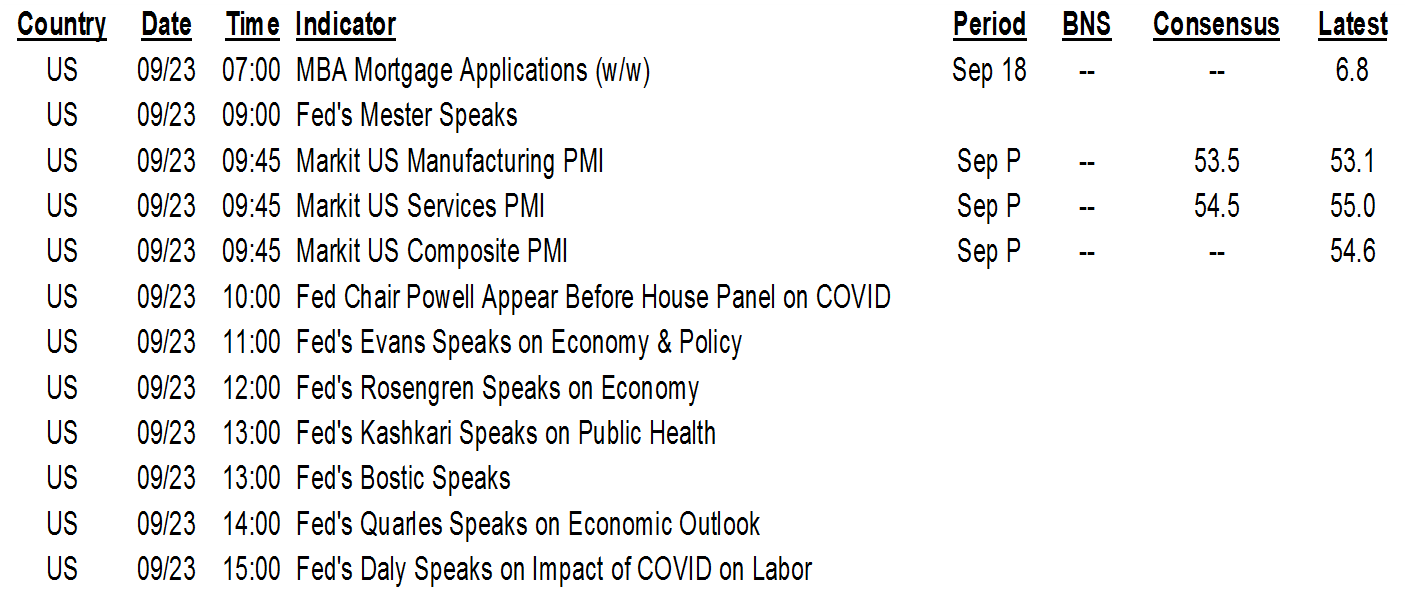

ON DECK FOR WEDNESDAY, SEPTEMBER 23

KEY POINTS:

- Mild risk-on emphasizes vaccine trials over weak data

- Ottawa seeks to hit reset on throne speech day

- Eurozone and UK PMIs disappoint

- US PMIs: to follow Europe lower, or regional gauges higher?

