- Colombia: Economic activity shows signs of moderation

- Peru: A soft July GDP print with unexpected culprits

COLOMBIA: ECONOMIC ACTIVITY SHOWS SIGNS OF MODERATION

On Thursday, September 15, the Colombian Statistical Agency (DANE) released its monthly surveys of economic activity for July. Manufacturing production and sales showed a smaller expansion than expected and a slowdown in economic activity is becoming apparent, further to moderating base effects that had supported year-on-year figures.

Retail sales also showed some deceleration, although y/y growth remains significant in all sectors thanks to increased mobility while seasonality due to school supplies also positively contributed. Having said that, the sector’s performance is showing some signs of slowing, probably owing to higher inflation. Therefore, we would expect activity to continue to moderate gradually as inflationary pressures (which imply higher policy rates) continue.

In contrast, DANE reported that business confidence improved in August. The share of firms expecting increased revenues over the next three months rose from a twelve-month low in July. On a sectoral basis, construction-related companies remain the most pessimistic though sentiment marginally improved in August.

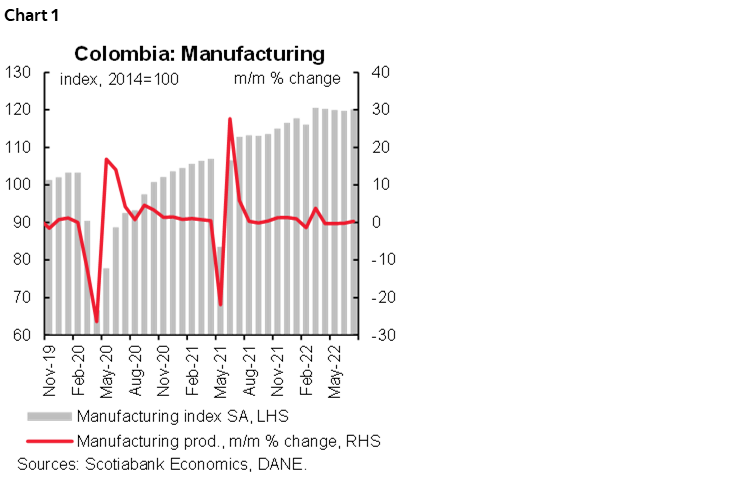

Manufacturing production

Manufacturing production increased by 5.2% y/y (below the market consensus of 7.8% y/y) and showed an advance of 0.3% m/m sa, an improvement from June’s pace (chart 1). Manufacturing remains on a softening path, however, due perhaps to supply shortages in some subsectors and high input costs, on top of a high base level for the year-on-year comparison. Year-to-date, production has risen by 15.8% y/y.

In y/y terms, the sectors that performed best were beverages (+7.6% y/y), clothing (21.8% y/y), chemical manufacturing (+16.9 y/y), and printing activities (+32.5% y/y) which contributed 2.6 ppts to the headline growth rate (50 % of the total). The sectors that dragged on overall activity were oil production (-6.5% y/y), paper and cardboard manufacturing (-2.8% y/y) and sugar and panela processing (-17.5% y/y)—where high international costs for raw materials sharply limited the sector. The sectors that are characterized by normalized mobility continue to lead the y/y expansion.

Manufacturing employment rose 5.4% y/y and 0.3% m/m, bringing manufacturing sector employment to 2.6% above pre-pandemic levels as the labour market recovery extends.

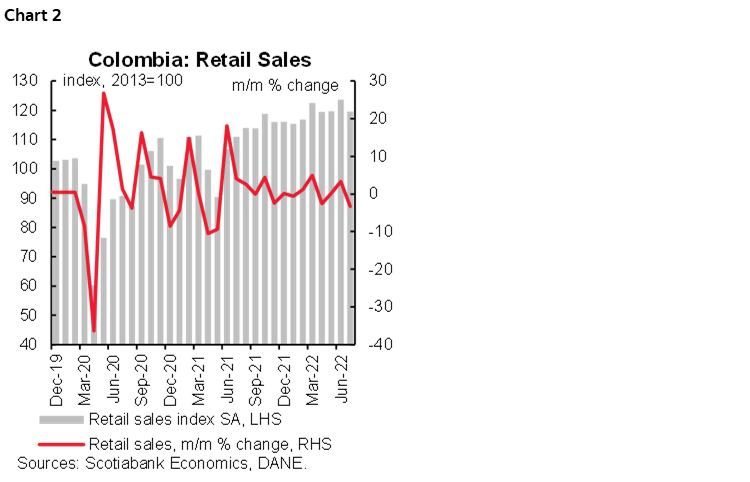

Retail

Retail sales climbed 7.7% y/y in July, below the Bloomberg median (+12% y/y), (chart 2), while employment increased though at a slower pace, 4.0% y/y. On a seasonally adjusted basis, retail sales (excluding other vehicles) showed a contraction of 3.3% m/m. In annual terms, the increase in retail sales is impacted by a smaller base effect but is showing signs that consumption levels have moderated, explained by inflation pressures.

