- Colombia: Inflation expectations increased again and the terminal rate is expected at 11.50%

- Peru: Slowing GDP growth; unemployment climbs

Risk-positive trading continued overnight on limited news as North American equity futures pull higher while European bourses caught up to US gains on Monday. The Financial Times reported that the BoE was set to delay its outright sales of UK government debt starting on October 31—which a bank’s spokesman later described as inaccurate. UK gilts are underperforming among the major economies while US yields are marginally lower on the day. Aside from continued observance of political events in the UK, global markets may focus on US industrial production data for September at 9.15ET.

Colombia’s Finance Ministry announced yesterday that it will issue no more peso bonds this year thanks to solid tax revenues and the issuance to-date allowing it to cover national expenses through year-end. The COP33.75tn in issuance this year fell significantly short of the government’s expectations of full-year COP37.5tn. Colombian markets reopen today after yesterday’s public holiday, ahead of economic activity data out today at 12ET. Our Bogota team anticipates a 6.9% y/y economic activity expansion compared to the median Bloomberg forecast at 7.4%—which is skewed by the stronger-than-expected sector-level data published last week (see Latam Daily).

Chile’s central bank President Costa said yesterday that the country’s economy will record annual contractions from late-Q3. This is line with our Santiago team’s forecasts that see a sharp deceleration in Chilean economic activity that buttresses their expectation that the BCCh will rapidly cut rates starting in January 2023. Their latest projection sees a five-quarter y/y GDP contraction starting with a 0.3% y/y contraction in Q3-22 (see our latest Latam Weekly). The BCCh chief reiterated that the bank’s key rate has reached its maximum level and that the rate will stay there as necessary to ensure inflation converges to target. The CLP opened today at its weakest level since early-October before swinging back into gains in (usual) volatile trading.

—Juan Manuel Herrera

COLOMBIA: INFLATION EXPECTATIONS INCREASED AGAIN AND THE TERMINAL RATE IS EXPECTED AT 11.50%

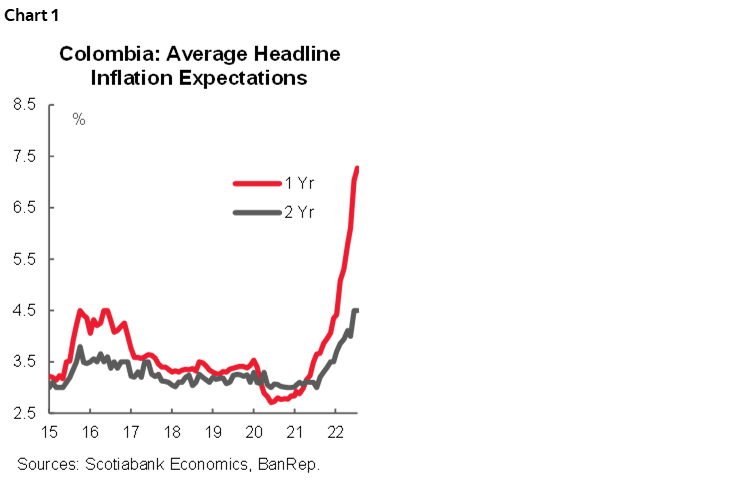

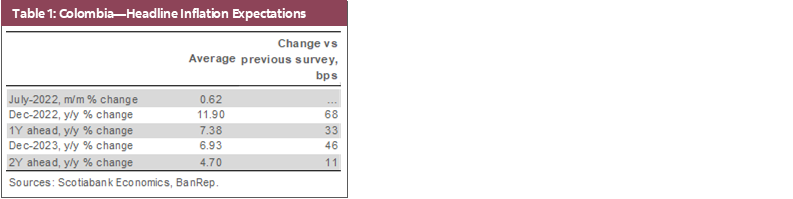

Late on Friday, October 14, the central bank, BanRep, released its monthly survey of economic expectations. Inflation expectations (IE) for the end of 2022 increased by 68bps, as a result of the strong upside surprise in September’s inflation. By end- 2023, the survey showed inflation expectations well above the central bank target, at 6.93% (chart 1 and table 1). October inflation is expected at 0.62% m/m, vs Scotiabank Economics at 0.76% m/m. We forecast a year-end inflation rate of 12.45% y/y and of 6.11% y/y at end-2023.