- RBNZ further opens the door to more stimulus

- Heavy day for Fed-speak

INTERNATIONAL

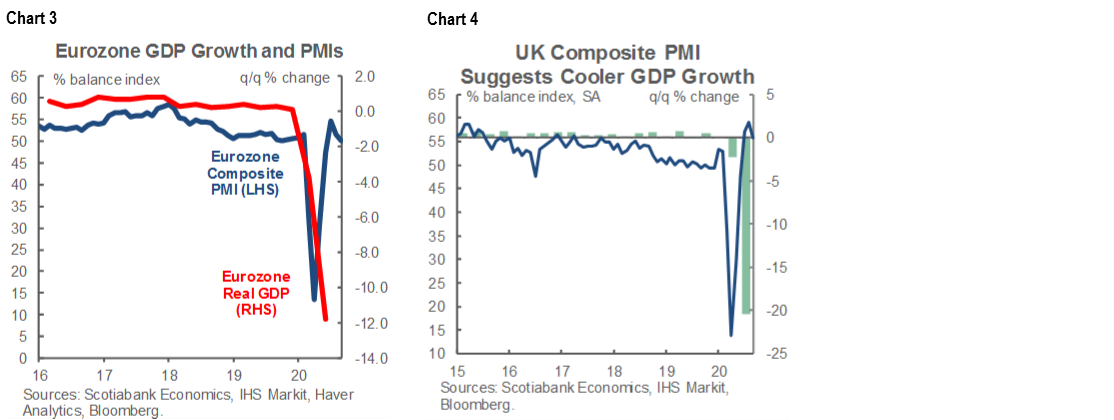

All life revolves around Ottawa, or so local denizens and policy wonks think. That may actually hold true for a day in the absence of further global catalysts today as attention shifts to the Trudeau government’s reset on its agenda against the backdrop of surging COVID-19 cases and various political missteps. Vaccine testing is a positive market driver (J&J), but softer than expected growth signals out of Europe are a market headwind (see charts 3–4). We’ll see if the US follows suit this morning while everybody and their uncles and aunts gets a chance to speak at the Fed. The small/medium sized country comparator for central banks like the Bank of Canada got a bit more dovish information overnight as the RBNZ made it clear it’s not done yet and did so right ahead of next month’s election.

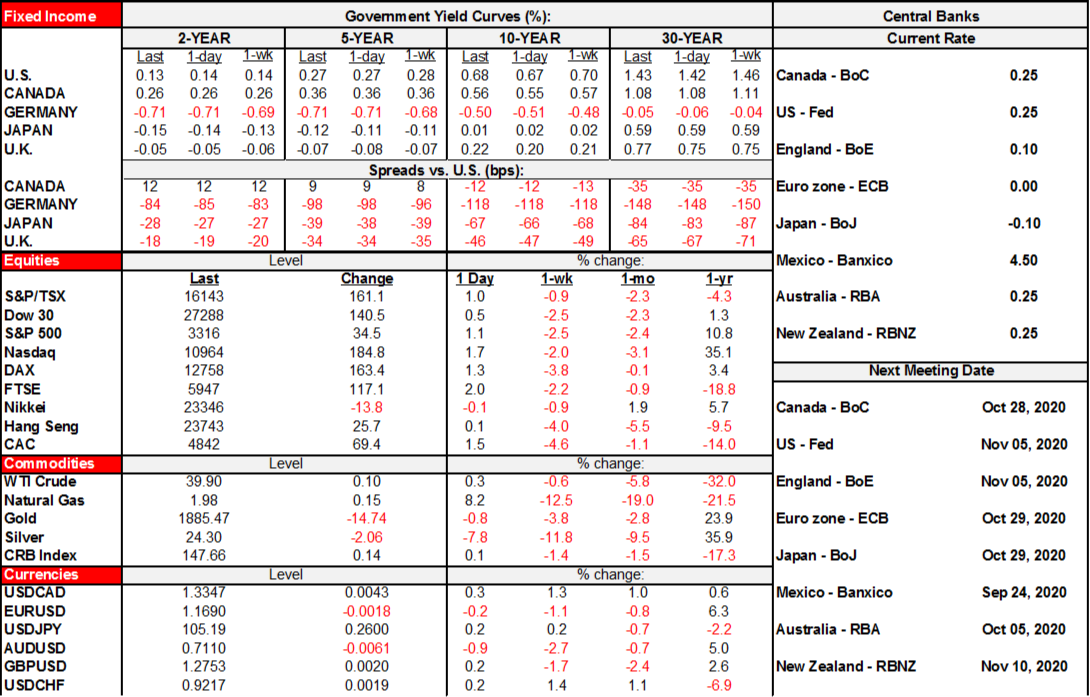

- US equity futures are mildly positive with the S&P500 up ¼%, the DJIA up ¾% and the Nasdaq exchange flat. Toronto is up ½%. European cash markets are up by between 1% (Italy) and 2% (London). Asian markets were mostly flat.

- Sovereign bond yields are little changed across almost all markets but curves in Australia and NZ outperformed partly on the back of the RBNZ.

- Oil prices are up ½% with gold down 1%.

- The USD is little changed with a slightly firmer feel as sterling holds its ground, the euro and related crosses are slightly softer and the weakest crosses are the Mexican peso and A$/NZ$.

