ECONOMIC OVERVIEW

- It’s been an eventful month in Latam and key developed markets, with a multitude of central bank decisions, some surprisingly hawkish, some more dovish, and some pretty much as expected.

- Overall, global markets have not taken well to hawkish developments and month/quarter-end adjustments are an additional risk next week.

- We have only BanRep’s decision to go next Friday before returning fully to the cycle of data and speculation about what the next moves by officials will be.

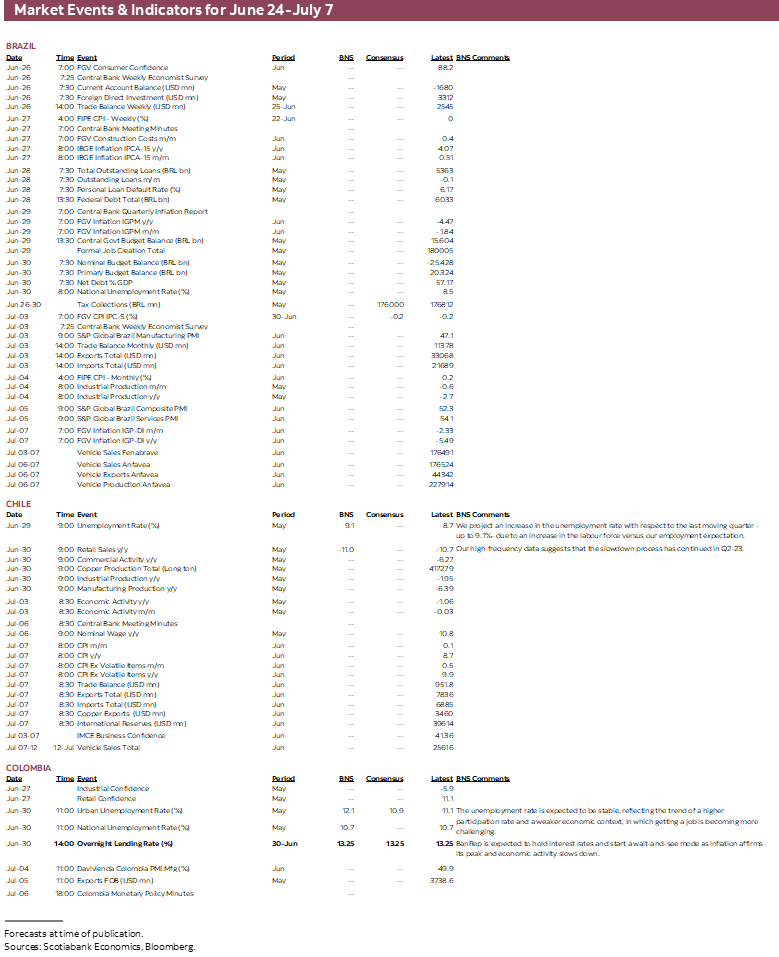

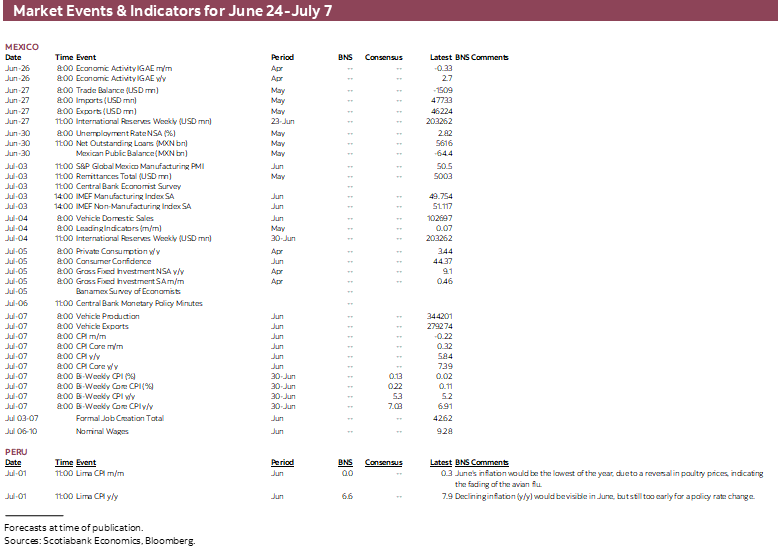

- The week also has a collection of Chilean economic figures (unemployment, industry-level activity), Mexican economic activity, and Brazilian mid-month inflation alongside the BCB’s minutes and quarterly report.

- Peru’s calendar is again devoid of key figures or events, but in today’s report our economics team revises their 2023 GDP growth forecast lower after disappointing data and weather risks.

