FISCAL OUTLOOK IMPROVED AMID DARKENING ECONOMIC CLOUDS

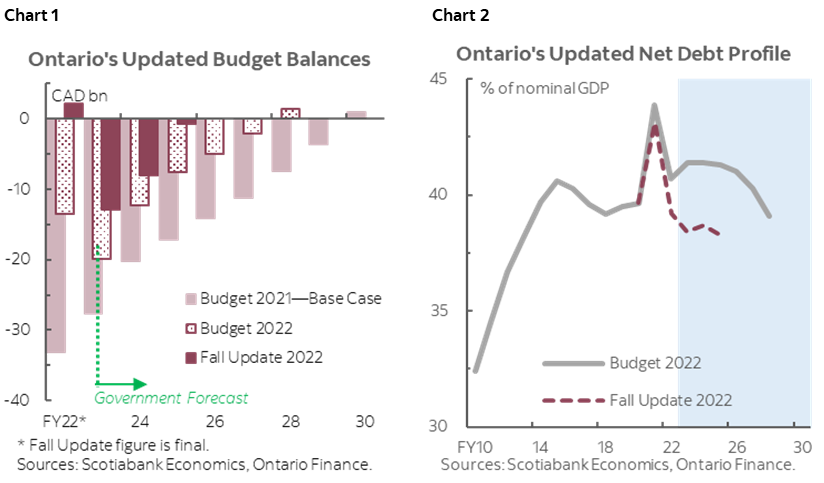

- Budget balance forecasts: -$12.9 bn (-1.2% of nominal GDP) in FY23, -$8.1 bn (-0.7%) in FY24, -$0.7 bn (-0.1%) in FY25 and return to surplus territory before reserve—respective reductions of $7.0 bn, $4.2 bn and $6.9 bn versus Budget 2022 projections (chart 1).

- Net debt: expected to decline further to 38.4% of nominal GDP in FY23 from 39.2% in FY22, then stabilize near 38.5% of GDP in each of the next three years—2–3 ppts lower than the trajectory defined in Budget 2022 (chart 2).

- GDP growth forecast: real growth assumptions nudged down across the forecast horizon from 2022 to 2025—+2.6% in 2022 before slowing rapidly to +0.5% in 2023 and +1.6% in 2024; faster nominal growth in 2022 (+9.2%) in light of higher GDP inflation outlook, yet slower nominal growth assumptions in 2023 (+3.5%) and 2024 (+3.8%) .

- Borrowing program: long-term public borrowing of $32.2 bn in FY23, $38.4 bn in FY24, and $32.3 bn in FY25—$26.1 bn lower versus Budget 2022 over the three-year outlook—largely reflects reduced funding requirements in FY22 and improved budget balance projections.

- While sizable windfalls put the province on a much better fiscal trajectory, the Update maintains prudent planning and prepares Ontario well for an economic slowdown. We see some near-term upside given the conservative assumptions underpinning forecast but expect heightened uncertainty in the medium-term. The government seems to be holding the line on spending with new policies addressing key priorities largely targeted and should have limited fiscal impact.

OUR TAKE

Ontario’s fall update projects general improvements in the province’s bottom-line across the three-year forecast horizon despite downward revisions to the medium-term economic outlook. Driven by the strong hand-off of the $2.1 bn surplus in FY22, balance projections continue to improve substantially in the near-term, with shortfalls reduced by a total of $18 bn versus the 2022 Budget for FY23–25. Debt levels are projected to edge down from a much lower starting point as a share of output than anticipated in Budget 2022, before stabilizing around the lowest levels in close to 10 years. Debt servicing costs remain largely unchanged despite higher interest rate outlook than assumed in the Budget given lower funding needs.

The tighter fiscal trajectory benefits from an improved starting point and is anchored by near-term own-source revenue gains. FY23 own-source revenue is tracking $7 bn higher than initially estimated in the Budget in light of higher-than-expected nominal growth. Compared to the 2022 Budget, the update is less optimistic about the economic prospects of 2023 and 2024, yet with higher inflation masking the impact of an economic slowdown on revenues, the balance projections still improved relative to the path outlined in Budget 2022 even with a deterioration of real growth outlook.

Continued prudence is largely warranted as the economic clouds darken. The update maintained a level of fiscal buffer similar to the budget—reflecting still-elevated uncertainty in the economic outlook. Nominal GDP is projected to grow 9.2% this year, well below Scotiabank’s forecast of 10.4% (chart 3), with next year’s nominal growth assumption (3.5%) slightly higher than our forecast (3.2%), but still under the private-sector average by a hair. Following the $1 bn reserve in FY23, FY24–FY25 maintain a reserve of $1.5 bn each year. The Contingency Fund has increased slightly to $7.5 bn in FY23, with $3.5 bn remained unallocated—leaving room for more upside. Under slower growth assumptions, deficit could widen to -$14.6 bn in FY23 before narrowing to -$8.5 bn in FY25, and a more optimistic scenario could see a nearly balanced book in FY24.

NEW SPENDING ADDED TO SUPPORT BUSINESS INVESTMENT AND AFFORDABILITY

Program spending remains virtually unchanged as new policy measures are incremental and covered by the contingency fund, and mainly target affordability and business investment. Key affordability measures include the pre-announced extension of the gas tax and fuel tax cuts by another year, as well as doubling the Guaranteed Annual Income System (GAINS) payments for seniors in 2023. The fiscal impact of these affordability measures should be limited (under 0.1% of nominal GDP in FY23–FY24). The government also raised the Ontario Disability Support Program (ODSP) monthly exemption to address the labour shortage—identified as a constraint on economic growth in the province.

Various tax measures were announced with an attempt to boost business investment incentives as the province enters a downturn. The bulk of the program is to temporarily allow immediate expense up to $1.5 mn per year for certain capital investments. Other measures include supporting small businesses by extending the phase-out range for their corporate tax rate from $10 mn to $50 mn of taxable capital. Impact of these tax measures are incremental (in the order of $400 mn in FY23) and unwinds quickly over time. These time-limited and targeted measures are welcomed as policymakers face increasing challenges to maintain the balance between affordability support and the risk of fueling inflation.

DEBT & BORROWING

Much narrower deficits projections underpin material improvements in the updated debt trajectory. Net debt as a share of GDP is projected to be 3 ppts lower than the 2022 Budget forecast in FY23, and remains lower than the Budget estimates over the medium-term. As the recession risk looms, the debt path could change as a result of weaker revenues and heightened spending pressures. Under the alternative economic scenarios, Ontario’s net debt-to-GDP ratio could go up to 40.8% by FY25 following a slower growth trajectory, a historical high other than the COVID-19 spike yet still below the 42% target.

Borrowing program has scaled down for FY23, FY24 and FY25 to $32.2 bn, $38.4 bn and $32.3 bn, respectively. The province’s FY23 borrowing program is $9.3 bn lower than estimated in the Budget, reflecting a smaller deficit with some offset from the $3 bn pre-borrowing planned for FY24. Projected borrowing rate has been revised higher by 80 bps in FY23, 90 bps in FY24 and 50 bps in FY25, yet debt servicing costs are expected to be lower as a share of total revenues. With average debt maturity among the lowest across provinces, Ontario improved its average term of debt in FY23 to 11.3 years, and aims to maintain it at levels trending since 2014.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.