ECONOMIC OVERVIEW

- The week ahead in Latin America will start with Brazil’s definitive election in the rear-view mirror—or not. A very narrow margin of victory for Lula could see Bolsonaro challenge the results of the election.

- Elsewhere in the region, the focus will be on Mexican Q3 GDP, Peru Oct CPI, and Chilean Sep economic activity on the data front.

- While the Latam calendar presents several key local events to monitor, the main driver of the performance of regional (and global) assets will likely be the Fed’s decision on Wednesday.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

MARKET EVENTS & INDICATORS

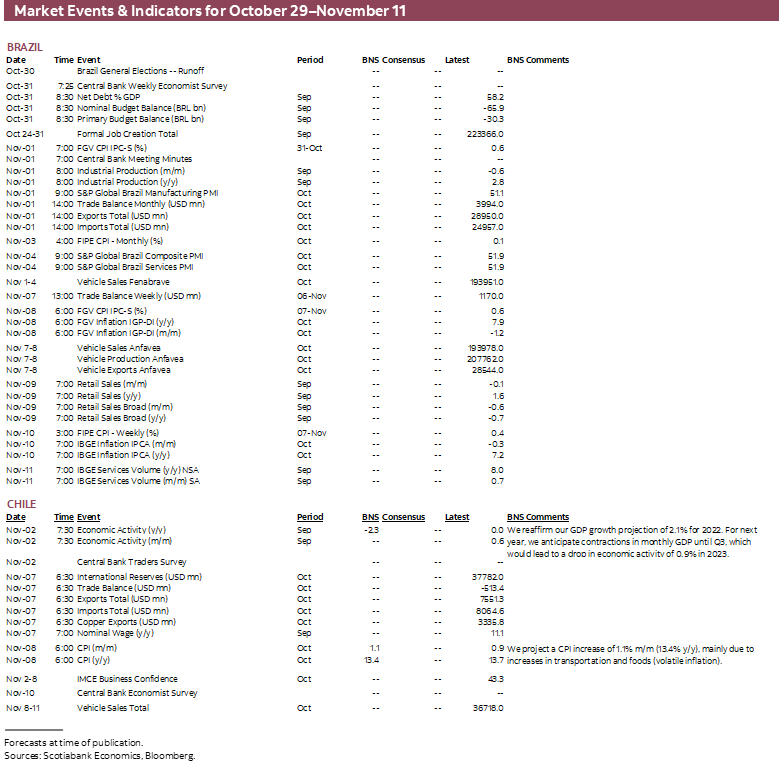

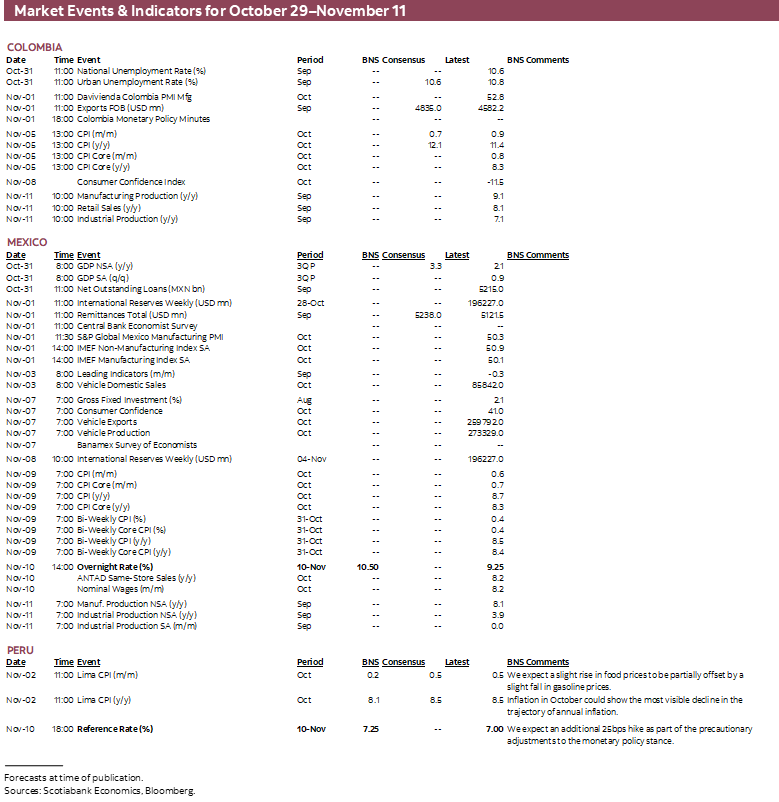

- A comprehensive risk calendar with selected highlights for the period October 29–November 11 across the Pacific Alliance countries and Brazil.