PACIFIC ALLIANCE COUNTRY UPDATES

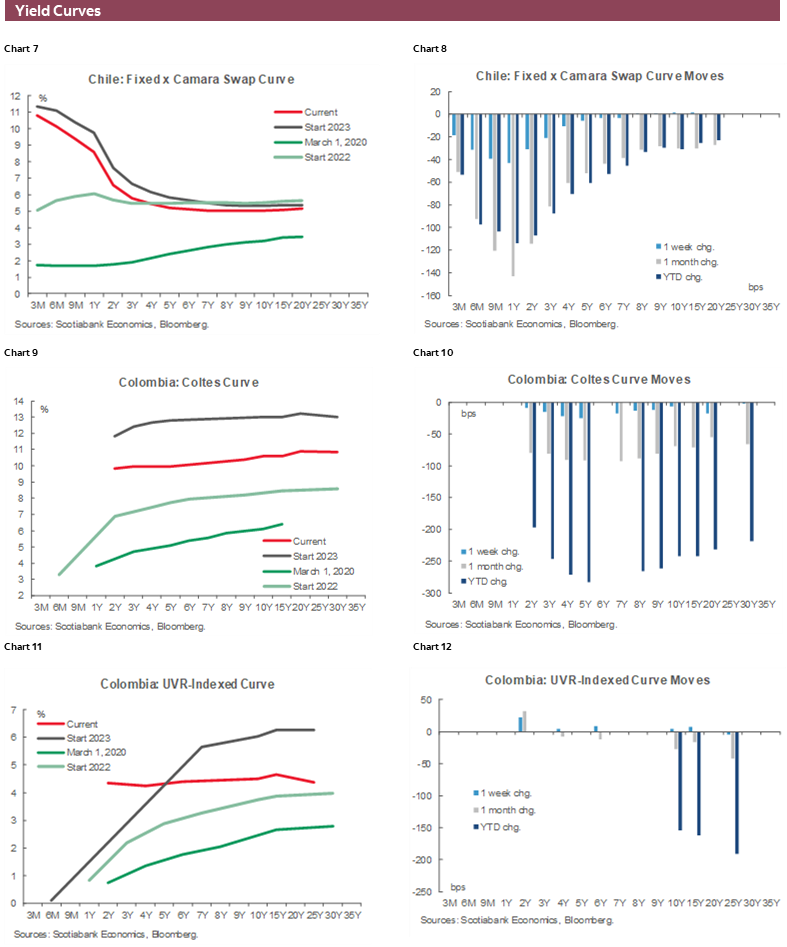

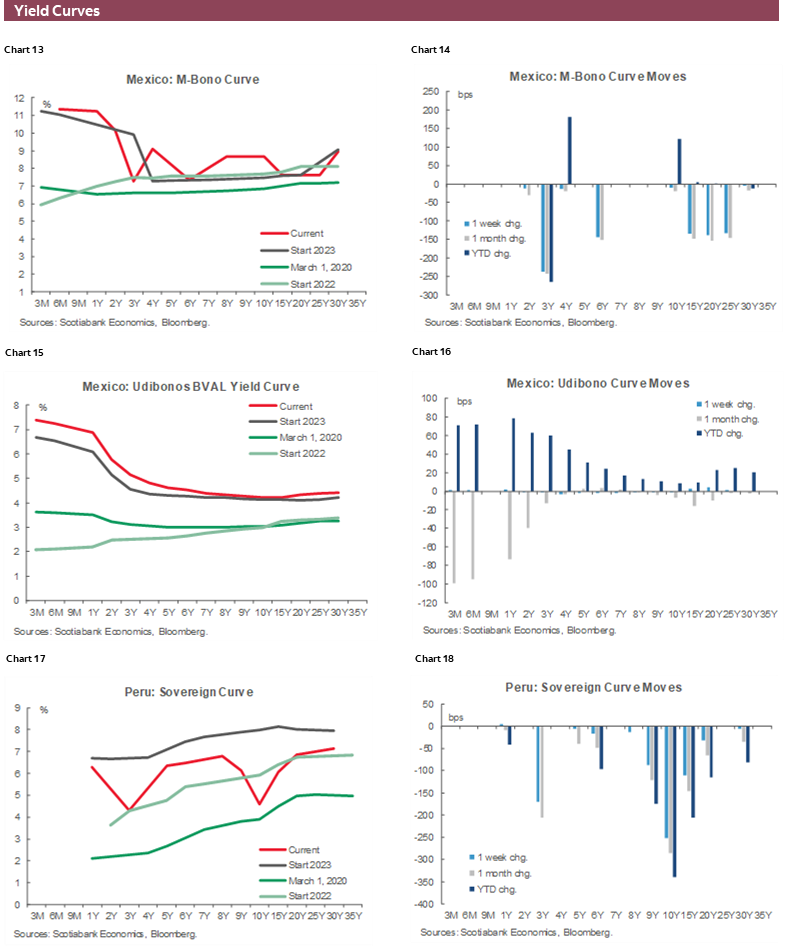

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia and Peru.

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period June 24–July 7 across the Pacific Alliance countries and Brazil.

