- Colombia: Monetary policy minutes—BanRep reacted to market volatility with a unanimous vote

- Peru: Inflation slows in Oct but not enough for a BCRP pause; early indicators tee up 2% y/y growth in Sep

Risk-averse trading continued overnight in the aftermath of Fed Chairman Powell’s press conference yesterday. The Fed has stuck to its guns on its rate path with a chance that they will raise rates by more than their September projections had indicated—and they are not thinking about pausing. The MXN was a relative out-performer in the FX space as markets consider that Banxico will keep pace as much as possible with the Fed, while other central banks (such as the BoC or the ECB) will have to stop sooner.

Mexican and Brazilian markets reopen today after holidays on Wednesday, but the Latam day ahead is quiet on the data and events front. The recent bout of weakness in the Colombian peso had raised calls for the resignation of Finance Minister Ocampo, which forced him to declare in social media yesterday that he has no intention of quitting.

Peru’s central bank Chief Velarde said yesterday that the bank is “at the end” of the hiking cycle “but that does not mean that we are not going to lift”. This is in line with our forecast for a 25bps hike at the BCRP’s policy decision next week, in line with continued inflationary pressures (see Peru section below).

The Chilean Peso is starting the day on the backfoot with a 1.5% decline after President Boric announced a pension reform plan yesterday, noting that AFPs (private pension managers) “in this reform, are finished”. We will have more details on this in upcoming publications as the situation develops.

At writing, global markets are reacting to the BoE’s policy decision at 8ET while they await US nonfarm payrolls data due out tomorrow morning.

—Juan Manuel Herrera

COLOMBIA: MONETARY POLICY MINUTES—BANREP REACTED TO MARKET VOLATILITY WITH A UNANIMOUS VOTE

BanRep published the minutes to its October 28 monetary policy meeting on Tuesday, which showed that the unanimous vote was considered a strong response to market volatility, also reflecting the dilemma the board faces in monetary and exchange rate stability. The board noted elevated concern about the deterioration of Colombian financial conditions and they considered that the 100bps hike contributed to maintaining the confidence of offshore investors. Unfortunately, despite the board thinking Friday’s move was enough, markets did not concur and the COP exchange rate remains under pressure, while trading in fixed income markets remains volatile.

The minutes also reflected that concerns about a potential economic downturn eased as recent data have shown stronger than expected activity. In the same vein, increasing inflation expectations also allowed the board to continue with a 100bps pace in the hiking cycle. The board also considers the current rate as a restrictive rate, and expects it to contribute in achieving the inflation target in the medium term and make economic growth more sustainable.

Our take is that the board remains highly data-dependent. However, despite their perception that a unanimous 100bps hike is a strong signal of independence and compromise with macro stability, it wasn’t enough for markets that had expected the bigger hike complemented by currency intervention measures. For now, we maintain our call of a 50bps hike at the December 16 meeting.

Key points discussed by the board:

- The board emphasized that inflation, economic activity, and international rates were higher than expected. These fundamentals supported their choice to continue increasing the monetary policy rate.

- One board member said it is necessary to increase rates to balance nominal GDP growth with monetary aggregates. The board emphasized that the 100bps hike is supportive towards financing the current account deficit.

- Regarding inflation, one board member said that supply shocks are still dominant, and that he/she expects these pressures to continue in upcoming months. However, he/she highlighted that external conditions justified the strongest action possible last week from the central bank.

—Sergio Olarte, María (Tatiana) Mejía & Jackeline Piraján

PERU: INFLATION SLOWS IN OCT BUT NOT ENOUGH FOR BCRP PAUSE; EARLY INDICATORS TEE UP 2% Y/Y GROWTH IN SEP

Inflation slowed in October, but not enough to stop BCRP from raising policy rate

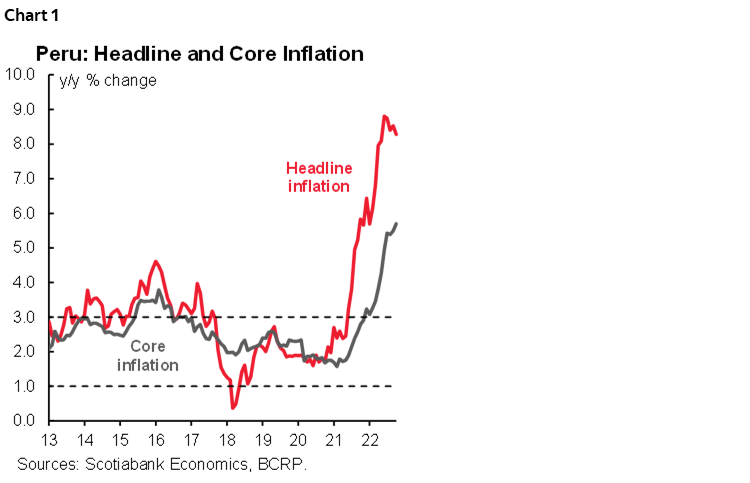

Peruvian month-on-month inflation was 0.35% m/m in October in data published on Tuesday, slightly above our forecast (0.20%) and below the Bloomberg consensus (0.47%). Notably, this is the fourth consecutive time in which monthly inflation slows down. Year-on-year inflation fell from 8.5% y/y to 8.3% y/y, remaining above the 3% upper limit of the target for the seventeenth consecutive month, thus surpassing the most recent record during which it remained outside the target range (sixteen months, between March 2015 and June 2016). Since 2000, the longest period with inflation above 3% was 21 months (between October 2007 and June 2009). The BCRP sees the risk that this period of inflation above the 3% limit will be the longest ever (since it was instituted in 2007).

