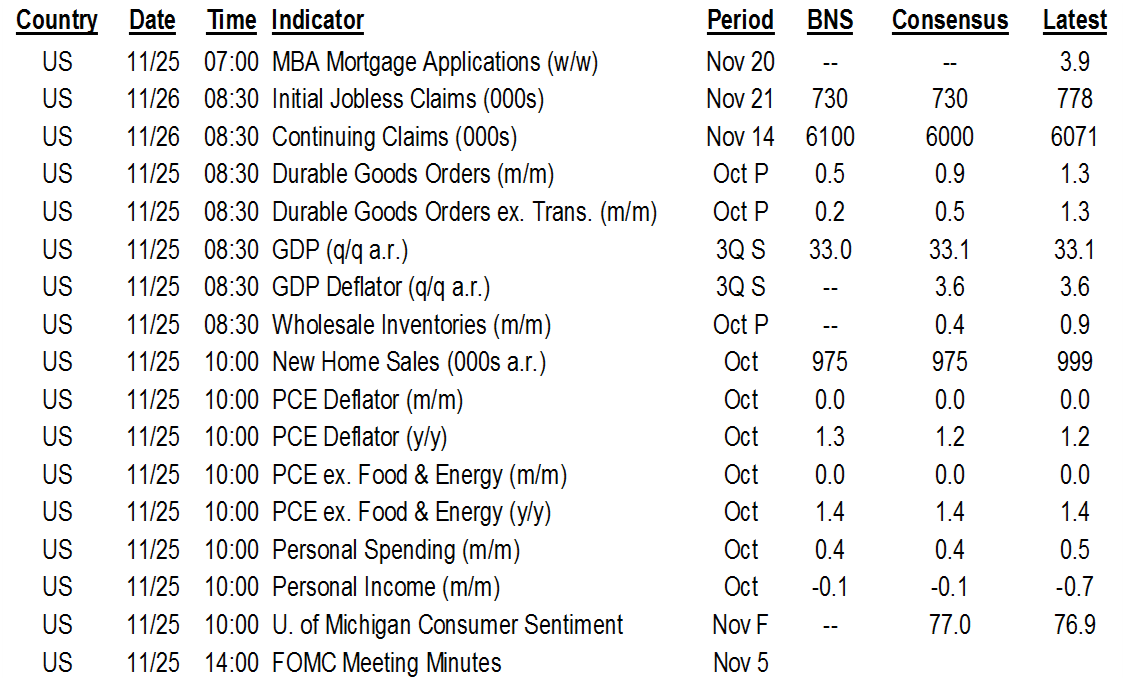

ON DECK FOR WEDNESDAY, NOVEMBER 25

KEY POINTS:

- Markets shake off mixed US macro reports

- Pessimists will see higher initial claims, lower incomes…

- ...while worrying about rising covid cases & waning US stimulus

- Optimists will see lower continuing claims, higher durables…

- ...higher new home sales and tighter inventories…

- ...higher consumption and an expected dip in core inflation…

- ...while looking ahead to vaccines

- How much pent-up US consumer demand exists?