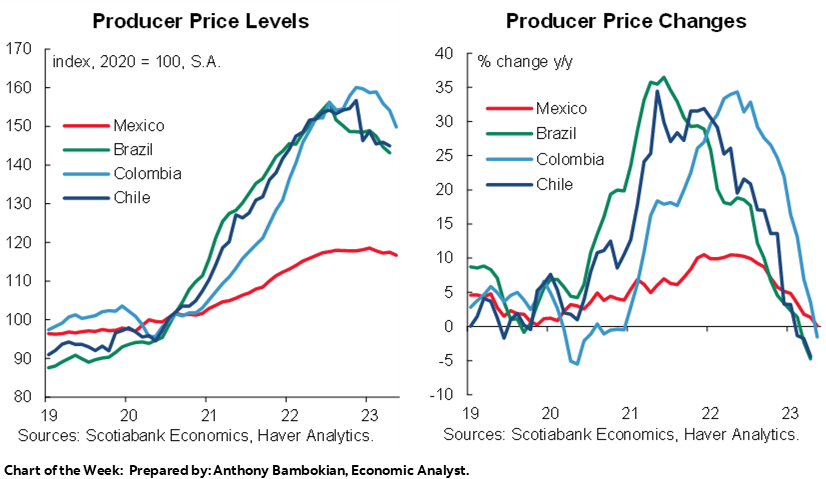

Charts of the Week

ECONOMIC OVERVIEW: CHILE MACRO, BANREP DECISION, PERU GROWTH DOWNGRADE

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- It’s been an eventful month in Latam and key developed markets, with a multitude of central bank decisions, some surprisingly hawkish, some more dovish, and some pretty much as expected.

- Overall, global markets have not taken well to hawkish developments and month/quarter-end adjustments are an additional risk next week.

- We have only BanRep’s decision to go next Friday before returning fully to the cycle of data and speculation about what the next moves by officials will be.

- The week also has a collection of Chilean economic figures (unemployment, industry-level activity), Mexican economic activity, and Brazilian mid-month inflation alongside the BCB’s minutes and quarterly report.

- Peru’s calendar is again devoid of key figures or events, but in today’s report our economics team revises their 2023 GDP growth forecast lower after disappointing data and weather risks.

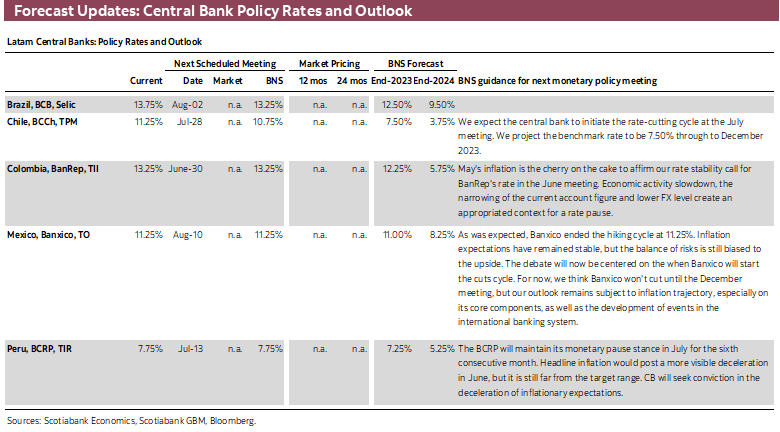

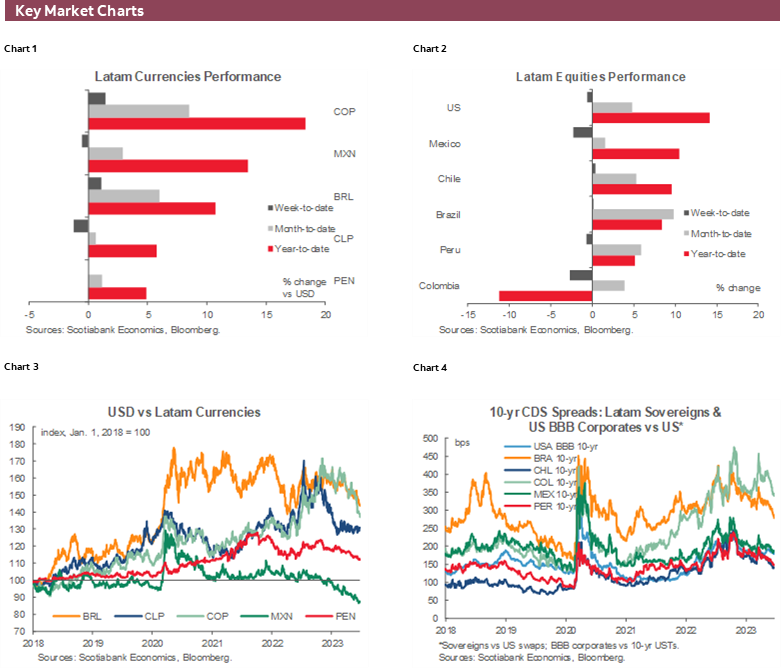

It’s been an eventful month in Latam and key developed markets, with surprisingly hawkish decisions from central banks in the US, UK, and Canada, among others, mostly as-expected Banxico and BCRP announcements, but a slightly more dovish BCCh against a stubbornly neutral BCB.

The second half of the month has also seen some of the earlier trends reverse in markets. The USD is looking better against a broad basket of EM and DM currencies, though in Latam only the MXN has seen a clearer cooling of gains—and this may just be a consolidation period—while other regional FX trade more range-bound or even record slight gains.

The risk mood has weakened since late last week as traders consider that the necessary aggressive fight that central banks are bringing to inflation could result in more malignant growth outcomes. It could also simply be a correction from overbought conditions in equities. Commodity prices weren't doing too poorly, until disappointing PMIs added to global growth worries (China, especially) and the ~3.5% decline in Bloomberg’s commodity prices index is its largest weekly drop since mid-March.

