ON DECK FOR FRIDAY, NOVEMBER 6

KEY POINTS:

- Markets cautious ahead of nonfarm

- Biden ahead in Georgia, Philly update pending

- Will nonfarm exceed downside signals?

- CAD nervously anticipates jobs update

INTERNATIONAL

Markets are cautious ahead of nonfarm payrolls, given softening signals like ADP and the employment component within ISM-services. Election fever is heating up again as Biden is ahead in Georgia and that state alone would declare him winner if he retains Arizona. So could Pennsylvania where Trump is ahead but an update “maybe in the tens of thousands” is pending shortly. Markets may also be reflecting mild concern that the US election results will be contested in a prolonged legal attack by Trump following a rambling televised complaint that was widely panned last night. Canada’s jobs report is of regional market interest and while you know as well as I that it can be volatile, this one has some good reasons to expect either much slower growth or a dip. For recap of the Fed and Ontario’s budget go here and here.

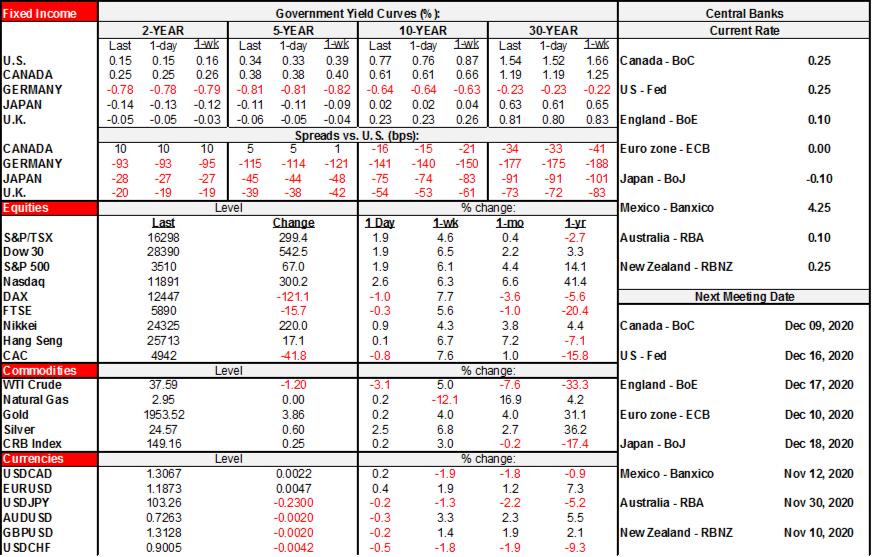

- US S&P futures are off by ½%. TSX futures are little changed. European stocks range from a mild declin in London to down by ¾% – 1% (Germany, France, Spain).

- Sovereign bond yields are little changed with a touch of cheapening across the US longer end and mild spread compression in Italian over Germany bonds.

- The USD is very slightly softer as currencies are divided. CAD is among the decliners with slight depreciation ahead of jobs and given lower oil, while sterling, the A$ and Mexican peso are a touch on the softer side. The offsets are gains across the Euro and euro-related crosses.

- Oil prices are down by about 3%.

UNITED STATES

The latest vote tallies by key states are as follows. A Biden win in either Georgia or Pennsylvania would declare him winner and we may find that out this morning, but the Philly results in particular are expected to arrive in chunky fashion through to late in the day.

- Georgia: Biden assumed a slim lead of 1,096 overnight. There remaining about 10k votes to be counted and they are generally mail-in ballots that have so far favoured Biden.

- Pennsylvania: Trump is still up by +18,229. A Philly update coming roughly between 7–8amET. 163k votes are left to be counted—50k of which in Philly—and once again the vote composition of what remains likely favours Biden.

- Arizona: Biden is ahead by 47,052.

- Nevada: Biden is ahead 11,438

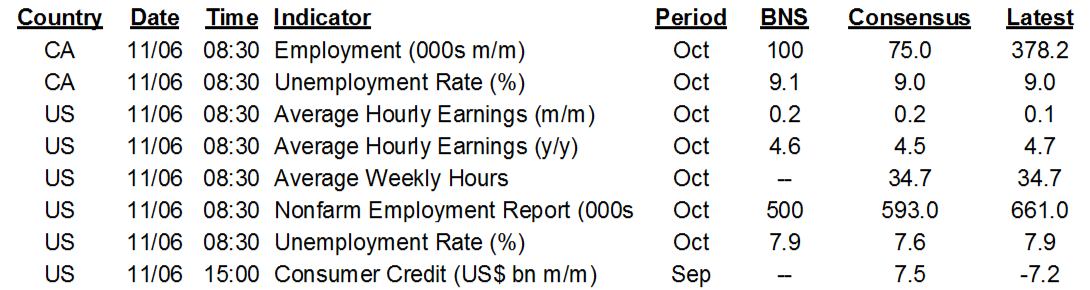

Nonfarm payrolls are due at 8:30amET. Consensus expects a rise of 593k (Scotia 500k) with a range of estimates roughly between 300k–900k. To the upside, we probably won’t see a repeat of the 231k lost education jobs the prior month. To the downside may be ADP’s disappointment on Wednesday, the softer employment sub-gauge to ISM-services and the effects of tightened pandemic restrictions.

CANADA

Canada updates its job figures at 8:30amET. The October tally is widely expected to be a cooler print with possible risk of a negative reading. Consensus expects 75k (Scotia 100k) with a range of -100k to +189k. One risk is that 70% of what drove the job gain in September—moms returning to work in droves when the kids went back to school, and youths as restrictions eased—won’t repeat. Another thing is that the biggest provinces tightened restrictions between reference weeks (calendar week including the 15th of the month). There are about 1 million jobs nationwide in the hospitality sector with about 40% in Ontario and one-quarter in Quebec. They are the ones facing renewed downside risk as restaurants, bars etc shut.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.