ECONOMIC OVERVIEW

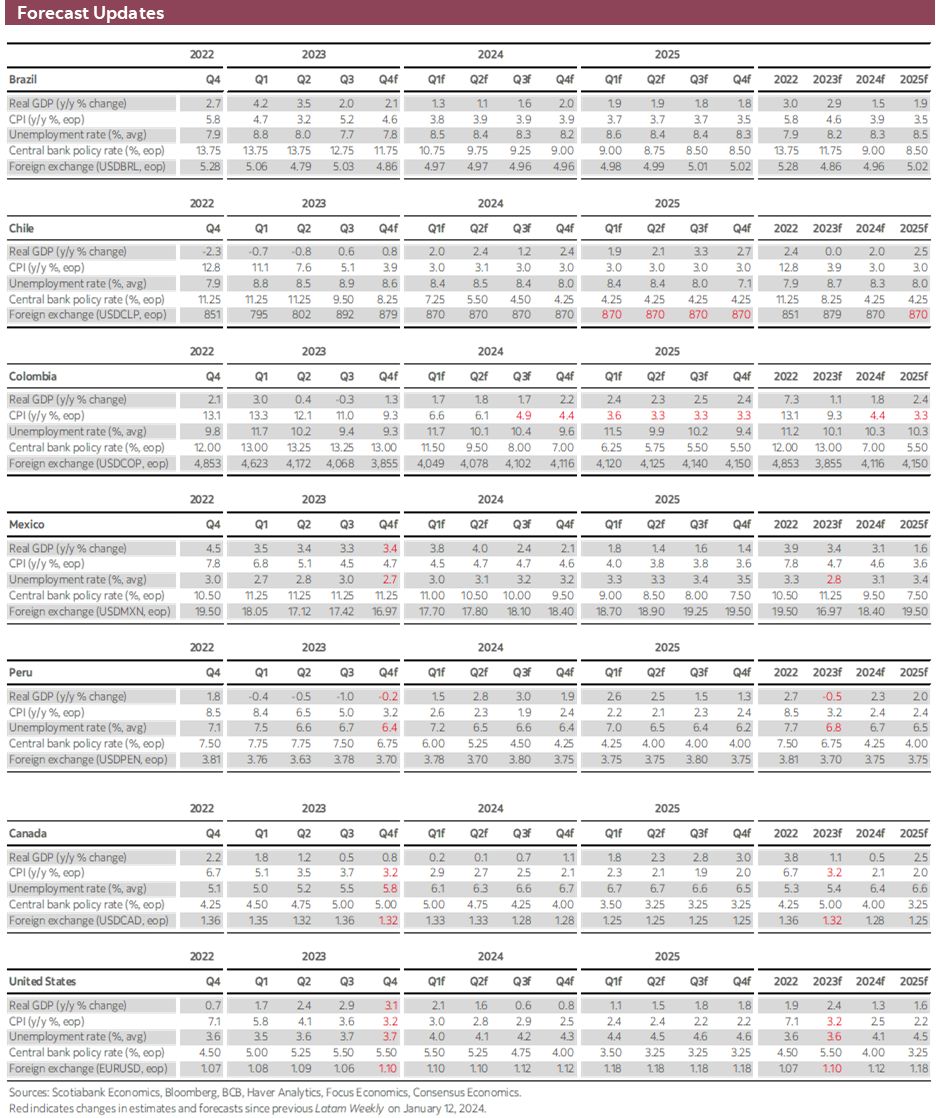

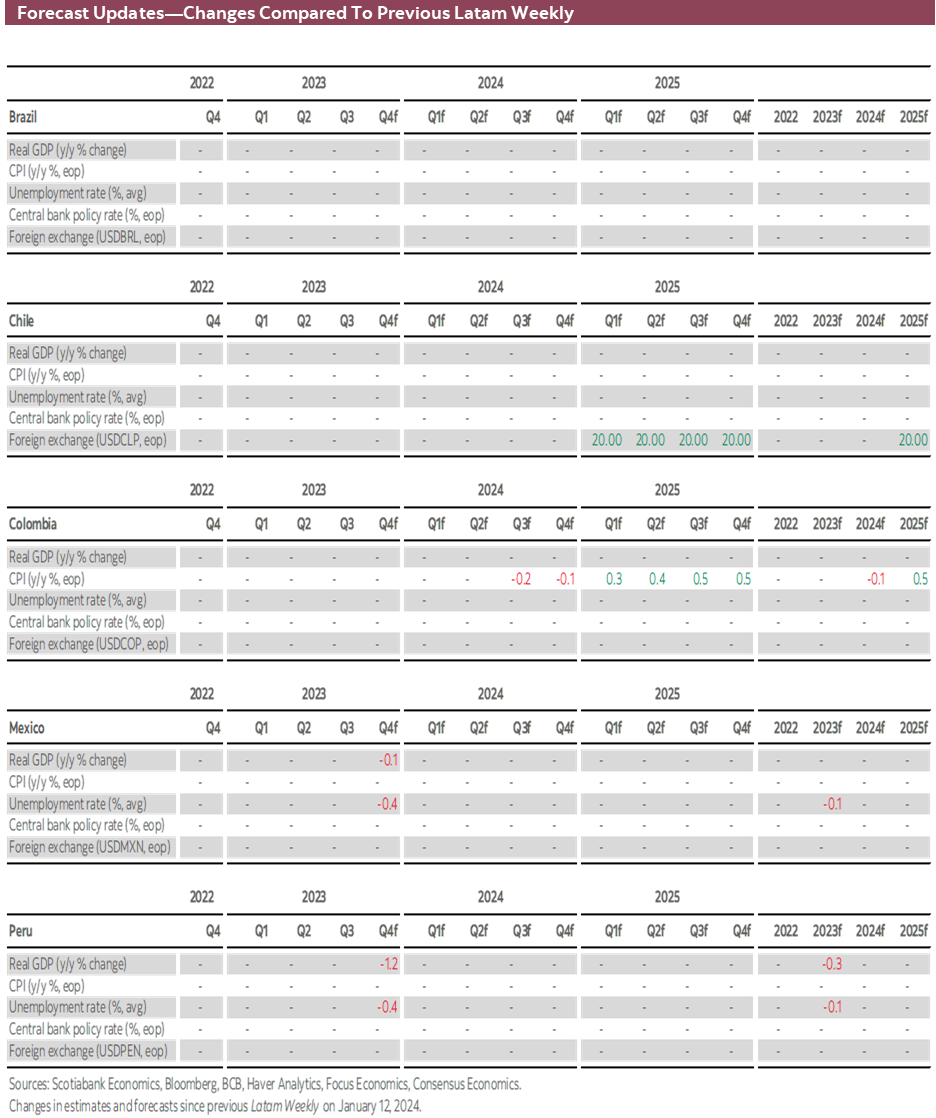

- A massive week awaits in Latam and the G10, full of central bank decisions and key data. January ends with a bang on Wednesday, with announcements from the Fed, BanRep, the BCCh, and the BCB. US jobs, the BoE, Eurozone CPI, Canadian GDP, and Chinese PMIs are also on tap.

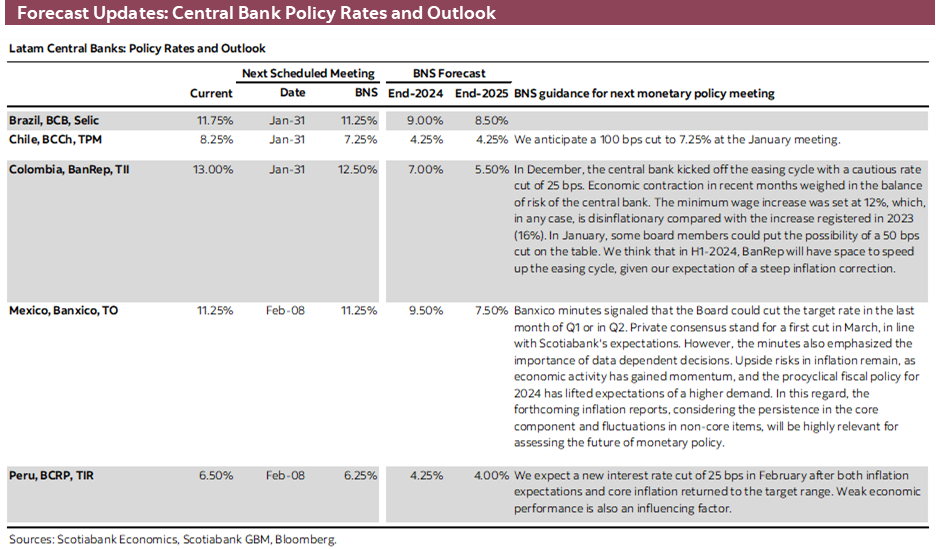

- The Fed will hold and the BCB will cut 50bps, but guidance from both will be key as markets time the Fed’s first cut and how many more half-point cuts the BCB may roll out.