We’ll see what month/quarter-end position adjustments bring next week for moves in markets, while European, Canadian, Australian, Japanese, and US prices data, Chinese PMIs, and numerous central bank events over the period also keep global traders busy.

Within our coverage, we have one more central bank to go before returning to the cycle of data and speculation about what the next move will be. That institution is BanRep. There shouldn’t be too many fireworks, however, but the decision will be important in that it will be the first on-hold meeting of the current cycle.

Colombian data have been weak, of late. Economic activity surprisingly contracted 0.8% y/y in April according to figures released earlier this week. Inflation has peaked, and inflation expectations are on a clear downtrend, while the stronger COP is also cause for optimism via imported price pressures.

In today’s report, our Bogota economists look at the factors that lead them (and the totality of those polled by Bloomberg) to call a rate hold. Where Friday’s decision will be of greater interest will be the bank’s outlook and message around how many meetings the policy rate will remain at 13.25%.

The team thinks officials will hold off on rate cuts until Q4, when they see 100bps across the two meetings in the quarter. It’s somewhat of a long wait for local markets until the policy decision, and only business confidence gauges on Tuesday and unemployment rate data a few hours before BanRep’s announcement are due for release next week.

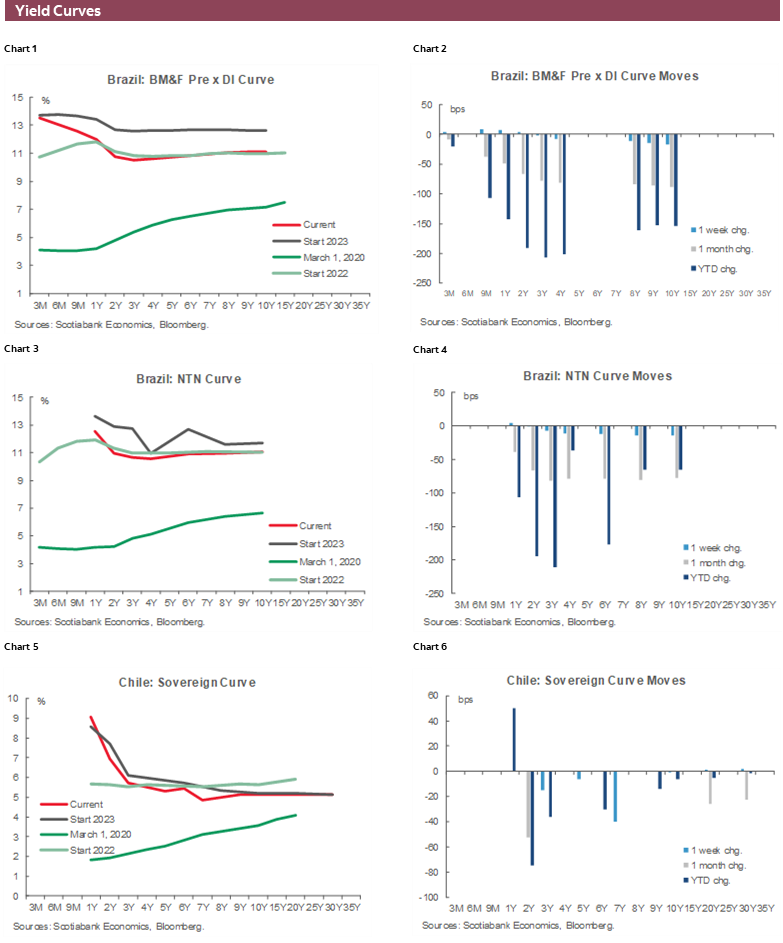

The tail-end of the week also has a collection of Chilean economic figures. Starting with unemployment data on Thursday, and followed by retail sales, industrial/manufacturing production, and copper output readings on Friday, our economists in Santiago will likely have more evidence to affirm their view that the BCCh will begin rate cuts in July. Today’s Chile section covers their expectations for these data releases.

The Mexican week ahead is a bit more front-loaded, kicking off with IGAE data for April on Monday and May international trade numbers on Tuesday with a break until the release of May unemployment on Friday. Mexico’s statistics agency’s advanced indicator of economic activity points to a 2.4% y/y increase in economic activity in April, down from the March 2.7% y/y IGAE reading, while teeing up a May increase of 2.5%. That’s decent, and not too far off 2015–2018 average rates of activity growth but it does represent a slowing from the 4.5% pace in January 2023.

In any case, the data should not be a smoking gun for Banxico as an influence on when it may first reduce its overnight rate (see our Banxico flash here). Unemployment data may play a bigger role in keeping policy easing at bay. At around 2.8%, the unemployment rate is at its lowest since the early-2000s, and will likely not change materially in next week’s data.

In Brazil, the main event will be the release of the BCB’s Quarterly Inflation Report on Thursday, where Campos Neto will defend the COPOM’s decision to leave guidance little changed against expectations that they would lay the groundwork for cuts to begin in August. Maybe that was the prudent thing to do, as that gives them six weeks worth of additional data. If a cut is warranted in early-August, then fair enough. If it’s not, then the BCB could not be accused of misleading markets and firms or households. It will probably be time to begin the easing cycle. We’re not in the government’s camp of suggesting the BCB risks wrecking the economy without cuts, but concede that realised and expected inflation declines and economic activity sputtering qualify as enough progress to not need a nearly double-digit real policy rate.

