orders is probably temporary. US stimulus talks are progressing with the outlines of the GOP’s opening bid expected later today, albeit lacking broad support within the GOP, let alone among Democrats in the House.

- The USD is broadly lower again this morning with all major and semi-major crosses gaining except for the Swiss franc that is flat. CAD is also underperforming most other crosses.

- Gold is up again by about US$35/oz (see below for more about drivers). Oil is down by 1½% across WTI and Brent.

- Sovereign bond curves are mildly flattening in 2s10s in core Europe. US and Canadian 10s are little changed. 10s in the UK, Germany and France are down 3–4bps which is driving spread widening in unchanged Italian and peripheral 10s.

- Equities are mixed. The Nasdaq is up by 1¼% to lead the way with gains in the S&P500, DJIA and TSX around ½% to ¾%. European cash markets are slightly negative on balance.

German business confidence increased in the July IFO reading. The overall climate gauge increased by over four points to 90.5. The current assessment increased by over three points to 84.5 and the expectations measure increased by over five points to 97. The forward-looking expectations component has now rebounded to the strongest since November 2018 (chart 1).

UNITED STATES

US markets will principally focus upon ongoing fiscal negotiations amidst evidence said stimulus talks remain in disarray. The GOP is expected to outline about a US$1 trillion stimulus bill today with support questionable even within the party that is lined up between offering no further stimulus to the lower end of the range being tossed around in Washington. The jobless benefit enhancement of US$600/week has expired with the Dems saying they won’t approve a temporary extension in a single bill while wanting a much larger package than the divided GOP advocates. Timeline targets vary according to who is speaking and range from this week being the feasible target to after the August recess. Encouraging? Not really. The way Washington works? Yep. To get in front of things in unified fashion rather reacting in rancorous fashion is just the way things are in a divided political system.

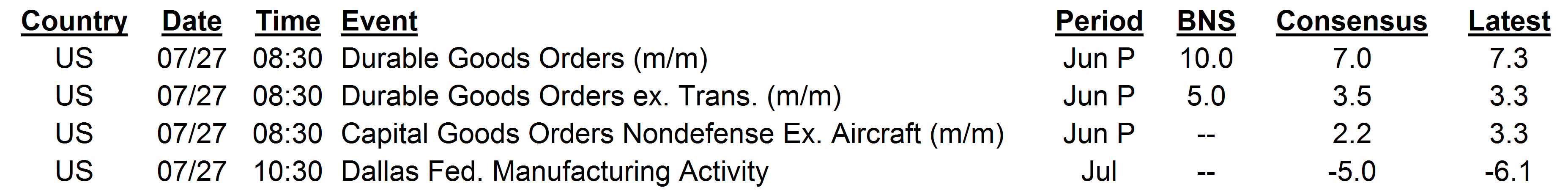

US durables goods orders, m/m % change headline/ex-transportation, SA, June:

Actual: 7.3 / 3.3

Scotia: 10 / 5

Consensus: 6.9 / 3.6

Prior: 15.1 / 3.6 (revised from 15.7 / 3.7 )

US durable goods orders were roughly in line with guesstimates. Headline, ex-transportation and core orders ex-defence and air all posted gains (charts 2–4). The latter’s 3.3% rise is the second consecutive pick-up after declines of 6.6% and 1.3% in March and April. This is probably a pent-up demand argument that is more likely to flatten earlier than consumption growth given the sheer amount of spare capacity that has opened in the US economy. With that, there should be little demand for investment in expanded capacity.

For now, however, there was considerable breadth to the gain. Orders for vehicles and parts were up by about 86% m/m after a prior 29% gain which reverses the 54% drop in April and the 20% decline the month before that. This is consistent with the recovery in auto sales. Electrical equipment orders were up by 1.2%, computers/electronics were flat (+0.1%), machinery orders gained 2.7% and each of the primary (+3.6%) and fabricated (+4.5%) metals categories grew.

As an add-on, what’s driving gold? As argued in the Global Week Ahead here, I think it’s mostly a USD play. The USD is down again this morning and the USD price of gold is up (chart 5).

On the role of real rates, I’ve seen charts that overstate the relationship that is sensitive to how we define real rates and the performance of the underlying inflation gauges.

Chart 6: shows gold along with the real rate defined as the nominal 10 year Treasury yield minus the current year-over-year CPI inflation rate. This relationship has broken down of late and doesn’t seem to work as an explanation for gold’s recent run-up.

