- Chile: Higher rates, higher inflation

- Colombia: Consumer confidence improved in May, but inflation weighs on durable goods and vehicles purchases

- Peru: Business confidence improves slightly in May

CHILE: HIGHER RATES, HIGHER INFLATION

I. Central bank hikes benchmark rate 75 bps, further increases coming

On Tuesday, June 7, the central bank (BCCh) increased the benchmark rate to 9.0%, in line with market and our expectations. In its statement accompanying the rate hike, the BCCh shifted focus from global inflation to worries about weakened GDP growth. The statement notes a deterioration in global growth expectations, reflecting the weakening of the Chinese economy and the deterioration of global financial conditions in the context of an accelerated withdrawal of monetary stimulus. Although this trend has been observed for several months, and incorporated into downward revisions in global GDP growth projections by international organizations, such as the International Monetary Fund, the central bank gave it more prominence in this meeting.

The central bank recognized that the speed at which the domestic economy is slowing is less than expected. For now, the component that surprised the BCCh’s expectations has been consumption, however, we observed that private investment has also shown somewhat greater resilience, especially in machinery and equipment.

In our view, cuts in the monetary policy rate should begin as soon as inflation starts to ease, which is highly conditional on the external scenario, the exchange rate, and to a lesser extent on the capacity gap at this juncture. Absent additional supply chain disruptions, further increases in global food prices, and/or multilateral depreciation of the CLP, the first cut could take place in the December 2022 meeting.

The foregoing is compatible with a scenario in which growth begins to slow in this second half of the year, and would most likely feature zero growth at end 2023 and even the risk of recession. For now, our baseline scenario considers GDP growth of 3% for 2022 and output remaining flat (0%) in 2023.

II. CPI inflation 11.5% y/y, largely explained by volatile items

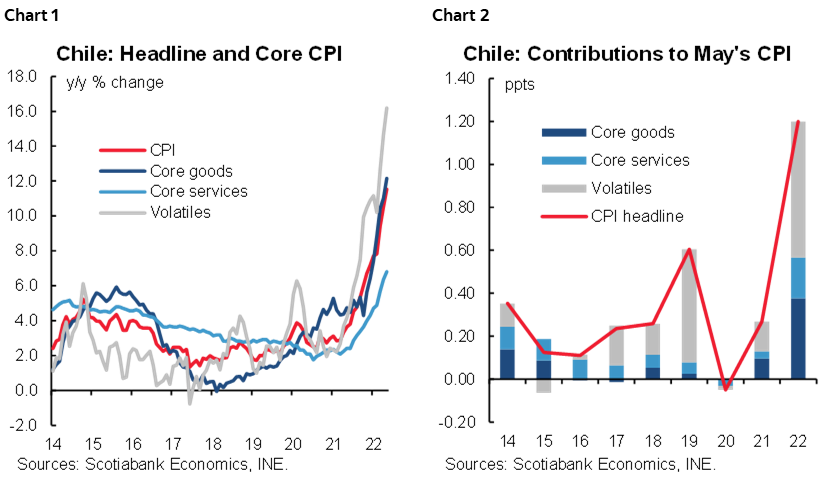

On Wednesday, June 8, the statistical agency (INE) released the May CPI, which increased 1.2% m/m, largely explained by food and transportation. The CPI excluding volatile components increased 0.9% m/m, similar to that of April (1.1%) and still high in historical perspective. The adjustment of prices at the retail level and service providers, together with the second-round effects, show no signs of slowing down. Furthermore, a worrying acceleration is observed in the price adjustments of goods.

By components, food once again explained a large part of the month’s increase, with non-perishable food standing out. Transportation had the second largest contribution to m/m inflation, mainly owing to the hike in air transport fares, which reflected the increase in international tickets on routes to high season destinations. Goods inflation was likewise above the average, reaching 1.3% m/m, while services inflation reached 1.1% m/m. Overall, the incidence of volatile elements explained 53% of the variation in the total CPI.

For its part, inflation excluding volatile items (0.9% m/m) was driven mainly by an acceleration in the prices of goods (1.4% m/m), which was once again concentrated in food and transportation. Meanwhile, services inflation excluding volatile elements stood at 0.5% m/m, explained to some extent by increases in the restaurant and hotel prices (charts 1 and 2).

Given the persistence and second-round effects observed in recent months, we have adjusted our inflation forecast for the end of December 2022 upwards, from 8.4% y/y to 10.2% y/y. In the coming months, we will most likely see new second-round effects, mainly in services, which will augment the effects of higher local fuel prices in the short term.

