ECONOMIC OVERVIEW

- A relatively quiet week awaits the Latam region—and the continent, in general—with only the release of bi-weekly Mexican and Brazilian CPI catching our eye amid limited trading with US Thanksgiving on Thursday.

- Off-calendar events may be the focus for regional markets as Lula-related uncertainty grips traders (and troubles the BCB) in Brazil. In Peru, President Castillo facing investigations of corruption and influence-peddling in Congress.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

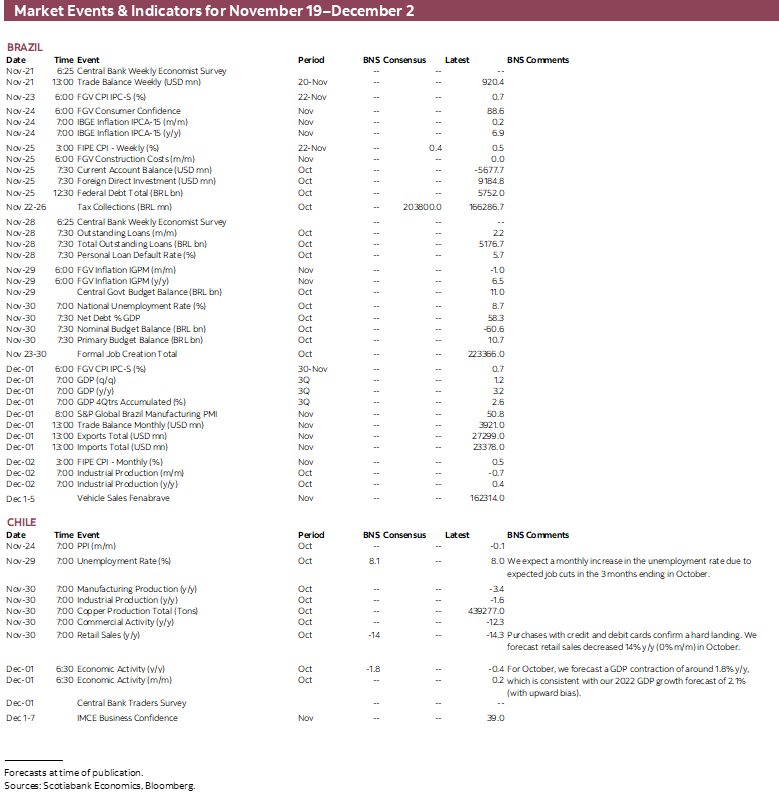

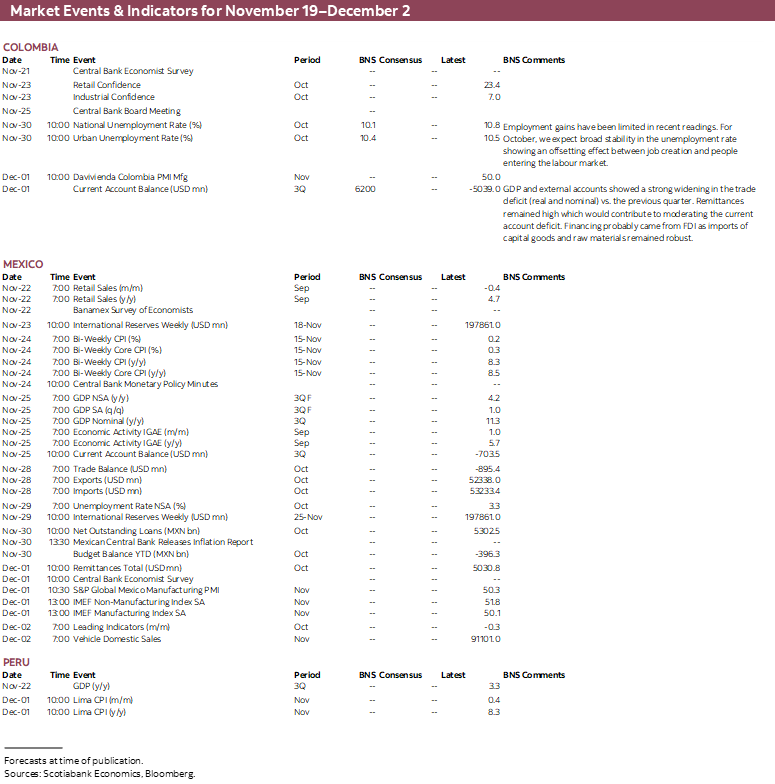

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period November 19–December 2 across the Pacific Alliance countries and Brazil.

