ECONOMIC OVERVIEW

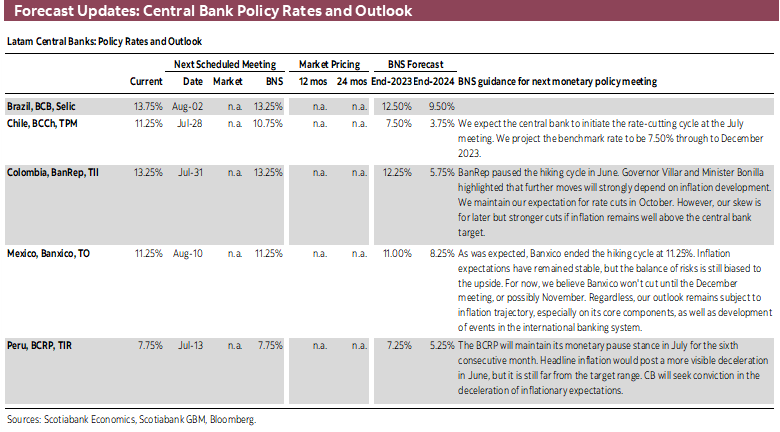

- Colombian, Brazilian, and US inflation data, and the BCRP’s rate announcement are next week’s highlights, with the BoC’s and RBNZ’s rate decisions, UK jobs, and a collection of Chinese data are also on the horizon as global market risks.

- Colombian inflation is not projected to have slowed much, if at all, in June while the opposite is likely in Brazilian figures where headline inflation is seen in the low 3s.

- The BCRP is expected to leave its reference rate on hold at 7.75%, but recent prices and economic activity data have increased the odds that the central bank chooses to reduce rates sooner.

- Chilean and Mexican calendars offer little of note aside from the BCCh’s economists and traders surveys and Mexican industrial production data.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Colombia, Mexico and Peru.

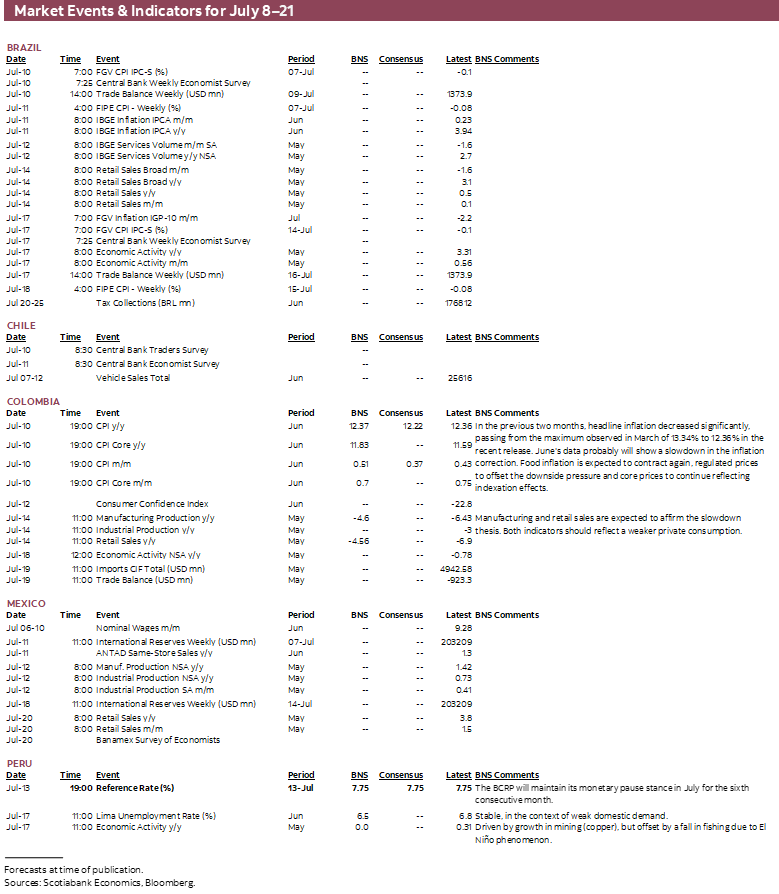

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period July 8–21 across the Pacific Alliance countries and Brazil.