The September composite UK PMI fell by 3.4 points to 55.7 as the services PMI sank by 3.7 points and the manufacturing PMI fell by just under a point. That’s the first setback since April.

The September composite Eurozone PMI fell by 1.8 points to 50.1 as services sank back into contraction (47.6, 50.5 prior) while manufacturing accelerated (53.7, 51.7 prior).

Within the Eurozone, France fared worse than Germany. The French composite PMI fell by 3.1 points to fall back into contraction at 48.5 (51.9 consensus, 51.6 prior). That was all due to a move back to contraction in services and manufacturing picked up a bit. Germany’s composite PMI slipped a bit but remains in expansion territory at 53.7 (54 consensus, 54.4 prior) but that masked a return to contraction in services (49.1, 52.5 prior) as the manufacturing PMI increased 4.4 points to 56.6.

The RBNZ held policy measures overnight, but indicated it may introduce a Funding for Lending Program for the banking sector before year-end. It also jawboned negative rates and QE, saying the banking sector is getting better prepared for negative rates and that the central bank would complement the policy tool with added term funding. The NZ curve outperformed overnight and the NZ$ is among the weakest crosses to the USD.

CANADA

Canada’s throne speech will be at 2pmET and PM Trudeau will hold a press conference at about 6:30pmET. See last evening’s note for more (here). Scotia’s Rebekah Young will put out a note on the speech tonight and highlights will be shared in Closing Points. Opposition reaction is likely to be swift and expect more as Parliament reconvenes tomorrow after being prorogued due to the government’s WE Charity scandal and resignation of Finance Minister Morneau.