Ahead of the report, Tuesday’s IPCA-15 inflation for June may even fall below 4% y/y for the first time since October 2020. The bank’s meeting minutes out on the same day may compensate for the ‘gray’ guidance at the announcement, but don’t rule out the BCB waiting until the last second to give an indication that policy easing is nearing. Do watch on Monday the BCB’s weekly economist survey’s results for a marginal chance that the median economist adjusts their Selic rate call. Fiscal accounts out on Thursday’s could be worth a look, too.

¿Perú, qué está pasando? The economy is not having a good first half of the year—and the second half outlook does not inspire confidence. Social unrest could only be blamed for weakness in early-year. An underwhelming ‘rebound’ from these disruptions left a lot to be desired, and now a spectre is haunting Peru—the spectre of El Niño. The weather phenomenon is having a clear impact on the country, namely in primary sectors like agriculture and fishing. There are some bright spots in the economy, like mining (but that was expected), though overall the country’s GDP growth for 2023 will now undoubtedly be lower than our Peru economists had anticipated prior to the most recent round of data. With no relevant data releases nor events in next week’s calendar, our Lima colleagues outline the drivers behind their projection of weak GDP growth in Peru, of 1.4% from 1.9% previously.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Deterioration in Private Consumption Has Deepened in Q2-23, Reducing Inflationary Pressures

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

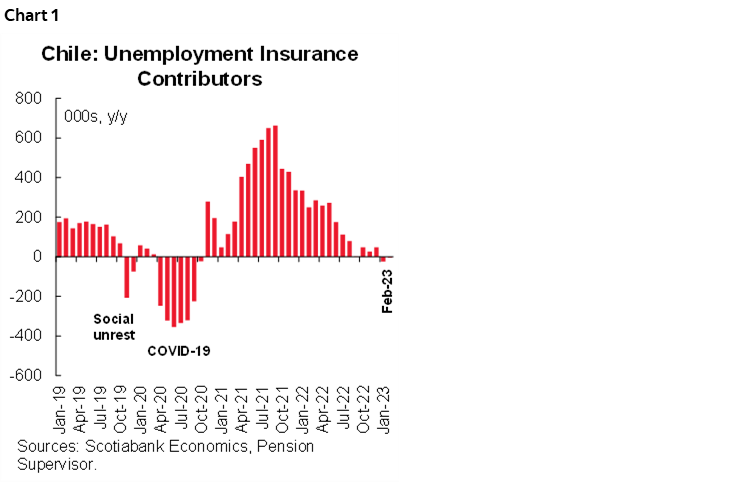

On Thursday, June 29, the statistical agency (INE) will publish unemployment rate data for the quarter ending in May. We project an increase in this indicator with respect to the last moving quarter—to 9.1% from 8.7%—due to an increase in the labour force versus our employment gains expectation. In this sense, we see that both public and private salaried employment will continue to show less dynamism than in previous quarters, mainly the private sector which is losing employment due to the deterioration of labour-intensive economic sectors. We compare the INE figures with the unemployment insurance data for private salaried employment (contributors), which confirms the slowdown in job creation. In fact, with data as of February 2023, we see marginal job losses (chart 1), which we estimate would have continued in the following months. In our view, the outlook for the labour market is negative for the coming months, and would affect the dynamism of economic activity indicators, mainly private consumption and trade.

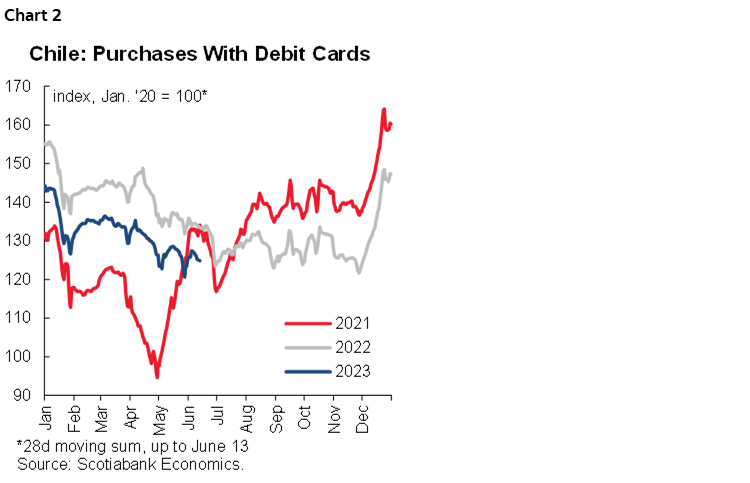

We project an 11% y/y decline in retail sales, which mirrors year-over-year contractions in all economic sectors except tourism that is growing compared to last year. Based on our short-term indicators of debit card purchases (chart 2), we observe a sharp decline in demand for durable goods in May and a slowdown in purchases of semi-durable goods. Services, on the other hand, showed stabilization at low levels.