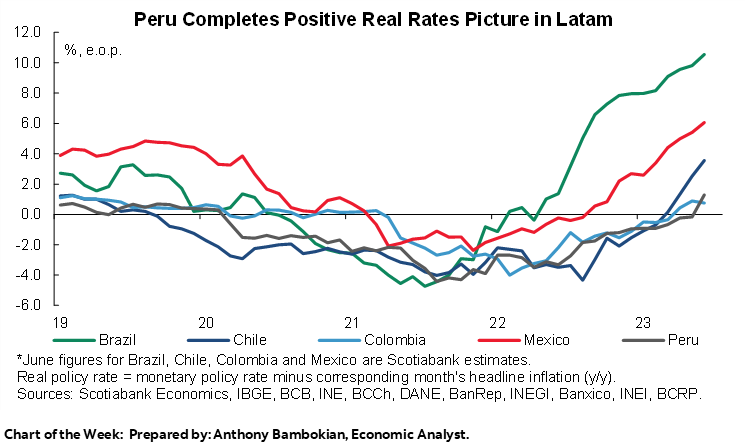

Chart of the Week

ECONOMIC OVERVIEW: BCRP DECISION, COLOMBIA, BRAZIL, AND US INFLATION

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- Colombian, Brazilian, and US inflation data, and the BCRP’s rate announcement are next week’s highlights, with the BoC’s and RBNZ’s rate decisions, UK jobs, and a collection of Chinese data are also on the horizon as global market risks.

- Colombian inflation is not projected to have slowed much, if at all, in June while the opposite is likely in Brazilian figures where headline inflation is seen in the low 3s.

- The BCRP is expected to leave its reference rate on hold at 7.75%, but recent prices and economic activity data have increased the odds that the central bank chooses to reduce rates sooner.

- Chilean and Mexican calendars offer little of note aside from the BCCh’s economists and traders surveys and Mexican industrial production data.

Colombian and Brazilian prices figures out on Monday and Tuesday, respectively, are the data highlights of the week, to complete the set of June inflation data for the countries that we cover. These will be followed by the BCRP’s rate decision on Thursday as the main event of the week, with Peru’s board the first key Latam central bankers to decide on monetary policy with June CPI numbers at hand.

Regional inflation will be on our radar, but global markets will be paying much closer attention to the US CPI release on Wednesday, ninety minutes prior to a too-close-to-call BoC policy announcement. The RBNZ’s decision, UK employment, and a collection of Chinese credit, prices, investment, and international trade data throughout the week will also be monitored by traders.

The BCRP is set to leave its reference rate unchanged at 7.75% at its Thursday announcement. Headline inflation in June fell much more than expected, coming in at 6.5% from 7.9% versus a median forecast of 6.9% and below our Lima team’s projection of 6.7–6.8%. Despite this ‘miss’, we maintain our expectation that the BCRP will not roll out its first rate cut until the November meeting but the sharp deceleration does raise the possibility of an earlier start to the loosening of policy. In today’s weekly, the Lima team previews the BCRP’s decision and their views on inflation trends and expectations.

