ECONOMIC OVERVIEW

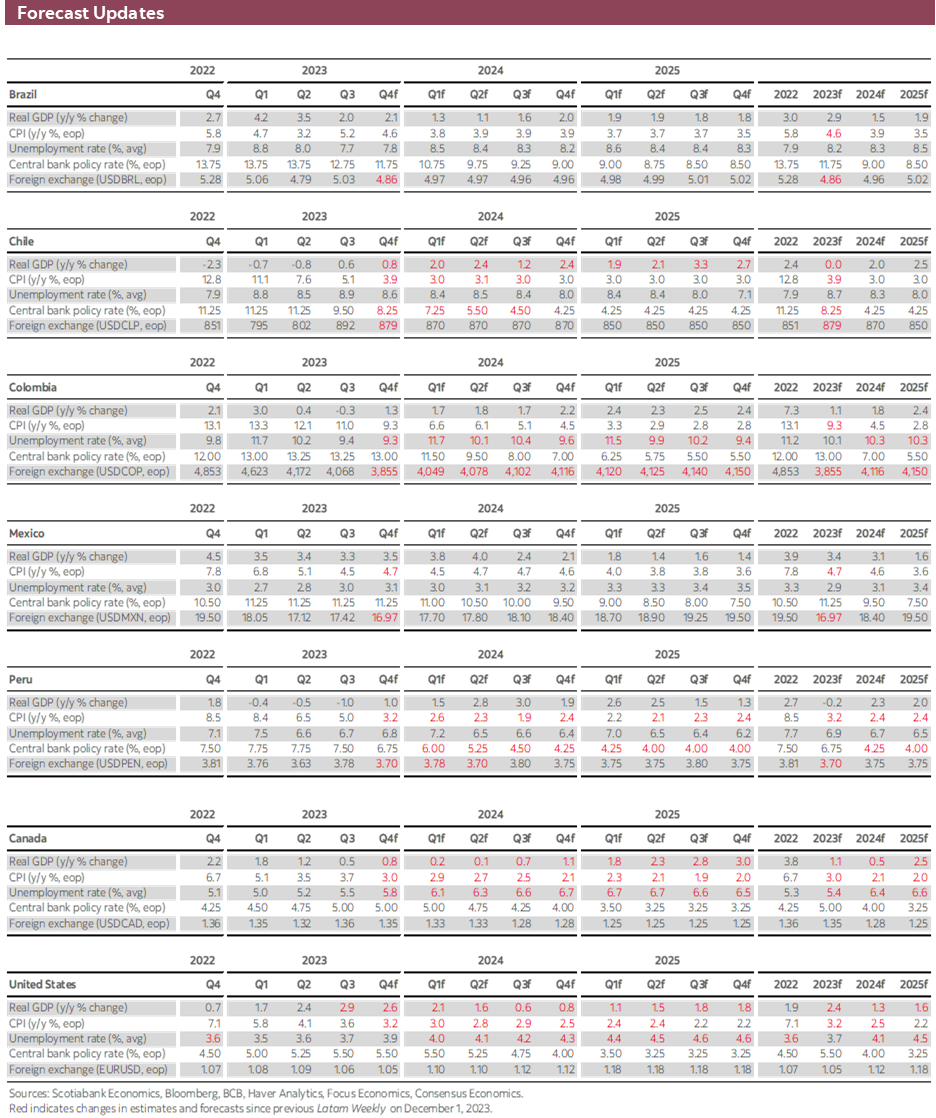

- After a busy week of inflation data in Latam and the US and the BCRP’s rate decision, we have a quieter week ahead in the region where the highlight is economic activity releases that in Colombia and Peru should interrupt a streak of negative prints though still show sluggish conditions. Chinese and US economic data, the PBoC’s decision, and geopolitical developments await as external risks for Latam markets next week.

