- Chile: USD 2 bn bond completes total foreign currency issues planned for 2022

- Colombia: Exports surge in January on positive price effect

- Peru: Lima home sales soften in January on higher prices and lower supply

CHILE: USD 2 BN BOND COMPLETES TOTAL FOREIGN CURRENCY ISSUES PLANNED FOR 2022

On Wednesday, March 2, the Ministry of Finance (MoF) reported issuing Treasury bonds in international markets totaling USD 2 bn, as part of the government’s 2022 financing plan. The plan contemplates bond issues of USD 20 bn within the debt limit authorized by the 2022 Budget Law, of which USD 6 bn corresponds to foreign currency offerings.

The latest offering completes planned foreign currency issuances for 2022. It was heavily over-subscribed, with a total demand of USD 8.1 bn, 4.1 times the allocated amount. The yield was 4.346% (spread of 200 bps over the US Treasury rate).

The MoF also announced the injection of USD 4 bn to the Economic and Social Stabilization Fund (FEES) in January using the resources from previous offerings. We do not rule out that this new USD 2 bn issuance could be allocated to the FEES.

—Anibal Alarcón

COLOMBIA: EXPORTS SURGE IN JANUARY ON POSITIVE PRICE EFFECT

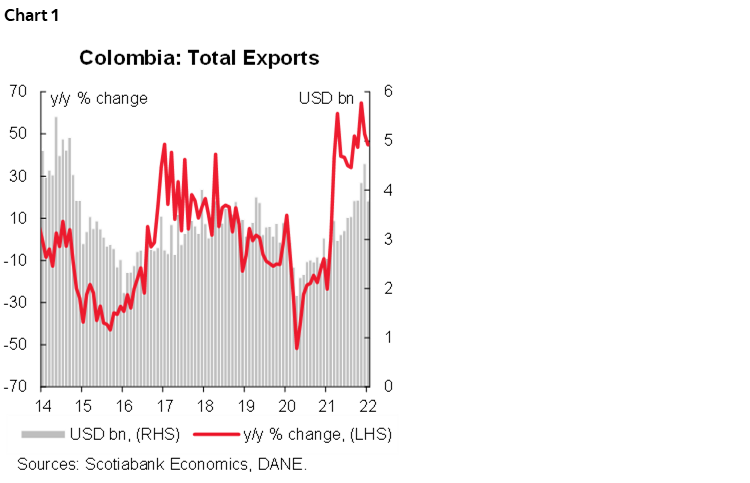

Data released by the DANE statistical agency on Thursday, March 3, show monthly exports at USD 3.78 bn in January, up 44.8% y/y and well above the pre-pandemic 2019 average of USD 3.3 bn (chart 1). Export growth was driven by traditional commodity exports; on the non-traditional side, the main impulse came from chemical products and gold.

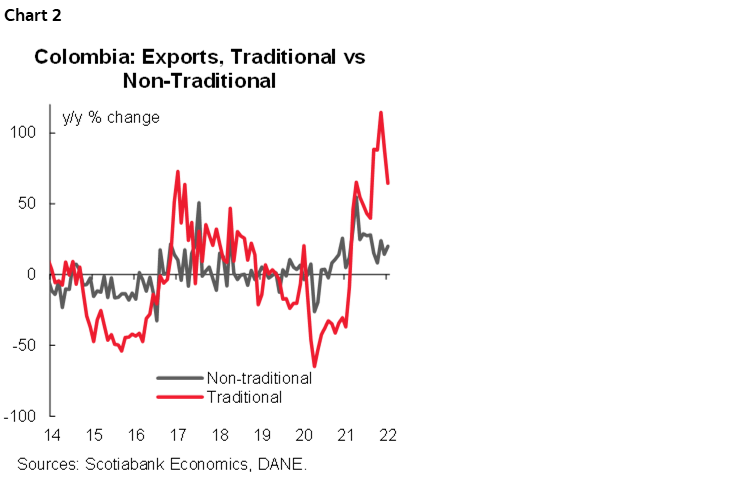

Traditional commodity exports were up 64.3% y/y in January 2022 (chart 2), showing a strong contribution from coal exports, which expanded by 72% y/y, an increase explained by prices since exported volumes contracted by 0.9% y/y. The same phenomenon was observed in the case of oil exports, which increased by 63.3% y/y but contracted 11.6% y/y in terms of volumes. Coffee exports also contributed positively with a 29.1% expansion, but again showed lower volumes (-1.8% y/y). January’s results contrast to 2021, when traditional commodity exports decreased by 7.5%.