Economic Overview: Brazil Runoff Vote Aftermath; Global Focus on the Fed

Juan Manuel Herrera, Senior Economist/Strategist

+44.207.826.5654

Scotiabank GBM

juanmanuel.herrera@scotiabank.com

- The week ahead in Latin America will start with Brazil’s definitive election in the rear-view mirror—or not. A very narrow margin of victory for Lula could see Bolsonaro challenge the results of the election.

- Elsewhere in the region, the focus will be on Mexican Q3 GDP, Peru Oct CPI, and Chilean Sep economic activity on the data front.

- While the Latam calendar presents several key local events to monitor, the main driver of the performance of regional (and global) assets will likely be the Fed’s decision on Wednesday.

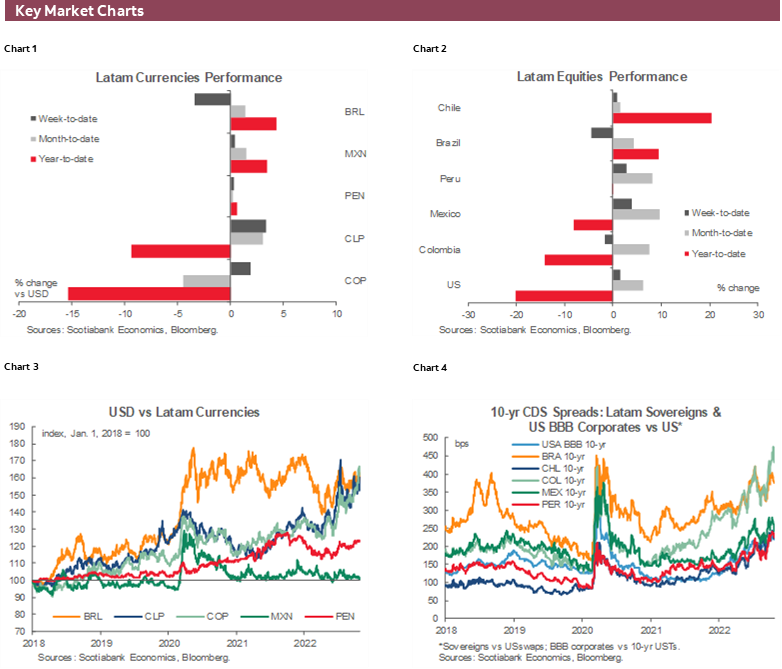

The week ahead in Latin America will start with Brazil’s definitive election in the rear-view mirror—or not. Despite Lula’s lead in the most recent polls steadying around 5–6ppts over Bolsonaro (amid ‘valid’ votes), the vote is still too close to call convincingly. Survey error margins combined with the possibility of ‘under-polling’ Bolsonaro supporters means the incumbent has a solid shot at staying in power. The Brazilian stock market’s ~5% decline this week owing, in part, to political anxiety could reflect this (compared to ~3% gains in Mexico and ~2% in the US). A very narrow margin of victory for Lula could see Bolsonaro challenge the results of the election and cause additional stress on Brazilian assets and the real.

Elsewhere in the region, the focus will be on Mexican Q3 GDP, Peru Oct CPI, and Chilean Sep economic activity on the data front (see write-ups in the country sections below). The minutes to Brazil’s and Colombia’s most recent central bank decisions will also be watched to refine forward guidance. This may be particularly true for the latter where markets may have forced its hand to deliver a bigger hike at its Friday meeting than it may have wanted a few weeks ago.