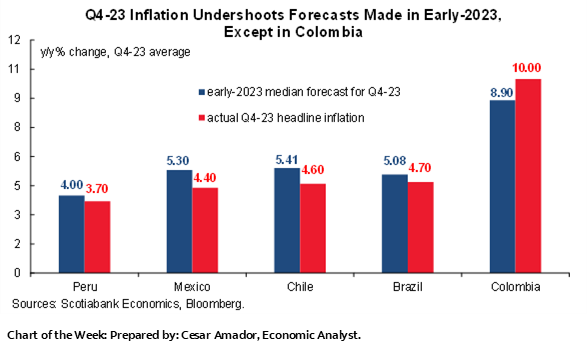

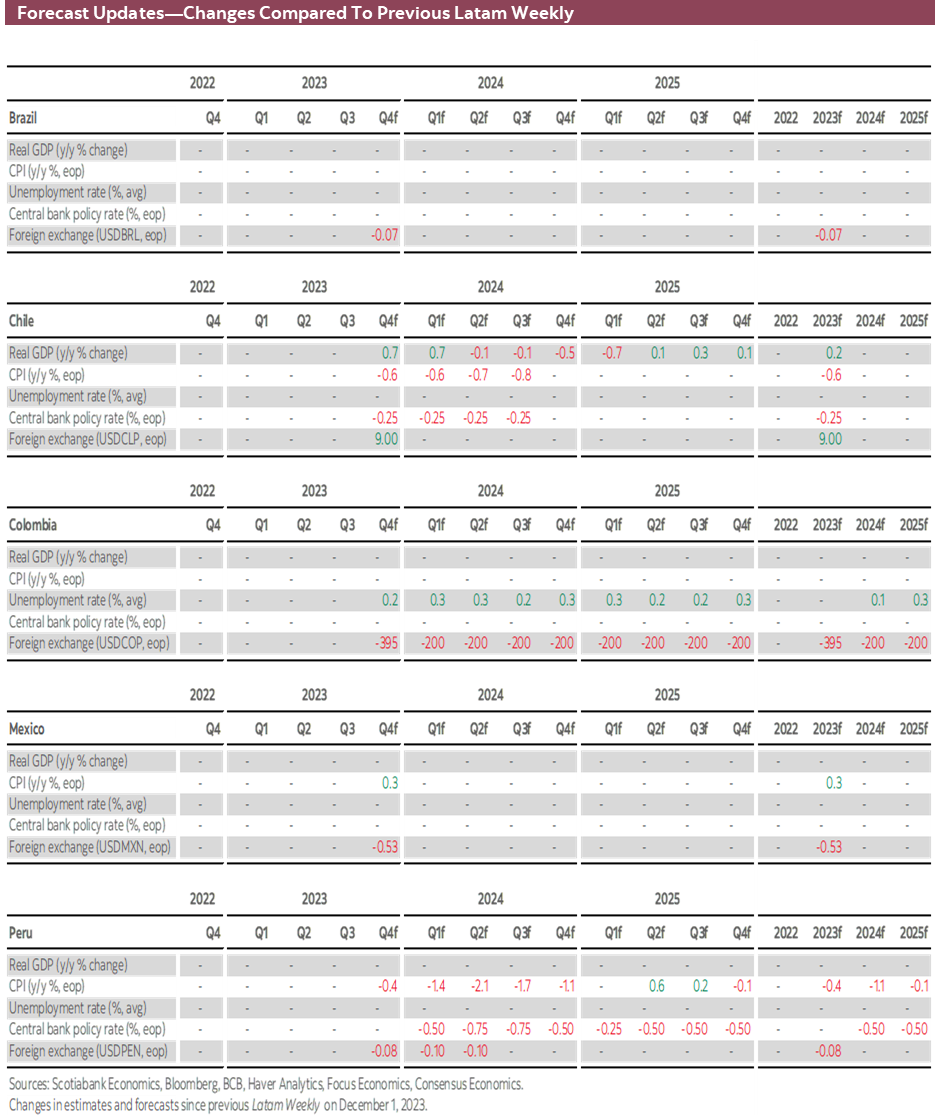

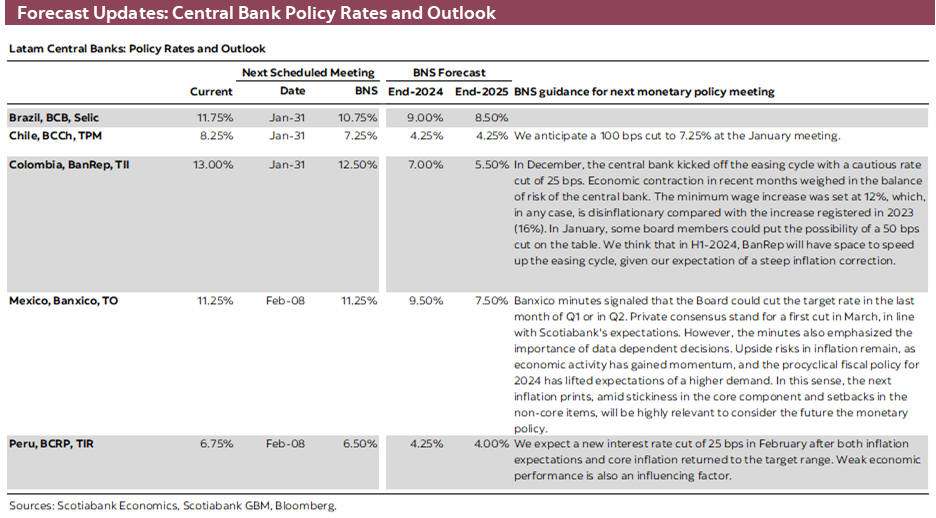

- Small inflation beats in Mexico and Brazil were of little consequence for central bank expectations, but decent misses in Colombian and Chilean figures mean their respective central banks could consider larger rate cuts at their first meetings of 2024. BanRep may have started small last month with a 25bps move, but the team discuss the chance that officials ramp up to a 75–100bps cut at the March meeting in today’s Weekly.