- The BCCh and BanRep will both cut rates next week, there’s no doubt about that, but economists are somewhat divided on the size of these cuts. We lean towards both banks accelerating their pace of easing, to 100bps in Chile and to 50bps in Colombia after December cuts of 75bps and 25bps, respectively.

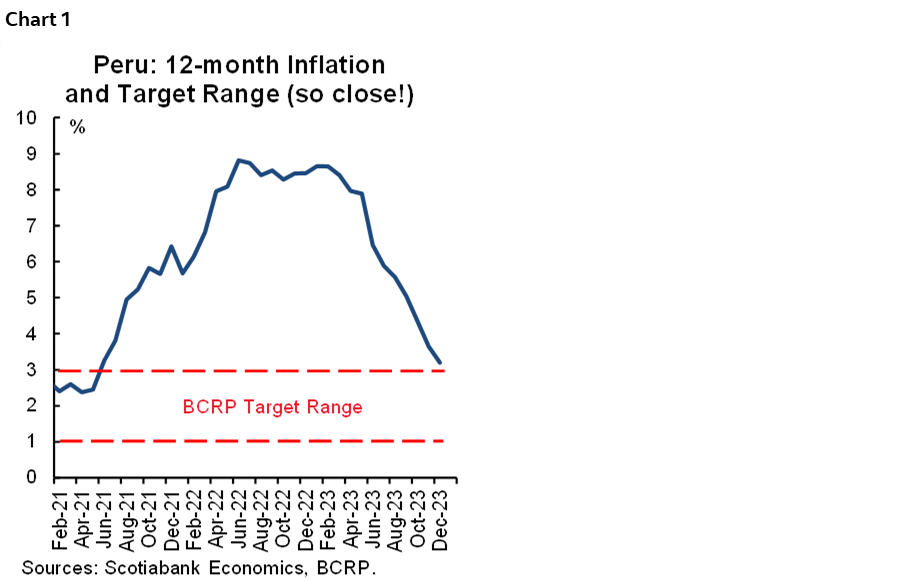

- There’s a chance Peruvian headline inflation fell within the 1–3% BCRP target range in January as it continues to evolve better than us and the central bank expected. Maybe down the road this could prompt an acceleration of cuts? It also depends on how the economy performs.