—Jorge Selaive, Anibal Alarcón, & Waldo Riveras

COLOMBIA: CONSUMER CONFIDENCE IMPROVED IN MAY, BUT INFLATION WEIGHS ON DURABLE GOODS AND VEHICLES PURCHASES

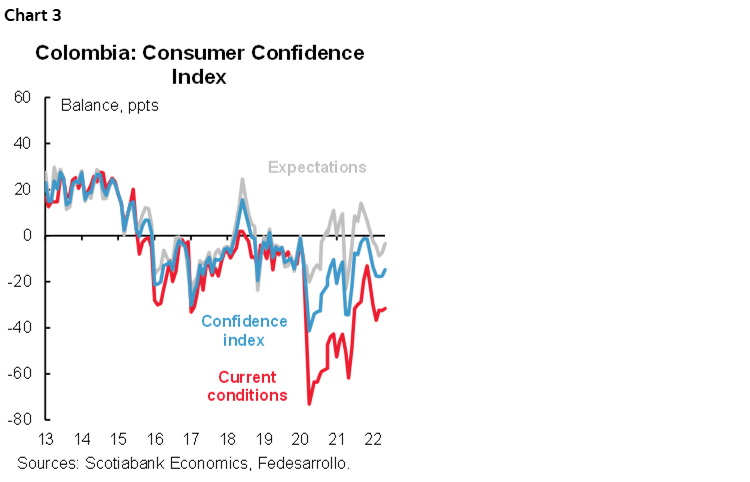

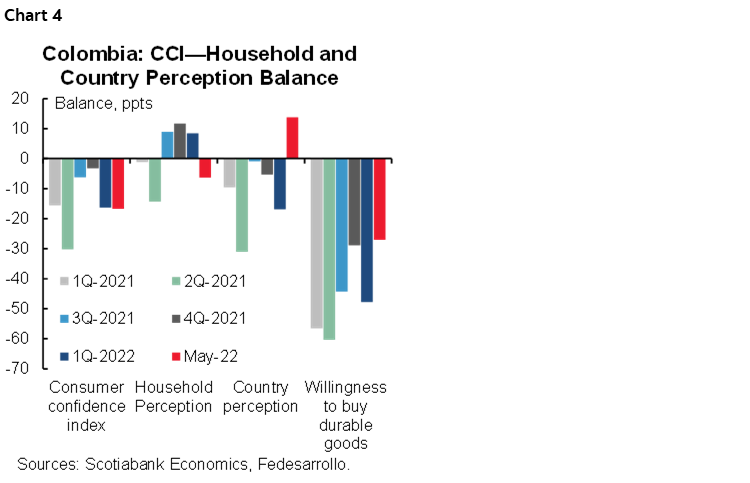

Colombia’s Consumer Confidence Index (CCI) stood at -14.7 ppts in May, an increase of 2.8 ppts from the previous month. The improvement is explained by a rise in both the index of expectations of future conditions, which swung from -7.4 ppts to 3.5 ppts (chart 3), and the index of current conditions, which rose slightly from -32.6 ppts to -31.5 ppts.

Despite the modest improvement in the current conditions index, it is clear that households continue to feel pessimistic with respect to economic conditions. Their willingness to buy durable goods fell again compared to the previous month. Similarly, the willingness to buy houses declined (from -22.6 ppts to 33 ppts) and the willingness to buy vehicles weakened further by -4.0 ppts compared to the previous month, down to -63.3 ppts.

Households’ perception of the future has improved, but uncertainty remains regarding the political context and the behavior of inflation. Looking at May’s results in detail:

- The Current Conditions Index reached -31.5 ppts, slightly above the -32.6 ppts reading in April. Households slightly improved their economic perception, despite the fact that inflation remains high, perhaps reflecting households’ have managed their budgets better and employment has shown a trend of improvement with closures in gender gaps, although the overall pace of labour market recovery remains slow. The languid jobs’ recovery may explain why the willingness to buy durable goods decreased by 3.4 ppts compared to the previous month.

- The Expectations Index improved to -3.5 ppts in May from -7.4 ppts in April (chart 3, again). Expectations about the future brightened (rising 6.5 ppts), while the assessment of the country’s economic prospects strengthened, at -5.1 ppts from -7.7 ppts (chart 4). It will be important to monitor consumption in the coming months, given the fact that while inflation has moderated slightly, especially in food, other living costs remain under pressure. At the same time, uncertainty continues with respect to the presidential election. For now, credit remains robust, especially in the consumer sector, which suggests that consumption will continue strong at least in the remainder of the first half, encouraged by the second VAT holiday on June 17.

- Consumer confidence figures weakened in two of the top five cities surveyed. Medellin and Barranquilla showed the worst balances, -23 ppts and -20.3 ppts, respectively. These results are explained by less willingness to buy durable goods. In Bogota, in contrast, confidence improved by 6.7 ppts.

- Confidence improved in all economic groups, despite high inflation: confidence increased in the low-income population by 2.5 ppts; for middle- and high-income households the increase was 1.5 ppts and 17.6 ppts, respectively. In absolute terms, the low income population recorded the worst sentiment (-15.1 ppts). Overall, it seems that households continue to feel the effects of inflation, but to a lesser extent.