- FOMC minutes will likely prove to be stale

INTERNATIONAL

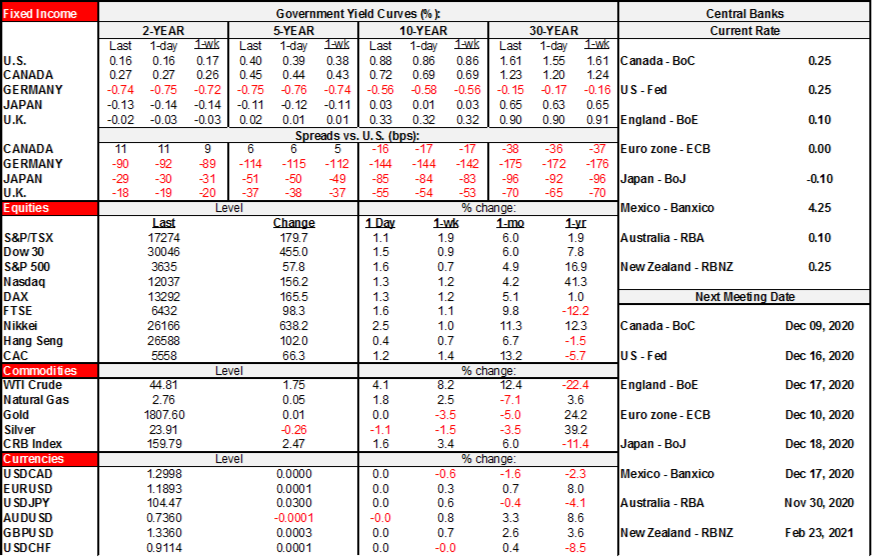

It’s not terribly surprising to see stocks consolidating yesterday’s solid gains in the absence of any materially new information overnight and after mixed backward looking US macro data. FOMC minutes are pending but likely offer low risk as Americans head for virtual exits into US Thanksgiving.

- Stocks are little changed on average.

- Sovereign curves are slightly bull flattening.

- Oil prices are up by over 1% again.

- The USD is losing ground against all major currency crosses.

UNITED STATES

A massive US data dump registered a mixed bag of overall results. Pessimists could emphasize another up-tick in weekly initial jobless claims and weaker personal incomes during October. Optimists could emphasize another rise in big-ticket durable goods orders including core orders, another gain in total consumer spending and a solid beat in new home sales amidst very lean inventories. Core inflation ebbed broadly in line with expectations and the second swing at Q3 GDP was left unchanged at 33% annualized growth over the prior quarter.

US weekly initial claims moved up for the second consecutive week to 778k (748k prior) as continuing claims continued to move lower (6.071 million from 6.37 million prior). The trend in initial claims may well keep rising in the weeks and months ahead as the effects of tightened restrictions on layoffs mount. Nearer term data is likely to deteriorate as markets keep most of their attention focused on conditions further out, including vaccines.

US durable goods orders surprised higher. Total orders climbed by 1.3% m/m (consensus 0.8%, Scotia 0.5%). Core orders excluding aircraft and defence climbed by another 0.7% m/m for the sixth consecutive gain and have entered multi-decade highs (chart 1). Chart 2 shows the weighted contributions to growth in durable goods orders by category.

So why are businesses investing during a pandemic that has sharply raised spare capacity? Well, you could reason that the problem with that thesis is simply this: they’re not really. Six months of growth in core orders could just be the reversal of the magnitude of decline in the order book during the first pandemic wave. Current orders are high, but this could be just a transitory burst of pent-up demand that leaves the gains over the past six months and the magnitude of the drop before that as a wash on net.

Another plausible explanation is that much of the gain in total orders just reflects the bounce back in underlying consumer items like orders for vehicles and parts (although they fell this latest month) as well as primary and fabricated metals.

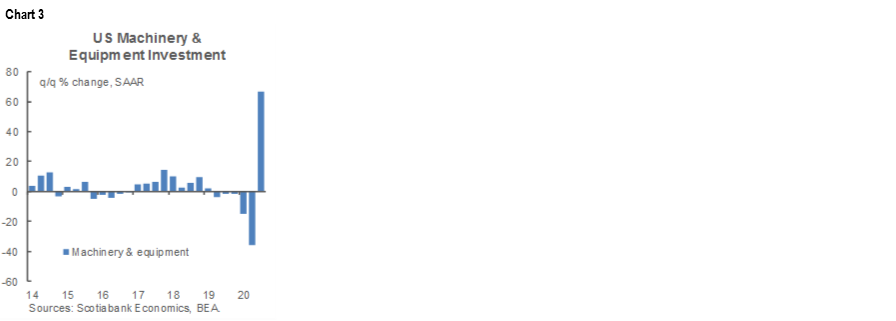

As for broader evidence of business investment patterns that squares the circle, the GDP accounts are more relevant. Equipment spending climbed by 67% q/q at an annualized rate in Q3 after falling by 36% in Q2 and by 15% in Q1. Equipment spending fell for five straight quarters starting with the aftermath of Trump’s trade wars and then through the pandemic before the latest recovery signs. Chart 3 shows that the burst of pent-up demand in Q3 that may have been significantly driven by realignment of technology needs will have to be followed by continued strength in order to offset the prior pattern of weakness.