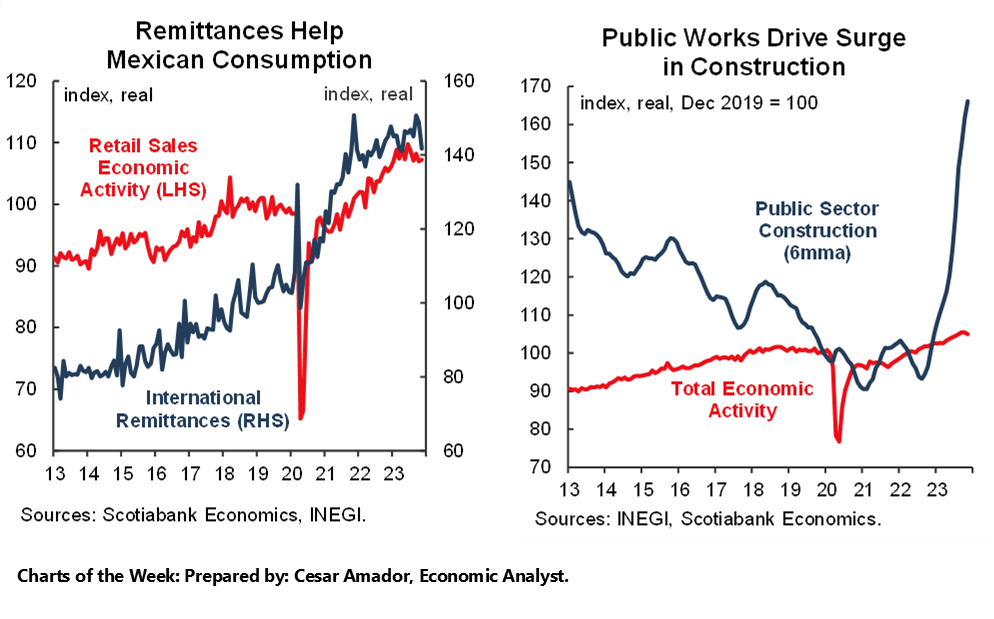

- Mexican GDP data for Q4 are expected to show a 3.4% y/y expansion that would result in a full-year pace of growth of 3.4%—almost a full percentage point above that of the US. Strong remittances and a surge in public construction spending were a key tailwind for the Mexican economy last year.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia and Peru.

