A PATH TO BALANCE AMID NEAR-TERM ECONOMIC ADVERSITY

- Budget balances: -$2.2 bn (-0.2% of nominal GDP) in FY23, -$1.3 bn (-0.1%) in FY24—respective improvements of $10.7 bn and $6.8 bn since the November 2022 update; a surplus is forecast in FY25 before widening to $4.4 bn (0.4%) in FY26—three years earlier than previously anticipated (chart 1).

- Net debt: expected to stabilize at 37.8% of nominal output through FY23–25 before declining to 36.9% in FY26—60–90 bps lower in each year than projected in the Fall Economic Statement and sitting comfortably below the revised debt-to-GDP target of 40% (chart 2).

- GDP growth forecast: real growth assumptions nudged down to +0.2% this year and +1.3% next year—30 bps below projections in the Fall Economic Statement; nominal growth assumptions also lowered to +2.8% in 2023 and +3.6% in 2024.

- Borrowing program: total long-term public borrowing of $32.1 bn in FY23, $27.5 bn in FY24, $28.7 bn in FY25—combined reduction of $14.6 bn over three years versus the November 2022 projection—and $33.4 bn in FY26.

- The budget outlines a path to balance with stabilizing debt burden and solid spending growth in key sectors. Given the high level of economic uncertainty, prudent planning and spending restraint presented in this budget should position Ontario well for further slowdowns.

OUR TAKE

Building on improvements seen in previous updates, Ontario continues to project improvements in its bottom line and is now on track to achieve a balanced budget three years earlier than previously anticipated despite a downward revision in its near-term growth trajectory. Benefiting from an upward adjustment in tax receipts from prior years, FY24 own-source revenue is now 5.4% higher than in the Fall Economic Statement, narrowing its projected deficit to -$1.3 bn (-0.1% of GDP), including $1 bn in reserve and $4 bn in contingency funds. The medium-term outlook is optimistic—it shows a projected increase in total revenue by 4.1% annually over the three-year planning horizon, whereas total expense is expected to grow by 2.4% per year over the same period, leading to a rapid reduction in the budget deficit and a balanced budget by FY25.

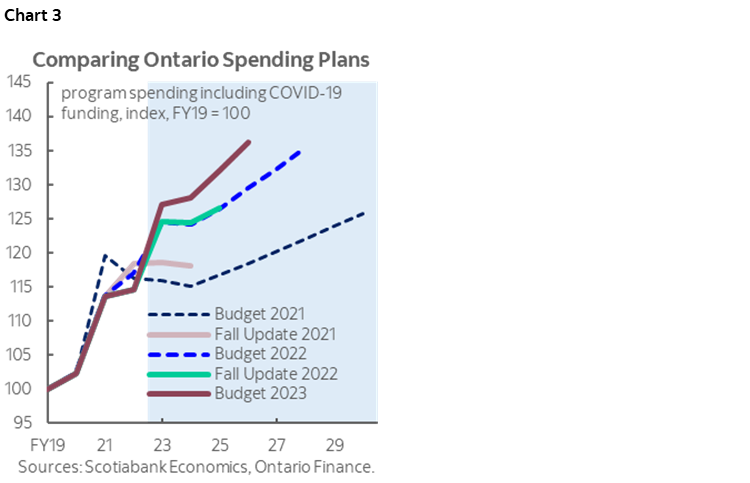

Supported by this newfound headroom, the spending profile has been lifted relative to previous plans, boosting spending in key sectors such as healthcare and education (chart 3). FY24 total revenue is anticipated to be $11.5 bn higher than what was projected in the mid-year update, and expenditure projections were raised by $5.6 bn, with most of the increase going towards healthcare and education—both expect growth of over 7% relative to the year prior. With subsiding spending pressure from COVID-19 control, the government plans for increased spending in base programs, which is set to jump by 8.9% in FY24 (net of temporary COVID funding), then grow by 3% per year in FY25 and FY26—the rate seems reasonable considering population growth and inflation. Incremental health care investments total $15.3 bn over three years—far exceeding the additional federal government funding of $4.4 bn. Reduced borrowing helps lower debt-servicing cost—still the fourth largest expense item—and is set to grow by 5% per year over the next three years.