Economic Overview: Brazilian and Mexican CPI with Watchful Eye on Regional Politics

Juan Manuel Herrera, Senior Economist/Strategist

+44.207.826.5654

Scotiabank GBM

juanmanuel.herrera@scotiabank.com

- A relatively quiet week awaits the Latam region—and the continent, in general—with only the release of bi-weekly Mexican and Brazilian CPI catching our eye amid limited trading with US Thanksgiving on Thursday.

- Off-calendar events may be the focus for regional markets as Lula-related uncertainty grips traders (and troubles the BCB) in Brazil. In Peru, President Castillo facing investigations of corruption and influence-peddling in Congress.

A relatively quiet week awaits the Latam region—and the continent, in general—with only the release of bi-weekly Mexican and Brazilian CPI catching our eye amid limited trading with US Thanksgiving on Thursday. Mexican headline inflation is expected to remain practically unchanged around 8.30% y/y in the first half of November, while in Brazil economists see a more pronounced year-on-year deceleration (6.23% from 6.85%) but a significant jump on a m/m basis (0.58% from 0.16%).

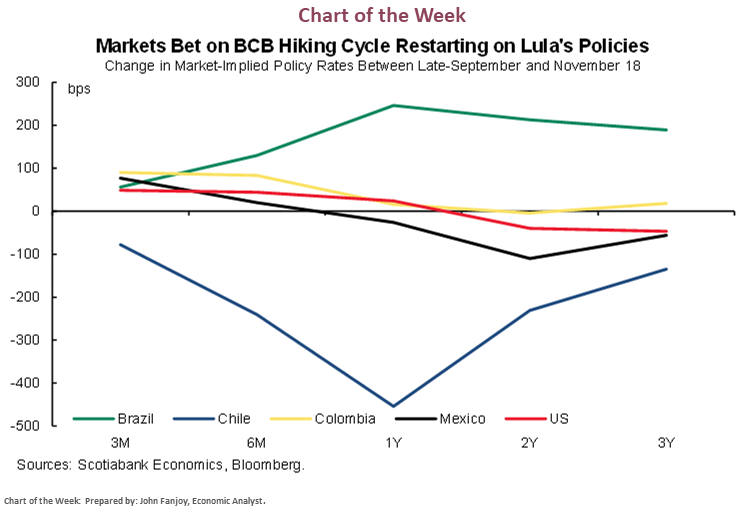

BCB’s Gov Campos Neto said on Friday that officials will do “whatever it takes” to depress inflation towards target. His comments, which included an indirect (though clear) critique of President-to-be Lula’s fiscal policies, reinforced the market’s expectation of a resumption of the BCB’s hiking cycle soon as fiscal loosening would worsen the inflation outlook.

Off-calendar events may be the focus for regional markets as Lula-related uncertainty grips traders in Brazil. First, we’re watching for developments on Lula’s Bolsa Familia initiative and how much will be ‘excluded’ (and for how long) from the country’s fiscal cap for these social spending plans. Second, we’ll monitor rumours around who will be appointed to the Ministry of Finance as market sentiment soured on reports that leftist and less-market-friendly Haddad is Lula’s top choice; though the resignation of former Finance Minister Mantega from the transition team helped the BRL and Ibovespa on Friday.

In Mexico, we await news on who may replace Esquivel in the Banxico board once he leaves (as expected) when his term ends in December. The balance of the board would still be able to handle a one-for-one dovish replacement and still see a majority vote for a would-be 50bps hike from Banxico, following the Fed. And we still see the bank moving in parallel with rate increases in the US for a few more meetings. Where we see market mis-pricing is in the beginning of Banxico’s cutting cycle (see Mexico section); given the Fed’s pressure and stubbornly high inflation with limited declines expected. On Thursday, Banxico will publish the minutes to its November policy decision when it opted a 75bps increase with four votes in favour and one against (Esquivel). Mexico will also publish September economic activity (IGAE) data on Friday alongside a revision to Q3 GDP figures (prelim 4.2% y/y and 1% q/q), after bi-weekly CPI data on Thursday.

Peru’s economy expanded 1.7% y/y in Q3-2022, according to BCRP data published on Thursday (see Peru section), decelerating from the 3.3% y/y pace seen in Q2. Export volumes sharply slowed from 9% y/y to 0.8% y/y due to temporarily depressed mining sector output; in Q4, our economists expect that the start of the Quellaveco mine will boost headline growth. There’s nothing major to monitor next week in Peru aside from political developments with President Castillo facing investigations of corruption and influence-peddling in Congress.