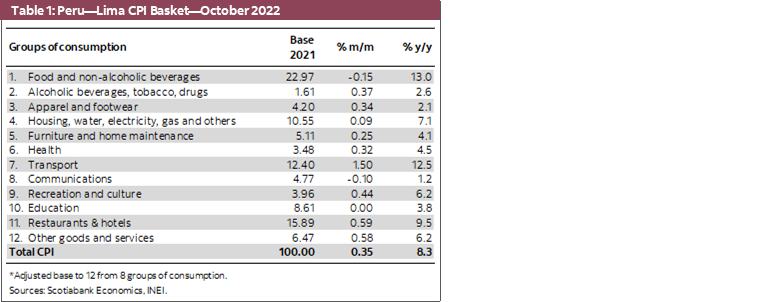

Inflation for October reflected increases in transportation prices, mainly due to transportation costs and fuel prices. Higher restaurant prices also had an impact. Unlike previous months, food prices showed a decline (table 1). Of the 586 products that make up the consumer basket (base 2021), 419 rose (72%), 76 fell (12%) and 91 remained unchanged (16%). Core inflation accelerated from 5.5% y/y in September to 5.7% y/y in October. Wholesale and construction material prices slowed. At the country-wide level (i.e. not the headline Lima print, considering the 26 most important cities), inflation y/y slowed down, but in a smaller number of cities (12) compared to previous months. In six cities an annual rate of inflation higher than 10% was recorded, an increase from the four cities with double-digit inflation in September.

Looking ahead, we expect the slowdown in inflation to continue, albeit at a gradual pace. Cost pressures persist with a ~9% year-on-year increase in wholesale prices (chart 1). Our inflation forecast remains at 7.7% for end-2022 and 4.0% for end-2023, as published in the October 21, 2022 edition of the Latam Weekly. For November, we expect an inflation rate similar to October’s (around 8.2%). We expect inflation to break below 8% in December, mainly due to a high statistical base.

Over the last fourteen months, the central bank raised its benchmark rate by 675 basis points to 7.00% and raised reserve requirements three times. Twelve-month inflation expectations are down, but still without conviction. The BCRP considers an inflation forecast of 7.8% for this year and 3.0% for 2023. The real interest rate (2.11%) is already above the neutral rate (1.50%), where the position of monetary policy begins to turn contractionary. Like us, the central bank has indicated that it sees the end of the interest rate hike cycle as near, without ruling out additional hikes, if necessary. We believe that the central bank will want to ensure that inflation returns to its target range, so until then we expect the benchmark rate to rise 25bps to 7.25% at its meeting on Thursday, November 10.

—Mario Guerrero

Early indicators point to 2% y/y GDP growth for September

September GDP figures will not be released until mid-November, but partial figures for September GDP were released by the National Statistics Institute on November 1. Based on these figures, we expect September GDP to come in around 2% y/y, slightly better than the 1.7% y/y of August, and broadly in line with our forecast of 2.8% full-year GDP growth.

The main indicators that were provided include (in y/y growth terms):

Mining: +0.05%

Oil & gas: -15.5%

Fishing: -9.4%

Cement demand: -2.4%

Public investment: +20.5%

Electricity: +4.9%

Sales tax revenue: +17.9%

Mining growth in September, though low, was actually the first positive y/y figure in four months. The sharp decline in oil & gas is surprising, although it does not have nearly as great a weight as mining. Certain maintenance disruptions were reported in gas production during August–September and yet the decline in production seems greater than warranted by these, rather brief, disruptions—at least in September. Meanwhile, fishing conditions have been poor for some time now; this will not be a good year for fishing. However, it also has relatively little weight in aggregate GDP.

More importantly, construction GDP should show low, albeit positive, growth in September as a decline in cement demand is largely compensated by strong public investment. On a positive note, which provides support for a 2% growth rate, domestic demand related sectors and electricity and sales-tax revenue point to robust consumption. Note that both overstate the strength of domestic demand to some degree, however. Electricity overstates as part of the reason behind the increase would be the coming online of the energy intensive Quellaveco copper operations. Sales-tax revenue overstates to the extent that it also partially reflects the impact of digitalization on formalizing sales that were previously conducted as non-registered cash transactions.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.