New policy measures announced in this budget appear moderate in scale and targeted, focusing on supporting businesses and increasing Ontario’s competitive advantage. The signature policy is the new Ontario Made Manufacturing Investment Tax Credit, which offers a 10% of refundable corporate tax credit for qualifying investments, costing an estimated $260 mn per year over FY24 to FY26. The budget also proposes additional tax relief for small businesses by extending the phase-out range for the CIT rate at a cost of $80 mn per year through FY26. The province continues to advance its Critical Mineral Strategy with investments in infrastructure and initiatives to attract major business investments in clean steel and EV batteries. Cost-of-living support measures remain incremental and targeted, notably by expanding the eligibility to the Guaranteed Annual Income System (GAINS) program, and extending the gas tax cut until the end of 2023. There are a series of new measures ($324 mn) supporting newcomers and skill development, which should help address the province’s labour shortages—identified as a major drag to the province’s medium- to long-term growth.

The government’s plan incorporates appropriate levels of prudence in three fold—conservative growth assumptions, contingency funds and a reserve. Real growth is expected to stall in 2023 at 0.2% and then accelerate to 1.3% in 2024—the outlook appears conservative compared to Scotiabank’s latest forecasts (0.6% and 1.7%) and is slightly below private-sector averages. The budget maintains $1 bn in reserve for FY24 which goes up to $4 bn in FY26—and combined with the $4 bn in Contingency Funds in FY24 under other programs spending—offers more buffer against unexpected loss of revenue and/or additional spending needs and ensures that the province’s fiscal path remains on track.

Ontario remains ambitious with infrastructure investments, as reflected in the record-high capital plan outlined in the budget, which underscores the government’s efforts to strengthen public transportation, healthcare and education. Total outlays scheduled under the Ontario Capital Plan were increased by $25 bn over 10 years (chart 4), allotting $20.6bn in FY24 and $25.8 bn in FY25. A significant proportion of the plan will go towards expanding public transit and highways, and improving hospital infrastructure and long-term care facilities.

In line with the reduced deficit forecasts, the province anticipates a much smaller borrowing program from FY23 to FY25—a combined reduction of $14.6 bn versus the November 2022 projection. Long-term public borrowing is forecast to total $27.5 bn in FY24, down from the $32.1 bn completed in FY23—the lowest borrowing program since 2016–17. 88% of borrowing was completed in Canadian dollars In FY23—via 30 syndicated issues and two Green Bonds—and domestic borrowing will be targeted at 75–90% in FY24.

An improved bottom line and reduced borrowing leave net debt tracking downward as a share of the economy, leading the government to revise its fiscal anchor. The net debt-to-GDP ratio is expected to stabilize at around 37.8% until FY25 before edging down to 36.9% in the following year. The renewed Debt Burden Reduction Strategy highlights a material step forward in debt reduction since the last budget, which now imposes stricter limits on three indicators: net debt-to-GDP below 40%, net debt-to-revenue below 200% and interest on debt-to-revenue below 7.5%. The budget is delivered amidst high uncertainty, and even under the slower growth scenario that features a mild contraction in 2023 and a deficit of $5 bn in FY24, the fiscal anchors should still be met.

Ontario’s debt should remain attractive despite exogenous market sentiment driving broad-based near-term movements in Canadian provincial bond markets. The recent turmoil in the global banking system and subsequent deterioration of bond market liquidity have triggered a widening in provincial spreads against the backdrop of mounting recession fear but remain far tighter than crisis periods. As policymakers offer liquidity supports—combined with the central banks’ ongoing efforts to combat inflation—global factors will dominate market risk appetite, but over the long run, this largely stay-the-course budget should underpin Ontario’s firm fiscal footing. Ontario should continue to benefit from robust demand, a long-dated debt structure, and implicit federal backing with its debt remaining attractive to investors.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.