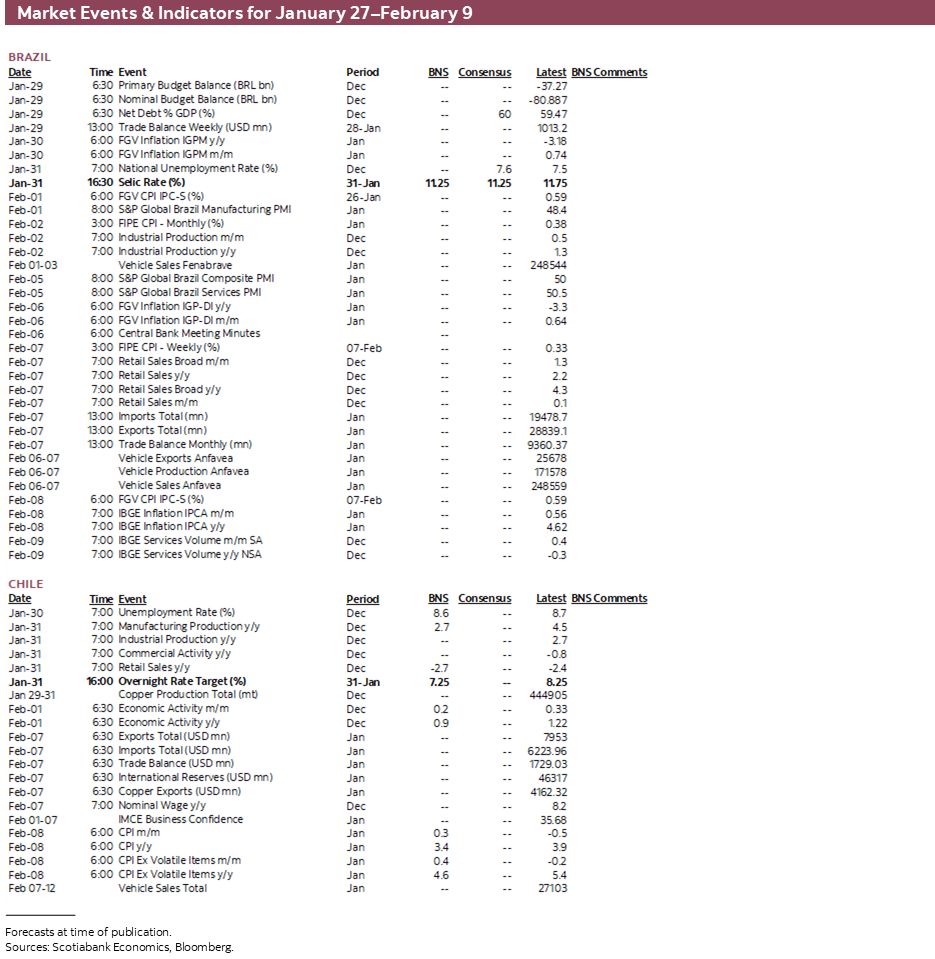

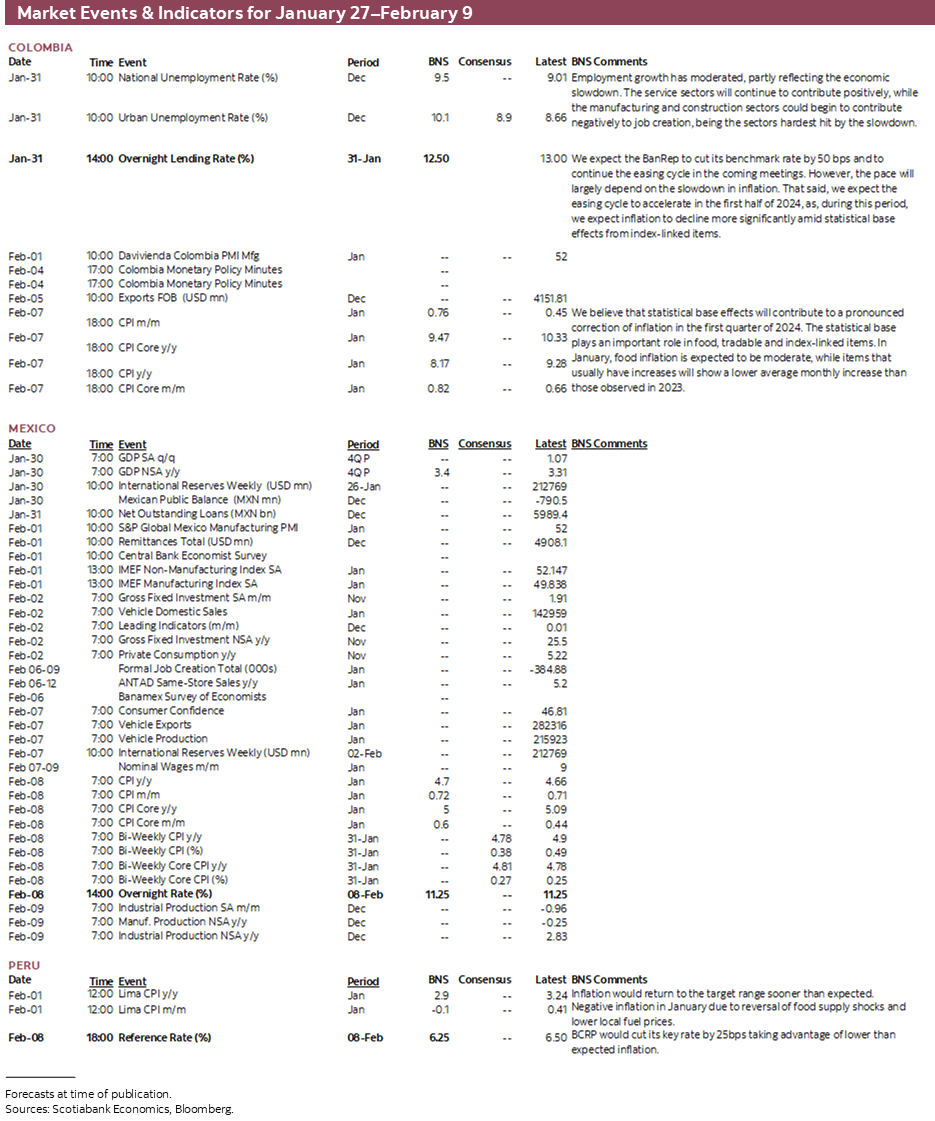

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period January 27–February 9 across the Pacific Alliance countries and Brazil.

Charts of the Week

ECONOMIC OVERVIEW: HOW MUCH FROM BANREP AND THE BCCH?; KEY DATA AND CENTRAL BANKS AWAIT

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- A massive week awaits in Latam and the G10, full of central bank decisions and key data. January ends with a bang on Wednesday, with announcements from the Fed, BanRep, the BCCh, and the BCB. US jobs, the BoE, Eurozone CPI, Canadian GDP, and Chinese PMIs are also on tap.

- The Fed will hold and the BCB will cut 50bps, but guidance from both will be key as markets time the Fed’s first cut and how many more half-point cuts the BCB may roll out.

- The BCCh and BanRep will both cut rates next week, there’s no doubt about that, but economists are somewhat divided on the size of these cuts. We lean towards both banks accelerating their pace of easing, to 100bps in Chile and to 50bps in Colombia after December cuts of 75bps and 25bps, respectively.

- There’s a chance Peruvian headline inflation fell within the 1–3% BCRP target range in January as it continues to evolve better than us and the central bank expected. Maybe down the road this could prompt an acceleration of cuts? It also depends on how the economy performs.

