ECONOMIC OVERVIEW

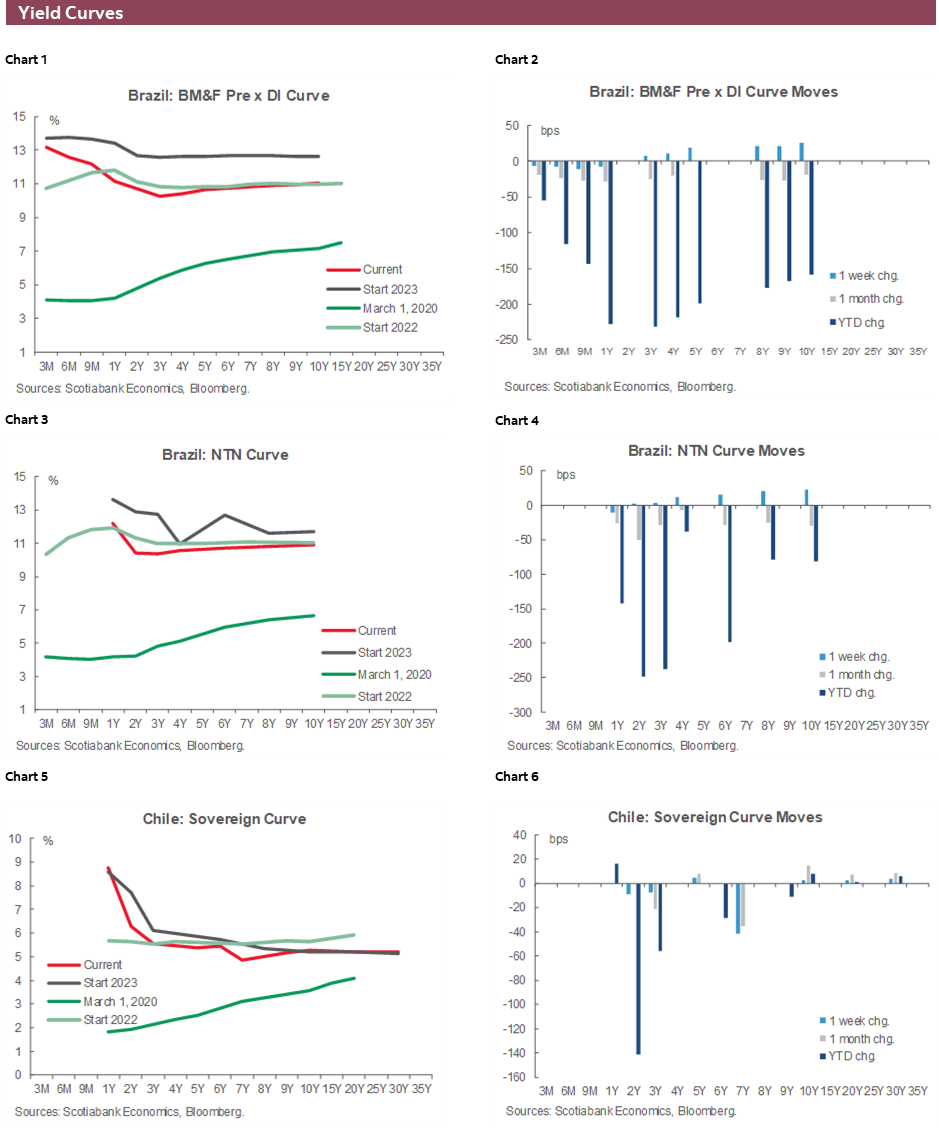

- It’s a full week ahead in Latam and around the globe, with key inflation data in Mexico, Brazil, and across the G10, alongside central bank decisions in Chile, the US, the Eurozone, and Japan. Colombian and Peruvian calendars have nothing of note, and the focus will remain on political developments.

- Mexican CPI for the first half of July is expected to show only a 0.1–2ppts decline in headline and core inflation—not enough to prompt a clear change in tone at Banxico.

- Brazil’s IPCA-15 will be the final key input ahead of the BCB’s decision on August 3, as markets hesitate between the bank starting with a 25 or a 50bps cut.

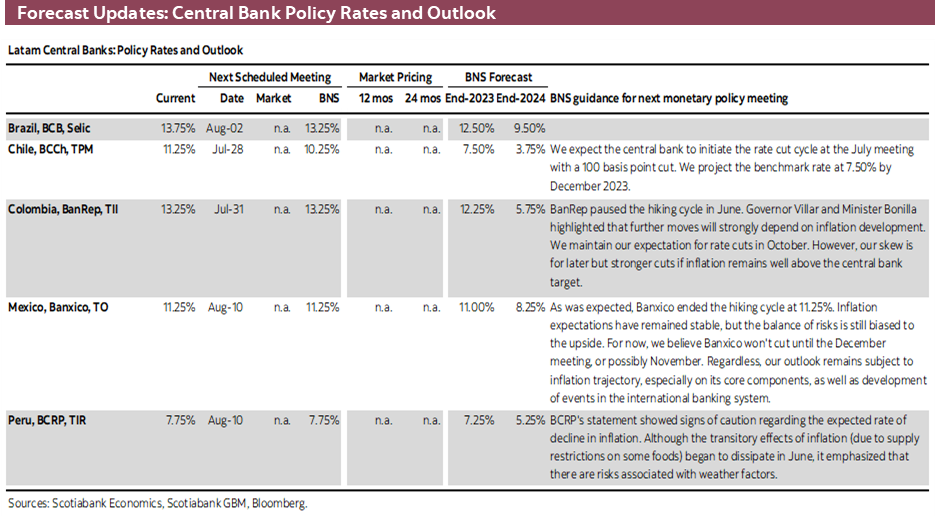

- Chile’s BCCh decision closes out the week. A large cut is widely expected, with our economists projecting a 100bps move to start out the easing cycle, towards a year-end rate of 7.50%.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia and Peru.

