ON DECK FOR TUESDAY, OCTOBER 27

KEY POINTS:

- Risk appetite shakes off US releases

- US consumers more confident now, less so about the post-election future

- US capital goods orders are unambiguously strong

- Richmond reinforces another gain for ISM-manufacturing

- Biden is outperforming Hillary at the same point in the 2016 campaign

INTERNATIONAL

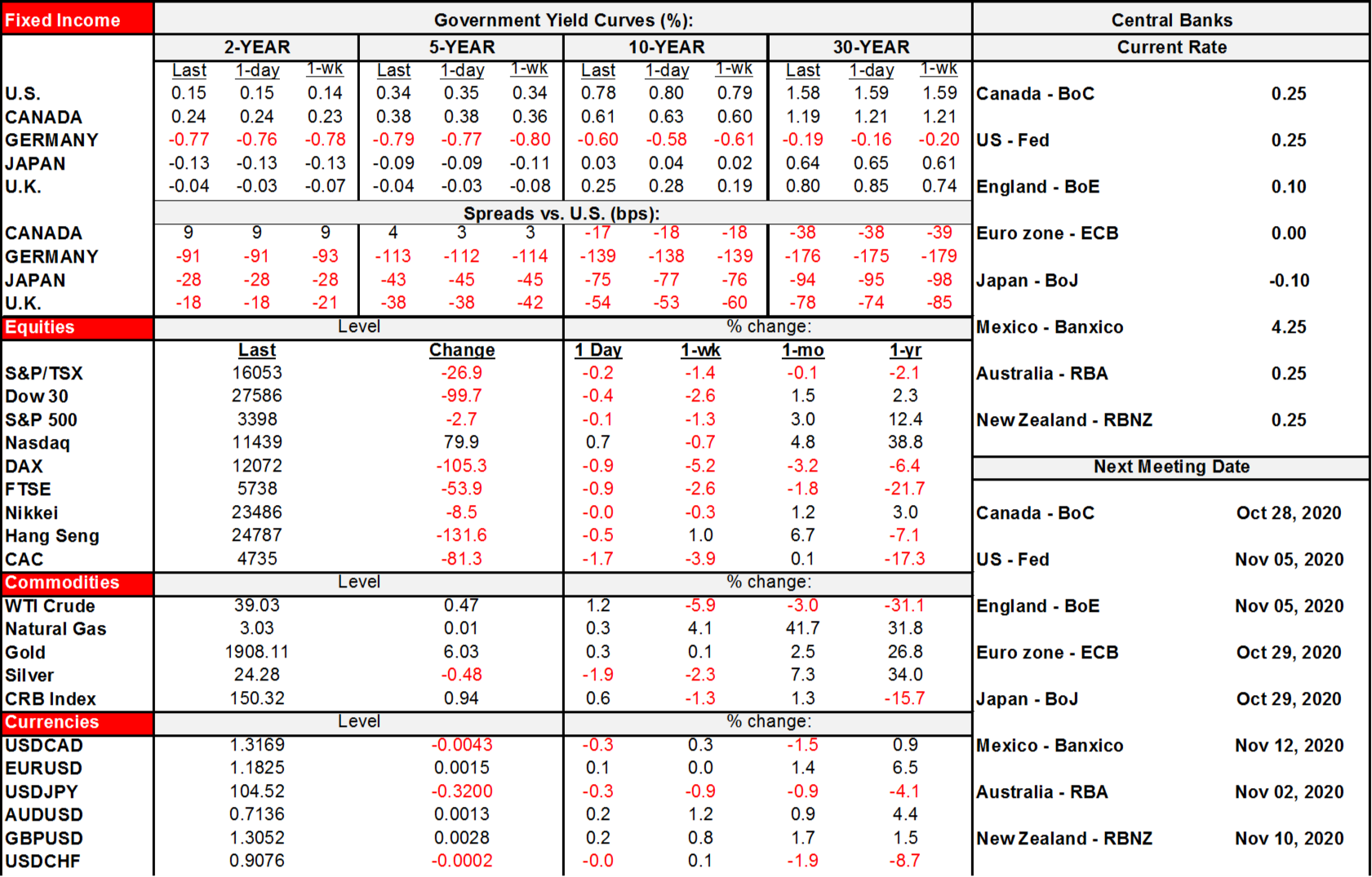

US equity futures are slightly positive while all other equity indicators are in the red including European cash markets and TSX futures. Sovereign bonds are little changed with slight richening in Europe while the USD is flat on balance. There wasn’t any material new information overnight either on- or off-calendar to inform market positioning. US election watch brings out another daily update from 538 showing Biden at 88% probability of victory; by this comparable point in the 2016 election, Hillary had already begun falling to 71% from previous estimates in the upper 80s.

- US stocks are little changed on average with a flat S&P, ½% rise in the Nasdaq and ¼% drop in the DJIA. Toronto is little changed. European equities are down by ¾% to 1½%.

- Sovereign curves are rallying by 2–3 bps in 10s as curves generally bull flatten. I’ve long supported yield caps by the BoC given supply and other issues and wouldn’t be surprised to see something on this tomorrow.