In Colombia, we’ll keep an eye on the Petro’s Government’s fiscal plans following the approval of the tax reform by Congress on Thursday; the data and events calendar is otherwise quiet in the county.

On the global stage, news/reports/rumours around China’s possible reopening next year will clash with reports of surging contagions. European and US S&P PMIs are also on tap, with those for the “old continent” expected to show persistent economic weakness that may worsen as colder temperatures take hold and nations possible struggle to keep the lights on. The Fed’s November meeting minutes and speaking appearances from officials could also be the key to determine whether the recent rally has legs, or if hawks will erase the recent optimism in markets.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Conditions in Place for a Big Cut to the Benchmark Rate in January 2023

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

POLITICAL UNCERTAINTY WILL SLOWLY DIMINISH, GENERATING A BETTER RELATIVE PERFORMANCE OF CHILEAN ASSETS AGAINST THEIR PEERS

The economy is rapidly closing the output gap while our view about economic activity, inflation and interest rates has been quickly reflected in surveys and asset prices. We assign an upward bias for GDP growth in 2022 (today at 2.1%) and a downward bias for 2023 (today at -0.9%).

A lame-duck government will have to concede much more on structural reform. The new constitutional process, with the “walls” established by the centre/right-wing parties, will allow no room to extreme proposals. Congress is overwhelmed with the constitutional agreement, the fiscal budget law, and structural reforms. In this context, we believe that we could only have partial approvals of some components of the Tax Reform before the legislative recess next February. In particular, we only see copper royalties being approved soon as a sign of market-friendly policy.

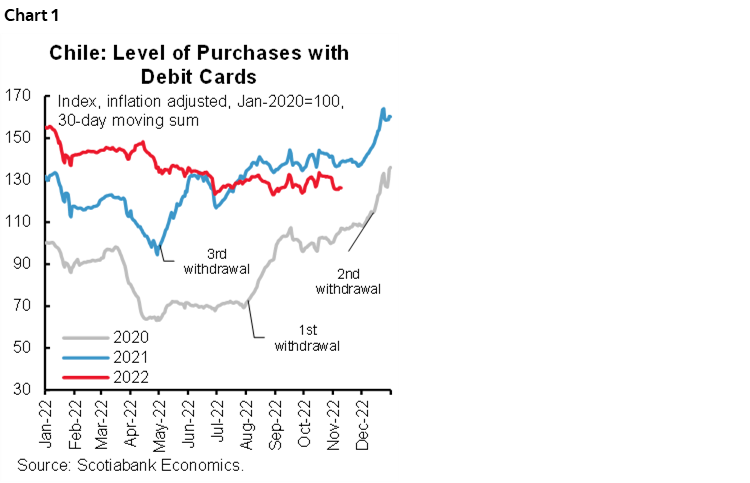

Our high-frequency indicators of purchases with debit cards confirm the hard landing of private consumption (chart 1). We forecast retail sales decreasing 14% y/y in October (0% m/m). We anticipate a deceleration in consumption imports, especially durable goods, and strong deceleration in banking credit. For its part, the current account deficit is no longer a concern and will converge to sustainable levels by mid-2023. We observe a more intense usage of credit cards in low-income segments.

We reiterate our view of a “big cut” to the benchmark rate at January’s monetary policy meeting—between 100 and 200bps—after low inflation prints in Q4-2022, along with deteriorated fundamentals. Weak domestic demand, a recovery in inventories, and FX multilateral stability with a more benign external inflationary environment are elements sufficient to secure a deceleration in inflation over the next few quarters. In addition to that, political uncertainty will slowly diminish, generating a better relative performance of Chilean assets against their peers.

DESPITE THE HIGH CURRENT ACCOUNT DEFICIT, ADJUSTMENT IS UNDERWAY TO CONVERGE TO SUSTAINABLE LEVELS BY END-2023

The central bank released today GDP data for Q3-2022, showing a 0.3% y/y expansion (-1.2% q/q SA), in line with the preliminary estimate based on the monthly activity index. The data confirmed a fall in private consumption (-2.8% y/y), mainly in durable goods. As we’ve mentioned before, excess liquidity has been completely drained, and as highlighted card purchases have been weak in Q4-2022. Total investment grew 2.2% y/y, thanks to the better performance of both machinery and equipment and construction. The positive external sector contributed to economic growth, with an increase in exports and a fall in imports, the latter thanks to the slowdown in private consumption. Taking the above into account, we reaffirm our upward bias for our 2022 GDP growth projection, assigning a downward bias for 2023 GDP growth.