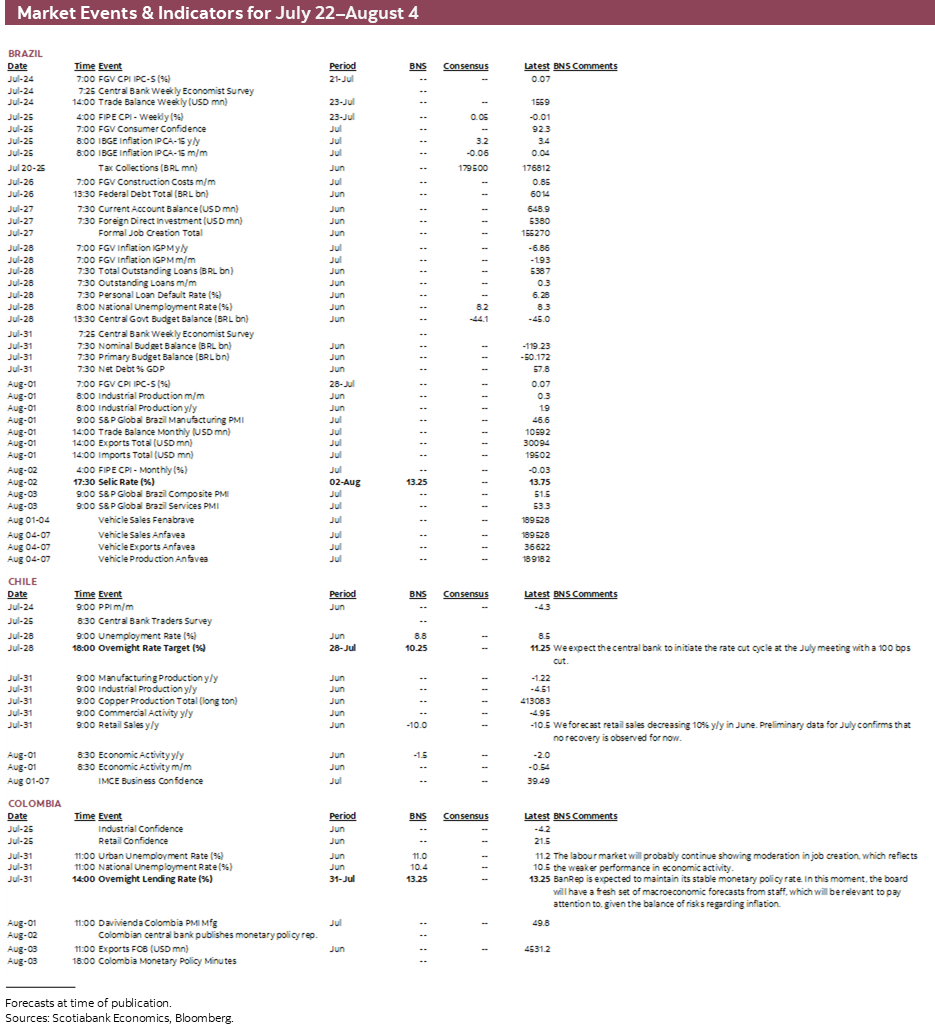

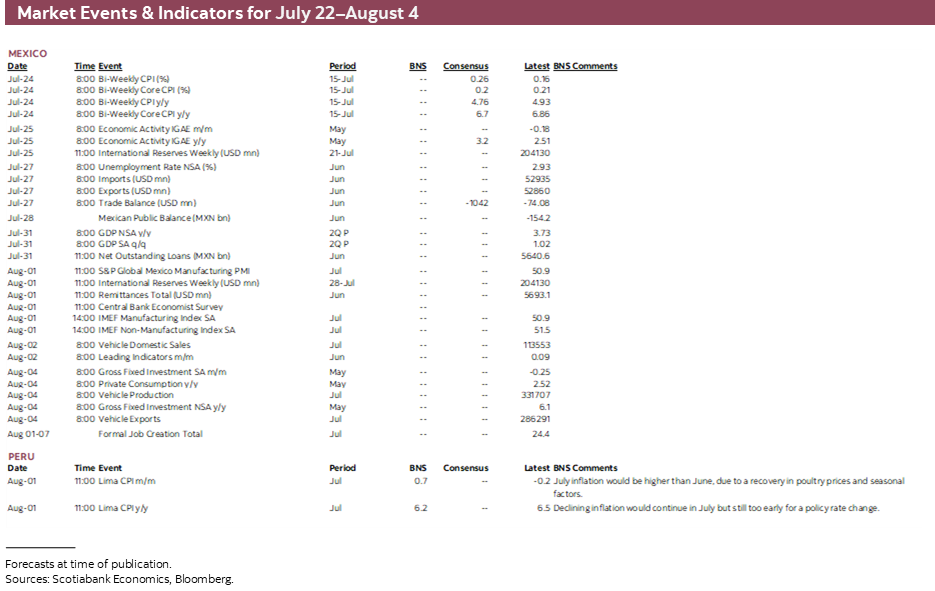

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period July 22–August 4 across the Pacific Alliance countries and Brazil.