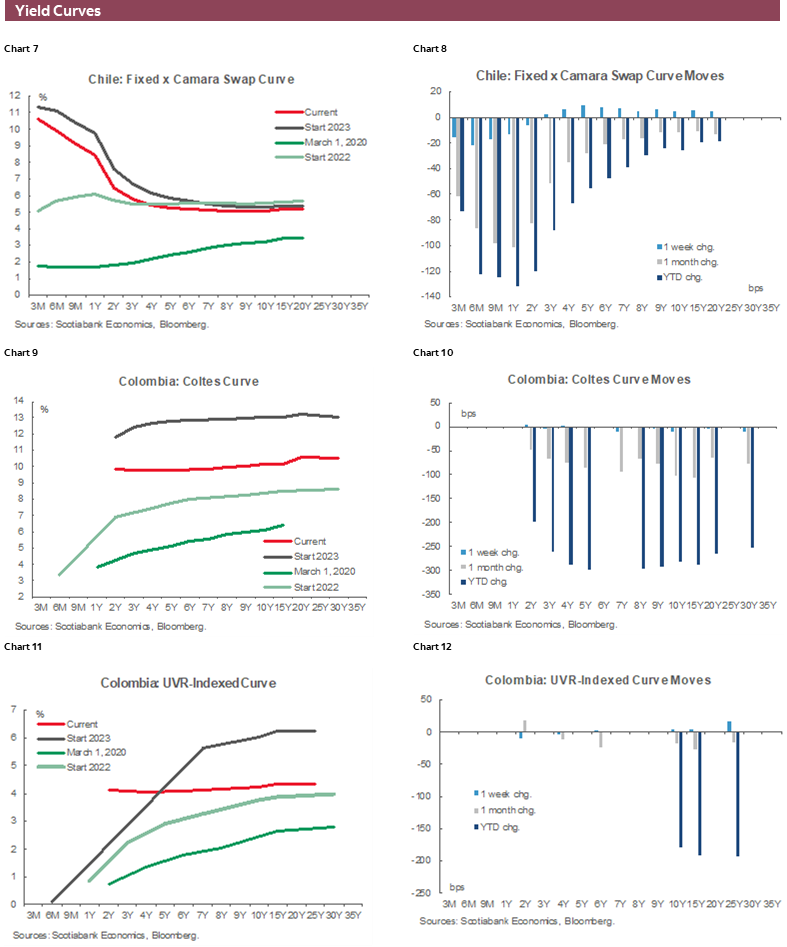

Inflation is not expected to decelerate all that much in Colombia, if at all. From 12.36% y/y in May, the median economist estimates that June inflation will come in only a touch lower, at 12.22% y/y. Our local team forecasts a practically unchanged reading of 12.37%—and an acceleration in core inflation to 11.83% from 11.59% that will reflect indexation practices. In today’s report, our economists in Bogota outline their expectations for BanRep policy after the bank’s rate hold last week. Inflation, and expectations for it, will be the top determinant for when the easing cycle may begin.

Whether it’s an unchanged or marginally lower print, next week’s headline inflation data are unlikely to result in significant readjustments in economists’ policy rate expectations; more so due to still strong core inflation. This would be in line with BanRep’s data-dependent rate decision last week, when the bank held rates unchanged (as expected) and highlighted core inflation falling as a condition to discuss rate cuts.

On Friday, retail sales, and industrial/manufacturing production data may show a continued deceleration of the Colombian economy that BanRep has in a way welcomed as necessary to guarantee inflation stability.

