ECONOMIC OVERVIEW

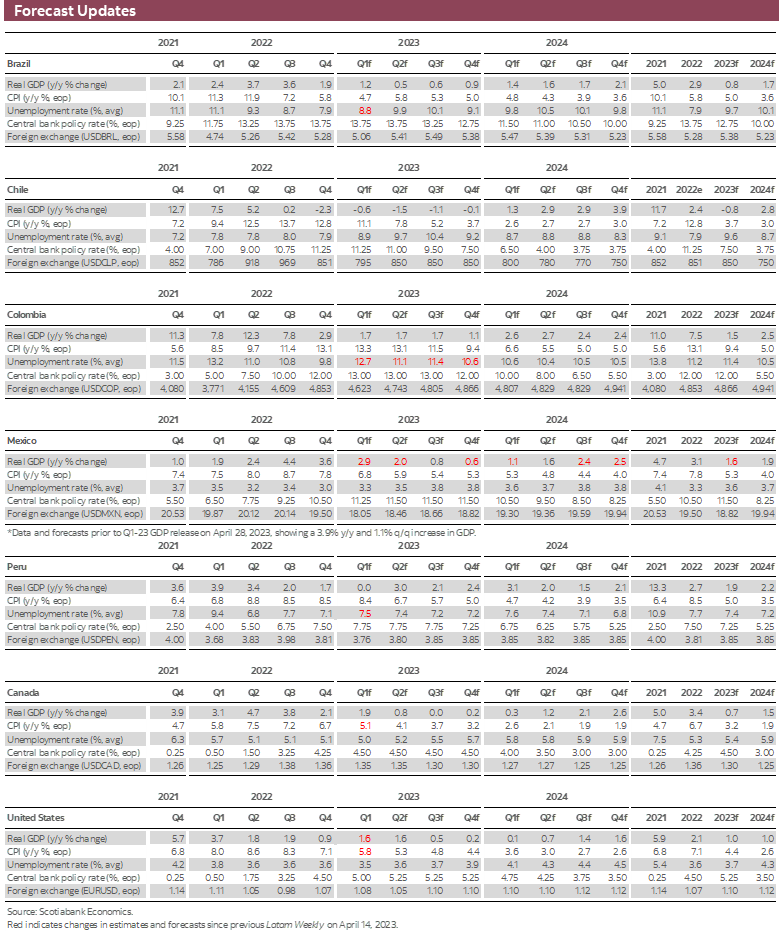

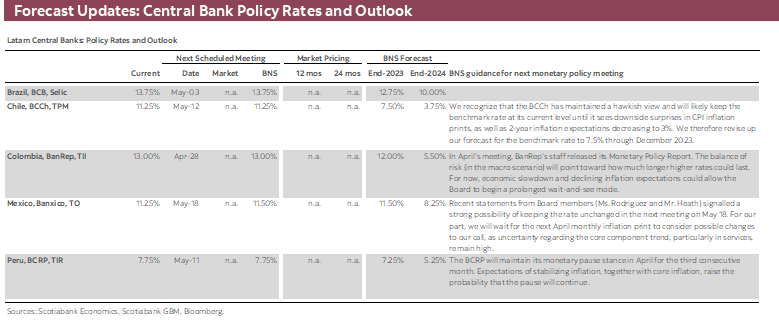

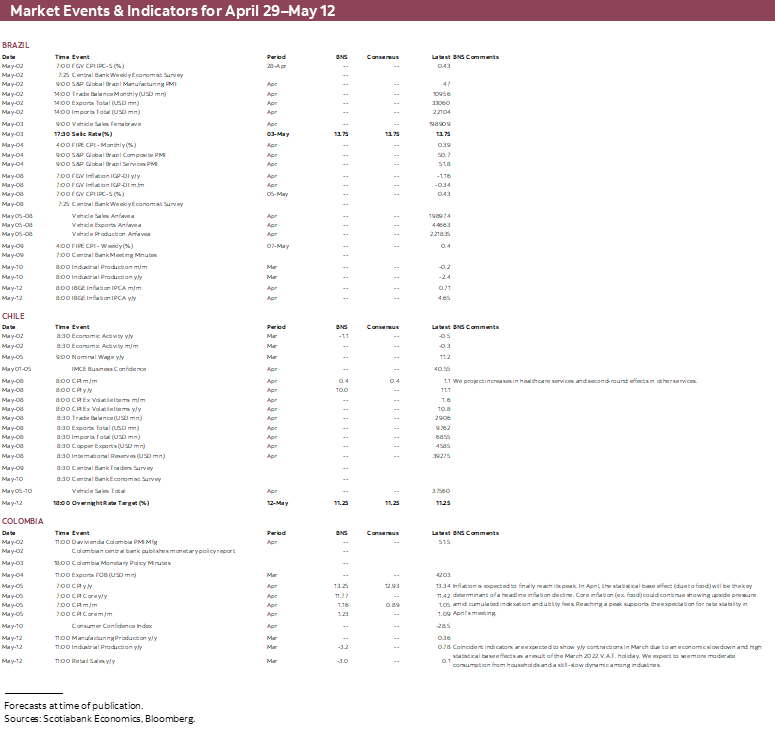

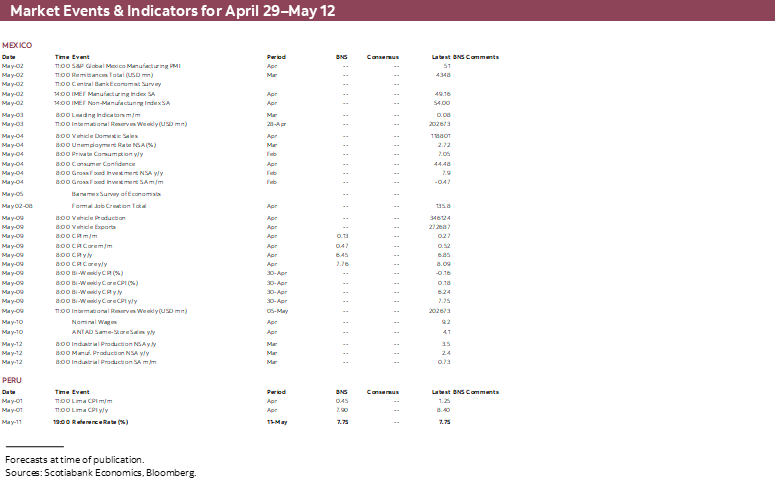

- A busy period awaits regional and global markets, starting the month with key rate decisions in the US, the Eurozone, and Brazil, as well as inflation prints in Peru and Colombia.

- Next Friday’s release of April CPI will inform the outlook for BanRep’s policy rate. The team anticipates that headline inflation will decline to 13.2%, thus confirming a peak in headline inflation.

- Peruvian markets will reopen from the long weekend with Monday’s April CPI data at hand. We project that inflation will slow to (just) below 8% after spending the past twelve months above this level.

- Brazil’s central bank has a tough communications challenge at Wednesday’s decision, where we see no change, given a very restrictive real policy rate—its highest it’s been since mid-2007. The government's fiscal plans remain an important source of risk for the central bank.

- Chilean and Mexican calendars also have some important data to digest. We start out the local trading week with Chilean economic activity for March that is expected to show another year-on-year contraction (the sixth in seven). In Mexico, we await unemployment rate data and the results to a key economists’ survey ahead of a possible Banxico pause next month.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Colombia, Mexico, and Peru.

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period April 29–May 12 across the Pacific Alliance countries and Brazil.

Chart of the Week

ECONOMIC OVERVIEW: PERU AND COLOMBIA INFLATION, THE BCB’S TOUGH COMMS TASK, FED AND ECB WATCH

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- A busy period awaits regional and global markets, starting the month with key rate decisions in the US, the Eurozone, and Brazil, as well as inflation prints in Peru and Colombia.

- Next Friday’s release of April CPI will inform the outlook for BanRep’s policy rate. The team anticipates that headline inflation will decline to 13.2%, thus confirming a peak in headline inflation.

- Peruvian markets will reopen from the long weekend with Monday’s April CPI data at hand. We project that inflation will slow to (just) below 8% after spending the past twelve months above this level.

- Brazil’s central bank has a tough communications challenge at Wednesday’s decision, where we see no change, given a very restrictive real policy rate—its highest it’s been since mid-2007. The government's fiscal plans remain an important source of risk for the central bank.

- Chilean and Mexican calendars also have some important data to digest. We start out the local trading week with Chilean economic activity for March that is expected to show another year-on-year contraction (the sixth in seven). In Mexico, we await unemployment rate data and the results to a key economists’ survey ahead of a possible Banxico pause next month.