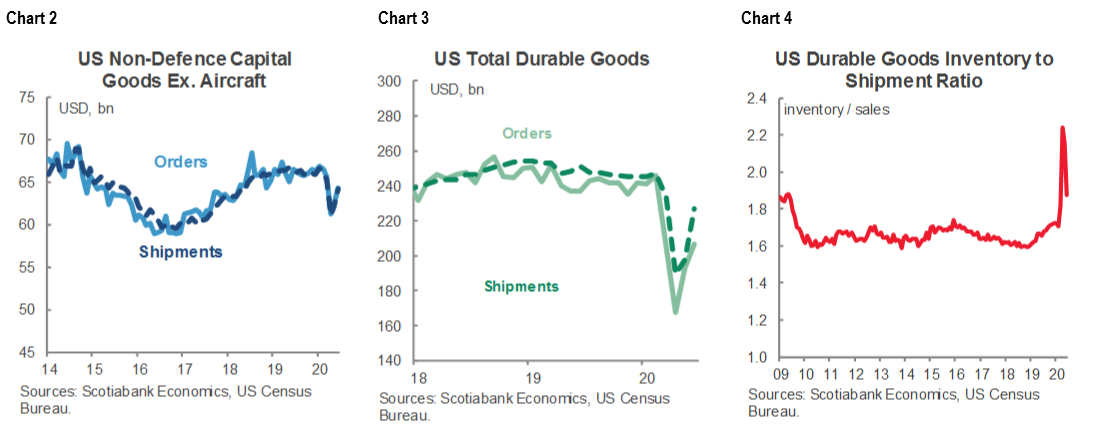

Chart 7 takes that in a more forward looking sense by using a real rate that subtracts the one-year ahead rolling consensus CPI forecast. This one was working better than the backward looking CPI inflation measure, but has also weakened of late.

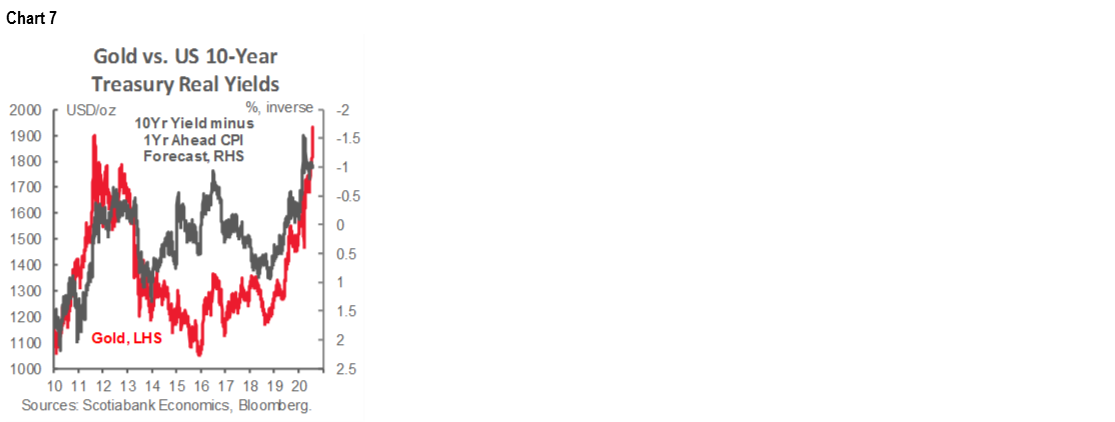

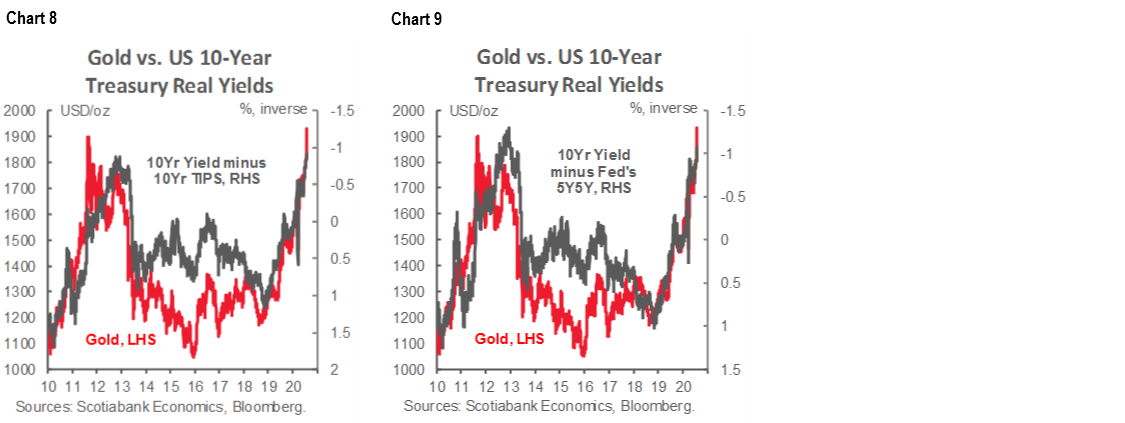

Charts 8 and 9 are the ones you may have seen in the financial press and from gold doomsayers who appear to have captured elements of the financial press. It shows a better connection between gold and the real rate using the measure of inflation expectations derived from the 10 year TIPS breakeven rate derived from real return TIPS, or the Fed’s preferred 5y5y expectations measure. The usual big caveat with this approach to the real rate is that the inflation market a notoriously weak predictor of actual inflation that is often distorted by varying liquidity premia and central bank interventions. Nevertheless, what the ten year TIPS breakeven and the Fed measure suggest is that inflation will average 1.5%; that is neither runaway inflation as gold bugs suggest to be a gold driver, nor a runaway collapse of the economy and financial system as gold bugs also seem to curiously suggest despite the massive internal consistencies. Even stagflation—which has been rolled out incorrectly on countless occasions—can’t have a collapsing economy and financial system.

There is another tempting explanation: gold bugs are building castles in the air.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.