- Mexico: July’s trade balance came in with a wider deficit and slower annual growth

- Peru: Finance Minister Burneo attempts to get economic policy back on track

MEXICO: JULY’S TRADE BALANCE CAME IN WITH A WIDER DEFICIT AND SLOWER ANNUAL GROWTH

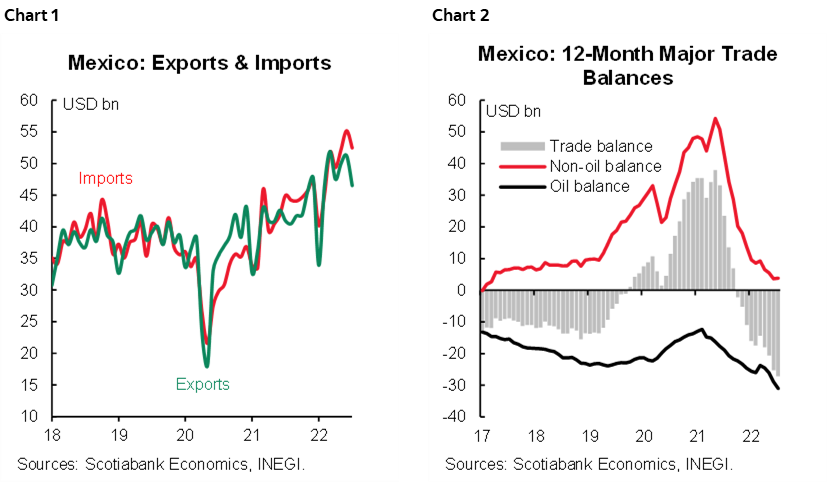

According to INEGI, the balance of trade deficit increased in July from -USD3,957 million to -USD5,959 million, the fourth consecutive monthly deficit, as both import and export growth decelerated on an annual basis (chart 1). Imports slowed from June's 32% y/y pace to 17% y/y, with a 37% increase in consumer imports offset by an increase of 14% in intermediate and capital goods imports. Exports also decelerated, from 20% y/y to 14%. Oil exports led the advance, at 32% y/y (compared to 54% previously), while growth of non-oil exports fell from 18% y/y to 12%. Manufacturing exports also moderated, from 20% y/y to 12%, while automotive exports fell to 13% y/y. On an annual accumulated basis, the trade balance records a deficit of -USD18,903 million, reflecting exports of USD327,275 million (representing an increase of 18.0%), and imports of USD346,179 (equivalent to an increase of 23.7%) (chart 2). On a monthly seasonally adjusted basis, imports fell -3.13%, while exports declined -0.26%.

PERU: FINANCE MINISTER BURNEO ATTEMPTS TO GET ECONOMIC POLICY BACK ON TRACK

The Ministry of Finance released on Thursday, August 25 its annual policy framework document: The Multiannual Macroeconomic Framework 2023-2026 (Marco Macroeconómico Multiannual, MMM). Newly-appointed Minister of Finance, Kurt Burneo, provided more details in a press conference.

In our view, the main takeaway from the MMM is that Minister Burneo is seeking to get economic management, which has been derailed since President Castillo came to power (or, perhaps, arguably, before COVID knocked government policy out of whack), back on track. Namely, restore business confidence and get private investment back on board, re-emphasize infrastructure spending through Project Management Officer (PMO) and government-to-government initiatives, and pursue greater public investment through technical assistance to local governments and by unblocking obstacles to current projects. All this while maintaining fiscal prudence and avoiding ineffectual populist measures.

This "getting policy back on track in a prudent and non-populist manner" may be the most important message that Minister Burneo is conveying. And, in fact, he is apparently trying to send this message not only to the business community, but to the government itself. The financial press has played up most especially the comment Burneo made during his press conference that he had not liked a recent cabinet decision to reduce the sales tax for the tourist and hospitality industries (he was apparently appointed too late to prevent the cabinet giving the measure), and that any other cabinet decision involving economic management that was made without his consent would motivate his resignation.

Minister Burneo and the MMM both stress the importance of fiscal sustainability. The MMM explicitly stated the need to “continue with Peru’s long history of fiscal prudence”. In line with this, the MMM maintained its previous forecast of a fiscal deficit of 2.5% of GDP for 2022, as well as projecting a path of decreasing the fiscal deficit to 1.0% by 2026. It may be tempting to see this as conservative fiscal spending at work. However, to expect (or, perhaps, seek?) a fiscal deficit of 2.5% of GDP by year-end, when the deficit is currently at 1.2%, is hardly fiscally conservative. If anything, the government would need to spend aggressively for the remainder of the year to reach this level. Which is precisely what Minister Burneo has been signalling he intends to do. Apparently, a fiscal deficit of 2.5% of GDP this year and of 2.0% of GDP in 2023 gives it ample room to implement an expansionary fiscal policy. We would agree with this assessment and, if anything, the challenge for Minister Burneo will be to increase spending sufficiently.

An additional note of market interest concerns fiscal financing. According to the MMM, the Ministry of Finance has reduced domestic debt financing for 2022 by PEN8.8bn (approximately USD2.3bn). It has maintained global debt issues at USD. In short, given lower fiscal needs, the government is preferring to cut debt issuance in Pen rather than USD, most likely due to interest rate differentials and debt market dynamics.

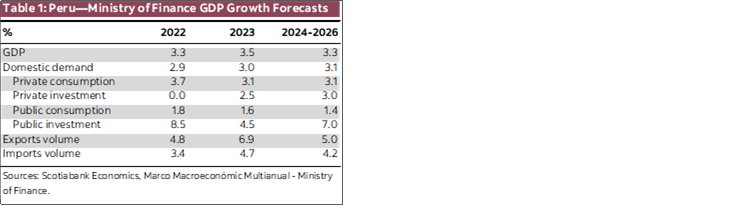

Many comments have centered around the new GDP growth forecast for 2022 (table 1), which the MMM reduced from 3.6% previously, to 3.3%. This was not much of a change, but does bring the forecasts closer to our own forecast of 2.6%. More interestingly, the MMM is forecasting nil private investment growth (versus our forecast of -2.3%). Overall, these and other growth figures suggest an encouraging reckoning with reality.

More important than the forecast tweaks were the policy guidelines that the MMM provided, and which appear to spell out the philosophy of what we may call Burneoconomics. There are three main focal points:

1. Stimulate private spending, by promoting new infrastructure spending, unblocking current projects, simplifying procedures, and enhancing the investment-for-taxes mechanism. In addition, provide temporary subsidies to vulnerable households to help them deal with inflation.

2. Accelerate public investment by providing greater resources to the most vulnerable regions, reactivating projects that have been interrupted, improving project management through technical assistance to all government levels, promoting Project Management Officer, PMO, mechanism.

3. Recover business confidence, by structuring a New National Infrastructure Plan, promoting the government-to-government project management system, advancing towards joining OECD, and in generating new—and unblocking extant—private-public partnerships.

The thing to note is that two of Minister Burneo’s three focal points are centered on the private sector.

Overall, he seems intent on turning back the clock on economic management and policy to pre-COVID and pre-Castillo times. This would represent a bit of a change in philosophy for the Aníbal Torres cabinet. Hopefully, Minister Burneo will win the day within the cabinet and the Castillo administration. The risk, of course, is that, in a government in which the average life of a cabinet member has been a short four months, Minister Burneo may not stay on long enough for economic management and policy to get fully back on track, and for business confidence to actually recover sufficiently.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.