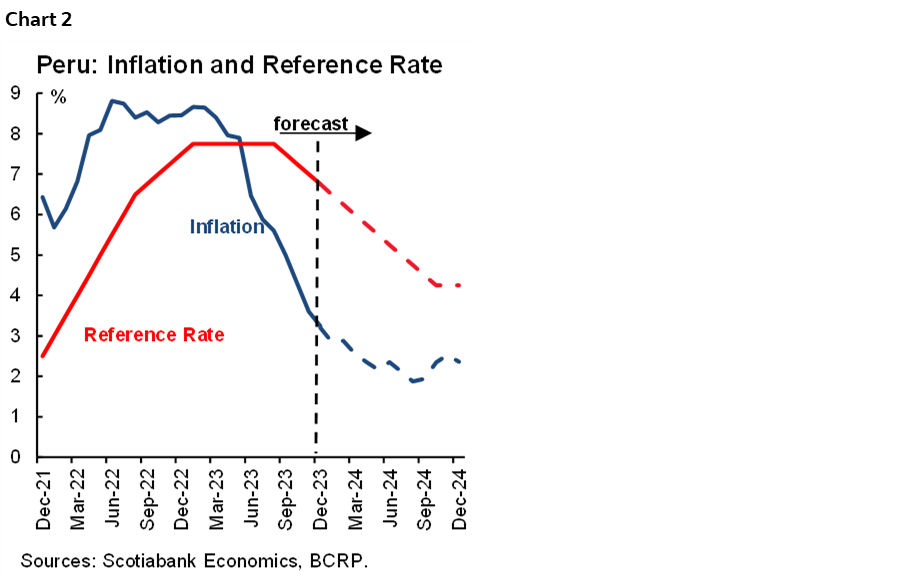

- Peru’s policymakers stuck to their 25bps cut script this week, but we think very encouraging inflation data mean the BCRP will now lower its reference rate by 50bps more than we previously expected for all of 2024 (250bps). Our economists have also slashed their inflation forecasts, as detailed in this week’s report.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Colombia and Peru.