Charts of the Week

ECONOMIC OVERVIEW: MEXICAN/BRAZILIAN CPI; BCCH/FED/ECB/BOJ DECISIONS

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- It’s a full week ahead in Latam and around the globe, with key inflation data in Mexico, Brazil, and across the G10, alongside central bank decisions in Chile, the US, the Eurozone, and Japan. Colombian and Peruvian calendars have nothing of note, and the focus will remain on political developments.

- Mexican CPI for the first half of July is expected to show only a 0.1–2ppts decline in headline and core inflation—not enough to prompt a clear change in tone at Banxico.

- Brazil’s IPCA-15 will be the final key input ahead of the BCB’s decision on August 3, as markets hesitate between the bank starting with a 25 or a 50bps cut.

- Chile’s BCCh decision closes out the week. A large cut is widely expected, with our economists projecting a 100bps move to start out the easing cycle, towards a year-end rate of 7.50% from 11.25% currently.

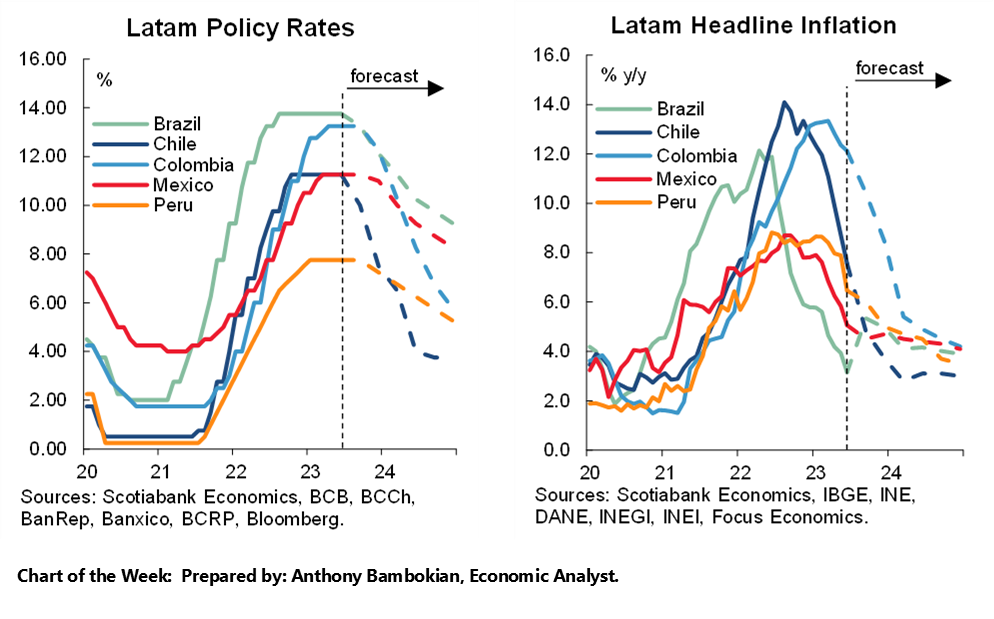

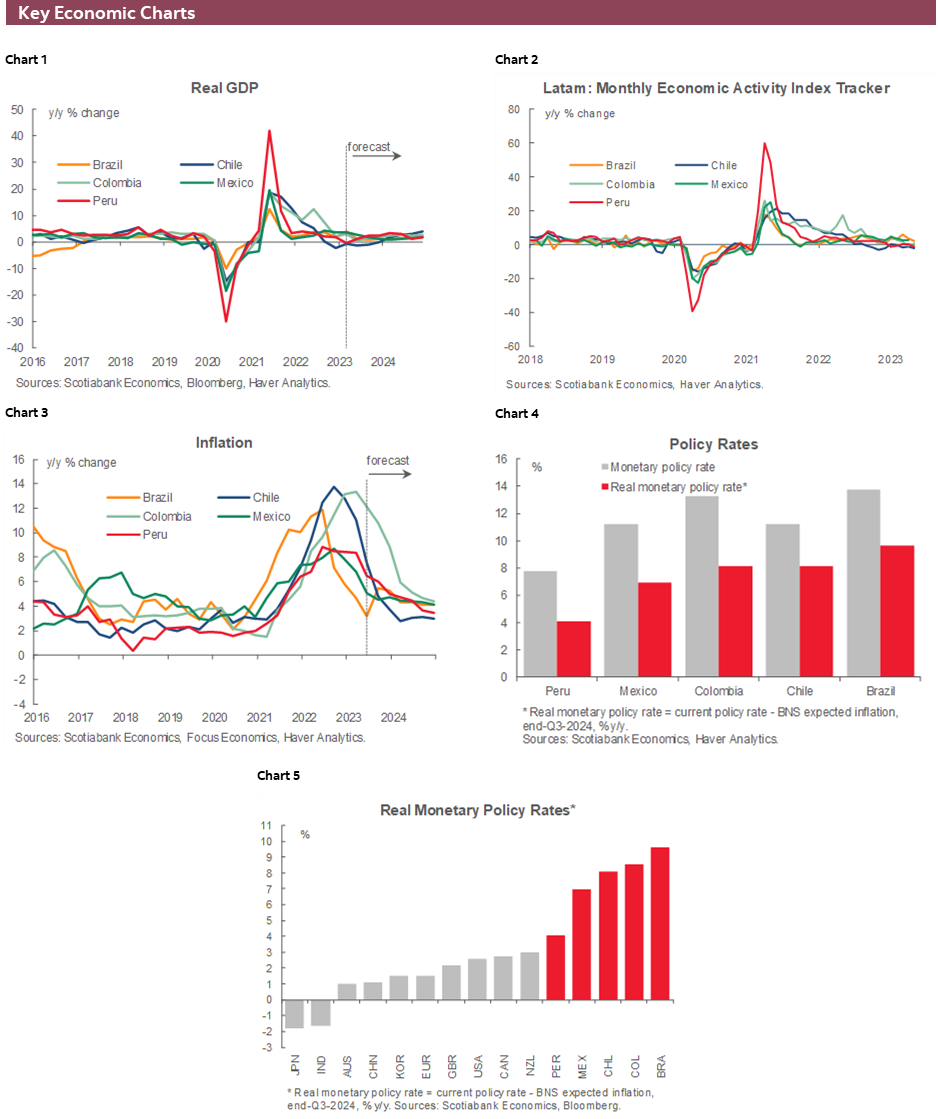

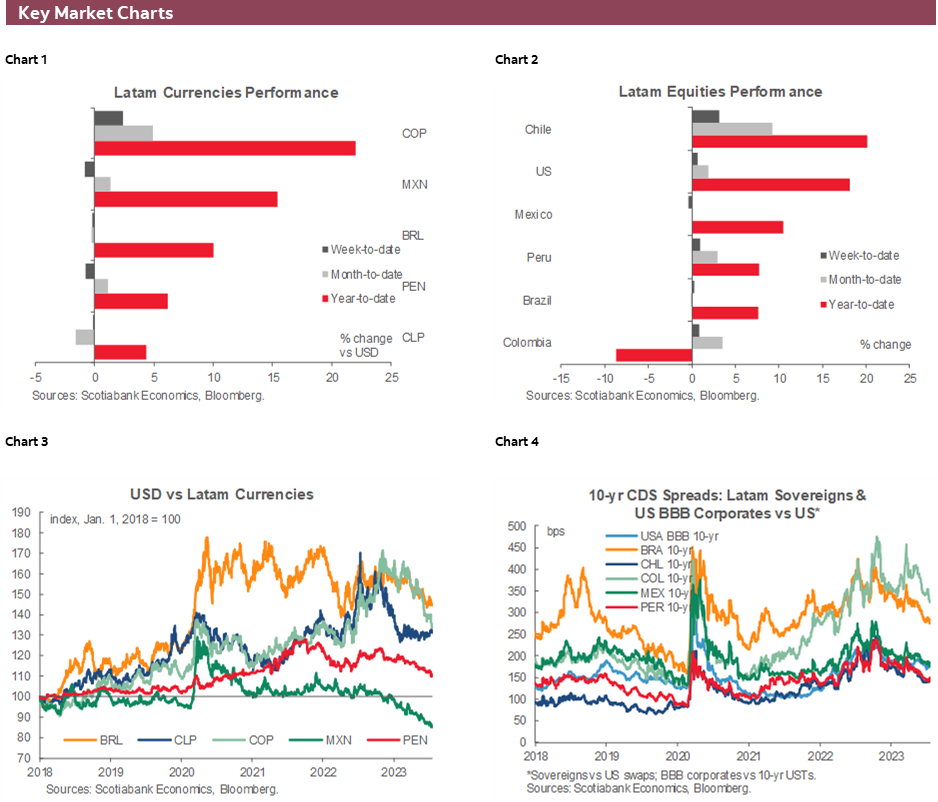

It’s a full week ahead in Latam and around the globe, with key inflation data in Mexico, Brazil, and across the G10, alongside central bank decisions in Chile (-100bps), the US (+25bps), the Eurozone (+25bps), and Japan (unch). Global markets will kick off the week with PMI releases, to be followed by the BoC’s meeting minutes, Australian, German, and Tokyo CPI, US PCE and ECI, and US, Canadian, and French GDP. In parallel, traders will watch food prices risks after the expiry of the Black Sea grain deal and India’s banning of some rice exports, and headlines around possible Chinese stimulus plans.

In contrast, the Colombian and Peruvian calendars have nothing of great relevance. There, the focus will likely remain on developments on the reforms front in Colombia after the start of the new legislative session on July 20 (though it may be a few days before debate actually picks up) and on the political front after the recent resignation of Mining Min Velez and who her possible replacement could be. The market would certainly appreciate someone who is more business/fossil-fuels friendly to lead the ministry.

