- Colombia: Services sector powers growth, but recovery clouded by inflation and rising imports

COLOMBIA: SERVICES SECTOR POWERS GROWTH, BUT RECOVERY CLOUDED BY INFLATION AND RISING IMPORTS

I. Services led growth, but high inflation having negative impacts

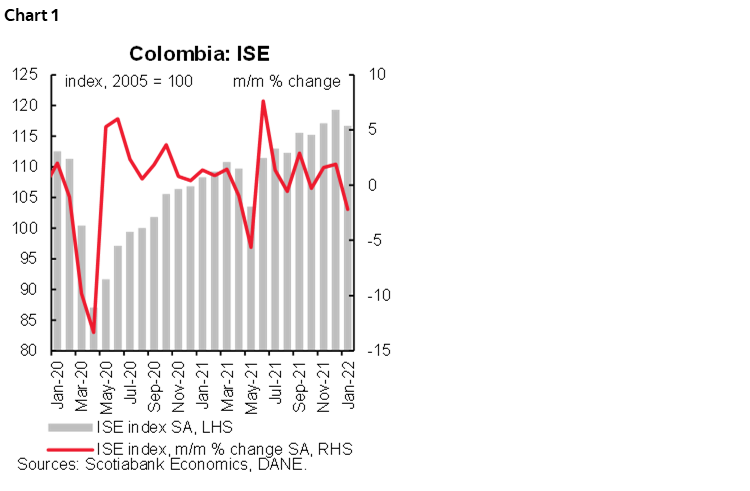

On Friday, March 18, the Colombian Statistical Agency (DANE) released the Economic Activity Indicator (ISE) for January 2022, with the key GDP proxy rising 7.8% y/y, well below the Bloomberg market consensus of 10.4% y/y. Indicators were mixed in January, as strong increases in the services sector were partially offset by negative contributions from agricultural and the financial sector.

On a seasonally-adjusted basis, Colombia’s economic activity fell by 2.2% m/m (chart 1), the largest contraction since May 2021.

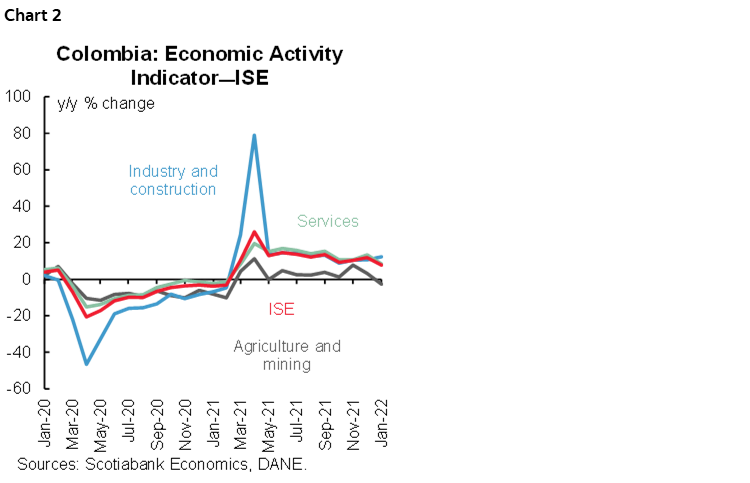

January’s ISE results showed mixed signals (chart 2). A closer look is detailed below:

- Primary activities (13% of the economy) contracted 2.71% y/y, falling 5.24% m/m (seasonally-adjusted terms) in January. The agricultural sector declined 4.4% y/y, while coal production staged a recovery, rising 6% y/y. Crude oil production continues to lag the recovery with a contraction of 0.6% y/y. The agricultural and oil sectors warrant close monitoring, as agriculture could point to adverse effects from higher production costs, while lower oil production would partially offset the positive news in terms of high international prices.

- Secondary sectors (17% of the economy) were up 12.4% y/y and by 2.0% m/m. Manufacturing production remains strong in areas tied to the reopening and the relaxation of mobility restrictions. Meanwhile, construction is performing better, expanding 12.9% y/y in the building sector and 2.9% y/y in civil works.

- Services-related activities (70% of the economy) were up by 8.3% y/y but contracted by 3.8% m/m sa mainly due to a one-off effect in the financial sector which accounted for the payment from an insurance company for the case of Hidroituango (related to dam construction issues in Antioquia). However, other service sectors such as commerce, transport, and hotels, contracted by 0.3% m/m sa, pointing to the effect of the inflation in the consumption of these items.

January’s ISE results show a weaker than expected result, mainly on a one-off effect. However, there were also some mixed signals that suggest inflation is starting to weigh on some activities. On the positive side, we highlight the recovery in the construction sector, which continued to close the gap relative to pre-pandemic activity levels. These results support our projected 4.5% GDP growth in 2022 and our expectation of a 150 bps hike in the March 31 monetary policy meeting.