The value of non-traditional exports was USD 1.38 bn in January, an increase of 20.0% y/y (chart 2 again). Manufacturing exports drove the overall advance, with an expansion of 25.3% y/y, on the back of diverse manufacturing goods (+32.3% y/y) and chemical products (a 27.0% y/y rise). However, in this month, we also saw a strong contribution from non-monetary gold (+65.5% y/y).

All in all, exports started 2022 with still strong gains, showing positive contributions from the increase in commodities prices. In this regard, mining sector production remains a key factor in the external deficit. And the current environment of high commodity prices due to the conflict between Russia and Ukraine will boost traditional exports. At the same time, the MoF’s assumption of an average price for Brent crude oil of USD 70 per barrel in 2022 is well below the current price. A scenario in which current prices are sustained would not only generate a potential reduction on the trade deficit but also increase government revenues.

—Sergio Olarte & Jackeline Piraján

PERU: LIMA HOME SALES SOFTEN IN JANUARY ON HIGHER PRICES AND LOWER SUPPLY

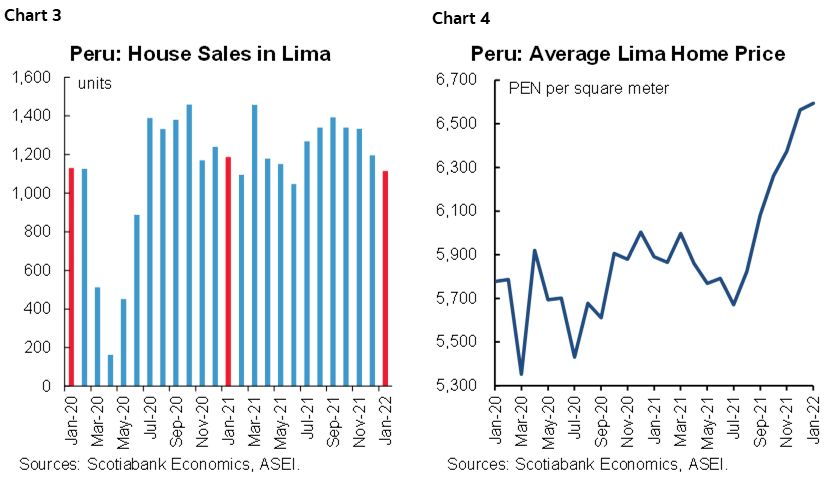

Home sales in Lima, the country’s key market, were down 5.4% y/y and 6.9% m/m in January (chart 3), according to the local Real Estate Association (Asociación de Empresas Inmobiliarias del Perú, ASEI). This outcome was below our expectations, and was the fourth consecutive month in which homes sales have declined. Although it is tempting to say that low demand is the cause of declining home sales, this is not so clear. Home prices priced in PEN rose 11.9% y/y (0.5% m/m) in January (chart 4). There may be a number of reasons for this rise in prices, but lower demand is not one of them. Construction materials prices have increased significantly, especially imported components. In addition, the year-on-year increase in prices largely reflected the PEN depreciation, as home sales tend to be priced in USD. Even the 0.5% increase in prices in January, when the PEN appreciated, may reflect a delayed effect from December. Lower supply apparently was a factor, as well. Houses on offer in Lima were down 6.2% y/y (-1.0% m/m) in January, as investment in real estate projects under development has softened in recent months, perhaps linked to higher construction costs, but probably mostly due to political turbulence. Our estimate of home sales growth for 2022 is 1%, under the assumption that demand will remain in future months.

—Guillermo Arbe & Carlos Asmat

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.