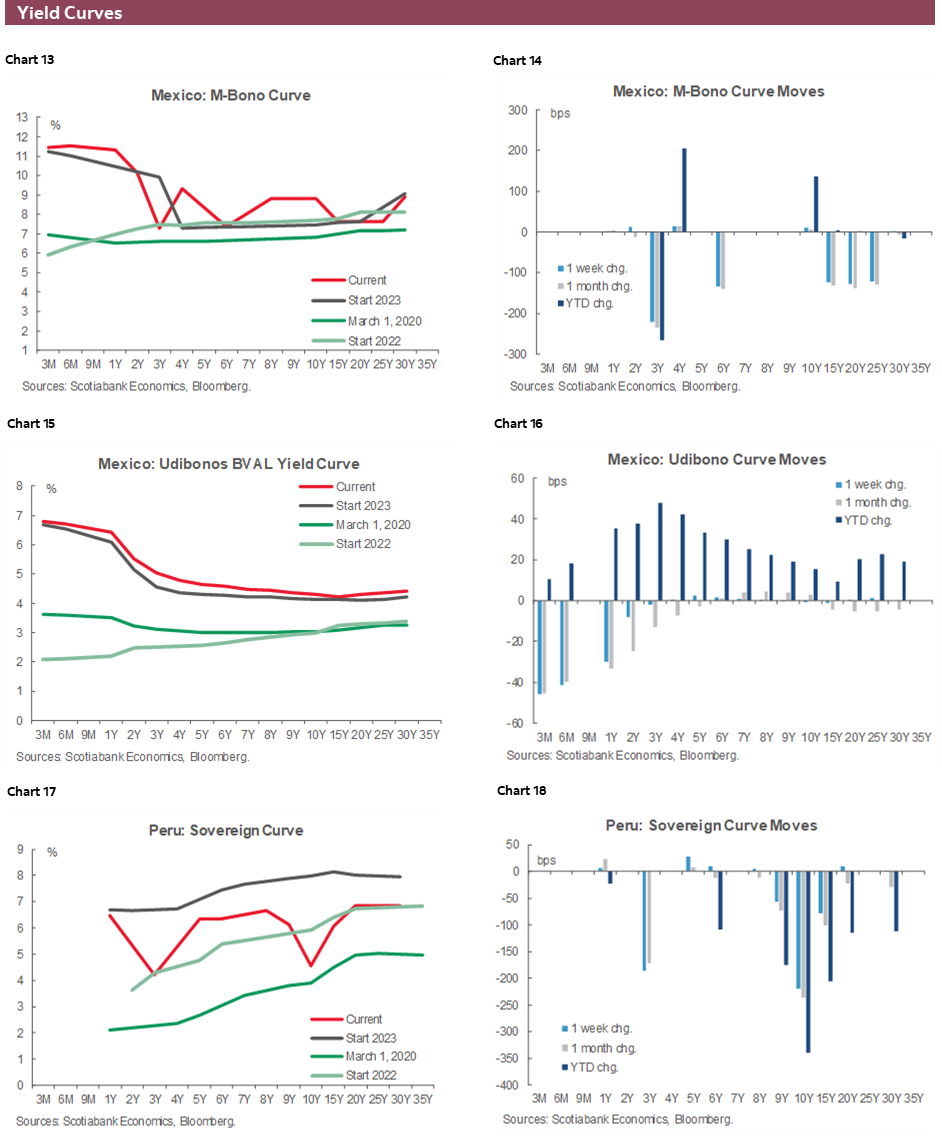

In Peru, we’ll monitor whether the recent bout of (relatively controlled and overall peaceful) unrest against Peru’s Pres Boluarte intensifies or dies down completely. In today’s report, our economists in Lima discuss the recent trend in Peru’s fiscal deficit that should improve over the remainder of 2023 as the country’s economy improves from a first half of the year marred by stagnation due to weather and disruptions from protests.

Mexican CPI for the first half of July is expected to show only a 0.1–2ppts decline in headline and core inflation that should keep calls for Banxico rate cuts at bay. At 6.7% (the economist median) core inflation would still be too high to point to the exits, particularly as services inflation has not decelerated all that much from its 5.7% y/y peak back in H2-Mar (currently at 5.3%).

A positive inflation result that shows a faster deceleration would definitely be noted by Banxico but it may be difficult, and/or risky, to strike a more optimistic tone at their August 10 meeting if the Fed sticks to a hawkish message next Wednesday.

May economic activity (IGAE) data due on Tuesday is also worth a look. The INEGI’s nowcast points to a 3.6% y/y expansion (vs latest median of 3.2%) that they estimate will be followed by a strong 4.0% gain in June. The statistics agency also releases June unemployment and international trade data on Thursday.

As for Brazilian inflation, the Jul IPCA-15 print will be the final key input ahead of the BCB’s decision on August 3. A much weaker than expected May economic activity reading released on the 17th (a 2% m/m contraction) added to speculation that the central bank could choose to start its cutting cycle with a 50bps reduction.

Markets are not ready to call it in either direction yet, however, pricing in 37bps in cuts for the decision that roughly equate to a 50% chance of a half-point move. With BCB chief Campos Neto on vacation, we also haven't got much guidance of late on what the bank may decide, so a lot is riding on next Tuesday’s prices data. Brazil also releases unemployment data for June on Friday, with the jobless rate seen only a touch lower vs May.

Chile’s BCCh is widely expected to roll out the first rate cut among core Latam central banks next Friday. After a divided rate hold in June that saw two members vote for a 75bps cut, our team in Santiago believes the bank will lower the monetary policy rate by more than even the ‘doves’ wished, 100bps towards a year-end 7.50% rate. This is also a larger cut than the 75bps move expected by the median economist and trader polled in the latest BCCh surveys. Note, however, that in the economists survey, 36% of respondents think the BCCh will cut rates by 100bps or more (30% at 100bps).

On Tuesday, we get a last pre-decision update of traders’ views in the BCCh survey (that also last showed 36% seeing a 100bps+ cut) and, the morning of the BCCh’s decision, the INE publishes June unemployment rate data. The Santiago economics team explains in today’s report that the BCCh’s expectation of only a 0.2% contraction in GDP is much too rosy, and an economic reacceleration in H2 would require significant cuts and a pick-up in public and private investment.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Over-Adjustment Can Only be Avoided With Aggressive Monetary Policy Response and Execution of Public Investment

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

MARKET PRICES RAPIDLY INTERNALIZED OUR VIEW

Economic activity figures up to Q2-23 suggest that it will be difficult to see only a slight contraction of GDP this year like the -0.2% forecast by the Central Bank (BCCh) in its Monetary Policy Report (IPoM). In fact, avoiding a technical recession in Q3-23 requires an acceleration in June and/or in one of the months of the third quarter. Moreover, if the economy experiences a seasonally adjusted growth of 0% m/m during the rest of the year, the GDP contraction in 2023 would be above 1%.