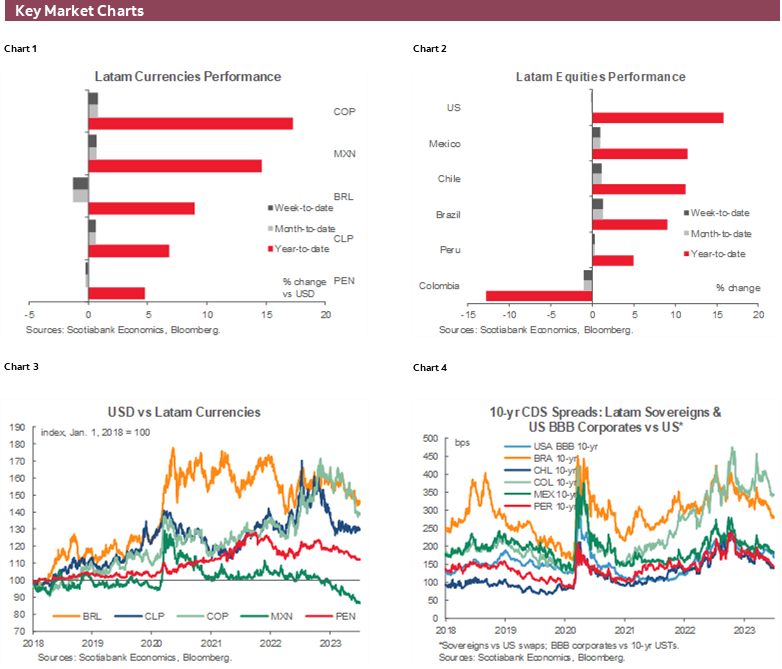

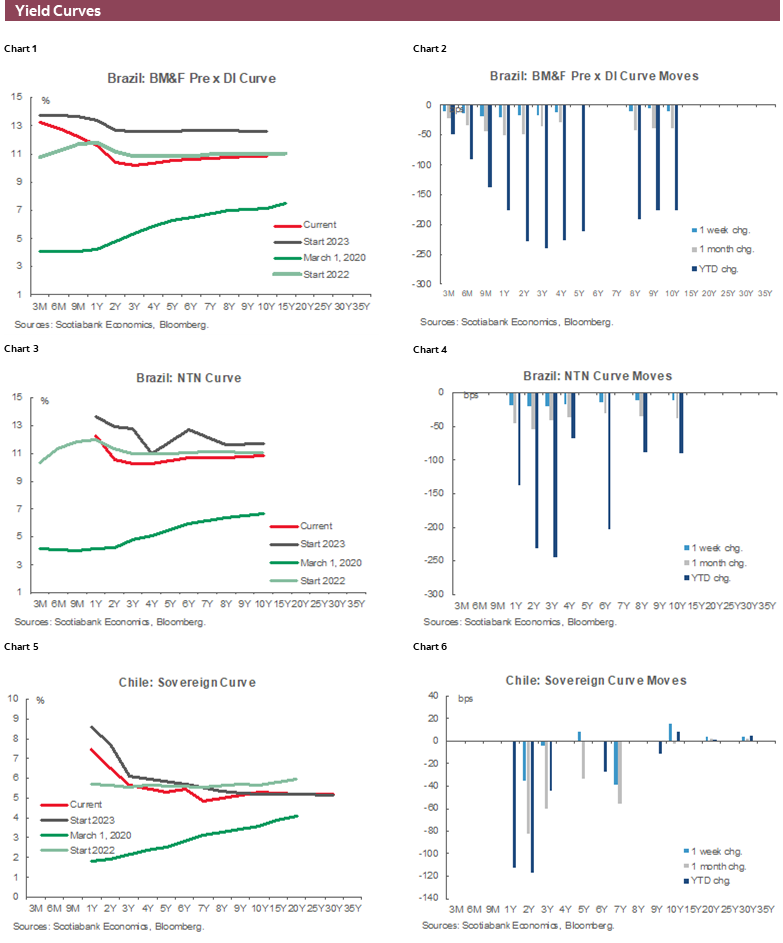

Brazil’s inflation is, in contrast, expected to fall by 0.8–1.0ppts in the year-on-year comparison to the low 3s in June data out on Tuesday. Next week’s reading could be the last notable decline, and/or mark the start of a plateau, ahead of a modest reacceleration in prices growth in the second half of the year. Base effects become much less favourable in H2, and month-on-month IPCA-15 prices growth that was averaging 0.0% in the six months to December 2022 has averaged 0.5% in the first half of 2023.

From a May IPCA reading of 3.9% y/y, the median economist surveyed by the BCB expects inflation to close out the year at 5%. Despite this ~1ppt rise in inflation by year-end, economists forecast that authorities will cut rates by 175bps over the period, from 13.75% to 12.00%—roughly 50bps above where markets see the Selic rate at end-2023. May retail sales data on Friday could shed some light on the restrictiveness on current monetary policy settings and Monday’s usual BCB economists survey could show more changes in forecasts.

