ON DECK FOR MONDAY, NOVEMBER 16

KEY POINTS:

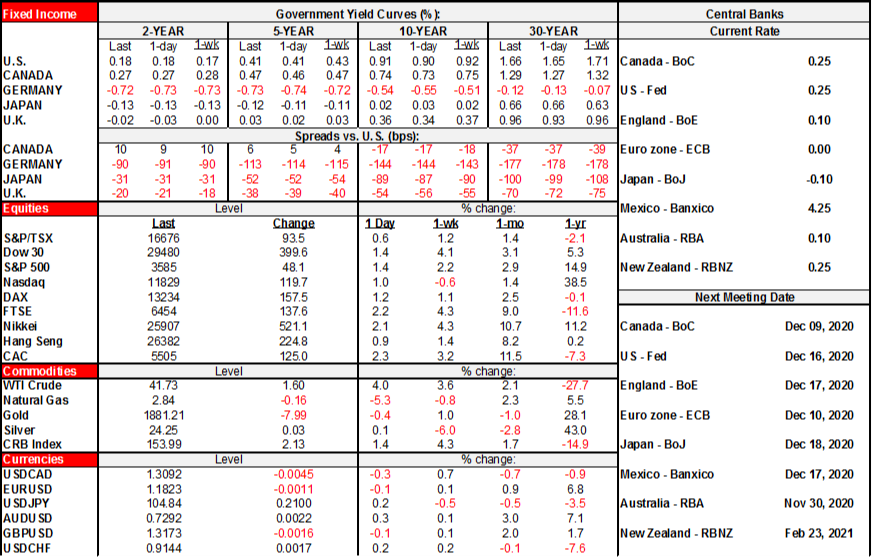

- Stocks rally, curves steepen on lower lock down risk & vaccines

- Stocks rotate out of pandemic beneficiaries to recovery plays

- The Biden administration leans against a nationwide shutdown...