In this context, what would be the factors that would drive the acceleration of economic activity during the second half of the year? In our view, we need not only cuts in the reference rate, but also a recovery in public and private investment.

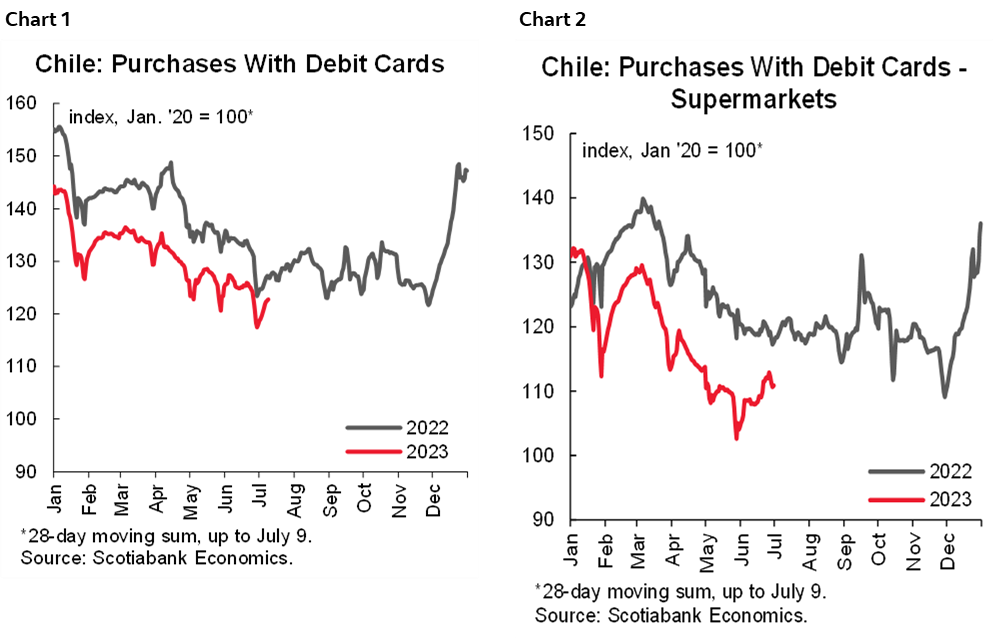

Regarding economic activity, our high-frequency data suggest that the slowdown process continued in Q2-23, both in goods and services consumption (chart 1). Supermarket sales remain weak but stabilizing, at the margin (chart 2), while restaurant and travel sales showed greater dynamism favoured by CyberDay (which is a transitory effect). In our view, it is not only the weakness of durable goods sales that we observed in Q1, but also that of semi-durable goods more recently. For this reason, we maintain our GDP growth forecast of -0.8% in 2023.

On the monetary policy front, we anticipate a 100bps cut in the benchmark rate at the July meeting, which would be the first step towards a 7.5% rate in December 2023. Market prices moved quickly toward our view, incorporating aggressive rate cuts for the coming months.

Colombia—Economic Activity: Surpassing Expectations and Navigating Potential Risks

Sergio Olarte, Head Economist, Colombia

+57.601.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.601.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

Santiago Moreno, Economist

+57.601.745.6300 Ext. 1875 (Colombia)