Chilean and Mexican calendars are somewhat quiet. In Chile, the release of traders and economist surveys on Monday and Tuesday, respectively, are the highlights as they could show a steeper path of rate cuts over coming months, with the BCCh expected to start its cutting cycle in late-July with a 50bps reduction. Our team in Santiago believes the central bank will lower its monetary policy rate to 7.50% by year-end compared to the June median in the economists survey at 8.50% and at 8.25% in the traders survey that look at risk of being revised lower in next week’s releases. As for Mexico, industrial production data out on Wednesday should not be a market mover, so in today’s Weekly, our economists provide an update on the presidential election candidacy process, specifically that of the opposition.

PACIFIC ALLIANCE COUNTRY UPDATES

Colombia—BanRep’s Next Move

Sergio Olarte, Head Economist, Colombia

+57.601.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.601.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

Santiago Moreno, Economist

+57.601.745.6300 Ext. 1875 (Colombia)

santiago1.moreno@scotiabankcolpatria.com

Currently, there is a different approach between developed countries’ central banks and some emerging markets’ central banks. The Fed, ECB, and BoE among others continue pointing to more tightening due to stubborn core inflation and still relatively healthy economies. In Latin America, in contrast, central banks are pointing to the stability of policy rates and have penciled in that easing cycles will start rather soon arguing that inflation is finally easing, inflation expectations also are converging to targets and economic activity in our countries has decelerated at a faster pace than initially expected. Additionally, Latin American economies, such as Brazil, Chile, Peru, and Colombia have increased their policy rates much more than many peers around the world.

Colombia was the last PAC country to finish the hiking cycle and reach policy rate stability. June’s BanRep meeting marked the end of the hiking cycle that increased the policy rate by 11.5ppts to 13.25% since September 2021, and although it did not close the door entirely to future tightening (BanRep almost never has closed the door to any policy movement), it sent the message that the base case scenario is that stability will last for a bit and once inflation deceleration consolidates, BanRep will start a gradual easing cycle. Our projection is that BanRep will start the easing cycle by October’s meeting on the back of the following:

- Food prices are helping headline inflation in the short run. These have decelerated more than 12ppts year-to-date to 15.7% y/y and are expected to end this year below 6%, which should continue to help headline inflation fall further throughout the year. However, the possibility of a strong El Niño weather phenomenon still brings uncertainty to these items, especially for next year. Therefore, food inflation expectations support that the easing cycle should start soon, although in a gradual manner due to uncertainty for next year.

- Core inflation (ex-food and regulated prices) stabilized at around 10.4% y/y suggesting that it will start its slow-motion deceleration due to still present indexation effects. Again, the point is in favour of graduality in the easing cycle and stability for a couple of months.

- Economic activity up to April has shown that domestic demand, and private consumption especially, is decelerating at a faster pace due to high inflation and higher interest rates. Having said that, current information suggests that Colombia is not at risk of entering into a recession this year and GDP growth will be between 1.5% to 2% in 2023. Another reason to think this is a gradual and late start of the easing cycle.

- Finally, inflation expectations although having dropped significantly for the 1-yr and 2-yr horizons, which can point that BanRep can start its easing cycle soon, are still above target, which in our opinion has been key information to decide to wait a bit before starting the easing cycle and if so, that it be gradual.

These four points are the main arguments for our call for stability until October 2023 and start the easing cycle with a 50bps cut towards ending 2023 at 12.25%.

What are the risks to the current view?

- There are risks to the downside in inflation and economic activity that can help to bolster a faster convergence of headline inflation. The current appreciation of the COP should help tradable goods (30% of the basket) to decelerate faster and make inflation end 2023 below the 8.8% y/y that we have in our base case scenario. However, even in a positive scenario, inflation will remain above double-digits most of the year, which is a challenging scenario to discuss rate cuts. That is why our bias is, rather than for an early cut, towards a potential later cut but more aggressive.

- Additionally, lower-than-expected private consumption also can make inflation drop further. If the economy weakens more than expected, we think BanRep could cut the policy rate even by 100bps in the October meeting or, if there is a material deceleration, BanRep can start rate cuts by September’s meeting if Q2-23 GDP results are too weak (data to be published in August).