In our view, the slowdown in economic activity—and in private consumption—will continue in the coming months, and should be one of the main drivers of the decline we project in core and headline inflationary pressures. We reaffirm our forecast for CPI inflation to decline to 3.7% in December 2023.

Colombia—Economic Activity: Surprising Contractions and Decelerations in Key Sectors

Sergio Olarte, Head Economist, Colombia

+57.601.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.601.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

Santiago Moreno, Economist

+57.601.745.6300 Ext. 1875 (Colombia)

santiago1.moreno@scotiabankcolpatria.com

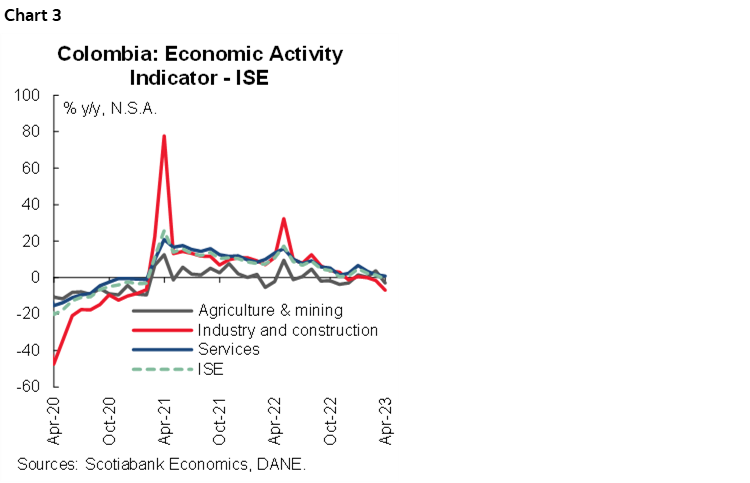

This week, the National Administrative Department of Statistics (DANE) released information regarding the performance of Colombia’s economic activity during April 2023. With a year-on-year contraction of 0.8% (chart 3), the Economic Activity Indicator (ISE) surprised the market by falling below the expectations of Bloomberg analysts (+0.2% y/y in April 2023) and its weakest since mid-2016 (excluding the declines caused by the pandemic in 2020). This decline is primarily attributed to moderation in activities related to the manufacturing industry, as well as the construction of buildings and civil works, which the DANE categorizes as secondary activities and recorded a 6.8% y/y decline in April 2023.

Furthermore, agribusiness and mining activities also experienced a decline of 2.9% y/y due to higher costs and climate issues. However, in the agribusiness sector, producer prices have undergone significant moderation in recent months, reaching single-digit annual variations. This moderation will provide relief in food production in the upcoming months and continue to have a positive impact on food inflation despite the possibility of El Niño phenomenon.

Regarding retail and services activities, although they have considerably decelerated over the past year (second only to the performance observed during the pandemic), they exhibited growth of 0.8% y/y in April 2023 compared to the same period in 2022. This growth was driven by the financial and insurance sector (+5.0%) and the public administration, education, and entertainment sector (+1.6%). However, the commerce and vehicle sector experienced a decline of 1.7% y/y in April 2023.

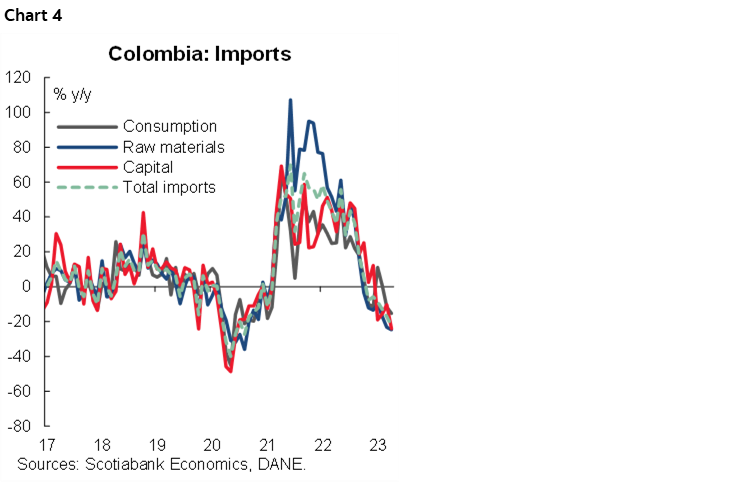

Aligning with these results, the most recent imports data up to April 2023, published by DANE on June 21st, corresponds with the economic activity deceleration, with imports amounting to USD4.9bn, reflecting a decrease of 22.7% y/y (chart 4), reaching the lowest levels since July 2021. Manufactured goods contracted by 22.7% and accounted for the largest share of total imports (72.8%). As for the trade balance, it recorded a deficit of USD0.9bn, showing a decline of 14.7% compared to the previous month’s USD1.1bn deficit.

In consequence, the economic slowdown, coupled with inflation decreasing, inflation expectations moderating, and FX appreciation, could lead the Board of Directors of the Central Bank of Colombia to evaluate holding the policy rate at 13.25% at the upcoming meeting on June 30th. This is aligned with our view.