- The USD is slightly depreciating and losing ground against all major currencies.

- Oil prices are up by about 1%.

UNITED STATES

A trio of US releases were generally upbeat with a bit of a caution toward the future. They indicate more buoyant consumer attitudes in the near-term coupled with improved manufacturing momentum and continued growth in business investment. The yellow flag popped up in the form of a significant drop in forward-looking consumer expectations six months down the line which is likely keyed off the US election next week. In short, onto the election!

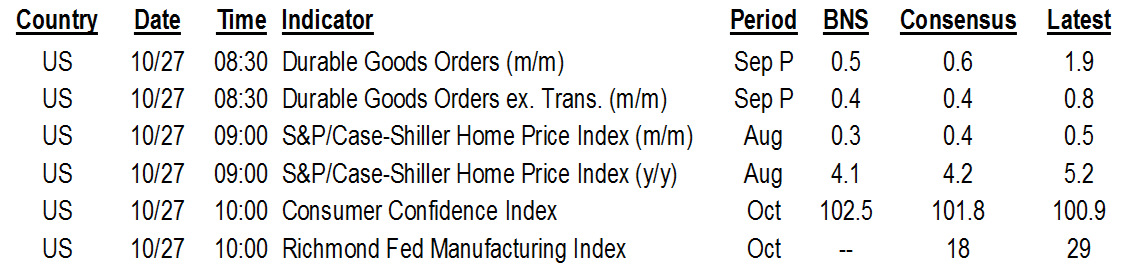

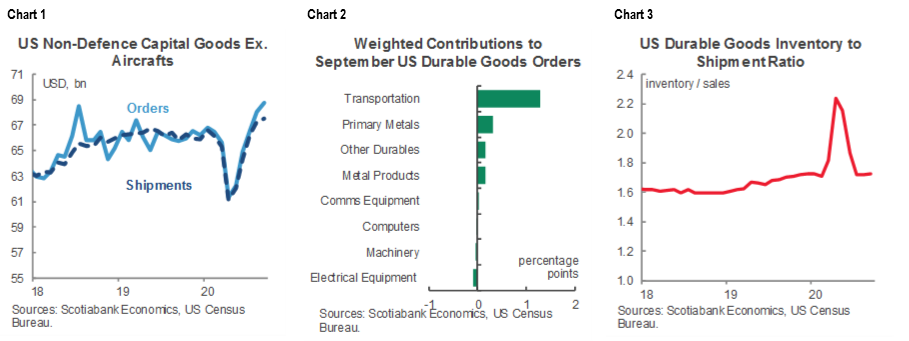

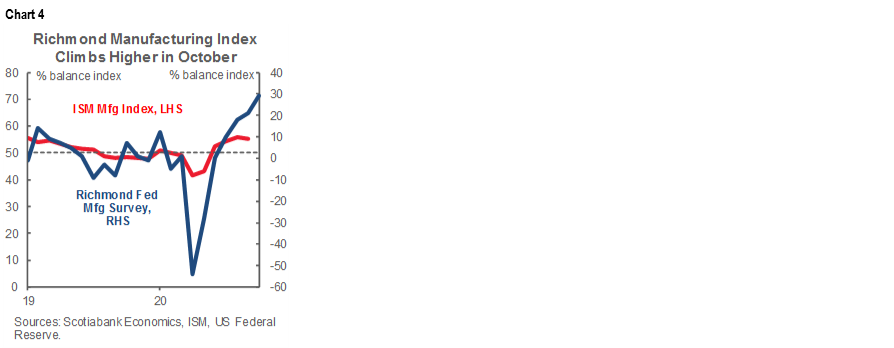

Core capital goods orders (ex-defence and air) hit a six year high last month (chart 1). They were up by another 1.0% m/m which beat expectations. By type of capital good order, transportation was up 4.1% m/m including vehicles and parts (+1.5%). Primary metals (+4%) and fabricated metals (+1.2%) were other bright spots. Computers and electronics were up by 0.6%. Electrical equipment fell 2% m/m and machinery slipped by 0.3% after a string of strong gains since May. Weighted contributions are shown in chart 2. Inventories remain in line with pre-pandemic levels (chart 3).

The next ISM-manufacturing next Monday could well register renewed improvement following September’s modest setback that in turn followed three months of strong increases. This morning’s regional Richmond Fed manufacturing index added further support for this view as it climbed to 29 (21 prior). Chart 4. That adds to the upsides in the Philly, Dallas and KC measures with only the Empire gauge slipping. When we pump the regional surveys and auto production estimates through our ISM model it spits out 56.7 for October’s estimate which would be a rise from 55.4 in September.

The Conference Board’s consumer confidence gauge was little changed at 100.9 from 101.3 (revised down from 101.8) but this masked shifts in terms of the timelines of expectations (chart 5). The present situation component moved almost six points higher to the highest since March but still far below March’s level. The expectations component, however, fell by about six points from the original estimate for September (104 revised down to 102.9). Forward expectations have been super volatile through the recovery process so I wouldn’t make that big a deal out of it, but it’s a caution toward the post-election world.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.