MARKET EVENTS & INDICATORS

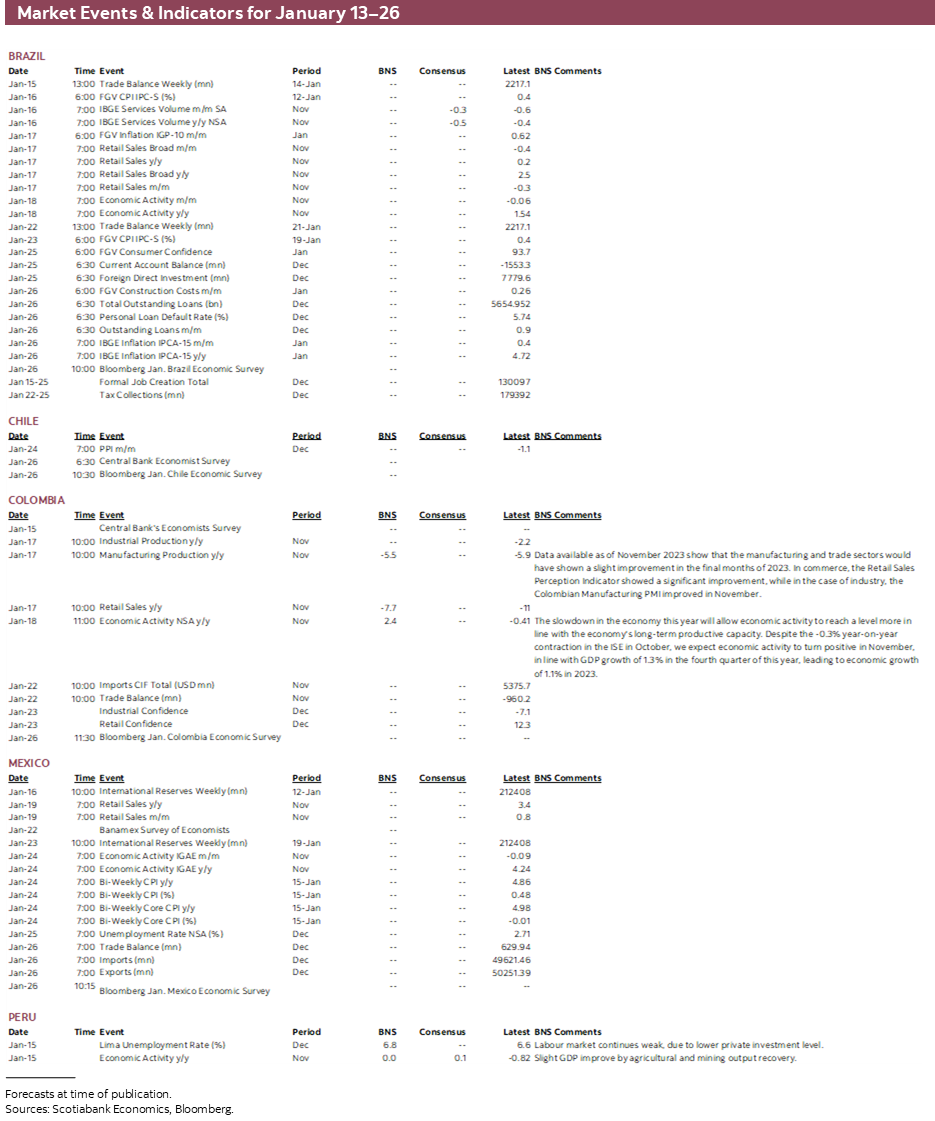

- A comprehensive risk calendar with selected highlights for the period January 13–26 across the Pacific Alliance countries and Brazil.

Chart of the Week

ECONOMIC OVERVIEW: ACTIVITY READINGS POST CPI

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- After a busy week of inflation data in Latam and the US and the BCRP’s rate decision, we have a quieter week ahead in the region where the highlight is economic activity releases that in Colombia and Peru should interrupt a streak of negative prints though still show sluggish conditions. Chinese and US economic data, the PBoC’s decision, and geopolitical developments await as external risks for Latam markets next week.

- Small inflation beats in Mexico and Brazil were of little consequence for central bank expectations, but decent misses in Colombian and Chilean figures mean their respective central banks could consider larger rate cuts at their first meetings of 2024. BanRep may have started small last month with a 25bps move, but the team discuss the chance that officials ramp up to a 75–100bps cut at the March meeting in today’s Weekly.

- Peru’s policymakers stuck to their 25bps cut script this week, but we think very encouraging inflation data mean the BCRP will now lower its reference rate by 50bps more than we previously expected for all of 2024 (250bps). Our economists have also slashed their inflation forecasts, as detailed in this week’s report.