On the political front, the regular legislative period in the Colombian Congress concluded on June 20th. The balance of the first year of President Gustavo Petro’s government in terms of social reforms includes the approval of a Tax Reform during the initial months of his administration, as well as ongoing debates on Health and Pension Reforms. While these reforms passed the first debate, they still have three more debates ahead. Since debates on those reforms have taken longer than expected, it’s highly probable that they could be significantly watered down.

The Labour reform has failed in gaining support even for the initial stage. However, the government will present it again during the next legislative session, which begins on July 20th. We shall see if the government moderates the proposal to gather improved support.

The budget addition, amounting to COP 16.9 trillion, was approved today (June 23) after going through the appropriate processes. These developments once again demonstrate that institutions in Colombia are strong and have pushed the Government to reach agreements with various sectors to push forward with initiatives in the coming months, especially considering that the President’s disapproval rating has reached 60% according to the latest survey.

Peru—Unlike the Weather, the Economy is Cold in Peru; We Revise our 2023 GDP Forecast Significantly, From 1.9% to 1.4%

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

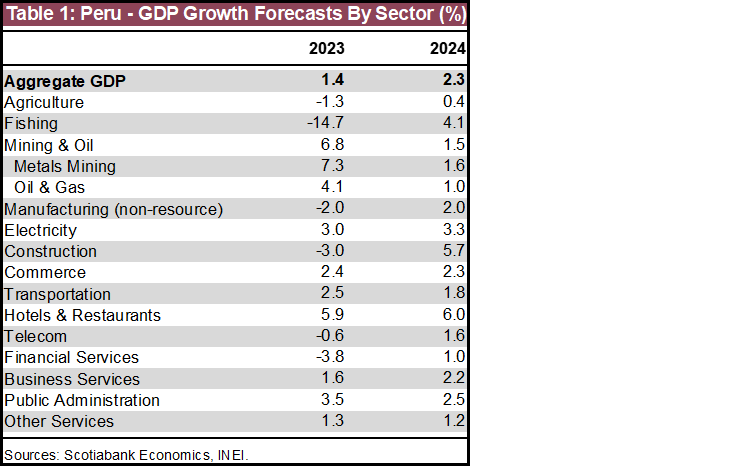

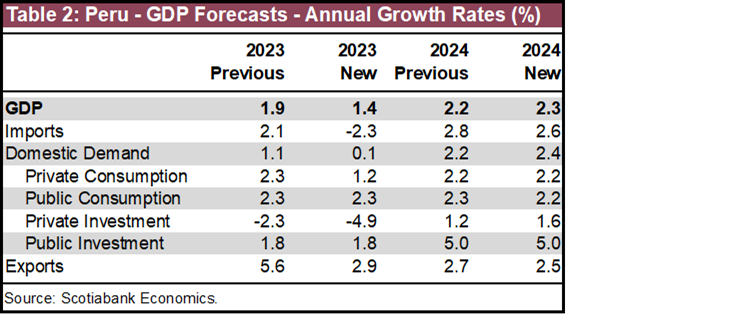

Not to be too dramatic, but we’re reducing our GDP forecast for 2023 from 1.9% to 1.4%.

This puts us a bit at odds with market consensus, which is closer to where we were previously,1.9% in the Bloomberg and Focus Economics surveys. Recently, the BCRP reduced its GDP forecast from 2.6% to 2.2% so we are distancing ourselves even a bit more from the BCRP despite their forecast cut.

In general terms, our change in GDP forecast owes to two factors. First, the growth trend so far in 2023 has been very weak; and secondly, we’re seeing a greater impact of El Niño-related severe weather on GDP this year than we had expected.

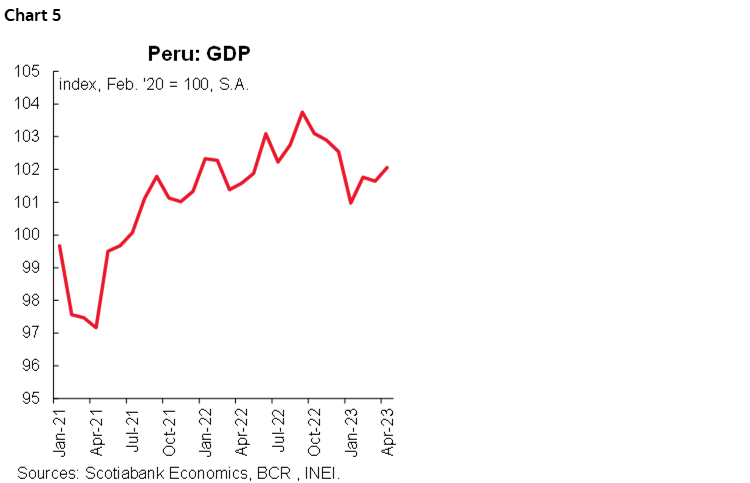

Let’s start with the GDP growth trend. April GDP growth of 0.3% y/y, which was released last week, was telling. Growth in Q1 was -0.4% y/y, which was not good, but could largely be explained away due to one-off events such as the January–February protests/roadblocks, and severe weather in March (chart 5). These unique events should have largely dissipated in April. And yet April GDP was also weak, and well below the 1.5% to 2.0% that would have represented a normalization of the economy.

