REALITY CHECK: DEEPER RED INK, DELAYED BALANCE

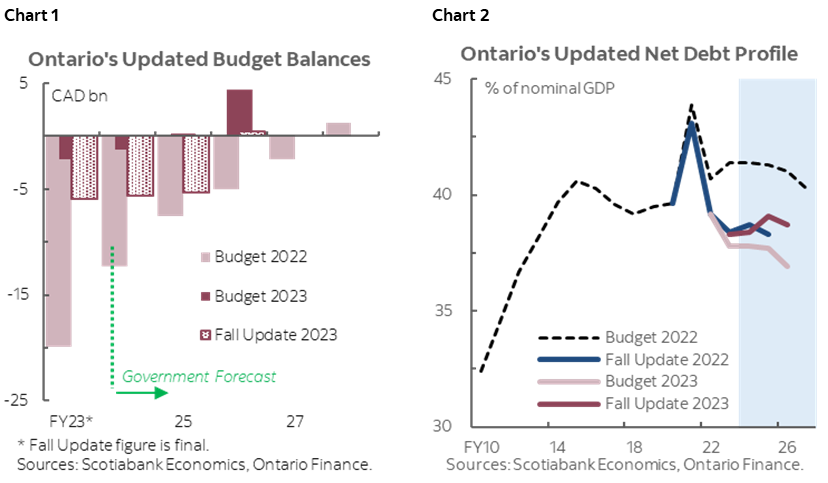

- Budget balance forecasts: -$5.6 bn (-0.5% of nominal GDP) in FY24, -$5.3 bn (-0.5%) in FY25, $0.5 bn (0.04%) in FY26 (chart 1)—combined deterioration of -$13.7 bn versus Budget 2023 projections. Return to balance delayed by one year to FY26.

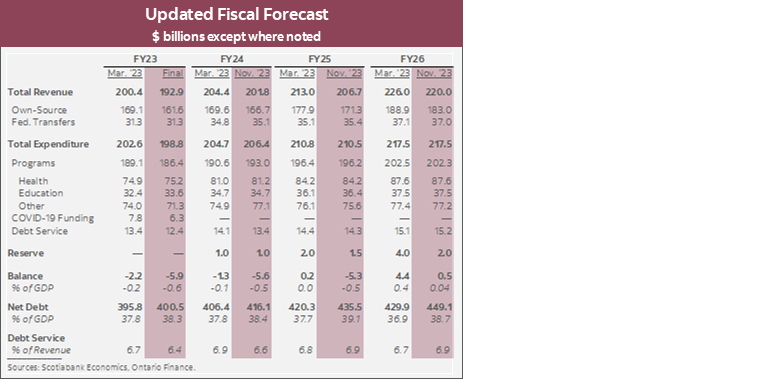

- Net debt: expected to remain flat at 38.4% of nominal GDP in FY24 from 38.3% in FY23, then rise to over 39% of GDP in FY25—higher than the trajectory defined in Budget 2023 (chart 2).

- GDP growth forecast: +1.1% real growth and +3.6% nominal growth in 2023—stronger than prior projections; slower real and nominal growth assumptions in 2024 (+0.5% and +2.9%). Relative to Budget 2023, the update assumes a weaker 2025 (+2.0% and +4.2%) and a stronger 2026 (+2.8% and +4.8%).

- Borrowing program: total long-term public borrowing of $34.7 bn in FY24, $37.4 bn in FY25, and $37 bn in FY26; a combined increase of $19.5 bn versus Budget 2023 largely reflects weaker revenue projections.

- The government kept additional policy measures incremental and targeted, but in an environment with no shortage of spending needs, medium-term outlook remains highly uncertain.

- Overall, this appears to be an under-promise, over-deliver update. The updated fiscal trajectory, albeit worsened, still suggests that Ontario’s public finances can withstand the ongoing slowdown. Notably, increased contingencies to $5.4 bn on account of continued uncertainty provide a considerable buffer to downside scenarios, absent which consolidation plans would otherwise remain intact. That said, if these contingencies are not required, there is merit in revisiting the earlier reassuringly downward trajectory of net debt.

OUR TAKE

As widely anticipated, Ontario’s fall update projects a deterioration in the province’s bottom line, driven by weakness in own-source revenue. Following the downward revision to revenue reported in the FY23 Public Accounts, the province projects larger deficits across the three-year forecast horizon, with shortfalls increased by a total of $13.7 bn versus the 2023 Budget. The return to balance was delayed to FY26—one year later than previously anticipated. The current consolidation plan is still anchored by an optimistic medium-term outlook, which shows a projected increase in total revenue by +4.2% annually over the three-year planning horizon (unchanged from Budget 2023), whereas program expense is expected to grow by +2.8% per year over the same period, leading to a rapid reduction in the budget deficit and a balanced budget by FY26.