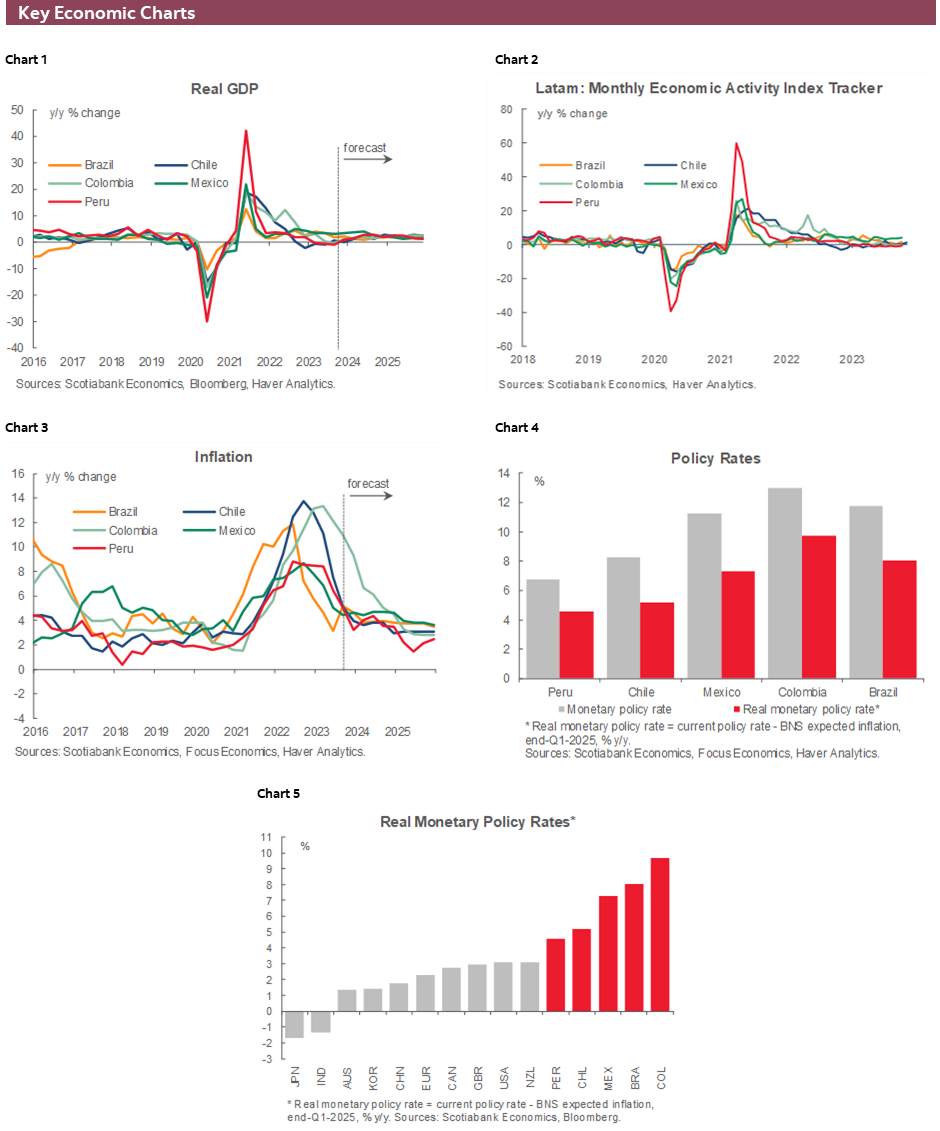

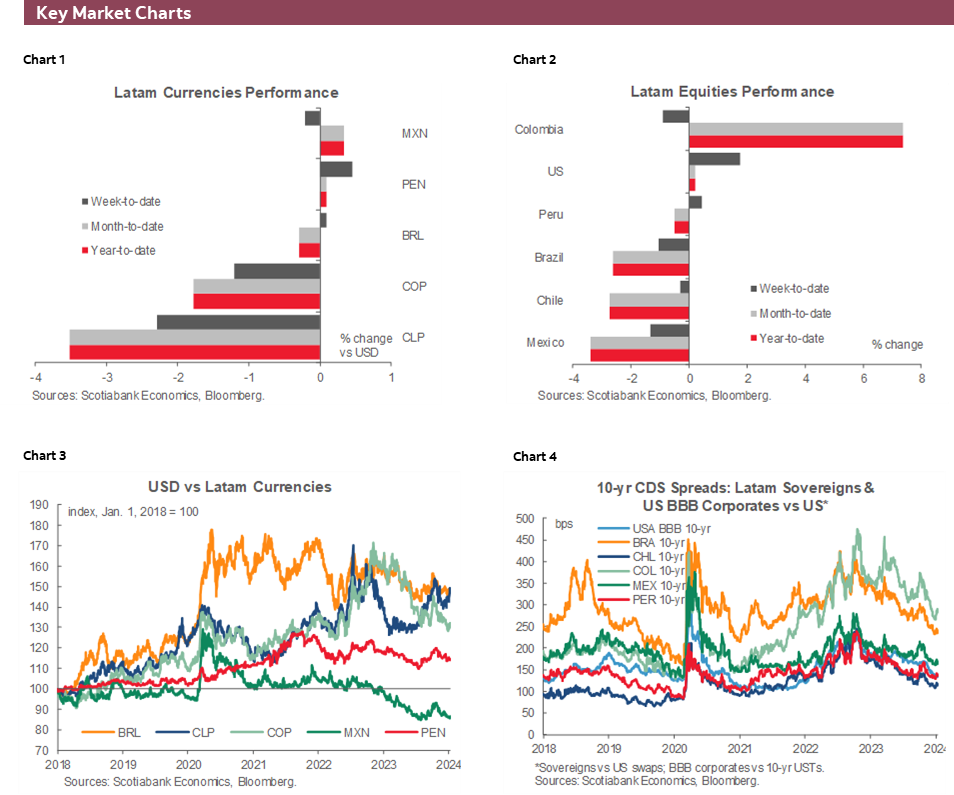

We head into the middle of the of the month with all regional inflation data for December in hand after a mixed set of reports from Chile, Colombia, Mexico and Brazil in recent days. The US CPI print also beat expectations but markets made a bit of a mess of the data and stuck to their guns that the Fed will cut ~150bps this year. Meanwhile geopolitical risks and sovereign and corporate supply were additional drivers of global market action in recent days.

In Mexico, headline inflation exceeded economists’ estimates but came in a touch softer than expected in core terms eyeing a sub-5% print in early-2024 (see here). On the whole, there wasn’t much to extrapolate from the print as far as Banxico expectations are concerned, with the bank still looking on track to begin its easing cycle in March. Brazilian inflation also slightly beat forecasts, though at 4.62% y/y still managed to close the year within the 3.25% +/-1.5ppts target range set by the BCB and monthly core price gains still point to the 2024 target of 3.00% +/-1.5ppts being met, so 50bps cuts will continue.

Colombian and Chilean inflation came in decently below forecasts, especially in the latter where underlying (ex volatiles) inflation even declined month-on-month, prompting speculation of a possibly larger BCCh rate cut in late-January (see here). That’s if the CLP cooperates, however. It didn’t this week, recording a 2.3% decline since Friday in what was the worst performance among all major currencies. But that is far from being enough to deter the BCCh from at least continuing at a 75bps click, though it is worth monitoring. Markets are currently pricing in a total of 140–145bps in cumulative reductions for January and March, with the second meeting showing a higher implied chance of a full-point cut.

As for Colombia, the December year-on-year reading was the first in single-digit territory since mid-2022 (see here) and notable declines await in the next few prints thanks to more benign indexation effects, which may mean BanRep debate a 25 or 50bps reduction on the 31st. In today’s report, our economists in Colombia discuss their expectations for a 50bps rate cut this month. Beyond the next meeting, we think that the central bank will debate much larger rate reductions at its March and Q2 meetings to adjust real policy rate settings amid fast incoming declines in inflation.

Peru’s BCRP already delivered its first rate decision of the year yesterday (January 11th), reacting to a roughly as expected 3.2% y/y inflation print in December but which showed core inflation falling below 3.00% for the first time since late-2021 (see our recap here). The BCRP’s 25bps-sized cut was in line with broad expectations but there was a slight chance that encouraging inflation data and year-ahead inflation expectations falling into the bank’s 1–3% target range would motivate a larger cut—certainly not yet given El Niño unknowns. Still, inflation has clearly surprised to the downside for a number of months now and that means our economists have had to revise their Peruvian inflation forecasts lower, as outlined in today’s note, and also include an additional 50bps in rate cuts over 2024 than previously thought.

