REVENUE WINDFALL ABSORBED BY NEW SPENDING AS ELECTION LOOMS

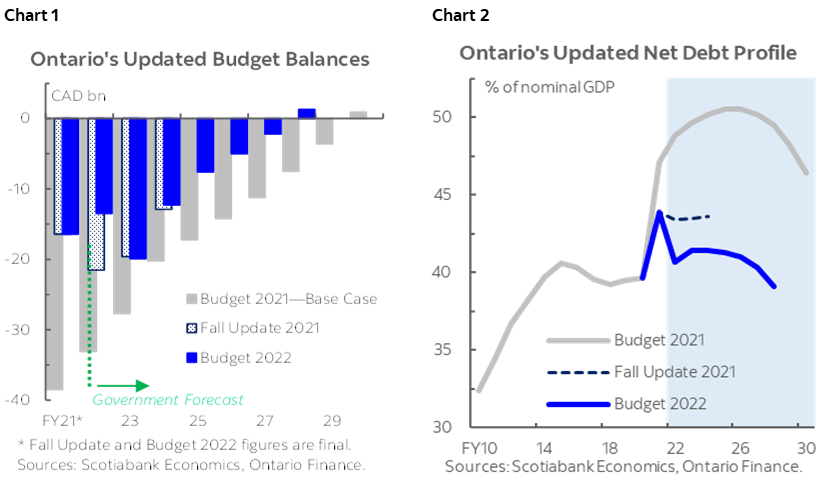

- Budget balances: -$13.5 bn (-1.4% of nominal GDP) in FY22, -$19.9 bn (-1.9%) in FY23, -$12.3 bn (-1.1%) in FY24, in line with the November 2021 update; however, surplus is forecast in FY28—two years earlier than anticipated in Budget 2021 (chart 1).

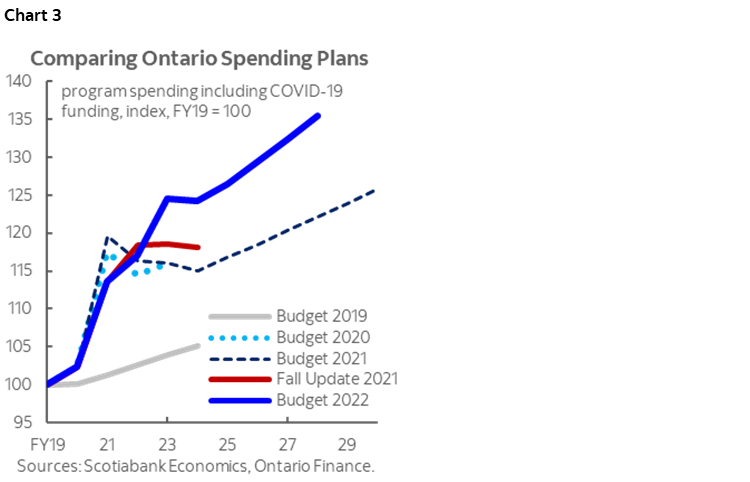

- Net debt: expected to decline gradually from 41.4% of nominal output in FY22 to 39.1% by FY28—lower than projected in November 2021 (chart 2).

- Borrowing program: total long-term public borrowing of $41.1 bn in FY22, $41.5 bn in FY23, $44.6 bn in FY24—respective reductions of $0.9 bn, $3.8 bn and $1.3 bn versus the November 2021 projection—and $38.9 bn in FY25.

- Another improvement in the debt trajectory should be reasonably well-received by rating agencies and Ontario’s creditors, and the plan leaves room for upside in the near-term.

- As expected, key policy measures target cost of living concerns and support for the health care system.

- Nevertheless, this Budget won’t see the light of day as Parliament will be dissolved before June 2nd elections and so this is a space to watch.

Ontario’s fiscal trajectory has improved versus prior projections. Though FY23–24 deficit forecasts are largely unchanged, the province now expects a surplus in FY28 instead of deficits until FY30 under the base case projections in last year’s budget. Net debt as a share of GDP is expected to trend lower through FY28, and sit more than 2 ppts below the ratio anticipated in November last year. Total debt servicing costs of about 7.5% of total revenues throughout the forecast horizon remain manageable and modest relative to much of the province’s history, even with steep and significant interest rate increases expected over the next two years.