- …that may push the decision to state and local governments

- Moderna’s vaccine appears to be more successful than Pfizer’s

- Biden to update his economic plan this afternoon

- Mixed Asian releases ignored by markets

- Canadian manufacturing grows in line with advance guidance

- US Empire gauge signals cooler manufacturing momentum

- Fed’s Clarida could balance near-term downside, longer upside

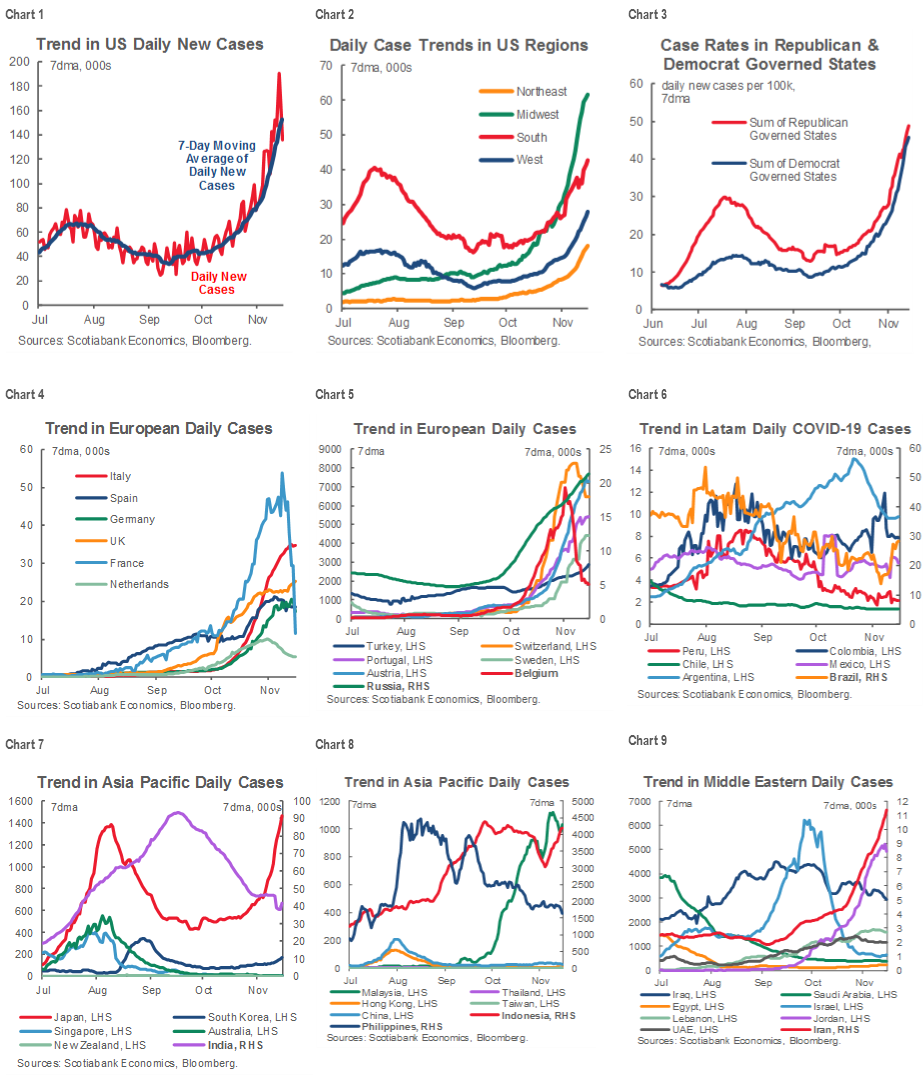

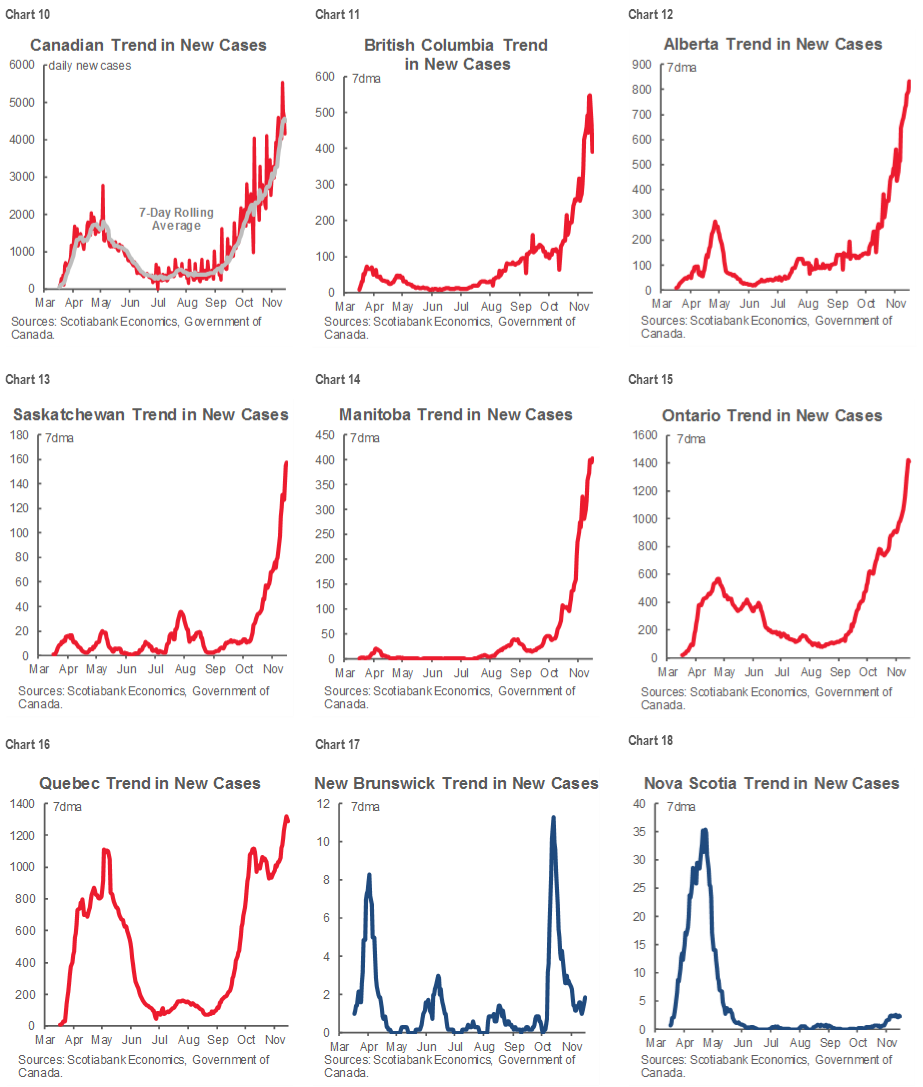

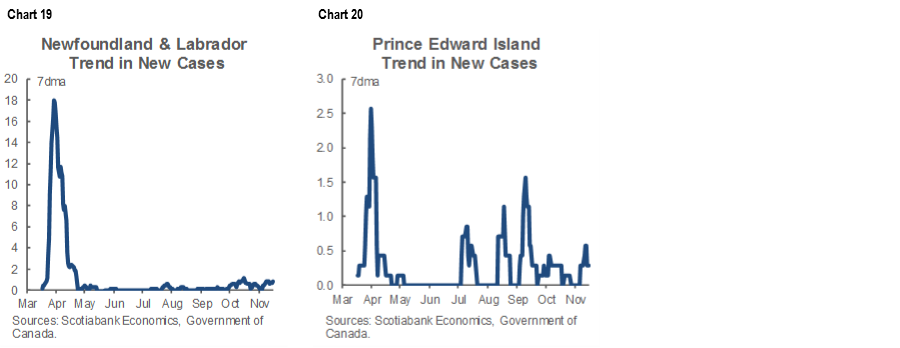

- Updated global covid-19 curves

INTERNATIONAL

Risk-on continues! There are two main catalysts.

