- Colombia: Sector-level activity shows mixed performance, but affirmed a moderation in domestic consumption

- Peru: Strong fiscal accounts while trade surplus narrows

The week has started with more developments out of the UK as newly-appointed Chancellor Hunt rolled back more of the late-September mini-budget—and signs continue to point to PM Truss being pushed out over the next few days. Equity markets in North America are following the positive mood in Europe with gains on track to reverse Friday’s steep declines.

Latam currencies are following the dollar-negative mood while ignoring generally softer energy and metals prices. The CLP is again trading erratically today, and far from correcting Friday’s 2.5% loss; the BRL is up ~0.8% and the PEN and MXN are up ~0.5% and 0.2%, respectively.

Colombian markets are closed today for a public holiday and the regional calendar is quiet over the rest of the day after Peruvian unemployment and Peruvian and Brazilian economic activity data published this morning.

Peru’s economic activity accelerated to 1.7% y/y in August, beating a median forecast of 1.4% y/y. The country’s expansion was driven by 2.6% and 5.6% y/y increases in retail sales and construction activity, respectively, against a steep decline in mining production of 5% y/y while manufacturing output fell 0.8%. Against good news on the economic activity front, Lima unemployment climbed to 7.7% last month from 7.3% in August—though the underemployment rate continues to improve.

Brazil reported a larger than expected decline in output in August of –1.13% (vs –0.70% expected), though coming off a +0.5ppts revision to July’s gain and still managing year-on-year growth of 4.86% (vs 5.30% expected). Lula and Bolsonaro faced off in a televised debate yesterday that focused on personal attacks rather than policy ahead of the October 30 vote. Polls have consistently shown Lula will become president, but ‘shy’ Bolsonaro voters remain somewhat of a risk for the former’s chances.

The regional highlights over the coming days include Colombian economic activity and international trade, and Mexican retail sales data. For more details, see our latest Latam Weekly that also discusses our most recent forecast changes—and our outlook for 2024.

—Juan Manuel Herrera

COLOMBIA: SECTOR-LEVEL ACTIVITY SHOWS MIXED PERFORMANCE, BUT AFFIRMED A MODERATION IN DOMESTIC CONSUMPTION

On Friday, October 14, the Colombian Statistics Agency (DANE) published its monthly surveys of economic activity in August. Manufacturing production and sales showed mixed performance and exceeded year-on-year expansion expectations. Even so, both indicators showed a slowdown amid a more moderate domestic activity but also due to lower contribution from statistical base effects.

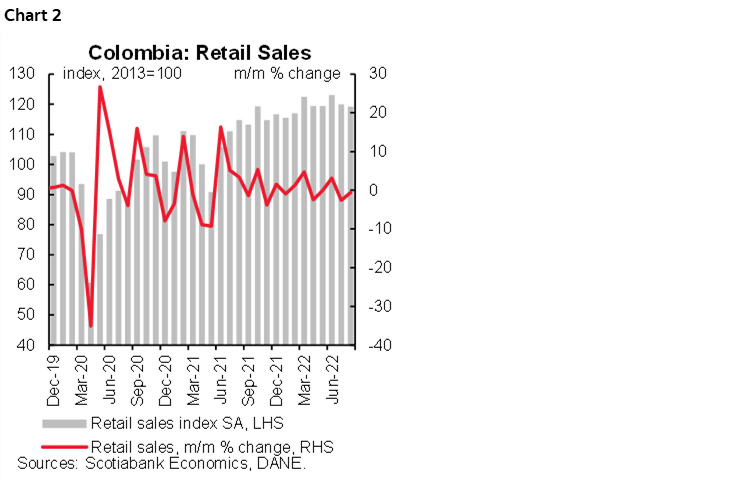

Retail sales showed a new slowdown, although the year-on-year expansion remains significantly high. All sectors associated with mobility continue to contribute to seeing still robust retail sales, especially those related to the school season. However, other items are showing a weaker performance, which is likely associated with lower household disposable income. We would expect weakness to continue in a context of high inflation and higher credit rates acting headwinds for domestic consumption.