All in all, consumer confidence in May shows that consumers have improved their sentiment regarding their current situation, but are optimistic with respect to one year ahead. Households continue to be affected by the effects of inflation, though to a lesser extent, suggesting that they have adjusted their consumption patterns. This adjustment may explain why the willingness to buy durable goods, vehicles, and housing has been reduced. It is important to follow these metrics and see how inflation continues to behave. We expect the central bank to continue its cycle of monetary policy tightening, perhaps reaching a terminal rate at 8.5% and holding it for longer, as we see inflation trajectories in the short and medium term remaining high and far from reaching BanRep’s target range in the short term.

—Sergio Olarte, Maria (Tatiana) Mejía & Jackeline Piraján

PERU: BUSINESS CONFIDENCE IMPROVES SLIGHTLY IN MAY

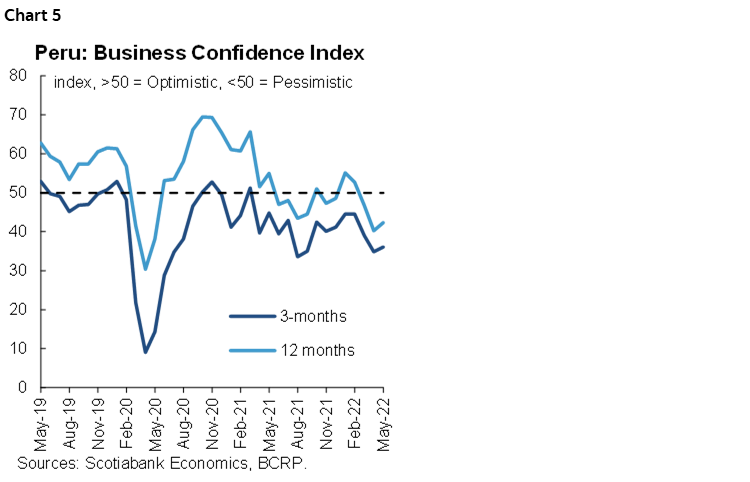

Business expectations showed a slight improvement in May (chart 5), but remain firmly entrenched in the negative range, well below the 50 point breakeven point. Looking at the glass half full, it is encouraging that 14 of the 18 current and future business situation indicators improved compared to April and that six have turned positive. These indicators are mainly those of future expectations—demand for products, company prospects, and industry outlook.

Looking at chart 5 again, however, the improvement in May appears to be more a fluctuation within a relatively stable (negative) range over the past 12 to 14 months. Consumer confidence has been erratic month to month, and we would need much more than the May monthly result to indicate a change in trend.

That said, the improvement did occur after Congress rejected in early May the government’s proposal to submit to a referendum the call for a Constituent Assembly to write a new Constitution, which could open the door for a change in the current economic model that privileges private initiative.

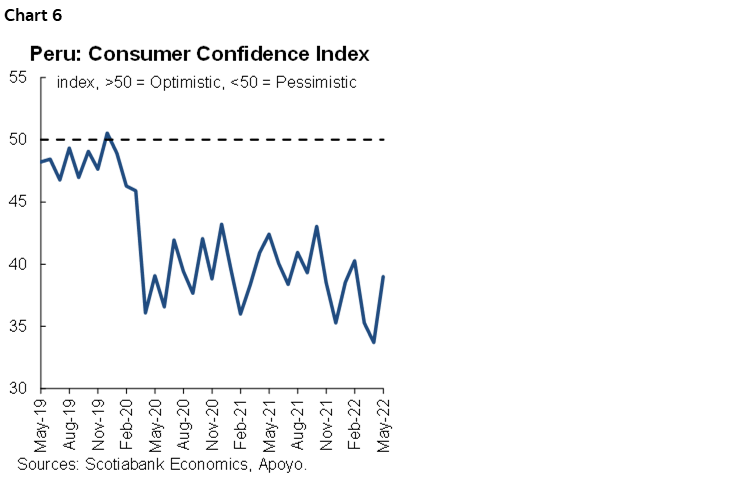

At the same time, the consumer confidence index (Indicca) prepared by Apoyo Consultoría, also improved in May, though it remains at historically low levels close to the minimums reached at the start of the COVID-19 pandemic (chart 6) and, if anything, the overall trend over the last six months appears to be downward.

Moreover, the recent approval in Congress of a new partial withdrawal of pension funds (AFPs) as well as the possibility of withdrawing CTS deposits—a kind of unemployment insurance—may have boosted consumer confidence. The withdrawal of AFPs could imply the withdrawal of up to PEN 30 bn in the coming months, which would have a positive impact on consumption.

Finally, it should be noted that the improvement in business and consumer confidence in May could be curtailed by the persistent political noise between Congress and the government, as well as by the accusations of corruption in the administration.

—Pablo Nano

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.