The current account registered a significant deficit of 9.9% of GDP in the year to Q3-2022—its highest in several years. By components, it shows a slightly positive balance of goods trade against a large negative balance in services and primary income. In our opinion, the adjustment is already underway in the fourth quarter of 2022. The factors behind the loss of national savings have been receding as fiscal consolidation progresses, in the absence of no more new withdrawals from pension funds. At the same time, the slowdown in domestic demand, especially private consumption, would materialize in a decrease in the current account deficit from Q4-2022. The current account deficit is no longer a concern and should converge to sustainable levels by end-2023.

Colombia—Tax Reform is Almost Done; the Big Question is How the Money Will be Spent

Sergio Olarte, Head Economist, Colombia

+57.1.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

María Mejía, Economist

+57.1.745.6300 (Colombia)

maria1.mejia@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.1.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

After three months of discussion among several participants, Congress reached the first milestone of Petro’s administration, the Tax Reform. As we were expecting, the discussion resulted in many changes to the first draft and a reduction of the potential additional revenues. In fact, from the initially expected size of COP25tn (1.7ppts of GDP), the final bill is expected to provide ~COP19tn (1.4ppts of GDP), which is still the most ambitious tax reform ever passed by Congress in Colombia.

Before explaining some details of the tax reform, we think it is worth noting some aspects that the tax reform process has shown.

1) Institutions in Colombia work effectively. When Petro was a candidate, he spoke about a COP70tn tax reform, then moderated the expectation to a COP50tn tax reform and, once he became president, he asked for a COP25tn tax reform, and then ended up with a different text and a watered-down version. Most of Congress is willing to discuss Petro’s reform, but he has no majority in Congress, so he can not pass any reform he wants. In other words, Congress and parties in Colombia establish their independence and there are some red lines that they are not willing to cross. In fact, as a final step in the institutional framework, the Constitutional Court will also verify that the Tax Reform process operates under the law. The government wants to comply with the fiscal rule and consolidate fiscal sustainability in the long run. We believe that part of the fresh resources of the tax reform are compatible with the reduction of debt burden in the long run. In fact, apparently, the 2023 budget, which complies with the fiscal rule, is somehow independent of the tax reform, which means that the ~COP5tn that Congress cut from the tax reform bill will not be replaced by new debt.

2) The tax reform structure revealed the main items that Petro doesn’t want to drop. The tax reform will reduce tax exceptions for individuals and businesses, which affirm the progressive taxation goal. Meanwhile, the energy transition is reflected in higher taxes for the sector as the main contributor of additional revenues will be the oil sector, accounting for around half of the additional expected tax collection.

3) The tax reform process also showed that the government’s communication strategy must improve. President Petro and his Cabinet always started a critical discussion with vague and ‘loud’ comments to later soften their stance and negotiate. That strategy did not really work since, in the end, every time he needed to give up on some things while markets only lost confidence in the administration’s communications and punished Colombia’s main assets such as rates markets and the currency.

What’s next?

After the tax reform approval, the government is going to discuss budget additions including the expected new fiscal revenues. This debate is key since it will confirm how fast the debt burden would decrease, or if the government decides on a high level of spending. It is worth noting that regional elections in October 2023 would motivate the government to maintain an expansive fiscal mode. However, as economic activity continues to surpass expectations, tax collection would support a more balanced fiscal picture. Petro has defended key topics such as energy transition, land reform, and progressive taxation, which would involve higher subsidies on the spending side. But we have to wait and see.

In mid-December, we expect to see some advancement in fiscal objectives with the Financing Plan for 2023. We expect the government to affirm the willingness to reach a primary surplus which would mean lower financing pressure for the year ahead.

Mexico—Quiet Week in Mexico on the Data Front, as Monetary Policy Implications are Pondered

Eduardo Suárez, VP, Latin America Economics

+52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

This has been a very quiet week for Mexican data, squeezed in between Banxico’s 75bps hike, and next week’s GDP and inflation prints. However, following the decline in Mexico’s inflation and a benign US inflation print we did have a repricing of the Mexican curve, and with it the implied monetary policy curve, which we think is now pricing in too dovish a scenario. Banxico is priced in kicking off its easing cycle at some point near the beginning of the summer. In the last inflation print, headline inflation was still over twice the ceiling of Banxico’s tolerance band, and core inflation maintained an upward bias (bi-weekly core inflation rose to 8.45% y/y). With that in mind, we think the base case scenario is that Banxico’s cuts will kick off towards the end of 2023.