The very busy week that we just had with the BCRP’s decision and inflation data in the Latam and the US is, unfortunately (fortunately?), followed by a relatively quiet data and events calendar in the region over the next few days. There are some notable data on tap but none are likely to shift markets or opinions to the degree that CPI releases have.

Economic activity in Peru, Brazil, and Colombia and retail sales in Brazil, Colombia, and Mexico, all for November, await. Unreliable unemployment rate data for Peru, industrial/manufacturing production readings for Colombia, and Brazilian services volumes figures fill out the calendar but should not call the shots in markets. Peru’s economy may finally show a positive y/y reading in November data after six straight months of contractions since May. Colombia’s economic activity has strung three months of y/y declines in the August to October period but we don’t see a fourth as we project a 2.4% y/y expansion. Last November was a seasonally abnormal soft month for economic activity that provides a supportive base for year-on-year growth in November 2023.

Local markets may largely follow the trend established by US retail sales and U Michigan survey releases, and maybe CPI out of the UK and Canada (where we also get retail sales) after US prices data surprised to the upside this past Thursday. The PBoC’s decision on Monday, where a small lending rate cut is expected, and Chinese Q4 GDP will be key for risk and commodity sentiment which will also take its cue from developments in the Middle East. In other geopolitical risks, Taiwanese take to the polls this weekend, with the incumbent party’s candidate (supportive of the island’s autonomy) leading the polls over a more China-friendly alternative. US markets are closed on Monday.

PACIFIC ALLIANCE COUNTRY UPDATES

Colombia—BanRep Could Speed Up Easing Cycle in H1-2024

Sergio Olarte, Head Economist, Colombia

+57.601.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.601.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

In its last official meeting of 2023, BanRep started the easing cycle in Colombia with a cautious cut of 25bps, taking the monetary policy rate to 13.00%. In our opinion, the December decision sent the message of a change in the monetary policy stance rather than thinking that this 25bps pace would be the benchmark pace of easing. Therefore, the next question/discussion regards the speed of the cutting cycle.

One of the main reasons BanRep had a split decision at the start of the easing cycle was the assessment of the progress and potential future risk of inflation. However, thinking from a monetary policy reaction function perspective, we think BanRep could speed up the easing cycle in upcoming meetings due to three reasons around the expected evolution of inflation:

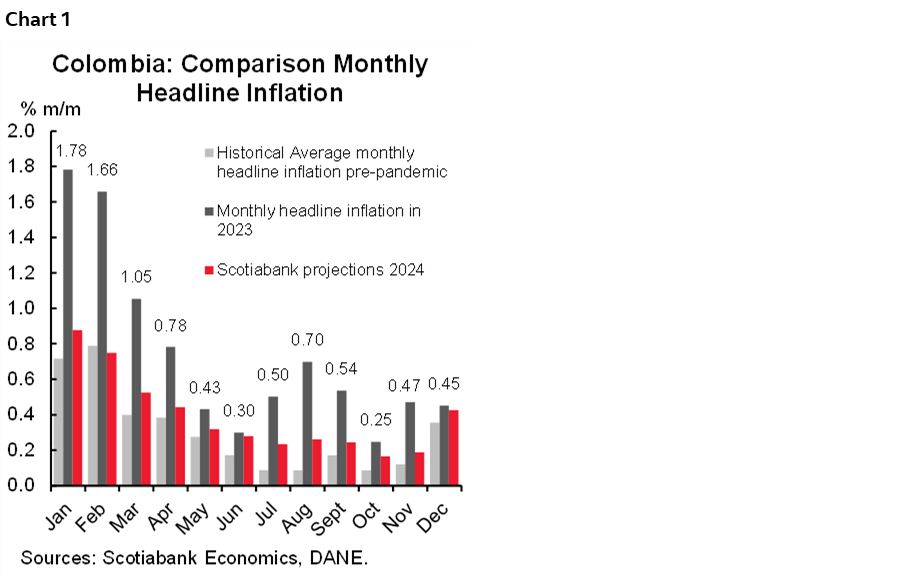

I. A high statistical base in 2023 will contribute to reducing inflation in 2024 (chart 1). Core inflation statistical effects are atypically high in H1-2024, which will help inflation ex-food and regulated prices (68% of the CPI basket) to drop significantly from 9% in December 2023 to around 6% by June 2024, while food prices should continue to help headline inflation for the same reason, a high base statistical effect in the H1-2024. The tailwind generated from statistical base effects will be concentrated only during H1-2024; in H2-2024, this effect will vanish as monthly inflation figures look closer to historical averages, and in that sense, we expect moderate inflation progress by the end of the year.