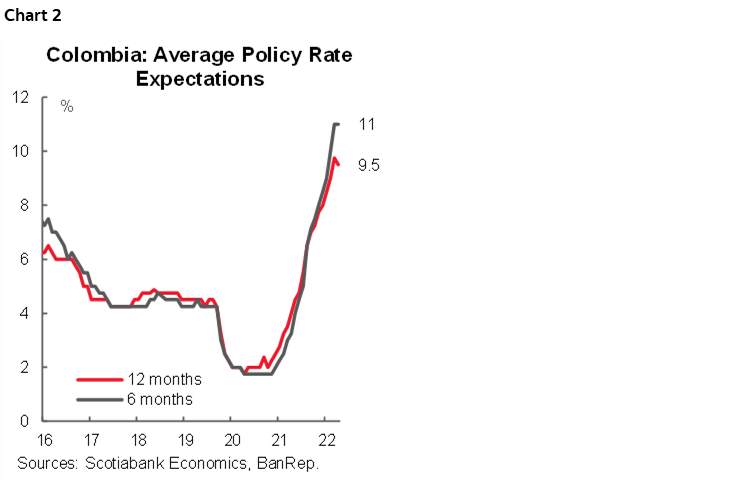

In light of inflation and inflation expectations data, the market consensus expects the hiking cycle to continue with a 100bps hike in October and a final move of 50bps in December, to reach 11.5% as the terminal rate (+50 bps vs the previous survey). At Scotiabank Economics Colombia, a 50bps hike is expected at the October meeting, as the board now has a negative view of economic activity which would prevent them from being aggressive.

- Short-term inflation expectations. In October, the consensus sees a 0.62% m/m increase in prices which would place annual inflation at 12.05% year-on-year (from 11.44% in September). That said, the dispersion of the survey remains high with the lowest estimate at 0.31% m/m against a maximum of +0.85% m/m. Scotiabank Economics expects monthly inflation for October to be +0.76% m/m and 10.31% y/y. In October we will have upside effects from food and gasoline prices but we also expect tradeable goods to continue contributing to upside pressure.

- Medium-term inflation. Inflation expectations rose to 11.90% y/y for December 2022, 68 basis points above last month's survey (table 1), showing the effect of the upside surprise in September’s data, but also incorporating the expected effects from higher gasoline prices. IE for 1-year ahead stood at 7.38% y/y (above last month's reading of 7.05% y/y); while the 2-year forward increased 11bps to 4.70% y/y, still away from the central bank target.

- Policy rate. The expectations median sees a 100bps rate hike on October 28 to leave the rate at 11% (from the current 10%, chart 2); Scotiabank Economics, instead, expects a 50bps hike, which would be the last one in the hiking cycle. The market consensus expects the rate at 11.50% by the end of 2022 with the first cut in March 2023 to close the year at 8.50%. At Scotiabank Economics we expect a terminal rate of 10.50%, stable rates for around one year, and cuts in the final quarter of 2023 to close the year at 9%.

- FX. The USDCOP projections for the end end-2022 averaged 4,484 pesos per USD on average (above the previous survey of 4,291 pesos). By December 2023, respondents think, on average, that the peso will end the year at 4,323, and in 2024 at 4,227. We believe that the USDCOP will close 2022 at around 4,561 pesos.