WEAKER REVENUE GROWTH BEGETS LARGER DEFICITS

The deterioration in projected fiscal trajectory is the direct result of a lower starting point and weaker near-term revenue growth. The province’s own-source revenue projection was reduced by -$2.9 bn for FY24, driven by a decrease in Personal Income Tax from prior years’ tax reassessment, partly offset by stronger-than-expected labour compensation in 2023. Despite a downward revision, this year’s own-source revenue is still expected to come in +3.2% higher than in FY23. Growth in own-source revenue is expected to slow to +2.8% in FY25—well below the +4.9% growth rate assumed at budget time—before picking up to +6.8% in FY26.

Economic assumptions underpinning the updated plan appear appropriate and align with our current view but risks are tilted toward the downside. The update raises real growth from +0.2% to +1.1% for 2023, while bringing down 2024 real growth from +1.3% to +0.5%—the outlook aligns well with Scotiabank’s latest forecasts (+1.2% and +0.6%) and private-sector averages. Over the medium term, the province expects real growth to pick up rapidly to +2.0% in 2025 and +2.8% in 2026—a plausible scenario in our view. The updated economic outlook does not leave much room for downside risks given heightened uncertainty over the horizon. Inflation remains above the Bank of Canada’s target, and faces further upward pressure from rapid wage growth and well-supported oil prices. A more persistent inflation trajectory could force the central bank to keep rates higher and for longer, resulting in a sharper slowdown in 2024.

In light of a highly uncertain environment, the province continues to provide transparency by presenting alternative fiscal paths under higher- and lower-than-baseline growth scenarios. Under the slower growth scenario, which includes a -0.9% contraction in real growth in 2024, deficit could widen by $2.1 bn in FY24, $6.6 bn in FY25 and $8.8 bn in FY26. A more optimistic scenario could see a balanced book in FY25.

The updated fiscal plan still has plenty of prudence built in. Anticipating heightened spending pressure, the update replenished the Contingency Fund by another $2.5 bn, bringing the remaining balance of the fund to $5.4 bn for FY24. While maintaining the $1 bn reserve for FY24, the plan dialled back on medium-term provisions, reducing reserve by a total of $2.5 bn over FY25–26. The enhanced financial buffer in FY24 sets the stage for outperformance this fiscal year, whereas reduced medium-term prudence could potentially expose the province’s finances to more downside risks in an environment of heightened revenue uncertainty and mounting spending pressures.

NEW POLICY MEASURES APPEAR INCREMENTAL AND TARGETED

Faced with a dimming revenue outlook, the province was able to hold the line on spending. Although total expenditures are expected to come in $1.7 bn higher in FY24, the bulk of the increases remain unallocated as contingencies—new allocated spending totals under $1 bn since the budget. Program spending projections are kept unchanged in the update for FY25 and FY26, with an average annual growth rate of +1.6%. Financing costs are expected to come in $0.6 bn lower than previously anticipated for FY24.

Additional policy measures detailed in the plan build incrementally on ongoing initiatives, and mainly target affordability and business investment. Ontario followed the federal government and removed the provincial portion of HST for new rental housing construction, which should prove effective in boosting the province’s much-needed rental supply. This signature policy comes with a small price tag, which is estimated to gradually reach $150 mn in FY26, with costs dependent on the rate of uptake. Other affordability measures include the extension of the gas and fuel tax cuts, which costs around $320 mn each year in FY24 and FY25. To support business development in the province, Ontario added $100 mn to the Invest Ontario Fund, which now totals $500 mn and aims at attracting leading companies to Ontario. The government also enhanced the Flow-Through Share Tax Credit by an additional $12 mn per year to support the critical mineral mining industry. The update announces the launch of the Ontario Infrastructure Bank, proposing to provide $3 bn in initial funding with details to come. Overall, keeping new policy measures incremental and targeted is consistent with the current economic circumstances.

Planned infrastructure outlays—estimated at $73.8 bn during FY24–26—were kept unchanged.

HIGHER DEBT & BORROWING

A larger deficit than expected sent net debt tracking higher as a share of nominal output. The net debt-to-GDP ratio is expected to rise from 38.4% in FY24 to 39.1% in FY25, before edging down to 38.7% in FY26—a higher trajectory than projected in Budget 2023. The updated path still meets the criteria set in the renewed Debt Burden Reduction Strategy in Budget 2023, which limits net debt-to-GDP ratio to levels below 40%. However, in the alternative scenario where the economy sees a contraction in 2024, net debt could go up to 41.5% of nominal GDP by FY26.

Borrowing requirements have been raised for FY24, FY25 and FY26 to $34.7 bn, $37.4 bn and $37 bn, respectively—a combined increase of $19.5 bn due to higher deficits over the three-year horizon. The $7.9 bn additional cash borrowing for FY24 stems from an unexpected larger deficit from the previous fiscal year. About 43% of this year’s long-term borrowing requirement has been completed.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.