Either way, June’s meeting showed that BanRep has started a wait-and-see mode. The critical variable is inflation and inflation expectations. Additionally, it is worth noting that even the finance minister, who is usually the most dovish member, didn’t mention the possibility of a call for rate cuts soon. Instead, he also remarked that it is important to see confirmation of a downtrend in inflation and inflation expectations. At Scotiabank Economics, we affirm our call for rate cuts in October, however, this strongly depends on inflation developments.

Mexico—Va Por Mexico Kicks Off Its Candidate Selection Process

Eduardo Suárez, VP, Latin America Economics

+52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

The registration for the opposition, Va Por Mexico, coalition’s presidential candidate took place on July 4th, with some surprises. A popular candidate among civil society, Xochitl Galvez, who was previously discussed as a contender for Mexico City Governor instead signed up for contention for the presidential candidate nomination. On the other hand, other prominent candidates who were previously discussed as contenders seem to have dropped out of the list: Lily Tellez, Jose Angel Gurria, Gustavo de Hoyos and Claudia Ruiz Massieu. Some candidates who are still being discussed as contenders, but who have not formally registered their nominations include: former Tourism Secretary Enrique de la Madrid, former Economy Minister Ildefonso Guajardo, and former Presidential Candidate Ricardo Anaya. The period for submitting candidacies for the Va Por Mexico coalition will be open July 4th to July 9th, with the final list announced on July 10th. After that, the key dates are:

- Candidates will have from July 12th to August 3rd to compile 150k registered voter signatures to make their candidacy official.

- After that on August 10th a forum will be held where each contender will explain his/her campaign platform.

- On August 11th – 16th a poll will be undertaken, from which the top three finalists will be selected.

- Once 3 candidates are selected, 5 debates will be held (August 17th Tijuana, August 19th Monterrey, August 22nd Leon, August 24th Guadalajara, and August 26th Merida).

- Between August 27th and August 30th, a second poll will be carried out, alongside a voting process, to select the final candidate—which will be announced September 3rd.

At this point in time (with 5 days left in the registration process), the contenders for the nomination include:

- Santiago Creel, the former Senator, and current Congressman, who also served in the Mexico City Assembly, who was also an Electoral Institute Counselor, a candidate for the Governor of Mexico City, has long been seen as a key leader of the center right PAN party. He holds a law degree from the UNAM, as well as post graduate law degrees from Georgetown and the University of Michigan.

- Xochitl Galvez is a candidate who is seen as very versatile, being of indigenous descent and a low-income background (some consider that makes her able to relate with what is traditionally seen as Morena’s base), but she rose to become a very successful business woman in the tech space and she’s been a consistent member of the center right PAN (which is seen as positive for mobilizing the opposition to get a high turnout, a key for an opposition victory). In terms of her background, Xochitl has been a Senator for the PAN, she governed the Miguel Hidalgo subdivision of Mexico City (a prosperous part of the city), she was candidate for the State of Mexico governorship (for the PAN), she was General Director of the Commission for Indigenous Peoples Development, she founded the Porvenir NGO, and also founded High Tech Services, a Mexican tech company, for which she won the award for Entrepreneur of the Year. She is a Software Engineer, with specializations in robotics, AI, intelligent buildings and sustainability and energy efficiency.

- Jorge Luis Preciado is a long time politician in the center left PRI party and center right PAN, who has been a Congressman, a Senator, as well as candidate to the governorship of Colima.

- Gabriel Quadri is currently a member of the center right PAN party but ran for the presidency in 2012 representing the Nueva Alianza party. He ran the National Ecology Institute, and worked for the business organization Consejo Coordinador Empresarial. He has a versatile career, which includes politics, environmental agencies, academia, and also received the German Walter Reuter journalism award.