II. As headline inflation decelerates, inflation expectations will get closer to the central bank target of 3%, making the ex-ante real policy rate look too restrictive. This inflation correction can be used as an argument by the dovish members of the board to speed up the easing cycle.

III. Governor Villar stressed at the December press conference that the positive output gap already closed, and the economy can start to run below potential during Q1-2024, making it less relevant to have a restrictive real policy rate.

According to our calculations, headline inflation will be below 7.5% by February, while economic activity will continue its underperformance. Therefore, a 25bps pace would mean a too restrictive ex-post real policy rate, while headline inflation below 8% will make inflation expectations converge faster to the target, which contributes to a higher ex-ante real rate.

We expect, then, that a cut of 50 bps will be discussed, while at the March meeting we do not discard a move between 75 to 100bps cut to catch up y/y inflation deceleration, trying to keep real ex-post policy rate around neutral (2 to 2.5%).

Since we anticipate that y/y inflation deceleration will be more significant in the first half of the year, we expect BanRep to fine tune the easing cycle accordingly. Therefore, we expect March, May, and June meetings to be more aggressive in the policy rate normalization getting 9.5% by June’s meeting and ending 2024 at 7%. Of course, these projections will highly depend on disinflationary pace. In fact, the way that we see easing cycle speed is keeping real ex-post rate as close to neutral as possible, thus if inflation starts to surprise up, BanRep won’t be able to cut policy rate as quickly.

Peru—New Figures for a New Year

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

We are reducing our inflation forecast for year-end 2024 from 3.5% to 2.4%. Inflation was one of the nicer surprises during 2023. The year started with inflation at 8.7% and ended it at 3.2%. This is just a hair above the target range ceiling (the target range is 1.0% to 3.0%). Indeed, we expect inflation to fall into the target range in January when the figure is released on February 1st. Although it’s early in the month, key prices we follow are currently suggesting nil or even slightly negative inflation for January (chart 2).

The strong downtrend in inflation over the past few months is part of the reason for our new 2024 inflation view. However, there are fundamental reasons behind this trend that we are considering. The first is that our original forecast presumed a strong Niño in early 2024, and recent information now suggests that El Niño is more likely to be weak-to-moderate, thereby having less of an impact on agriculture production and on transportation. The second reason is that domestic demand has been proving particularly weak going into 2024.

One could understand if the BCRP decided to remain a bit cautious early in 2024, until there’s greater confirmation that El Niño will, in fact, be weak, which should occur in a question of a few weeks. Having said this, however, the downtrend in inflation has been strong enough to give the BCRP more room to continue lowering rates month by month without interruption. We no longer expect the BCRP to take a monthly pause or to in reducing is reference in Q1. Instead, we expect the BCRP to continue with 25bps reductions month by month, until reaching a terminal rate of 4.25% early in Q4.

Our terminal rate of 4.25% is consistent with what the BCRP considers the real neutral rate of 2.0% and with inflation expectations of 2.4%. It is possible to build a viable scenario in which inflation expectations fall below 2.4% and domestic demand remains persistently weak, in which case the reference rate could fall below 4.25%. However, our base scenario appears to be closer to a stable state, and anything more aggressive would make us feel like we’re getting ahead of ourselves.

Meanwhile, on Monday, January 15th, November GDP figures will be released. Most of the pre-released figures so far suggest mildly positive GDP growth in November. The figures that have been pre-released include mining, up 10.6% y/y, agriculture & livestock, up 1.2% y/y (a turnaround from earlier months) and Fishing rising a significant 61.0% y/y. On the other side of the slate, oil & gas declined 8.0%, and cement sales fell 8.4%, which will drag construction GDP down by a similar figure. On balance, the figures suggest GDP growth of between nil and +0.5%. The most important thing about November GDP, however, will be parsing the sectors growth figures to see what their trends suggest regarding how strongly the economy may turn around in 1Q2024.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.