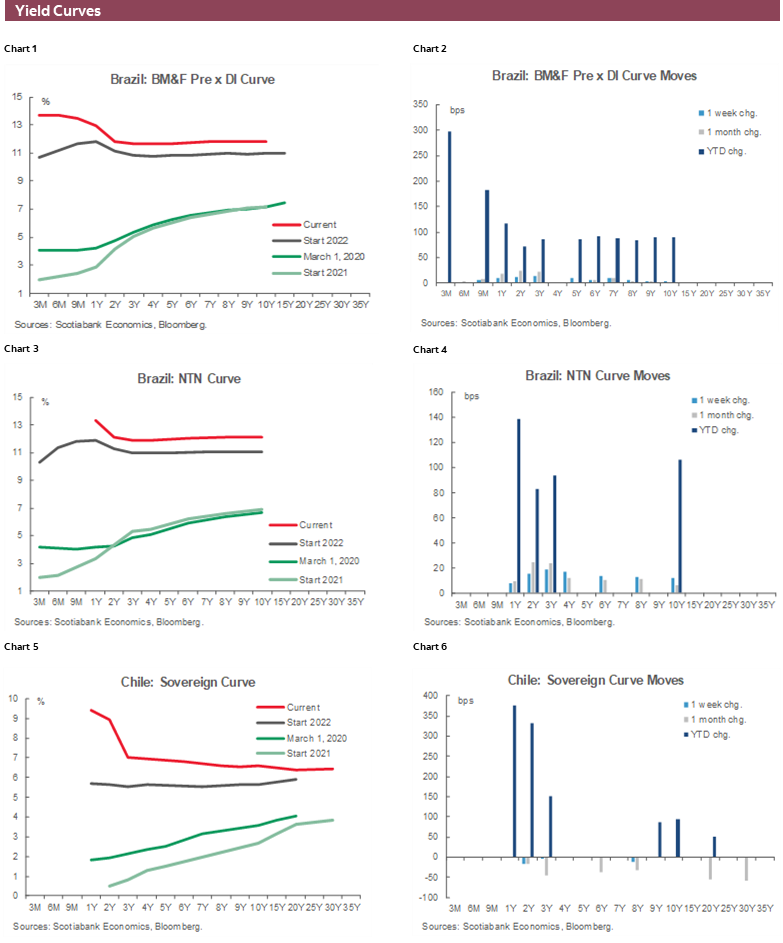

While the Latam calendar presents several key local events to monitor, the main driver of the performance of regional (and global) assets will likely be the Fed’s decision on Wednesday. Speculation has built recently over the Fed teeing up a slowing down its pace of hikes at its December meeting, thus concluding a four-meeting streak of 75bps increases (including next week’s). The hawkish message that has accompanied decisions to-date may be toned down and this has provided a tailwind for the Pacific Alliance’s currencies. However, sanguine markets on a soft Fed ‘pivot’ may be underplaying the risk that the Fed disappoints and regional assets could resume their weakening trajectories. For those sensitive to commodity prices, continued declines in these in the background opens up additional downside room. Note that the Bank of England’s policy decision follows the Fed’s on Thursday, and US jobs data on Friday will also play a key role for the market mood.

Chilean and Peruvian markets are closed on the 1st day of the month, with Mexico on holidays the following day alongside Brazil. Colombia’s markets are closed the following Monday.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Monthly GDP to Drop Year-on-Year in September

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

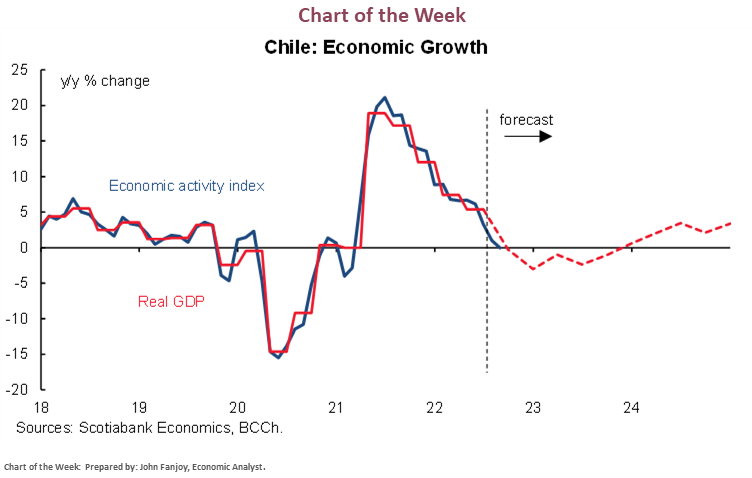

We expect a GDP contraction of 2.3% y/y in September. On Wednesday, November 2, the central bank (BCCh) will release economic activity data for September. In our view, non-mining GDP should continue to decline in m/m terms, mainly driven by falls in services and trade industries. Along the same lines, mining GDP is also expected to decrease versus the previous month. In this context, we reaffirm our GDP growth projection of 2.1% for 2022. For next year, we anticipate contractions in monthly GDP to last until Q3, which would lead to a decline in economic activity of 0.9% in 2023.

Colombia—BanRep MPR and Minutes; Tax Reform to be Discussed

Sergio Olarte, Head Economist, Colombia

+57.1.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

María Mejía, Economist

+57.1.745.6300 (Colombia)

maria1.mejia@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.1.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

At writing, we assume that BanRep will continue its hiking cycle at its Friday decision as is widely expected, with economists’ projections clustered on a 100bps hike. In this meeting, its main macro projections will be updated and in coming days details about the new macroeconomic scenario will come out with the publication of the Monetary Policy Report on Monday, and the press conference from the central bank staff on Wednesday. The minutes for Friday’s meeting will be released on Tuesday and we’ll look for clues on how soon the end of the hiking cycle is.