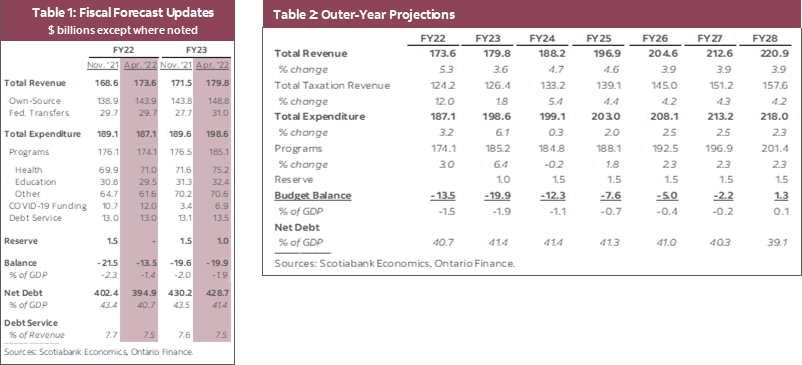

Expenditure projections were lifted for FY23-24, offsetting most revenue gains and keeping deficits in line with the mid-year fiscal update. Budget 2022 expects FY23 total revenues to be $8.3 bn higher than anticipated in the mid-year fiscal update, while program spending projections were also boosted by $8.8 bn—5% higher than in the mid-year update and 9% higher than in Budget 2021 (chart 3). The latter increase is mostly sourced to additional healthcare spending, which got a 5% boost, and additional COVID-19 funding. With revenue growth revised up for FY24-25 and kept unchanged at an annual rate of 3.9% in outer years, the province expects program spending growth to be slightly higher than anticipated in previous projections, but remain well below the speed of revenue growth.

Prudent assumptions and planning leave some room for upside. Ontario’s nominal output growth forecast is 6.7% this year—below the private-sector average of 7.3%. Budget 2022 links every 1 ppt in nominal GDP growth with $850 mn in tax revenues—based on that figure, the 0.6 ppts difference could be expected to reduce the FY23 shortfall by $0.5 bn. Another $6.9 bn in special COVID-19 funding—double the amount in the November 2021 update—and a $1 bn forecast allowance in FY23 offer more potential upside. Under the province’s more optimistic forecast scenario—assuming a very optimistic nominal growth rate of 9.8% this year—surplus could be attained as soon as FY25. With the global economic outlook uncertain at this moment given the ongoing war in Ukraine and risks related to Chinese economic growth, this prudence is necessary.

Signature policy measures fell into five categories: rebuilding the economy, worker support, infrastructure, cost of living help, and health care. The first category included further pledges to develop the Ring of Fire mineral deposit and previously announced plans to grow the critical minerals and hydrogen sectors. Worker supports included funds for immigrant attraction and skilled trades programs and a general minimum wage hike to $15.50/hour on Oct. 1. Infrastructure included highway, subway, and GO Transit expansion plans. Cost of living policy moves included already detailed temporary cuts to gas and fuel taxes, expansion of the LIFT tax credit for lower-income Ontarians, and the recent sign-on to the proposed Federal Childcare plan. Health care measures targeted staff retention, home care, and hospital capacity expansion.

In line with infrastructure ambitions, Ontario’s Capital Plan is expected to exceed $20 bn per year throughout FY23–25. For FY23–24, expenditure forecasts were raised by a cumulative $6.1 bn relative to November 2021 projections.

Long-term public borrowing is forecast to total $41.1 bn in FY22, $41.5 bn in FY23, and $44.6 bn in FY24—respective reductions of $0.9 bn, $3.8 bn and $1.3 bn versus the November 2021 projection—and $38.9 bn in FY25. Downward revisions mirror narrower-than-forecast deficits. This fiscal year’s $41.5 bn is helped by $10.3 bn in pre-borrowing conducted in FY22. In FY22, 78% of borrowing was completed in Canadian dollars—via 36 syndicated issues and two Green Bonds—near the top of the 65–80% target range. In the lower-growth scenario, the government projected long-term borrowing to rise towards $46.3 bn in FY25. In the optimistic scenario, long-term borrowing eases to just $28.8 bn by FY25. The government stated its current plan is “to maintain the term of Ontario’s debt at the level it has been at since 2014–15.”

In the short- to medium-term, we expect Ontario’s sovereign bond market movements to be anchored by global developments exogenous to jurisdictional policy decisions. We suspect that central bank action and developments related to the Russia-Ukraine conflict will continue to dominate investor risk preferences over the next couple of years. However, over the longer-run, improvements in Ontario’s fiscal trajectory should contribute to lower market supply and tighter spreads against Government of Canada benchmarks.

In all, Ontario’s budget aligns broadly with our expectations. Better-than-anticipated nominal economic growth continues to propel stronger-than-expected revenues; as indicated in the leadup to the plan, the government has targeted pocketbook relief with inflationary pressures on the rise and an election expected in June. Though fuel tax cuts are broad-based and could stimulate demand and exacerbate upward price movement, they are time-limited and relatively modest from a macroeconomic perspective, while the low-income tax credit expansions appear appropriately targeted. For the coming months, risks to the economic outlook are real, but prudent planning assumptions and credible fiscal anchors should be reasonably well-received by the province’s creditors.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.