- Brazil: BCB delivers 100 bps hike; we are revising our terminal rate call to 13.50% based on the recent spike in commodity prices

BRAZIL: BCB DELIVERS 100 BPS HIKE; WE ARE REVISING OUR TERMINAL RATE CALL TO 13.50% BASED ON THE RECENT SPIKE IN COMMODITY PRICES

As was widely expected, the BCB’s COPOM policy committee unanimously decided to increase the SELIC rate to 11.75% on March 16, as market expectations of inflation adjusted to recent spikes in commodity prices. All but six of the 43 economists surveyed by Bloomberg expected the BCB to hike the SELIC rate 100 bps in Wednesday’s meeting. Those not anticipating a 100 bp hike, expected an increase of 125 bps or 150 bps. The IPCA inflation print for February, published on Match 11, had come in slightly above expectations at 10.54% y/y (chart 1), relative to a consensus call for 10.47% y/y. At the same time, growth has been disappointing, with the latest print (January) of the monthly economic activity index coming in at a weak 1.3% y/y.

The Brazilian economy thus looks stuck in a borderline stagflation environment, with consensus GDP estimated at 0.5% for 2022, and inflation at 7.6%. As a single-mandate inflation targeting central bank, the BCB is prioritizing inflation, hiking rates from 2.0% in March 2021 to 11.75%. Markets are now discounting a terminal rate of 13.75%.

The BCB’s decision to hike 100 bps was driven by a general worsening of the inflation environment:

- The COPOM describes the external scenario as having deteriorated markedly, with commodity prices spiking and tightening financial conditions for emerging markets.

- On the domestic inflation front, the BCB continued to be surprised by higher-than-anticipated outcomes, with the COPOM highlighting elevated risks to its inflation outlook, including risks stemming from the oil price spike.

- The BCB’s base case scenario envisions the SELIC rate climbing to 12.75% in 2022, before declining to 8.75% in 2023, while the COPOM signaled that it will likely pull the trigger on another 100 bp hike in its next meeting.

Looking at recent inflation by components, the Brazilian story has some similarities with other Latam countries, but also discrepancies:

- The main drivers of inflation since the second half of 2021 have been transportation (18.3% y/y in February), Household goods (14.4% y/y in February), housing (14.6% y/y in February), and food & beverages (9.1% y/y in February). With the Ukraine conflict spike in energy prices, it is likely that recent decline in transportation costs will be reversed in March.

- On the flip side, two components that have served as anchors for inflation have been health & personal care (3.6% y/y in February) and communications (2.9% y/y in February). In the latter case, however, recent prints have shown an upward trend, further suggesting that inflation is building self-reinforcing inertia.

Based on what is priced into financial markets, the SELIC rate is expected to increase through September 2022, reaching a peak of 13.75%, before the BCB begins to gradually cut rates in Q1-2023. However, markets discount a 12% SELIC rate by the end of 2023, which would suggest a real policy rate of 8.0% based on the consensus expected inflation at that time. This pricing is at odds with the economists’ consensus (Bloomberg), which anticipates a real rate of around 4% at the end of 2023.

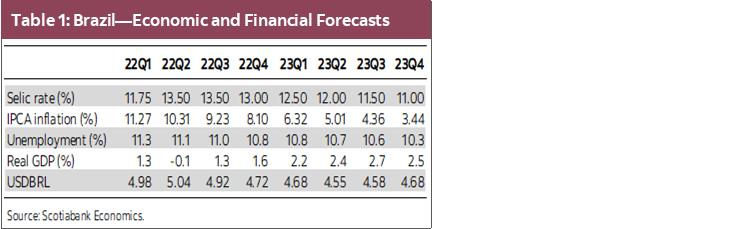

Before the start of the Ukraine conflict, and the ensuing spike in commodity prices, we called for a terminal SELIC rate of 12.25%, to be reached in Q3-2022. However, the spike in commodity prices is likely to further pressure inflation higher, and risks contaminating the price formation mechanism, which in our view will push the BCB to tighten rates further. Consensus and Scotiabank anticipate that inflation will remain above target over a two-year policy horizon, meaning that policy setting will likely have to remain tight for some time to bring inflation back in check. Accordingly, we have raised our forecast of the SELIC rate, resulting in larger hikes in the near-term meetings to the following path (table 1).

—Eduardo Suárez

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.