On the political front, minister Ocampo said that the Tax Reform will be discussed by the end of the week with Congress in the second debate, and changes in the potential rule to establish surcharges in the mining sector are expected. We expect negotiations between government and political parties to continue, which would lead to see more watering down of the reform towards its final shape.

Mexico—GDP Acceleration Expected in Q3

Miguel Saldaña, Economist

+52.55.5123.1718 (Mexico)

msaldanab@scotiabank.com.mx

In Mexico, GDP flash estimates for 2022Q3 will be released on Monday with analysts expecting year-on-year growth to accelerate from stronger momentum in both industry and services; our most recent forecast sees a 2.6% y/y pace that undershoots the median forecast of 3.3%. On a quarterly basis, growth is expected to maintain a modest pace of around 1%. The GDP monthly proxy has outperformed consensus in five of the first eight months of the 2022 calendar year, including August. With this in mind, analysts have revised their growth forecasts for 2022 higher.

In the Banxico survey also due for release this week (Tuesday), growth expectations could slightly move up to just above 2.0%. However, expectations for GDP growth in 2023 face downward pressure, with the median forecast likely to move below 1.0%, reflecting the risk of restrictive Banxico monetary policy and a weaker US economy. Other expected revisions include upward changes to year-end inflation projections for 2022 and 2023, suggesting that analysts expect ‘stickier’ inflation. In addition, the median interest rate forecast could slightly rise for 2022 as most analysts expect that Banxico will follow the Fed’s hikes—at least until the December meeting, carrying the overnight rate to 10.50% by year-end. Views differ more broadly for end-2023 as the consensus is not clearly aligned regarding Banxico’s terminal rate nor expected size of cuts during the final quarter of 2023.

Peru—Softer Inflation in October Would Not Be Enough to Prevent BCRP Hike to 7.25%

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Next week, we get preliminary September GDP data in addition to October inflation figures. The information will help the BCRP gauge the balance between growth and inflation when making its policy decision the following week on November 10.

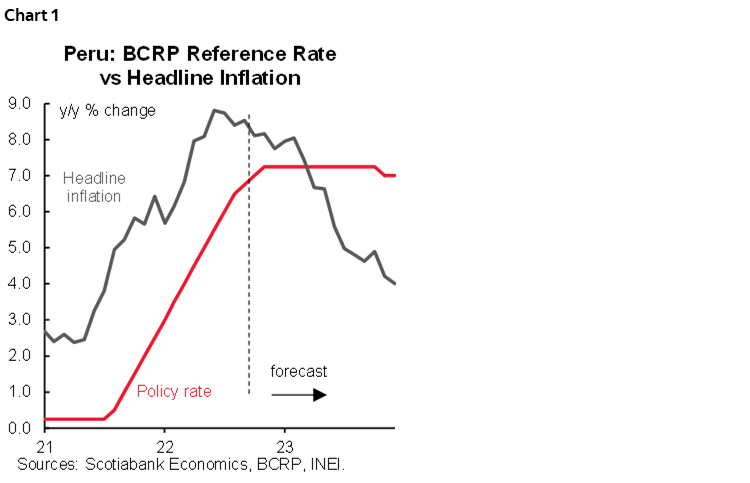

On Tuesday, inflation is expected to change slightly in October from the 8.5% y/y rate in September, which has proved sticky (chart 1). The key price indicators we track point to inflation of around 0.2% m/m in October. Given that this monthly figure will replace the 0.56% of October 2021 in the year-on-year readings, we expect yearly inflation to come in at around 8.1% y/y in next week’s data.

There is not much room for inflation to decline again in November, but should fall in December, to end the year broadly in line with our forecast of 7.7%. The BCRP knows all of this.

Lately, monetary authorities have been signaling greater concern for GDP growth. And concerned they should be, as GDP growth came in under 2% for the second month in August (1.7% y/y after 1.4% y/y in July). We’ll get a good sense of GDP growth for September when the National Statistics Institute releases information on resource sectors and cement demand on November 1. For the time being, we expect GDP growth to creep back above 2% y/y in September and beyond but that won’t fool the BCRP that knows that this would be entirely due to the Quellaveco copper mine coming online, not because of a pick-up in domestic demand. The problem is that growth is lagging at a time when inflation is stabilizing, but it is not falling, at least not with conviction. Thus, we are inclined to hold unchanged our forecast of another 25bps increase in the BCRP reference rate in November, to 7.25%, with which the BCRP would be ending the rising reference rate cycle. However, we do not discount the possibility that the BCRP stays put at 7.0%. This could occur if there is a sharp enough drop in inflation expectations twelve months out, which is a key variable for the BCRP in its policy decision.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.