II. Imports remain close to historical high amid raw-materials and capital goods purchases

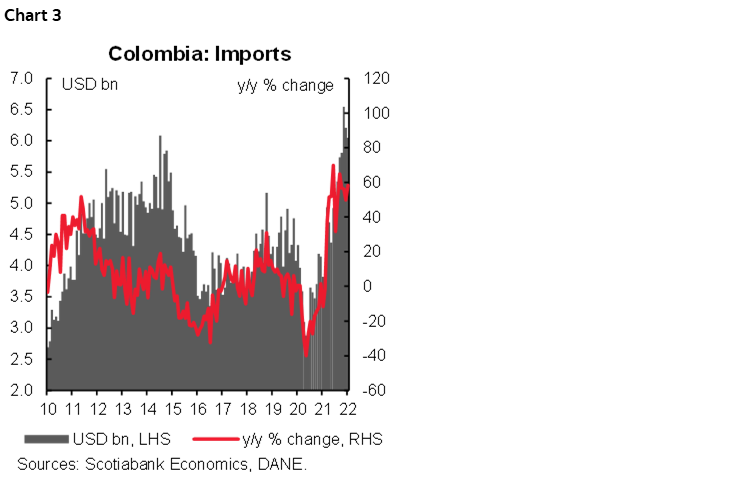

January import data, released by DANE on Friday, March 18, came in at USD 6.05 bn (CIF terms), expanding by 58.3% y/y (chart 3), close to the historical high reached in November (USD 6.55 bn). The monthly trade deficit stood at USD 1.7 bn, one of the largest monthly deficits since 2015, showing that the external deficit remains a challenge in 2022.

January’s imports slightly decreased from December, mainly on consumption goods purchases, and offsetting the increase in durable goods and raw material imports. Manufacturing imports grew by 59.5% y/y accounting for the biggest positive contribution to annual imports growth, while agriculture-related imports increased by 27.4% y/y and mining-related imports grew by 110.3% y/y.

From the perspective of imports by use, three major components showed strong increases compared with January 2022:

- Consumption-goods imports increased by +7.7% y/y, and stood at USD 1.18 bn. Both durable and non-durable goods imports, which moderated relative to previous months, expanded by +31.1% y/y and +41.8% y/y on an annual basis. In the case of non-durable goods, pharma products led the increase (+39.3% y/y) reflecting vaccines purchases by the government. In the case of durable goods, the positive performance was driven by vehicles purchases, as well as higher international prices.

- Raw-materials imports grew by 76.4% y/y to USD 3.22 bn, and remained as the main contributor to the overall increase in imports. Imports for industry (+65.4% y/y) led the gains, followed by fuel imports (+124.3% y/y) as world energy prices increased significantly compared with one year ago.

- Capital-goods imports were up by 46.3% y/y to USD 1.72 bn. Purchases of investment-related goods in industry led the gains (+26.4% y/y), followed by transport equipment (+116.3% y/y). The performance of this group is compatible with the ongoing economic recovery and we expect this to continue in 2022 as economic growth would be led more by investment.

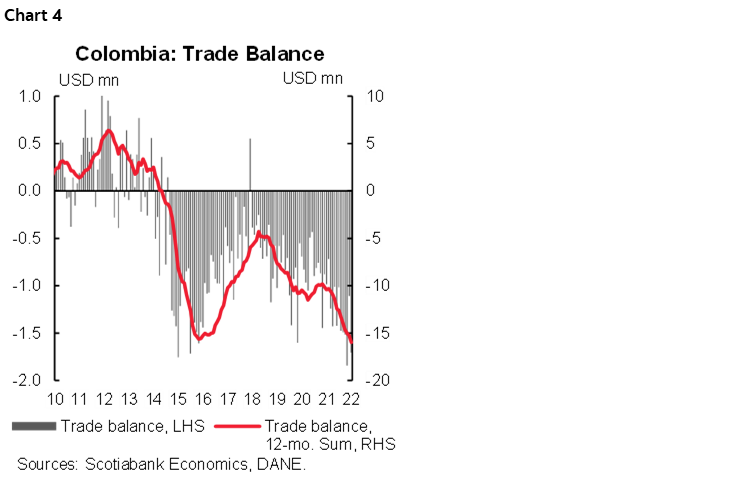

All in all, imports in January point to positive effects from the economic recovery, but also the effect of higher international prices. The trade deficit is likely to remain wide in 2022, with growth having asymmetrical impacts on imports and exports. On the positive side, as capital goods imports remain high, the financing side should be better supported by FDI. However, the external deficit remains one of the main issues of concern with respect to Colombia's macroeconomic performance (chart 4).

—Sergio Olarte & Jackeline Piraján

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.