Manufacturing production

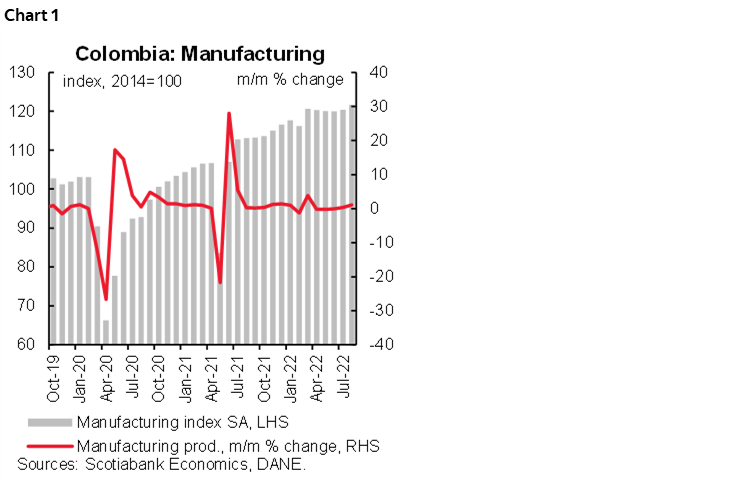

Manufacturing output increased by 9.1% y/y (above the market consensus of 5.0% y/y) and showing an advance of 1.05% m/m sa better than the previous month (chart 1) that still reflects strong manufacturing activity. However, we expect to see a greater trend of moderation in coming months as input cost pressures remain, and business sentiment is weakening amid the possibility of higher taxes in 2023. In the YTD, manufacturing has grown by 14.5% y/y.

In y/y terms, the sectors with the best performance were vehicle manufacturing (+57.1% y/y), clothing (30.7% y/y), vehicle parts and accessories (+32.9% y/y), and printing activities (+32.1% y/y) which represented 2.2ppts of the year-on-year gain (24% of total expansion). The sectors that subtracted from activity were leather tanning (-22.2% year-on-year), coffee threshing (-13.8% y/y), sugar and panela processing (-11.4% y/y), vegetable and animal oil processing (-7.4% y/y) and chemicals manufacturing (-11.1% y/y), this may be explained by pressures in production costs and perhaps more moderate demand.

Employment growth stood at 4.3% y/y. In monthly terms, employment presented a slowdown posting a 0.2% m/m compared to the 0.3% expansion of the previous month. Employment in the manufacturing sector is now 2.8% higher than in the pre-pandemic period.

Retail

Retail sales showed a y/y gain of 8.1% in August, above the Bloomberg survey (+6.9% y/y, chart 2) while employment in the sector increased but at a slower pace, 3.6% y/y. On a seasonally adjusted basis, retail sales (excluding other vehicles) showed a contraction of 0.59% m/m less strong than that observed in the previous month but complying with the moderation trend. In annual terms, the increase in retail sales has a minor base effect but shows signs that consumption levels have moderated, explained by inflationary pressures as higher prices have begun to affect household disposable income.

In annual terms, the expansion of retail sales was explained by sales of books, stationery, and school supplies (+263% y/y), vehicles (+1 8.9% y/y), footwear (18.1% y/y), alcoholic beverages (+18.3% y/y) and clothing (13.6 y and/y) which contributed around 2.6%ppts to total expansion. August is a school season so a higher share of sales related to school supplies was observed, it explains the good performance of the book and stationery industry. For the rest of the year, we continue to expect private consumption to slowdown towards healthier expansion rates.

Services & Hotels

In August 2022, most services-related activities exhibited positive rates of growth, with more robust growth in storage and complementary transport activities (+33.9% y/y). In terms of employment, computer systems activity recorded the greatest variation (+15% y/y), followed by storage and transport activities.

In the hospitality sector, revenues showed a variation of 36.2% year-on-year, lower than that observed in the previous month (46.1 % y/y), and employment growth stood at 28.5% from 29.5% in the previous month. Hotel occupancy was 58.5%. Business trips continued to show a positive path but lower than the previous month, representing 21.7% of total occupancy, and leisure trips represented 31.5% explaining for a month that is not considered holiday season.

In short, although activity indicators showed a positive surprise in August, they nevertheless showed some monthly moderation. There are still mixed signals since confidence surveys show that companies are more negative about the future of the economic situation amid the impacts of inflation and the supply of inputs (globally), further to expectations of greater tax burdens.

Our baseline scenario remains that the economy will continue to show robust but moderate growth for the remainder the year. We updated our forecast and now we expect GDP growth of 7.6% in 2022. This includes a gradual slowdown in the second half of 2022, due in particular to softer private consumption as a result of tighter monetary policy. That said, and taking into account the recent stance of heightened concern about economic growth shown by the BanRep Board, we expect it to raise the policy rate by 50bps at the October 28 meeting to reach a rate of 10.5% and remain at that level for about a year, as inflation begins to show a more strong reduction.