santiago1.moreno@scotiabankcolpatria.com

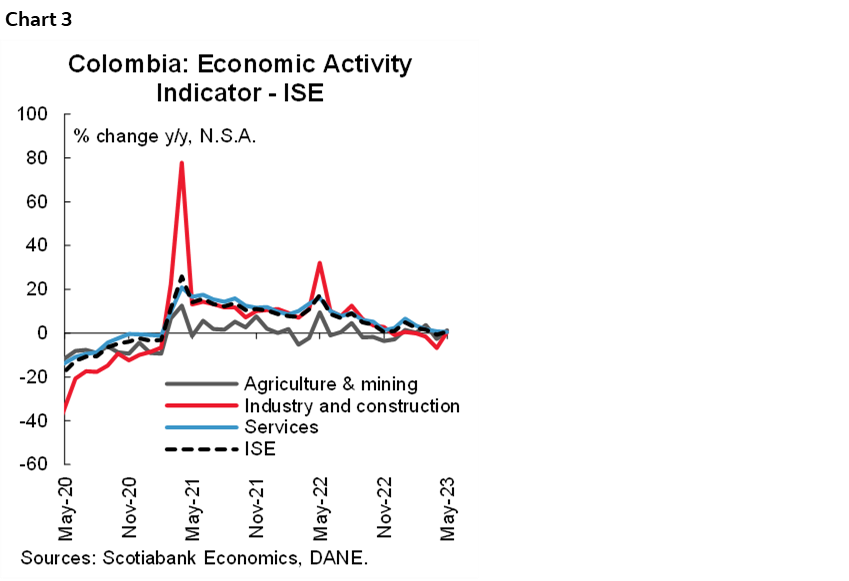

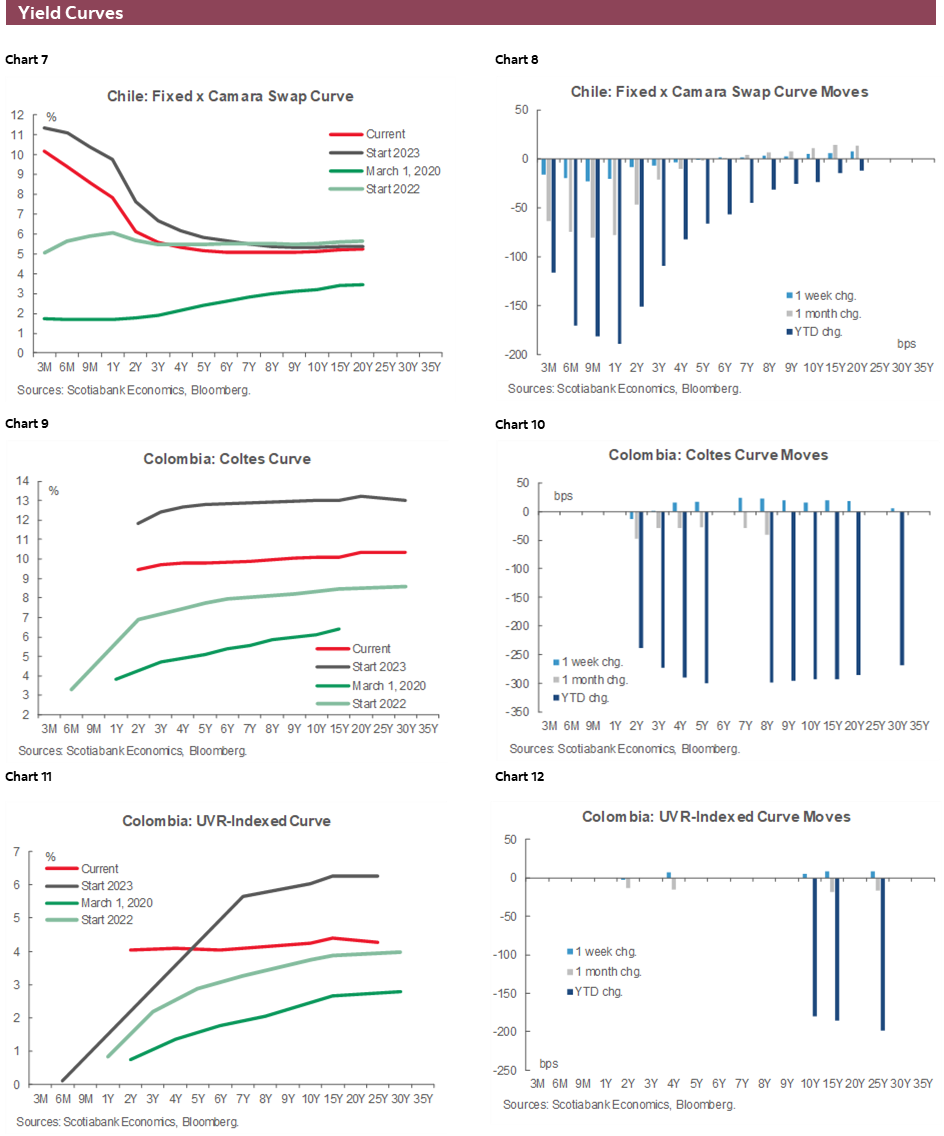

Over the past week, the National Administrative Department of Statistics (DANE) published better-than-expected May 2023 economic activity data. The Economic Tracking Indicator (ISE) grew 0.6% y/y (chart 3) and 0.9% m/m in seasonally adjusted terms. This result slightly exceeded the expectations of analysts surveyed by Bloomberg (0.5% y/y) and indicated a recovery compared to the decline recorded in the previous month (-0.8% y/y). The May gain was attributed to the recovery of primary and secondary activities, which showed positive annual variations (+1.3% and 0.6% y/y, respectively), after both sectors were in negative territory in the previous month. At the same time, the services sector (tertiary activities) recorded y/y growth of 0.6%.

In the agriculture and mining sectors (primary activities), the rebound was mainly driven by improvements in mining and quarrying. Regarding the agro-industrial sector, the single-digit moderation in producer prices continues to provide relief to food production, partly due to exchange rate appreciation, that reduces costs of imported inputs. However, the latent risk of the El Niño phenomenon remains, and could potentially impact food inflation depending on its intensity.

Regarding secondary activities (manufacturing and construction), the construction sector made the largest contribution. This result is not solely attributed to the residential subsector but also to non-residential building works and even the reactivation of some civil engineering projects, standing as one of the sectors with the highest positive contribution (+0.4 pp) to the annual variation of the ISE. As for retail and services sectors (tertiary activities), the sectors of artistic activities, entertainment, recreation, and other service activities stood out, contributing the most to the growth of economic activity in May 2023.

Alongside these economic activity results, imports data were published for May 2023, amounting to USD5.4bn, a seventh consecutive month of y/y contractions at 20.4% y/y. This was mainly due to a 17.8% decrease in the manufacturing group, contributing -12.5 ppts to the drop and accounting for a majority share of 72.6% of total imports. As for the trade balance, a USD599.2mn FOB deficit was recorded in May 2023, while the previous year it amounted to USD1.6bn FOB.

These indicators of economic activity reflect that while on the one hand the Colombian economy is undergoing a gradual and healthy adjustment process, on the other hand the recent improvement in consumer confidence combined with a reduction in inflation, decreasing inflation expectations, and currency appreciation could help cushion the deceleration path. Nevertheless, the economic slowdown is consistent with our expectation of a stable monetary policy rate in coming months until the fourth quarter of 2023.

At Scotiabank Economics, we expect to see the first interest rate cut by BanRep’s October meeting; however, it currently depends on the behaviour of inflation in the upcoming months, considering potential risks such as the weather phenomenon of El Niño and pending adjustments in regulated prices such as gasoline and potentially diesel, which could impact the reduction of overall inflation.