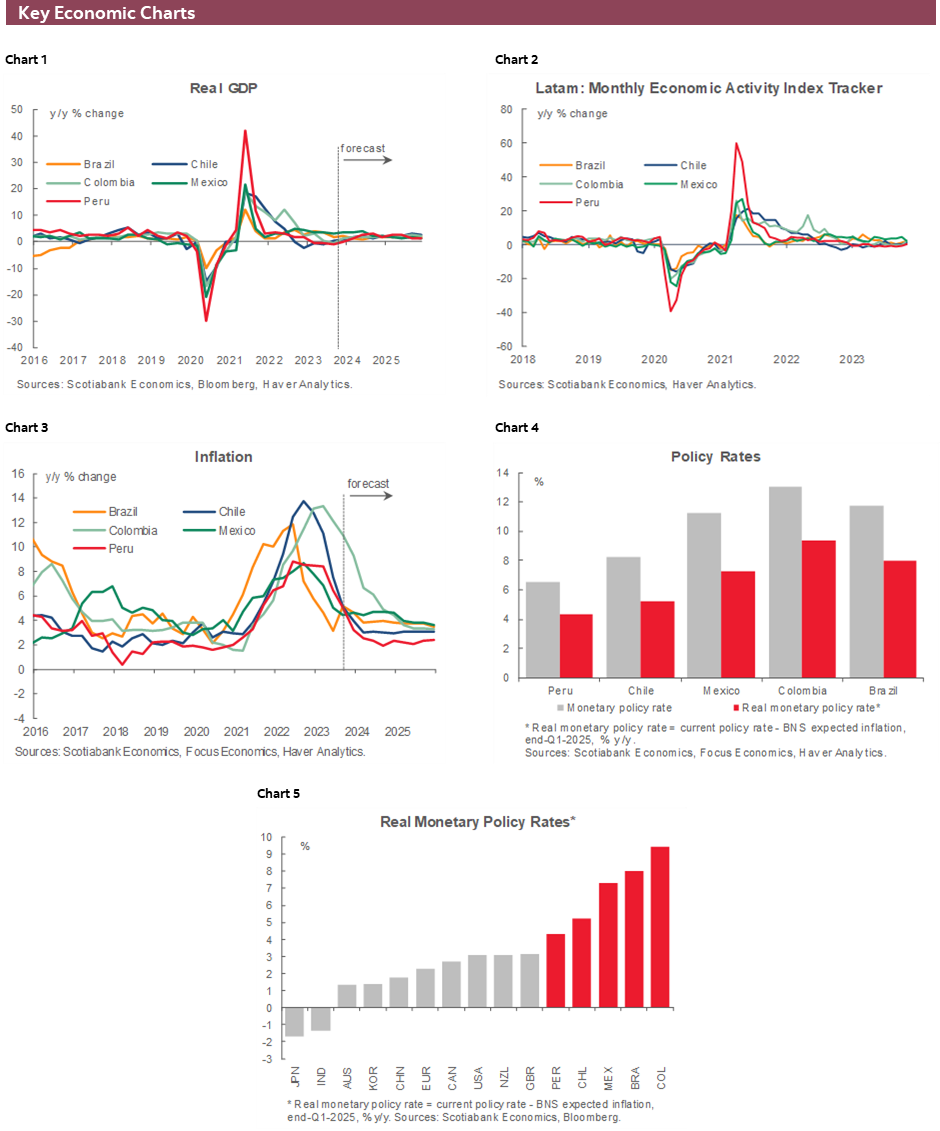

- Mexican GDP data for Q4 are expected to show a 3.4% y/y expansion that would result in a full-year pace of growth of 3.4%—almost a full percentage point above that of the US. Strong remittances and a surge in public construction spending were a key tailwind for the Mexican economy last year.

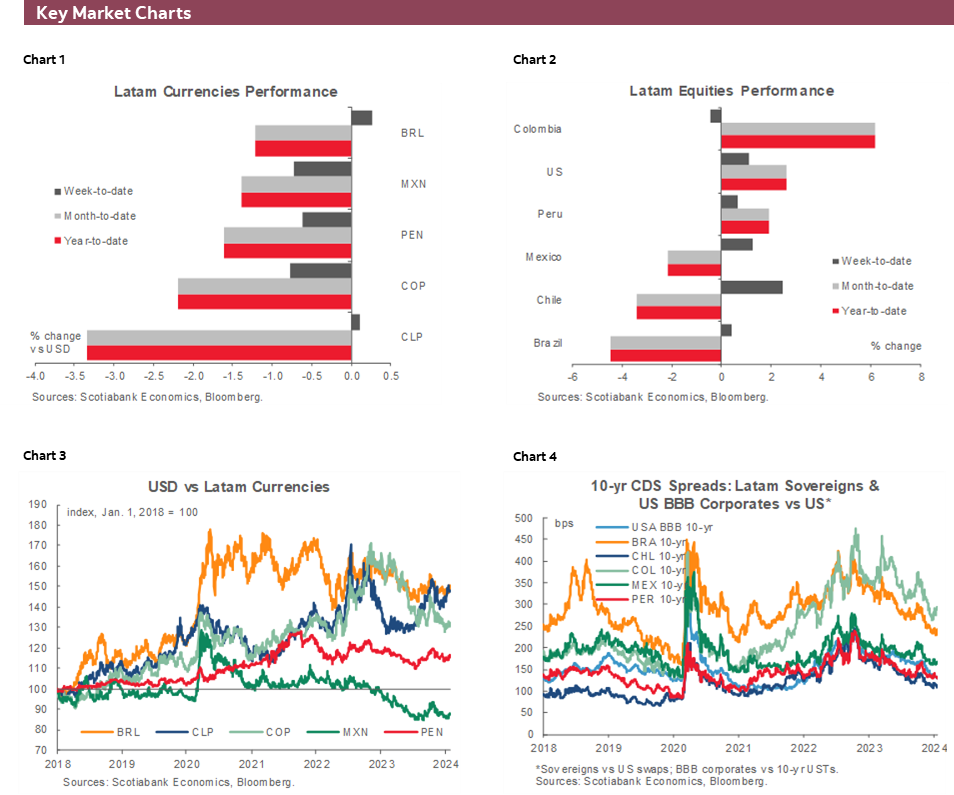

A massive week awaits in Latam and the G10, full of central bank decisions and key data to continue the active start to 2024 that has generally seen weakness in rates markets and currencies versus the USD, in contrast to a positive equities and commodities mood.

January ends with a bang on Wednesday, when we get rate announcements from the Fed, BanRep, the BCCh, and the BCB. That same day, China publishes key official PMI data and on Thursday we get the BoE’s decision with new forecasts. Eurozone and Canadian GDP, and Eurozone and Australia CPI also await. A string of corporate earnings releases from giants like Microsoft, Alphabet, and Apple, and the US Treasury’s refunding announcement are also on tap.

Of Wednesday’s four key central bank decisions, two look locked in while the other two are somewhat uncertain. The Fed will hold, and the BCB will cut 50bps, but guidance from both will be key. How long until the BCB shifts to a smaller pace of reductions (markets think not until June or August) and how long until the first Fed rate cut (markets think it will come in May)? US data over the next few days, from JOLTS jobs vacancies to nonfarm payrolls and wages, should also go a long way in refining expectations and shake up global markets in the process. Maybe the Fed will touch on an eventual QT taper.