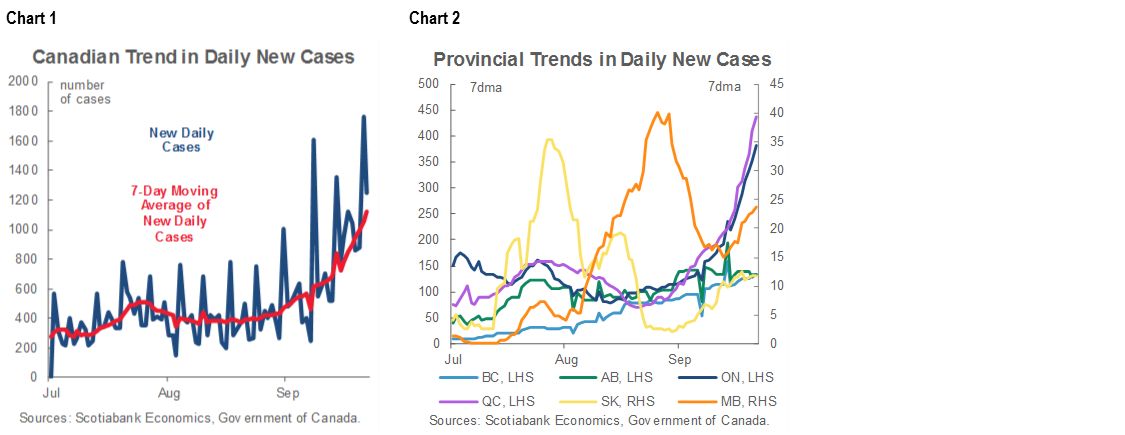

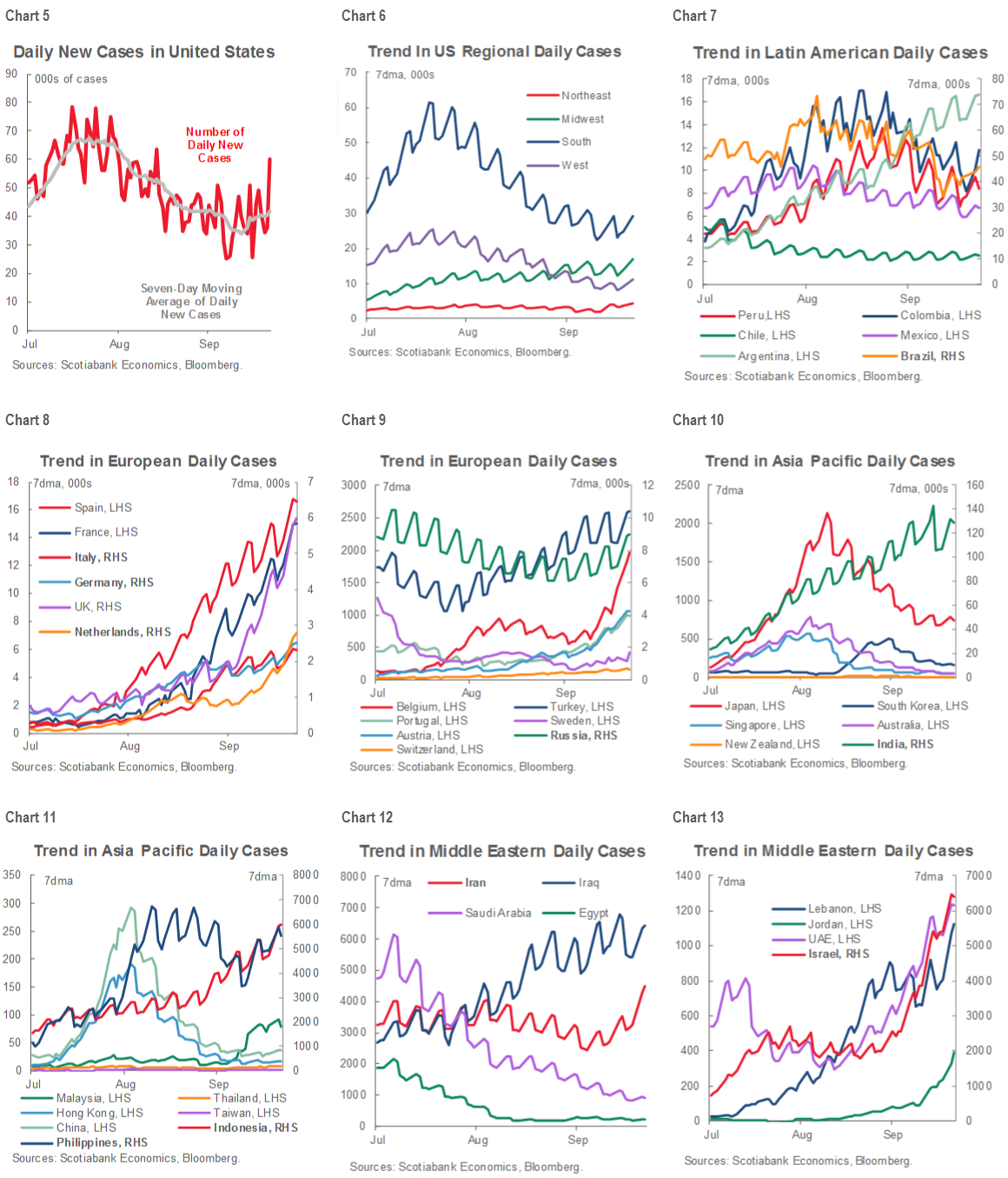

Charts 1 and 2 update the Canadian national and provincial covid-19 case trends while charts 5–13 update the international trends with figures up to yesterday. Canada is not alone in seeing an uptrend of late.

UNITED STATES

A heavy line up of Fed-speak and data risk is on tap. In light of the European gauges, there may be added reason to think of downside risk to US PMIs this morning but the conundrum lies in the fact that regional US measures like the Richmond, Philly and Empire measures have averaged out to show improvement.

- US Markit PMIs (9:45amET): Little change is expected in September’s readings.

- Cleveland Fed’s Mester (9amET): speaks on payments systems during the pandemic.

- Chair Powell (10amET): speaks on the covid-19 pandemic before the House select committee.

- Chicago Fed’s Evans (11amET): Speaks on the US economy and monetary policy.

- Boston Fed’s Rosengren (12pmET): speaks on the US economy.

- Minneapolis Fed’s Kashkari (1pmET): speaks on public health and the virus.

- Atlanta Fed’s Bostic (1pmET): speaks on communities.

- Fed Governor Quarles (2pmET): speaks on the economic outlook.

- San Fran Fed’s Daly (3pmET): speaks on labour force implications of covid-19.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.