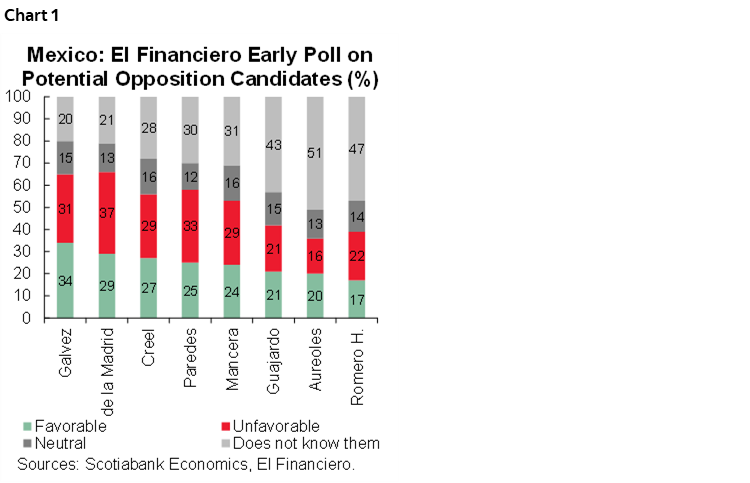

It’s still early in the selection process, although it will be fast, and we don’t have the final list of contenders, but an early poll by El Financiero has Xochitl Galvez in the lead, followed closely by Enrique de la Madrid, whose candidacy has not yet been confirmed (chart 1). We have 2 months left before the selection process is finalized, and even then, there are still some pending questions which include:

- In theory, campaigns don’t kick off until Q1-24, but this time around, the electoral cycle is starting unusually early. Many observers say that the oppositions strategy of holding several debates and 2 rounds for securing a candidate should give them a lot of airtime, to get their platforms and candidates known by voters. It’s uncertain in which direction that blade will cut.

- With a very long race, lasting about 1 year until the official election date on the first Sunday of July 2024, a key question is whether the selected candidate can maintain strong momentum going for such a long period, or whether he/she manages to get momentum to peak and wane, but find a peak for election day. In recent elections, an often-quoted trend is that a low turnout favours the incumbent Morena.

- Another key question is whether the MC party will join forces with the rest of the opposition. At this point in time, the political map in Mexico is dominated by Morena, which governs most of Mexico’s 32 States. The former dominant party PRI only governs 2 states, the PAN governs 5 states, and the MC party has 2 governors—although arguably the 2 most important opposition states: Jalisco and Nuevo Leon. With a split opposition, its odds of securing the presidency look slimmer.

Peru—Earlier Start to Rate Cuts is Beginning to Appear Probable

Mario Guerrero, Deputy Head Economist

+51.1.211.6000 Ext. 16557 (Peru)

mario.guerrero@scotiabank.com.pe

Inflation finally showed a visible slowdown in June, as we and a part of the market expected. This was possible due to the fading of the effect of avian flu on poultry prices, with a significant weight in the consumption basket, as well as a statistical base effect since inflation in June 2022 was the second highest of that year.

Will these data be enough to affect inflationary expectations and therefore already induce a change in monetary policy? We believe not, although it raises expectations that the BCRP will make progress in its decision to start lowering the reference rate. Still, 63% of the prices of the products that make up the consumer basket (586 products) registered increases in June, so victory cannot yet be claimed. The BCRP president has shown caution, stating that the worst mistake of a central bank is to cut its rate only to later raise it again. This reflects that the BCRP must be convinced that inflation has been defeated in order to start the rate cutting cycle.

Two arguments work for and against an earlier cut. As noted in the Latam Weekly of June 23rd, Peru’s economy has shown visible signs of weakness, mainly associated with components of domestic demand, so there are grounds for the BCRP to evaluate bringing forward the rate cut. We believe that this concern should be explicitly stated in the next monetary policy statement (on Thursday, July 13th) before making a future decision. In June, the BCRP cut its forecast for economic growth for this year from 2.6% to 2.2%, introducing a weak El Niño scenario, although the market consensus is closer to 1.9% according to Focus Economics survey (June 2023) and it would not be surprising if the consensus starts to approach 1% in the July survey, since the most recent data have been the most worrisome.

The argument that the BCRP will have to evaluate is the increasing probability of occurrence of an El Niño Phenomenon, both Coastal and Global, for the summer of 2024, with significant impacts on food prices, as has occurred in the past. In this context, it will be essential to evaluate the performance of core inflation and how these shocks are reflected in inflationary expectations.