On Friday, January IPCA-15 inflation came in below all economists’ estimates; were the trend to hold, the BCB may consider extending half-point cuts beyond mid-year. The board may take the latest prices data to discuss the possibility of a 75bps cut next week, more so as economic growth in Brazil seems to be faltering and still highly restrictive rates coming down faster looks like a more responsible response than more public spending (read rising debt).

The BCCh and BanRep will both lower their reference rates next week, there’s no doubt about that, but economists are divided on how large these reductions will be. Chile’s December inflation came in significantly below economists’ expectations after an upside surprise in November (see our take here). Today’s results to the BCCh’s traders survey showed the median expecting a 100bps cut next week, changing their view from the post-meeting survey median of 75bps; 12 expect a smaller cut, while 15 expect a larger cut.

In today’s Latam Weekly, our economists outline their call for a 100bps move by the BCCh, noting the chance that policymakers opt for a 125bps reduction. A few key data releases, like unemployment figures on Tuesday, and retail sales and industrial production on Wednesday morning could influence the decision. On Thursday, the INE publishes December economic activity data for which we project a ~1% y/y expansion but with nil growth month-on-month.

As for BanRep, the central bank began their rate reduction cycle at their final meeting of 2023, in December, with ‘only’ a 25bps cut in a split vote where two of seven board members preferred to hold (see here). The latest BanRep economists survey showed an average rate call of 12.64%, suggesting most economists do not expect a 50bps cut—although the mode of 12.50% shows this was the most popular projection (some dared to project a hold at 13.00%).

The team in Colombia think that officials will opt for a larger 50bps cut next week to 12.50%, possibly justified by a new round of projections by central bank staff. As our economists explain in today’s report, where they lay out their expectations for the year ahead, steep declines in incoming inflation readings should see BanRep shift to an even larger rate of policy easing in March (75–100bps) to maintain an adequate real policy rate. Unemployment rate figures out on Wednesday should not play a big role on the decision later that day.

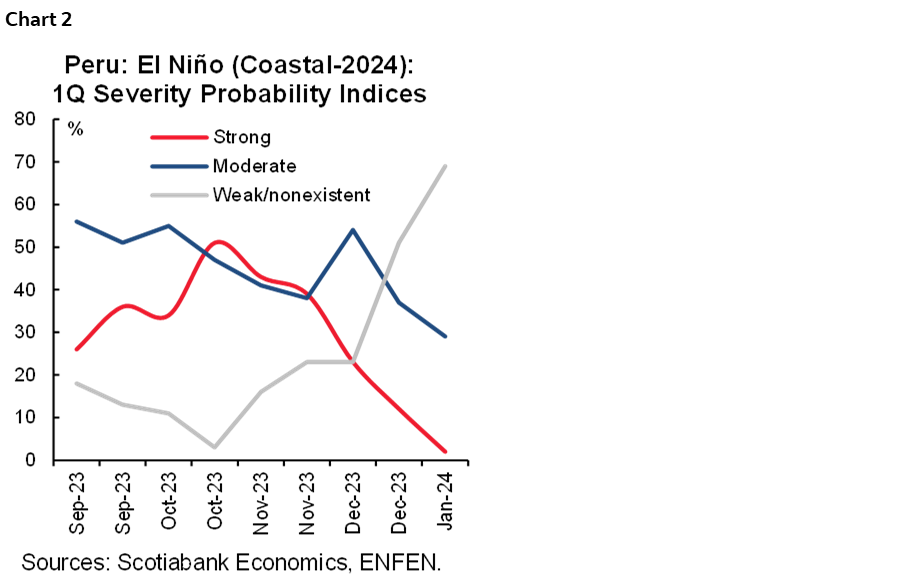

In Lima, we get the first full-month January inflation print in the region; Mexico and Brazil released figures for the first half of the month that beat and missed expectations, respectively. A lot hinges on next week’s data according to our Lima team. Year-on-year inflation has a decent shot at landing within the 1–3% BCRP target band and, as they explain in today’s report, El Niño upside risks to inflation continue to ease as authorities lower the odds of a strong episode. With the BCRP becoming less worried about inflation, it is now looking more closely at the weakness of the Peruvian economy. But, maybe it still needs the push of clearly normalizing inflation perhaps as soon as in January’s figures, and next week’s release of mining and fishing GDP as well as cement sales data (for construction GDP tracking) for December will also be key for their outlook for growth in the current year.

After this week’s stronger-than-expected H1-Jan inflation print and a miss in November economic activity (see here), Mexico’s INEGI publishes Q4 GDP data on Tuesday. Our latest forecast pencils in a 3.4% y/y expansion in output to close out the year, roughly equal to the 3.3% y/y growth recorded in Q3, and which would bring annual growth in 2023 to a very strong 3.4% pace. This would roughly represent a full percentage point outperformance of US GDP growth of 2.5% (preliminary), with Mexico reaping the benefits of strong income growth in the US via remittances as well as the government’s construction spending binge on AMLO’s hallmark infrastructure projects.

We’ve noted in previous reports that there are inconsistencies in the measurement of construction output (for instance), however, so there is a risk that once all is said and done, the Mexican economy did not expand at such a massive pace in 2023; GDP excluding construction expanded 2.8% /y in Q1–Q3, compared to 3.4% on the whole. We’ll also monitor Banxico’s economists survey results out on the 1st for inflation and rate expectations (first cut will come in March, we think).