In addition, during an event organized by Mexico’s Pension Fund Association, economist Paul Krugman said this is not yet the right time for Mexico to think about decoupling from the Fed. We agree. Mexico’s inflationary dynamics are at this point in the cycle worse than the Fed’s, as core maintains an upward trend, and the adoption of USMCA standards into Mexican wage negotiations from now until summer 2023 is likely to make wages quite sticky at high levels. Hence, we think Banxico’s decoupling should be a Q2-23 story, when markets are already pricing such an event, without destabilizing local markets.

On the political front, most of the relevant macro-financial relevant events are currently in cruising mode, outside of the power sector clash between Mexico & Canada/US under the USMCA state-state dispute mechanism. The consultation period was extended, but this ends in around three weeks. Indications from President Lopez Obrador in his morning pressers suggest he is seeking to settle the issue by granting existing investors the permits they need to complete their investments, while it appears that the US and Canada are looking for ‘horizontal’ legislation and rules of the game that will protect not only existing investors, but future ones as well. We should receive information on whether the dispute will reach arbitration in the over the next three weeks.

Peru—GDP to Accelerate in Q4-2022 Due to Quellaveco Mine

Pablo Nano, Deputy Head of Economic Research

+51.1.211.6000 Ext. 16556 (Peru)

pablo.nano@scotiabank.com.pe

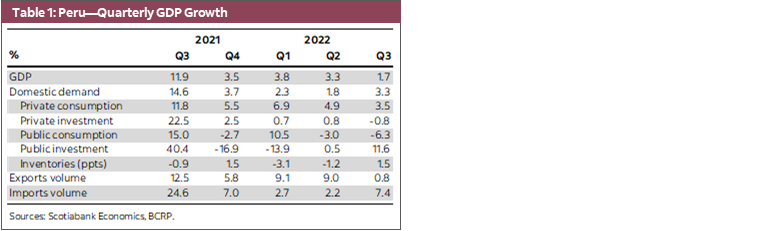

The BCRP published Q3 GDP data on Thursday showing that the country’s economy expanded by 1.7% y/y.

Domestic demand grew 3.3% during 3Q22, slightly above our estimate of 3% and well above the headline GDP expansion over the period (table 1). There were no major surprises, except for a more notable slowdown in exports and a higher-than-expected contribution from inventories (1.5ppts).

Private consumption (+3.5%) continued to grow above domestic demand, as a result of the gradual recovery in salaries, the elimination of restrictions associated with COVID-19 and the availability of extraordinary incomes (withdrawals from pension funds and CTS deposits).

Public investment (+11.6%) was favoured by spending at the regional and local government level, as these set on the final stretch of their administration. However, central government spending remained in negative territory due to the continuous changes of ministers and the lack of experience of new public officials.

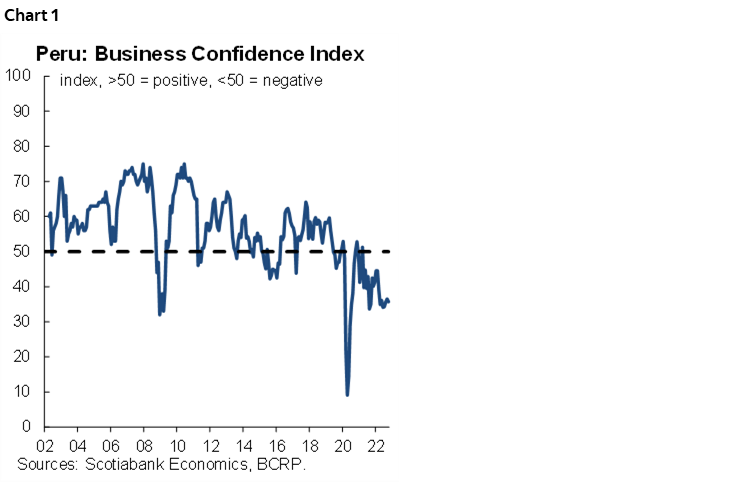

Private investment (-0.8%), as expected, showed a drop, explained by a decrease in mining investment (-12.5%) after the completion of the Quellaveco copper megaproject, which required an investment of USD5bn and began operations in September. Non-mining investment (+0.8%) remained stagnant, in line with the evolution of business expectations that have been negative for 18 consecutive months (chart 1).

For the fourth quarter (Q4-2022) we project that GDP growth will accelerate to 2.3% mainly due to the increase in the export volumes with the start of operations at Quellaveco. Likewise, we anticipate that dynamic private consumption will continue since the factors that drove it during Q3-2022 will remain in force. Finally, private investment should remain depressed as persistent political noise and quarrelling between the government and Congress impacts business expectations.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.