Finally, the new legislative period that kicked off on July 20th will be crucial in defining the future of the social reforms that the National Government aims to push forward at a time when it lacks majorities in the Congress of the Republic and amid the second half of 2023, where the protagonist will be the regional elections on October 29th.

Peru—Economic Stagnation During H1-23 Impacts Fiscal Accounts

Pablo Nano, Deputy Head Economist

+51.1.211.6000 Ext. 16556 (Peru)

pablo.nano@scotiabank.com.pe

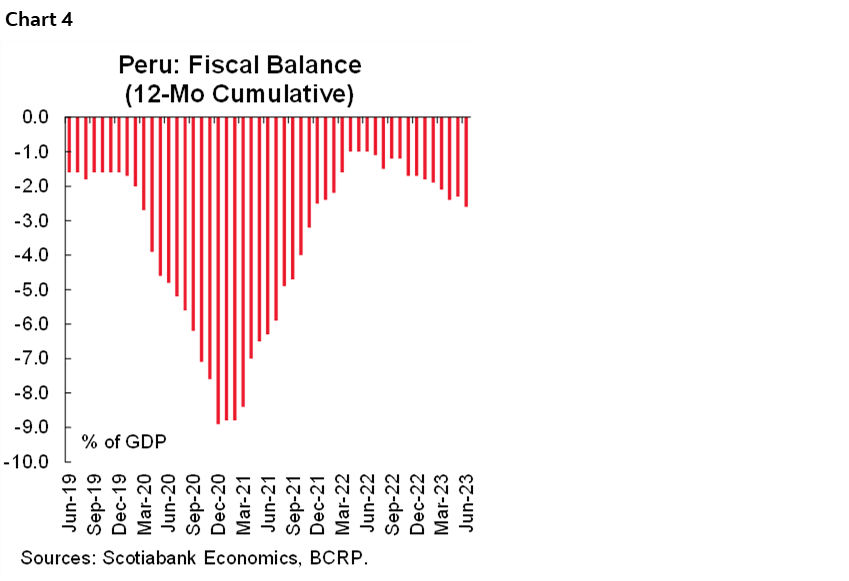

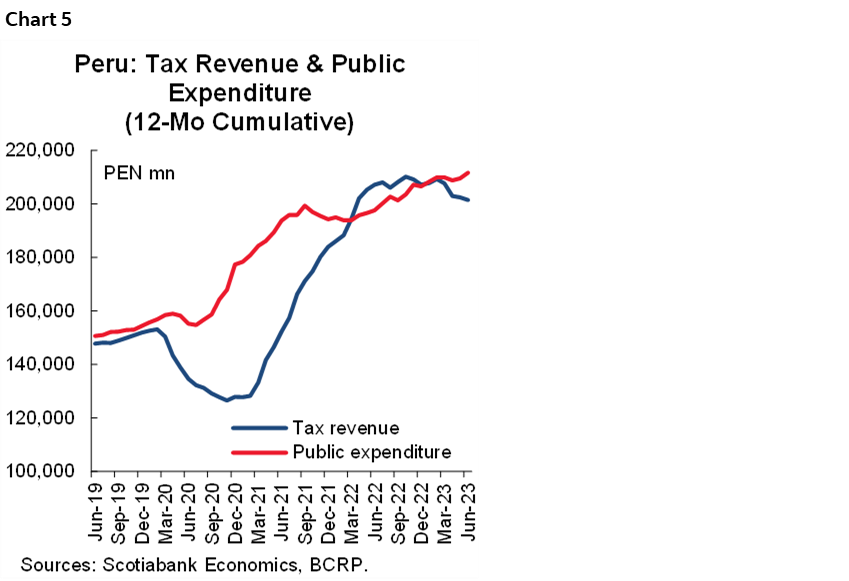

Peru’s fiscal deficit reached 2.6% of GDP in the 12 months to June, greater than the 2.4% deficit that we expected. This figure represented a significant deterioration in relation to the 1.7% of GDP deficit recorded at the end of 2022, and was above the fiscal deficit ceiling of 2.4% of GDP at end-2023 (chart 4). This result was due to both a drop in tax revenues and an increase in public spending.

In the case of tax revenues (-6.8%), the decline was mainly explained by lower Income Tax (IR) payments by mining and hydrocarbon companies—in line with the drop in commodity prices during the first half of 2023—as well as the lower collection of taxes linked to internal demand such as Value Added Tax (IGV) and import tariffs—in line with the stagnation of economic activity during the first half of the year (chart 5).

As for non-financial public spending (+6.1%), the increase was associated with the expansion in current expenditures (+5.2%), especially higher disbursements for remunerations—due to salary increases in the education sector—and expenses associated with the program Con Punche Peru aimed at reactivating the economy—that was affected at the beginning of the year by social protests and Cyclone Yaku. Likewise, growth in public investment (+7.9%), particularly in projects related to prevention efforts in view of the imminent arrival of the El Niño at the end of 2023, also led to increase spending.

The fiscal deficit is likely to continue its uptrend in July—a month with higher seasonal current spending due to bonus payments to public workers for Independence Day—before starting to decline in the coming months. The main reason for this improvement, which would become more evident towards Q4-23, would be a greater dynamism of economic activity. We forecast GDP growth of close to 2% during H2-23 compared to the -0.4% that would have been registered in H1-23, which would see a recovery in tax collection—especially taxes associated with domestic demand such as IGV and ISC—as well as a growth in nominal GDP—which is taken into account to calculate the Fiscal Deficit/GDP ratio. In this sense, we maintain our forecast of a fiscal deficit equivalent to 2.4% of GDP at the end of 2023.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.