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Options for the Next Monetary Policy Rate Cut Sit Between 75 and 125bps

Waldo Riveras, Senior Economist

+56.2.2619.5465 (Chile)

waldo.riveras@scotiabank.cl

On January 30th and 31st, the Central Bank (BCCh) will hold its monetary policy meeting, for which we expect a 100bps cut in the benchmark rate to 7.25%. We reiterate our view that the relevant options for a cut in the MPR sit between 75 and 125bps. We estimate that the Board would achieve unanimity with the 100bps option. Uncertainty about the permanent nature of the disinflationary surprise, the validity of the baseline scenario of the last Monetary Policy Report (and its MPR corridor), the change to a new CPI basket, the prolonged period before the new rate decision (April 2nd) and the recent peso depreciation would lead the Board not to opt for a moderate cut, but neither for a cut that would leave several dimensions of the December baseline scenario completely ruled out. We argue below.

December inflation was a real surprise to the CB’s baseline scenario, both at the headline and core levels. The CB’s baseline scenario would have had a surprise in inflation of at least half a percentage point, but not in activity, where a heterogeneous recovery is observed across sectors and the projection of zero GDP growth in 2023 and 1.75% in 2024 remains in place. In the international scenario, the assumption for the FED rate would not be particularly misaligned with the Fed’s recent vision, which the market has been gradually incorporating in recent times.

The January monetary policy decision will be characterized by the uncertainty generated by a new CPI basket and a prolonged period (two months) with the same level of monetary contraction. In effect, we have a new CPI basket, with a greater participation of tradable goods and a new methodology for emblematic products. Moreover, the Monetary Policy Meeting will occur before January’s CPI is revealed and with a new member of the Central Bank’s board (Claudio Soto).

After comments of one of the board members supporting a MPR at its neutral level by December 2024, together with a rapid inflationary convergence, and the president of the board calling not to rush and to evaluate the new scenario in the March Monetary Policy Report (IPoM), the market and surveys are pricing a cut of between 75 and 100bps. In this sense, it seems easy to rule out a 50bps cut, since such a cut would be compatible with a more adverse local or international scenario, as was the case last October. Furthermore, it would be a surprise of greater monetary policy contraction that is not compatible with the recent evolution of the macro scenario. On the other hand, a 75bps cut cannot be ruled out a priori if the CB remains concerned about the evolution of the exchange rate or considers that the recent disinflationary surprise is eminently transitory in nature. For our part, we see 75bps as not having the votes in the council as it would ignore some more permanent component of the disinflationary surprise as well as a particularly limited exchange rate pass-through observed in recent months. Moreover, it would be compatible with a cut near the center of the December MPR corridor, which does not speak to the magnitude of the inflationary surprise, even if it is considered entirely transitory.

In the above context, we could rule out a 150bps cut as it would leave the MPR below the floor of the December MPR corridor. Taking the MPR to 6.75% at the end of this month would be consistent with a more negative diagnosis in terms of activity in conjunction with a greater weighting towards a permanent component of the December inflationary surprise. At least the former has not occurred.

Undoubtedly, the exchange rate will be a topic of discussion to define the magnitude of the 100 or 125bps cut, as well as the rate corridor. Although the peso continued to depreciate against the dollar since the December meeting, from $870 to $920 currently, the real exchange rate (REER) is below last October’s levels, revealing that the recent depreciation has a larger global component and with less inflationary impact (pass-through). In this sense, the external scenario has not undergone major changes with respect to December. The view that developed economies have reached the end of their rate hike process, given the sustained downward trend in inflation and the stabilization of the economy, has settled, reducing the external risks that led the Central Bank to reduce the magnitude of the cuts last October, fearing a rebound in imported inflation. Beyond the recent depreciation of the peso, the exchange rate pass-through continues to be limited given the weakness of domestic demand and an adequate level of inventories.

So, 100 or 125 bp cut? The balance between the degrees of uncertainty due to the new CPI basket, the need to accumulate more external and local information, not to make a hasty reading of only one inflationary data and to wait for the new base scenario, we estimate would lead to an inclination to 100 bp cut. But these are not the only reasons, as there is also the MPR corridor. With the MPR at 7.25%, the Board would be at the floor of the actual MPR corridor, still validating the current base scenario, but opting for his strategy of going to the edges of the corridor if necessary. Indeed, opting for 125 or 150bps option, would mean going, albeit marginally, below the floor of the corridor which would leave the market without a clear guide for the MPR for a very prolonged period (two months). We do not see the Board leaning towards such an option as it would make it difficult to communicate the strategy for a long period of time, preventing eventual adjustments in the face of surprises in opposite directions in activity and inflation.

On Thursday, February 1st, the BCCh will publish December GDP, for which we project a y/y growth of 0.9%, with practically zero monthly growth. In this sense, we project a moderate m/m growth in non-mining GDP, which would be driven by a slow recovery of retail sales. Finally, we project a seasonal decrease in the unemployment rate to 8.6%, which would be explained by higher job creation compared to the expected increase in the labour force. However, our view is that the Chilean labour market still shows relatively loose conditions.

Colombia—2024 Economic Outlook

Jackeline Piraján, Senior Economist

+57.601.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

Santiago Moreno, Economist

+57.601.745.6300 Ext. 1875 (Colombia)

santiago1.moreno@scotiabankcolpatria.com

The post-pandemic economic recovery in Colombia was significantly strong. However, it was unsustainable. In 2021 GDP grew by 11.3% and in 2022 the expansion was 7.5%, which was well above historical averages in Colombia, creating a positive output gap. During 2023 the output gap had been closing at a fast pace, especially during the second half of the year. Even BanRep highlighted that the output gap closed very quickly and now is neutral. Reduction in the positive output gap is allowing the economy to adjust to more sustainable levels, which was also reflected in the narrowing of the current account deficit. In the Q3-2023, GDP contracted by 0.3% y/y, the first annual contraction since the pandemic. This was driven by manufacturing, retail sales, and construction, but offset by public administration, mining, agriculture, and leisure.