—Sergio Olarte, María (Tatiana) Mejía & Jackeline Piraján

PERU: STRONG FISCAL ACCOUNTS WHILE TRADE SURPLUS NARROWS

I. Fiscal accounts come in unexpectedly strong in September

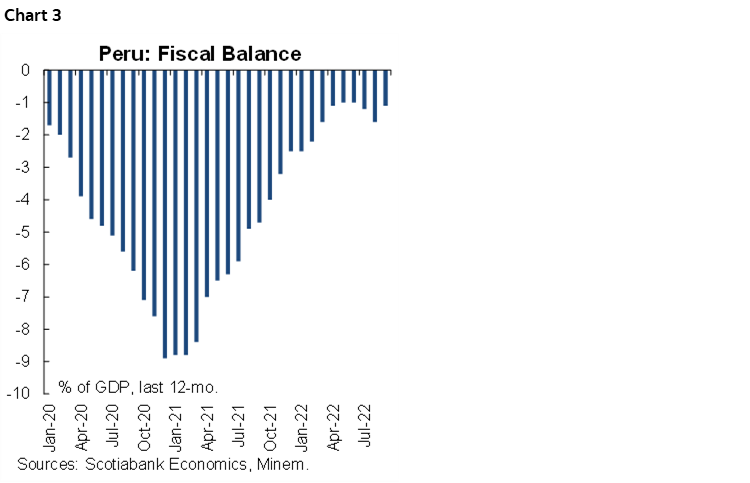

The BCRP released the fiscal deficit figure for September. The results were intriguingly robust. The 12-month cumulative fiscal deficit declined in September to 1.1% of GDP, from 1.6% in August (chart 3). The numbers included a one-off factor where, in September 2021, the government had disbursed a large transfer to households, representing just under two percentage points of GDP. Excluding this, the fiscal deficit would have still declined, although perhaps closer to around 1.3% of GDP.

Tax revenue rose a solid 13.7% y/y in September, although the figure conceals a slowdown in growth when compared to 18.5% growth in the year-to-August.

September’s results give the government plenty of fiscal oxygen for the next few months, if it is capable of using it (a very big if). Moreover, it enhances the argument that, even as political turmoil continues to take centre stage, behind the scenes fiscal management remains prudent.

II. The decline in the trade surplus accelerated in August

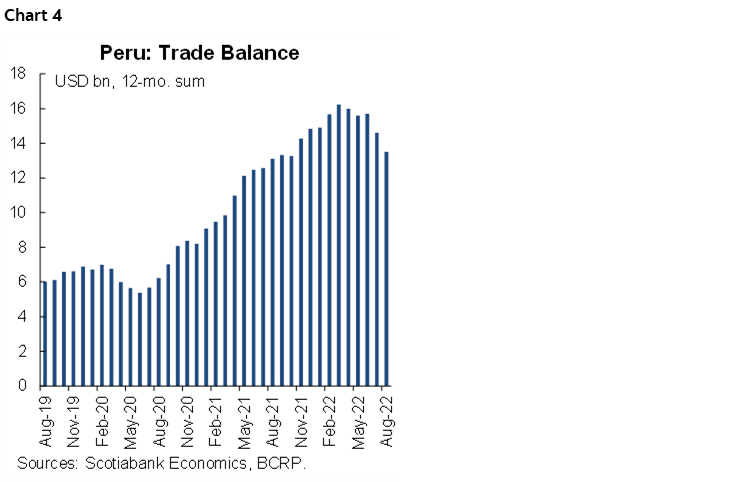

Lower metal prices are having a greater than previously expected impact on Peru’s trade surplus. The BCRP reported a paltry trade surplus of USD325m for the month of August. This brought the 12-month aggregate figure to USD13.5bn (chart 4), off its all-time peak of USD16bn in March, and the lowest figure this year.

Metal prices were mostly to blame, as mining exports fell nearly 20% y/y in August (nil growth in the YTD). This was not quite compensated by increasing exports from non-mining industries (agro-industry, in particular, rose 24% y/y in August), such that total exports growth was 0.2% y/y in August (+12.6% YTD). At the same time, imports rose nearly 26% y/y in August (20% YTD).

The upshot is that metal prices and terms of trade continue wreaking havoc on our trade forecasts. We now view it as likely that the trade surplus for 2022 will come in below our forecast of a USD11bn. Having said that, 2022 on the whole will still likely show the country’s second highest trade surplus in history, after the USD14.8bn registered in 2021.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.