In annual terms, the expansion in retail sales was driven by sales of alcoholic beverages and tobacco products (+25.2% y/y), books, stationery and school supplies (+26.8% y/y), computer equipment (+19.2% y/y) and clothing (+17.8% y/y) which contributed around 2.8 ppts to the total expansion. These results reflect moderations in sales momentum due to higher prices that have started to impact disposable incomes. Note that July is a holiday season and school season, which explains the good performance of the books and stationery industry.

For the second half of the year, we continue to expect private consumption to slow towards ‘healthier’ rates of expansion, weighed by continued increases in inflation and by more expensive consumer credit.

Services & Hotels

In July 2022, most services-related activities showed positive growth, with the most robust expansion evident in administrative and office support activities (+35.5% y/y). In terms of employment, publishing activity was the only one that registered a decline (-1.7% y/y), while employment growth was especially concentrated in the activities of restaurants and bars.

In the hospitality sector, revenues in July 2022 showed an increase of 46.1% y/y, and employment climbed by 29.5% y/y compared to 33% in the previous month. Hotel occupancy was up 59.2% y/y, accelerating from June’s 54.4%. Business travel continues on a positive trend, accounting for 33.8% of total occupancy, while leisure travel accounted for 56.6% amid the holidays.

In short, although the activity indicators showed a positive surprise in July they did so at a slower pace. However, there are mixed signals since confidence surveys show that companies are more positive about the future of the economic situation despite the impacts of inflation and global drivers of inputs supplies.

Our baseline scenario is that the economy will remain strong, with GDP expected to grow 6.6% in 2022. However, in the second half of 2022, we continue to expect more moderate private consumption as a result of tighter monetary policy.

Despite slowing growth, we now expect BanRep to raise its policy rate by 150 bps at the September 29 meeting to 10.50% and we may see an additional rate increase if inflation continues to rise. The government’s announcement to increase gasoline prices would likely result in a terminal BanRep rate of 11.5%.

—Sergio Olarte, Maria (Tatiana) Mejía & Jackeline Piraján

PERU: A SOFT JULY GDP PRINT WITH UNEXPECTED CULPRITS

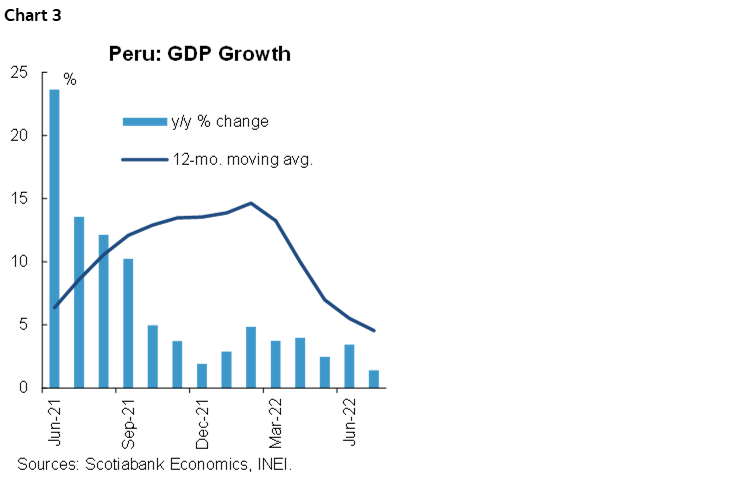

Peruvian GDP rose by 1.4% y/y in July (chart 3). This was an uncomfortably low number, coming in below our forecast of 2.0% y/y. More importantly, in month-on-month terms, GDP in July was 0.8% lower than in June. It was also the lowest year-on-year print since the early-2021 COVID-19 lockdown and was far below the monthly average of 3.5%, y/y over the first half of 2022.

Several notable factors were behind this disappointing number. The first was a 6.2% y/y decline in metals mining, which represented the weakest performance across the major industries. This is probably the least worrisome of the disappointments, however, since the decline largely reflected a high base twelve months ago. Official figures were artificially inflated in July 2021 as trial mining activity at the new Mina Justa mine between May and July was recorded on the aggregate into a single-month, July. Mining GDP growth should normalize in August.

The second reason was the soft 2.9% y/y growth in taxation, which in previous months had been rising at close to a 5% pace. The slowdown was expected, but the magnitude was somewhat greater than expected.

Thirdly, agriculture fell 1.5% y/y (and 0.6% m/m), which could simply represent variations in the harvest season from one year to the other, but it could also reflect the impact of fertilizer shortages in Peru.

Finally, the most worrisome factor of all: non-resource manufacturing fell 2.3%. This is particularly concerning as the decline was led by a 7.9% y/y plunge in consumer goods output. This is highly unexpected, as household consumption has been holding up rather well according to other data.

On the positive side, construction GDP grew 2.1% y/y almost solely due to public investment, which rose over 30% y/y during the month. Post-COVID-19 rebound sectors also continued contributing to growth, with transportation up 8.9% y/y and restaurants & hotels soaring 19.6% y/y.

Overall, we think GDP growth should improve in future months. We don’t expect a steep acceleration, but a decent enough pace to stay within range of our forecast of 2.8% annual growth for 2022. The full impact of pension fund withdrawals will likely be reflected in data starting in August and public investment remains fairly strong, acting as a tailwind for growth in the months ahead.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.