- Peru: Fiscal accounts strengthen, but public investment spending stalls while protests disrupt mining production

PERU: FISCAL ACCOUNTS STRENGTHEN, BUT PUBLIC INVESTMENT SPENDING STALLS WHILE PROTESTS DISRUPT MINING PRODUCTION

I. Fiscal accounts just keep on getting better!

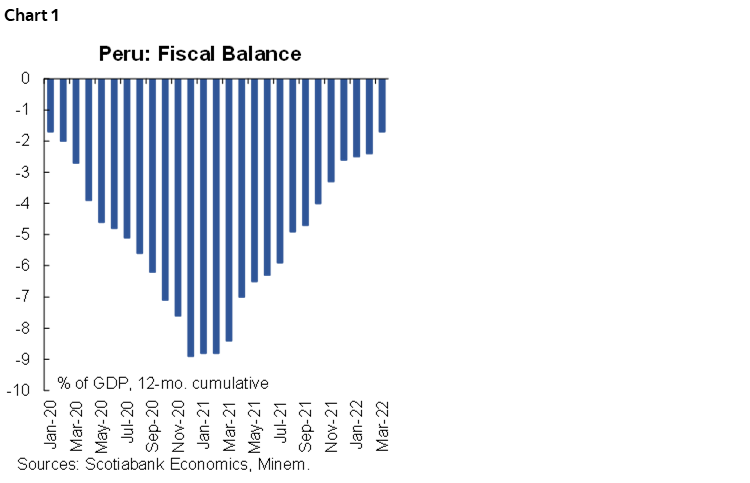

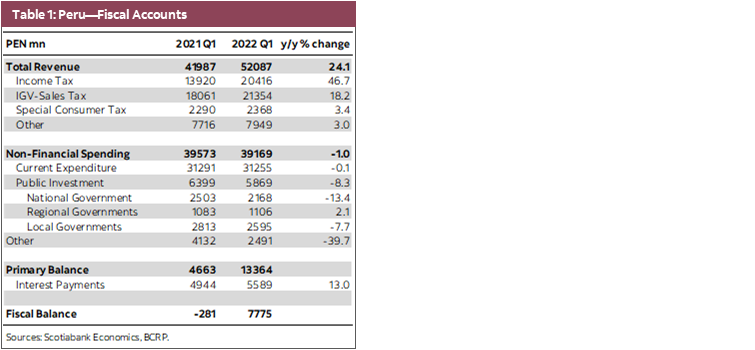

Peru registered a tremendous improvement in its fiscal accounts in March and Q1-2022, as the 12-month fiscal deficit shrunk from 2.4% of GDP in February to 1.7% in March (chart 1), according to the BCRP in a report published just before Easter. While this is a very encouraging outcome, it does contain one moderate distortion: about PEN 3 bn of tax payments that had come due in April 2021, but that were only made in March 2022. That said, excluding this transaction, income tax revenue is still up 25%, which is still a very strong number. Note, however, that March was the beginning of the two-month income tax season. Income tax revenue rose 47% y/y in Q1-2022.

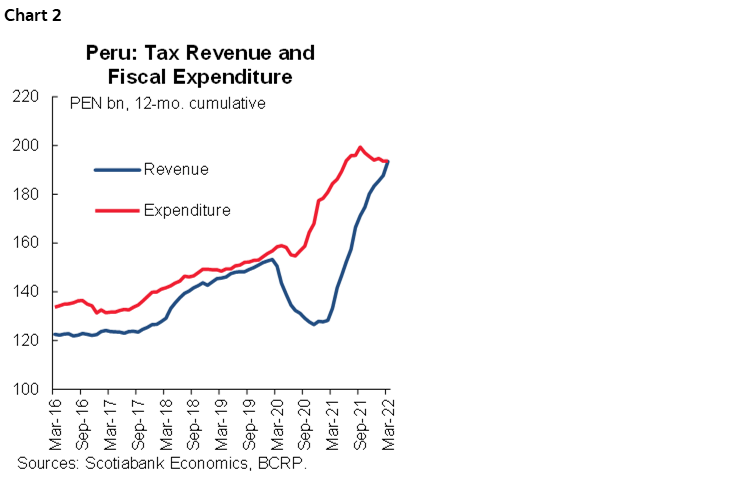

The solid fiscal accounts in Q1 mostly reflected extremely strong revenues. High metal prices represented the bulk of the increase in revenue. But the IGV sales tax (VAT) also contributed, rising a formidable 18% y/y. This impressive performance of the IGV tax has been sustained for some time now, and surpasses what one might expect from jobs growth. One of the drivers may be the lagged impact of government transfers to households and the access to savings that took place up until the end of 2021. Yet even this does not seem to be enough to justify the magnitude of the increase, which we believe is likely to also include a structural change in consumer behaviour towards greater digital payments, which are easier to capture for tax purposes.

Although fiscal accounts would have improved even if fiscal expenditure had risen in line with the 2022 budget, the fact that government spending actually declined marginally added to the stronger fiscal picture (chart 2). Current expenditure was flat in Q1. This was expected, as there were no longer any significant COVID-19-linked transfers. What was not expected was the 8% decrease in public investment (table 1). The Castillo Administration is largely responsible for this result, as investment at national level was down 13%. The decline in public investment may reflect, in part, high anti-COVID-19 spending in 2021. At the same time, public investment growth has been weak for six months now, and it has been our contention that this also reflects the Castillo administration’s difficulties executing spending plans.

At the end of the day, fiscal accounts are improving above and beyond what we expected. The current level of deficit, 1.7% of GDP, is not necessarily sustainable, as fiscal accounts typically improve during the March–April tax season, and then slip back a bit during the rest of the year. Even so, our forecast of a 3.0% deficit for 2022 is simply too high given the current fiscal balance, and we are revising it. On balance, we expect that the fiscal deficit for 2022 will fall within the 2.0% to 2.5% of GDP range. Uncertainties remain, however, owing to a number of emerging factors. To begin with, the government has announced a number of tax benefits for fuel and key food staples. So far, this accounts for approximately 0.3% of GDP in lower tax revenue. The question is whether more tax exemptions will be forthcoming? Similarly, while metals prices may remain high for longer (or not), there are questions regarding how social protests will impact mining operations. This is obviously not an easy question to answer. Finally, there is the question of whether the government can improve its spending capability as it makes progress on its learning curve, or if it is too unstable or preoccupied by other issues to improve its execution.

II. Las Bambas announces another halt in operations

The Las Bambas copper mine (MMG) announced yet another halt in operations, to begin on April 20. Las Bambas has reported that approximately 130 people from the nearby town of Fuerabamba had entered its installations on April 14. The company issued a statement expressing its frustration over the protestors’ refusal to acknowledge the company’s compliance with past agreements. Las Bambas has had to halt operations due to protests multiple times in the past. At this time, it adds to the Cuajone mine, operated by Southern Peru, which has halted operations since February 28 due to protests. Together, the two mines represent approximately 20% of Peru’s total copper output.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.