- Chile: BCCh signals terminal MPR of 11%; we anticipate an aggressive process of cuts next year

- Peru: Loans growth above 6% y/y continues in July

CHILE: BCCH SIGNALS TERMINAL MPR OF 11%; WE ANTICIPATE AN AGGRESSIVE PROCESS OF CUTS NEXT YEAR

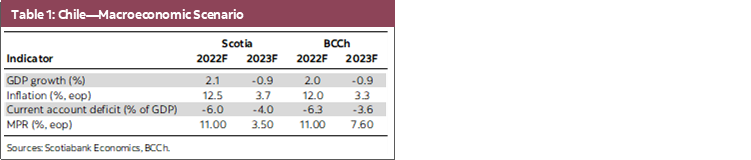

On Wednesday, September 7, the central bank (BCCh) published the Monetary Policy Report for September, in which it updated its macroeconomic scenario and the corresponding path for the Monetary Policy Rate (MPR). In general, the new BCCh scenario was close to the one Scotia had a few months ago, in terms of GDP growth, inflation and current account deficit.

The BCCh revised its GDP growth forecast upwards for 2022 and downwards for 2023, close to our baseline scenario (table 1). The BCCh projects GDP growth of 2.04% for 2022 (Scotia: 2.06%), where domestic demand would increase 1.2% owing to growth in total consumption (2.2%) against a contraction in total investment (-3.3%). For 2023, the BCCh projects a GDP contraction of 0.93% (Scotia: -0.91%) due to a drop in domestic demand (-4.7%).

As for inflation, the BCCh revised its forecast higher, in line with our base scenario. According to the BCCh, annual inflation will ease to 12% y/y in December 2022 (Scotia: 12.5% y/y) and to 3.3% y/y in December 2023 (Scotia: 3.7% y/y). In our view, annual inflation will peak during the third quarter of this year (around 14%) and will begin to slow down in the coming months thanks to lower external pressures for energy and food, as well as a deterioration of domestic demand that would lead to lower core inflationary pressures.

We maintain that a smooth but persistent convergence of the current account deficit towards sustainable levels is practically guaranteed. The BCCh shares our diagnosis that the current account deficit (8.5% of GDP in Q2-22) would converge to around 6% of GDP in December this year (BCCh: 6.3%) (see our Latam Insights: Chile—Let’s Talk about the Current Account Deficit), which would be led by a contraction of domestic demand and compliance with the fiscal rule. In this sense, we reaffirm that an additional real depreciation of the Chilean peso (CLP) is not necessary for a convergence towards sustainable levels.

Interestingly, in its base scenario, the central bank never reaches the neutral MPR in its forecast horizon, despite projecting inflation at 3% and the economy growing around its long-term pace. We think it will be difficult for the BCCh to avoid acting aggressively by cutting the MPR if a disinflationary scenario materializes like the one proposed in its projections, where the economy would find itself with a negative output gap as of Q4-22. Perhaps the reason for not delivering a terminal MPR around neutral (3.5%) towards the end of the horizon lies in the intention to keep inflation expectations anchored. However, we insist that if a scenario of economic contraction and low inflation materializes, the BCCh will be forced to quickly bring the MPR closer to neutral levels.

—Anibal Alarcón

PERU: LOANS GROWTH ABOVE 6% Y/Y CONTINUES IN JULY

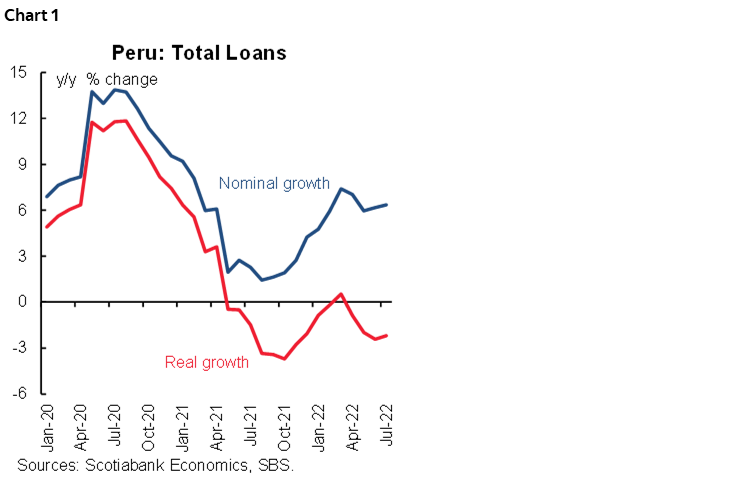

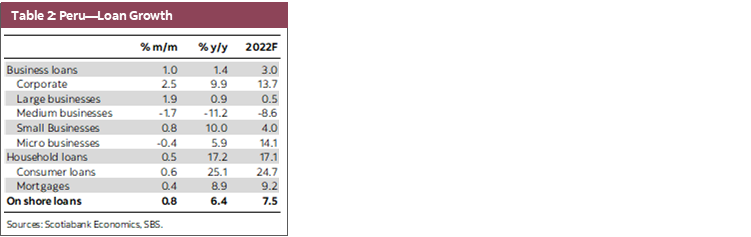

In July, bank loans accelerated slightly, rising 0.8% m/m. In y/y terms, this represented an increase of 6.4%, versus the 6.2% y/y recorded in June (chart 1). Growth in business loans at 1.4% y/y remains at odds with household loans growth at 17.2%. However, both are broadly in line with our forecast for October 2022 (Canadian Fiscal Year): business loans at 3.0% and household loans at 17.1%.

The net monthly flow in business loans continued its improvement since May, led by corporate loans (9.9% y/y, table 2). Lending to large businesses rose only 0.9% in y/y terms, but posted the highest monthly net increase since the beginning of the pandemic, while net flows to small businesses have been positive for six consecutive months. Meanwhile, subdued growth in loans to medium-sized businesses continued, stringing 14 months of negative monthly flows. Micro business loans fell again. Both of these declines reflected amortizations and pre-payments of the state-guaranteed Reactiva loan program that was put in place to provide liquidity during the COVID-19 lockdowns.

Household loans growth was much more encouraging, up 17.2% y/y in July, and has continued to be more robust than we have been expecting. Leading in household loans growth were consumer loans (25.1% y/y) and mortgage loans (8.9% y/y). However, household loans registered their lowest monthly increase in 11 months, for two separate reasons. The first is a seasonality effect due to a legal worker bonus that is equivalent to an extra monthly wage that is paid out in July and December. The second is new withdrawals available from private pension funds and worker compensation accounts (CTS).

Pension fund withdrawals will continue in August and September and will likely impact household loans growth until December.

—Ricardo Avila

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.