—Sergio Olarte, María (Tatiana) Mejía & Jackeline Piraján

PERU: SLOWING GDP GROWTH; UNEMPLOYMENT CLIMBS

I. GDP growth is slowing rapidly, but not surprisingly

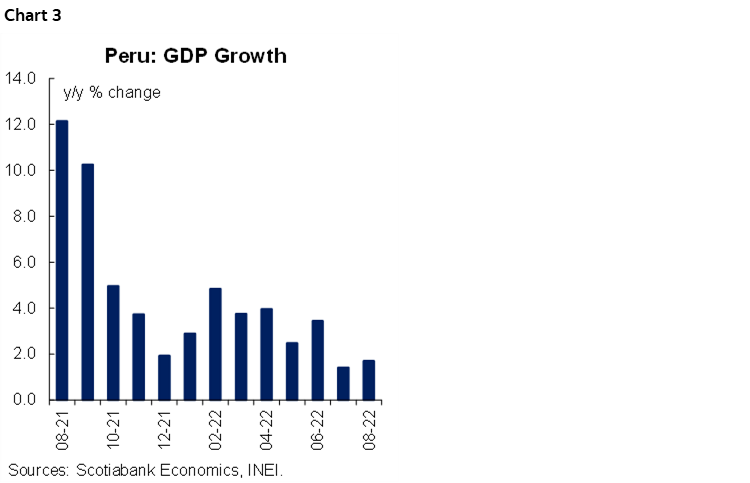

GDP growth was a mediocre 1.7% y/y in August. This was the second consecutive month in which growth came in significantly below 2%, after 1.4% y/y growth in July (chart 3). In m/m terms, growth was 0.26%, a figure that is not exciting, but is at least positive after declining in the two previous months.

What these recent growth figures are saying is that reality has finally caught up with Peru. We were expecting GDP growth to slow around this time and by around this much, and we believe that this low growth scenario is the country’s new reality. Growth in future months may crawl back above the 2% mark as the Quellaveco copper operations, which came online in July, begin to produce at heightened levels. Basically, going forward, what we can expect is that domestic demand growth continues to come in below 2%, but that an additional nearly half percentage point will be added to this thanks to Quellaveco.

The reason that domestic demand is faltering is that inflows to households through transfers and access to pension fund and worker compensation fund savings, that propped up consumption in the past, is drying up. Going forward, this would need to be replaced by private investment, but there is little hope that this will happen as long as investor confidence remains depressed.

Mining GDP was particularly disappointing in August, down 5.0% y/y. But mining output has been volatile lately, and should come back in future months. More worrisome, perhaps, was the paltry 0.3% y/y growth in industrial manufacturing, which is pointing to stagnant demand.

Sectors such as hospitality (hotels and restaurants), 10.8% y/y, and transportation, 8.5% y/y continue to rebound from COVID-19 lockdown levels, albeit at an increasingly slower pace. These sectors will also add to growth less and less going forward.

The one pleasant surprise was the 5.6% growth in construction GDP. This is mostly linked to government investment, especially by regional and local governments in view of the elections held early in October.

The future is here, and we expect GDP growth to hover in the vicinity of 2% going forward. The low growth figures in August and July (1.4% y/y) were actually in line with our expectations and do not impact our forecast of 2.8% growth for the whole of 2022.

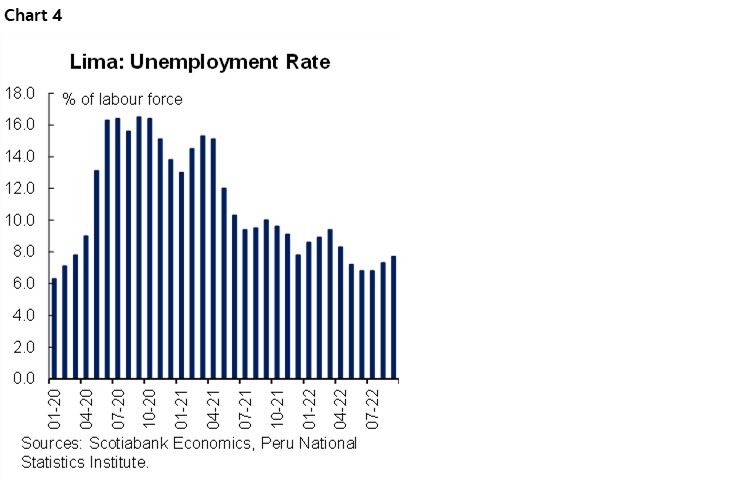

II. Unemployment affected by a slowing economy

Peru’s employment data is no longer surprising to the upside, as it had been doing for some time. In the three months to September (Peru National Statistics Institute releases employment figures on a three-month rolling basis), unemployment in Lima soared to 7.7% (chart 4). This was the highest level in five months, up from 7.3% in August, and 6.8% in July. The number of people with jobs was at its lowest level since March.

In a word, unemployment is no longer trending down, and is now showing volatility inside a 7.0% to 8.0% range. Outside of seasonal factors—unemployment typically declines in December—the great risk that we see is that unemployment may continue to drift upwards.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.