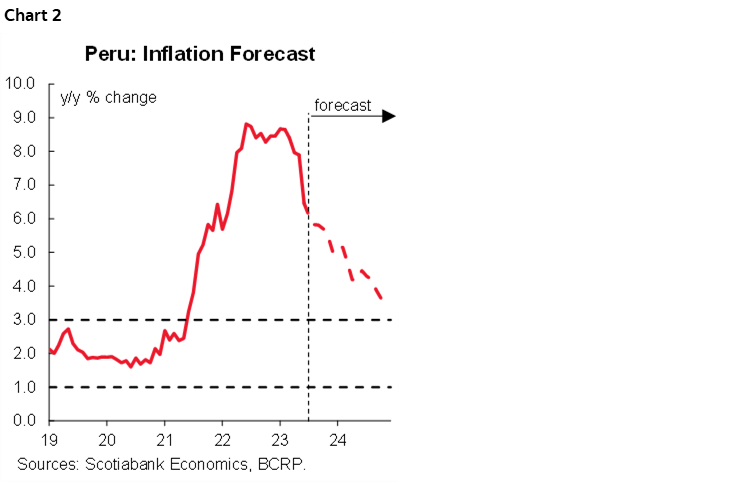

Normally, food price shocks should not trigger changes in the monetary policy stance, but due to the recent inflationary context, and the possibility that a shock caused by the El Niño Phenomenon—depending on its intensity—could contaminate other basket components, the BCRP would maintain a prudent stance regarding changes to its monetary policy. Our base case includes a moderate El Niño Phenomenon scenario. We kept our CPI forecast in 5.0% y/y for the end of the current year and 3.5% for end-2024 (see chart 2).

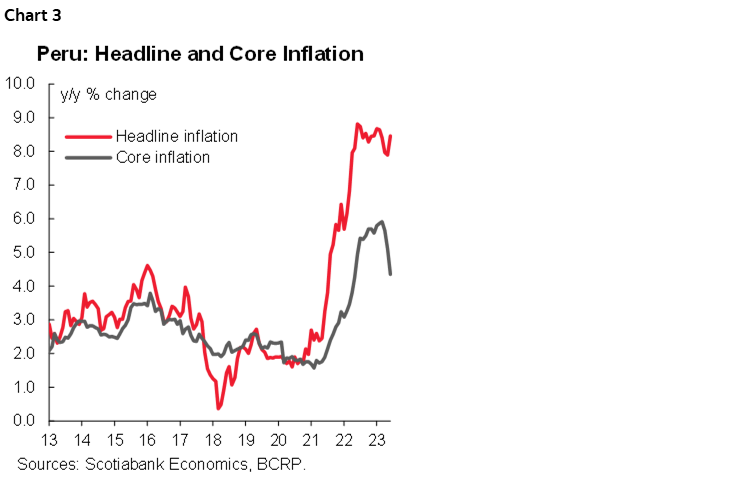

Core inflation slowed from 5.1% y/y in May to 4.3% y/y in June, decelerating for the third consecutive month (chart 3). In monthly terms, it has already accumulated two months in line with its historical average (corresponding to the months of May and June of the ten years prior to the pandemic), a welcome development after almost two years of records above the historical average. If monthly core inflation continues near its historical average, core inflation y/y could approach the upper limit of the target range in Q4-23, which is when in our baseline scenario we anticipate the start of the interest rate cuts cycle. This is possible, to the extent that production costs have been decelerating faster than consumer prices. Import prices also show a significant deceleration to which is added the PEN appreciation.

However, we believe that this will still take time. We hope that in the very short term the BCRP will maintain its reference interest rate at 7.75% at its meeting on Thursday, July 13th, for the sixth consecutive month, and that it will state in its statement its concern about weak economic growth, which would open the possibility of a future cut. In our baseline scenario, we forecast cuts of 50bps in 2023-4Q, to 7.25%, although due to recent information the bias is towards a lower rate.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.