First, Sunday morning headlines on how the victorious incoming Biden administration does not support a nationwide lockdown versus more pinpointed measures appeared to be the main catalyst behind why stocks immediately popped higher as Asia came in and US futures began to trade. What this development does is reduce the risk of a near-term double dip in the US economy. Two out of Biden’s three covid-19 advisers came out against the blunt measure of a nationwide shutdown. A note of caution here is that state and local governments may still pursue such measures. Because of this, it may be that the Biden administration is simply transferring the decision and accompanying heat to other levels of government, but that too may be preferred by way of allowing more custom-tailored solutions.

Nevertheless, a multidisciplinary approach appears to have won out at the federal level that involves paying serious attention to the potential devastation of serial system-wide lockdowns. The latter would potentially involve millions of lost jobs, millions of foreclosures, millions of bankruptcies and the resulting widespread long-term social and economic hardship and general despondency—and all that goes with the latter.

Second, Moderna released very positive vaccine trial results this morning. Their vaccine was found to be 94.5% effective at preventing covid-19 (Pfizer was 90%), while no participant became severely ill during the trial and the vaccine is stable after 30 days of refrigeration. The latter point is one reason why Moderna’s stock rally this morning is being accompanied by Pfizer’s sell-off, as Pfizer’s vaccine requires very cold temperatures and lasts only until a few days before use. That makes mass distribution less problematic. While the reduced risk of a US shutdown is positive for near-term growth, stocks are pricing the 6+ month impact of widespread vaccine take-up.

There was nothing on the econ calendar that was of much consequence.

- US stock futures were up before the Moderna headlines hit because of the reduced risk of a US shutdown, but the vaccine headlines added some momentum. S&P500 futures are up by over 1%, TSX futures are up by ½% and European cash markets are up by 1–3% or so after Asia was a sea of green overnight. In general, stocks that benefit from the pandemic (tech, broad health care, defensives like utilities) are underperforming as the lead is taken by energy, materials, banks (on steeper curves), consumer discretionary plays and industrials.

- Sovereign debt curves instantly steepened after the Moderna trial hit. Yields on 10s had been slightly richer across the US, Europe and Canada before the vaccine news, but are now 2–3bps higher.

- The USD is little changed on balance to Friday’s close, as the euro, sterling, yen and Swiss franc are all slightly weaker. Oil’s nearly 4% rise is popping several commodity currencies higher including the Mexican peso, the Norwegian krone, CAD and the A$/NZ$.

Overnight releases were inconsequential to markets and will be briefly highlighted.

Japan GDP Q3 beat expectations at 21.4% q/q annualized (18.9% consensus) but partly due to a small downward revision to Q2.

China updated industrial production, retail sales and investment figures and left its 1 year Medium-Term lending facility rate unchanged at 2.95% as expected. The macro readings were mixed as industrial output was very slightly better than expected (+6.9% y/y, 6.7% consensus, 6.9% prior) but retail sales slightly disappointed at 4.3% y/y (5% consensus, 3.3% prior).

Thailand’s GDP Q3 beat expectations at 6.5% q/q non-annualized (3.9% consensus).

ECB’s Lagarde speaks at 8amET.

Please see the accompanying updated charts showing the spread of covid-19 across the world. Notable developments include continued sharp increases in areas like the US, Canada and Japan, versus sharp declines in France and Belgium.

CANADA

Canadian manufacturing sales grew by 1.5% m/m in September which matched StatsCan’s advance guidance. Volumes were up by 2.1% m/m as prices slipped. The release is inconsequential to markets and the same will be true when existing home sales during October are released (9amET).

UNITED STATES

The Fed’s vice chair Richard Clarida speaks on the economic outlook at 2pmET. Expect a balance of near-term downside risks due to the spread of the covid-19 virus versus longer term hope stemming from vaccine developments.

The US kicks off another monthly round of regional manufacturing gauges to inform ISM-mfrg expectations. The Empire manufacturing gauge slipped to 6.3 (10.5 prior) which signals cooler momentum in the New York area and surrounding region.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.