The economy is not rebounding in Q2 like we had expected. What’s more, a feeling of deceleration in the economy has heightened and gives the sensation that it will last for a while. The economy is cooling very slowly. The seasonally-adjusted GDP index suggests that the economy peaked in September 2022, and has been languishing since. The index has improved over the last three months, but not with the determination we were hoping.

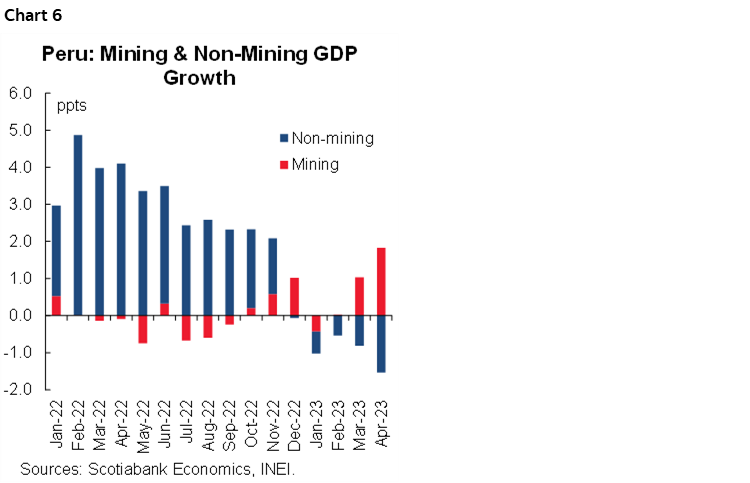

The situation becomes a bit more dramatic when we take a deeper dive into the data. Since December 2022, to the extent that there has been any growth at all, this has been nearly exclusively due to mining. Non-mining growth has been consistently negative so far in 2023, including April, long after the protests were over (chart 6). There is no doubt that the message that April GDP gave us is that this is a very cold economy.

The two sectors that are most representative of the economic chill are manufacturing and construction. Manufacturing was down 6.8% y/y in the year-to-April. This is a broad-based segment of the economy and includes exported goods such as textiles, but the main reason for the decline is domestic. We are lowering our forecast for Non-Resource Manufacturing GDP from +1.5% to -2.0%.

Construction declined 9.8% y/y in the year-to-April. This is significant. High interest rates and the increase in prices for construction materials have led to a decline in residential construction, especially in the informal sector, whereas office building construction, and weak overall investment have also played a part.

The good news is that mining is keeping up with expectations. Other sectors that are doing relatively well include electricity (linked to mining), commerce and hospitality sectors (table 1).

The second factor behind our forecast change is the impact of severe weather. Agriculture GDP plunged 14% y/y in April (and is down 4.6% y/y in the year). This is the type of performance which in the past has been frequently linked to severe weather events. It is our understanding that April was a bit of an exaggeration, as the figure reflected a delay in harvesting due to unusually warm weather, rather than lower productivity. Crop yields will suffer this year, but not to the extent suggested by April, but enough to lead us to lower our Agriculture GDP forecast for 2023 from +1-5% to -1.3%.

The other sector harmed by El Niño is fishing. Fishing GDP has a very low weight in GDP, but needs to be taken into account when large fluctuations occur, as we expect in 2023. Fishmeal fishing is controlled and has two seasons per year. The current fishing season, April to July, has been delayed, and is at risk of not taking place altogether, as El Niño weather impacts both quota availability and production cycles. The next season, which normally begins in November, is also at risk to some extent, if a new El Niño episode begins in December, as expected. Taking all of this into account, we are sharply reducing our Fishing GDP growth forecast for 2023 from +6.9% to -14.7%.

Our forecasts for domestic demand components have a greater degree of uncertainty about them, since official sources provide information with a greater delay. We are not modifying our forecasts for public sector spending. All the impact of a slower economy is in the private sector. This has to do with the private sector being endogenous, whereas the public sector is exogenous and less vulnerable to outside impacts.

We are lowering our forecasts for private consumption, from 2.3% to 1.2%, and for private investment from -2.3% to -4.9%. As a result, we expect domestic demand growth to be a negligible 0.1%, down from 1.1%. All figures are very soft, and in line with slow growth being witnessed in those sectors of the economy that cater to domestic demand (table 2). Private investment also correlates with the purchase of foreign capital goods, which is down 10.6% in the year-to-April. In fact, this decline in capital goods imports is a large part of the reason why we are lowering our import volumes component of GDP from +2.1% to -2.3%.

Finally, the decline in our exports growth forecast from 5.6% to 2.9% is linked to the sharp decline in our expectations for fishmeal exports due, once again, to El Niño.

In short, in 2023, Peru’s economy is being hit by the double whammy of political turbulence (early in the year), and the impact of El Niño. One is forgiven for wondering why the country is growing at all.

We are raising our 2024 forecast marginally from 2.2% to 2.3%. This is mainly math, as the lower base for 2023 plays in favour of 2024. Our 2024 forecasts already contemplate a moderate El Niño effect. We have upped the ante a little bit from moderate El Niño to moderate/strong El Niño, otherwise the impact of a lower base in 2023 would have been greater. It’s a bit early to go into too much detail regarding 2024 GDP, given the uncertainty surrounding El Niño. It is not easy to anticipate its magnitude, duration, and geographical presence, all of which affect growth.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.