On the demand side, private consumption continued to moderate. Demand for durable and semi-durable goods was very weak. However, the main drag on GDP in 3Q-2023 came from a sharp fall in investment (-33.5% y/y), largely explained by a reduction in inventories, while fixed investment fell by 11% y/y, both in machinery and equipment and in construction (residential and non-residential).

Nevertheless, in November, the indicator of economic activity (ISE) broke a three-month streak of annual declines. The ISE expanded by 2.3% year-on-year in November, due to the impact of discount events such as Black Friday and Cyber Monday, among others, the pre-holiday discounts such as the Vehicles showroom in Bogotá, which promoted a better context for household demand. In addition, the momentum of the regional election process in terms of demand for staffing services to count the votes made a positive contribution.

That said, despite probably economic activity performance in November was fueled for a couple of one offs, we believe that Colombia’s economic cycle is bottoming out and we expect to see moderate signs of improvement during 2024. The economy is expected to maintain weak momentum in the coming quarters, with annual growth rates below 2% in the Q4-2023 and 2024, which means that the output gap will be moderately negative during 2024. The investment part of the economy is the most uncertain part as our forecast is relying only in the reaction of the private sector to a better context with lower interest rates, inflation, stable exchange rate around 4000 pesos and a mild demand recovery. However, the lack of a clear strategy by the national government for a reactivation plan to promote investment is a head wind in 2024.

On the inflation side, statistical base effects will contribute to a significant inflation deceleration during Q1-2024. Scotiabank Colpatria’s inflation forecast is one of the lowest among consensus. However, we think there is a decent chance for this to materialize. Main risks around inflation are still the possibility of having increases in diesel prices, and a potential impact from the “El Niño” weather phenomenon that is currently causing fires in many areas. However, if any of those events had an impact on prices, they will be offset by the significant statistical base effects and won’t prevent inflation from going down in H1-2024. In the previous context, as we explained in a previous Latam Weekly, we expect the central bank will cut the monetary policy rate by 50 bps, and in March, we do not discard a move between 75 to 100 bps cut to catch up y/y inflation deceleration to maintain the real rate around a neutral level of 2% to 2.5%.

Next week, BanRep’s decision will be in the spotlight. This time it’s an even more interesting meeting because the board will decide to have a new set of macroeconomic projections from the central bank’s staff. It will be relevant to monitor if the staff considers the output gap is close and how long they project it could stay on the negative side; the assessment around inflation projections and risk will also be a good piece of information.

Either way, Colombia is approaching interesting times, and the possibility of having the steepest inflation deceleration that could trigger a faster easing cycle could also help the economy start a recovery path in economic activity in the medium term.

Peru—The BCRP’s Target is Finally Within Reach

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

So much hinges on the January inflation number, to be released on February 1st. To begin with, there is a good chance that 12-month inflation in January may drop within the BCRP target range (1% to 3%). The key prices we track are pointing to mildly negative monthly inflation in January. While this trend in key prices is purely indicative, it does suggest the possibility that 12-month inflation will decline from 3.2% in December, to just under the target range ceiling of 3.0%, or at the very least close to it (chart 1).

So, the first point to make is that the downward trend in inflation continues to be stronger than we, or, more importantly, the BCRP, anticipated. Even so, knowing the BCRP, one would expect caution on their part early in 2024, in view of the impact of a strong El Niño. Except that now it looks like there will be no strong Niño after all! The latest reports from Peru’s El Niño monitoring entity, ENFEN, indicates that El Niño has weakened significantly off the coast of Peru. The likelihood of a strong Niño in the next two to three months is a negligible 2% (chart 2), a huge turnaround from over 50% just three months ago. The likelihood that El Niño will be weak/nonexistent is what now stands at well over 50%. Furthermore, note that we are now in week six of the 15-week El Niño risk period for 2024, with no signs of an untoward Niño so far. A weak Niño would not have a material impact on growth or inflation in 2024.

Why should the BCRP continue to worry about inflation, if prices are stabilizing well and the threat of El Niño is dissipating? The fact is, it is giving signs that its main concern is moving away from inflation. During Davos, the press quoted BCRP president Julio Velarde as stating that the BCRP’s concerns were shifting from inflation to growth.

There are three reasons, then, that might suggest that the BCRP could conceivably accelerate its monetary policy of reducing the reference rate. After all, why not? The real reference rate is over 4%, which is high for a country in which the risk of low growth is outweighing the risk of inflation.

But there is a reason to wait a while yet, before rushing to lower our reference rate forecasts. Liquidity indicators managed by the BCRP are not in tune with a more expansionary monetary policy. This seems to suggest that the BCRP is not quite ready to accelerate in lowering rates. Plus, it probably doesn’t perceive a strong enough need to.

Could the BCRP’s perception change if inflation in January falls within the BCRP inflation target range? Maybe. So much hinges on the January inflation number that comes out next week.

Also out next week will be mining and fishing GDP figures for December, as well as cement sales, which is a large component of construction GDP. These figures will give us a preliminary, and partial, idea of how overall GDP performed in December. Of course December is so 2023, and everyone’s minds are currently focused on 2024. Even so, the figures will be interesting for 2024 as they will shed light on to what extent the negative impact of El Niño is beginning to dissipate (agriculture GDP will be more key to this question than fishing, which we know will decline heavily in December as the fishing season was early in 2023 and winding down by then), to what extent mining will continue to lead growth going into 2024 (we expect much more moderate, albeit positive, growth in December), and to what extent domestic demand has begun to rebound (not yet in December, we expect).

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.