US new home sales exceeded expectations and are at their highest levels since late 2006. October only dipped in percentage terms (-0.3% m/m) because the prior month was revised to be materially higher (+0.1% versus -3.5% previously). At one million sales at an annualized rate, we’re dealing with more than just the release of pent-up demand from the drop over the January–April period. Further, very tight inventories are bound to continue to feed appetite for new housing supply (chart 4).

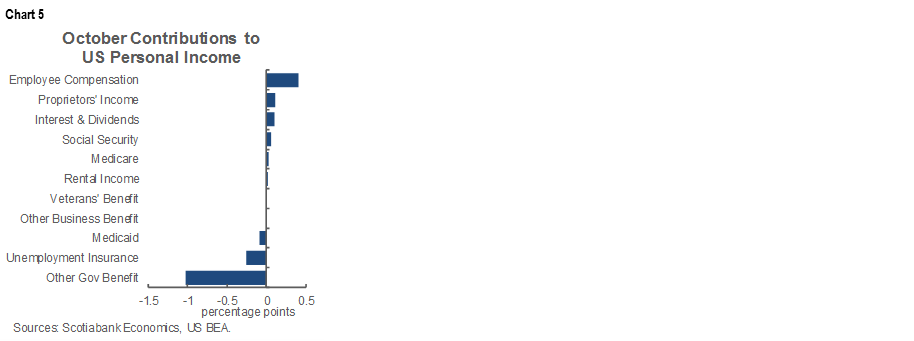

The surprise in the US income, spending and inflation figures that were updated for October this morning was that incomes fell by more than expected last month. Total income fell by 0.7% m/m and the prior month was revised lower to 0.7% (from +0.9%). The income drop was fed by lower unemployment insurance transfers as government benefits overall fell by 6.2% m/m with a 14% drop in unemployment benefit payments the main culprit while wages and salaries were up by 0.7%. Chart 5 provides the income break down. The breakdown of the support programs shows the hit came through the FEMA authorization to make payments from the Disaster Relief Fund to supplement wages lost at a result of covid-19 which is outside of the regular jobless benefit programs. Data like claims and incomes are probably going to be under negative pressure for some time as rising covid-19 layoffs and expiring stimulus at year-end take hold, but forward looking markets likely anticipated this for some time and are looking toward vaccines on the other side of what is expected to be a transitory dip.

Consumer spending was in line with expectations (+0.5% m/m, 0.4% consensus) and in line with prior signals from retail sales. Core PCE inflation slipped to 1.4% from an upwardly revised prior reading of 1.6% (from 1.5%) which is generally consistent with the prior core CPI signal. After an initial bounce, core PCE inflation has moderated of late (chart 6).

How much pent-up US consumer demand is there? One way of tackling this is admittedly crude but helps to put some parameters to the debate. The personal saving rate fell by a full percentage point to 13.6% in October because the spending increase occurred as total personal income fell due to lower government transfers (chart 7). Before the pandemic struck, the saving rate was just over 8%. If the saving rate were to revert back to pre-pandemic levels, then off of present disposable income that could mean US$830B of additional consumption. That would take consumption up by about 6% from here at a non-annualized level adjustment.

There are bi-directional risks to this view. Maybe the saving rate will remain high on pre-cautionary savings. Maybe it will fall to below pre-pandemic levels because of vaccines combined with massive monetary and fiscal stimulus. I would expect the saving rate to dip into early 2021 as lower transfers result in a negative income shock, but this should be transitory as the rest of the year unfolds. Maybe disposable income will rise on a trend basis through 2021 to reinforce spending potential as consumers adopt more of a forward-looking permanent income approach to consumption plans.

The key question is whether such pent-up demand will be unleashed as the pandemic continues to expand in the nearer term. Full lockdowns would negate this view, but punt activity to the next post-lockdown period. Short of full lockdowns, the majority are keeping their jobs and the overwhelming majority (95%+) have not been directly struck by the pandemic.

Minutes to the FOMC meeting on November 4th–5th arrive at 2pmET. They will probably offer a stale assessment of what was an uneventful meeting and accompanying statement and press conference. The meeting pre-dated vaccine developments, the Treasury-Fed spat in which Treasury Secretary Mnuchin basically fleeced the Fed in the transition to a new administration and much of the rise of covid-19 cases.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.