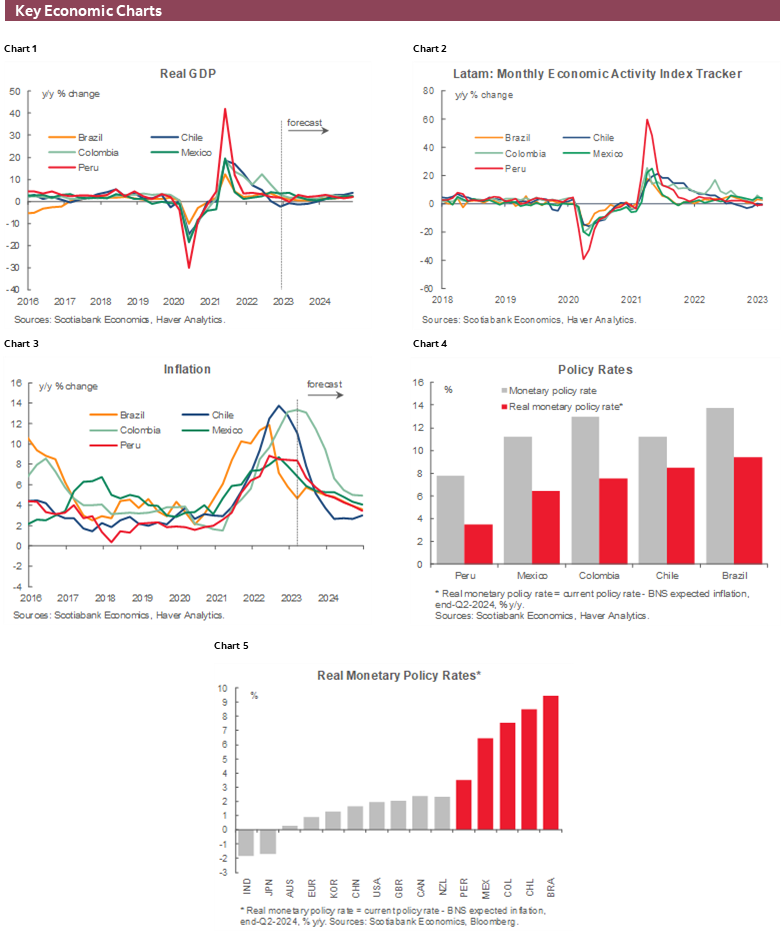

A busy period awaits regional and global markets, starting the month with key rate decisions in the US, the Eurozone, and Brazil, as well as inflation prints in Peru and Colombia.

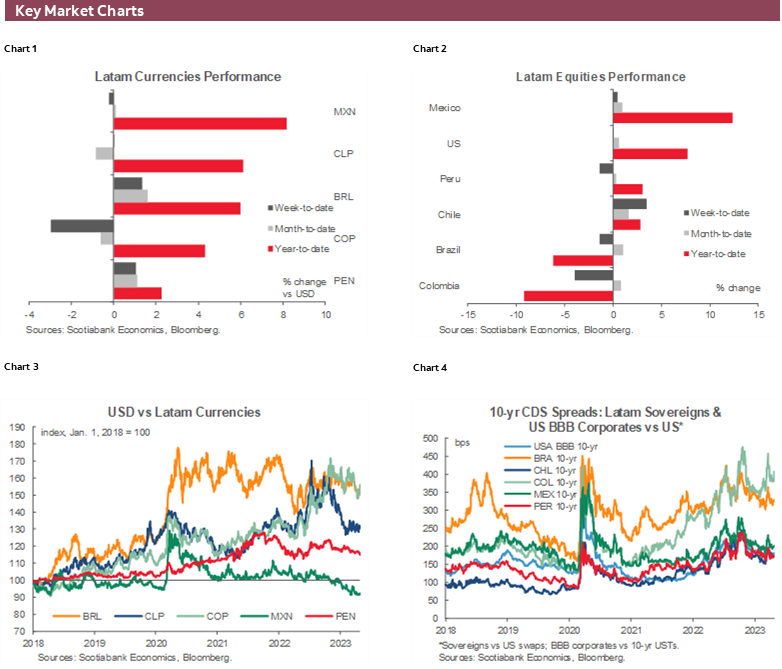

Next week’s rate decisions are certainly no slam dunks, especially when it come to guidance, and the G10 markets’ apprehension ahead of pivotal policy announcements may extend to Latam trading. Thin liquidity amid early-May holidays in a number of countries (Brazil, Colombia, Mexico, Chile, Peru, Germany, UK, China, Japan, and others) could also exacerbate volatility.

The Fed’s guidance on the possibility of additional hikes will be key, as markets anticipate no more rate increases in the US—and continue to price in multiple rate cuts in H2, which we disagree with. As for the ECB, the size of its rate hike is up in the air owing to a lingering chance of another half-point increase; talk of a QT acceleration later in the year is also something that may arise. These decisions are bound to impact global market sentiment—as are key data releases like US jobs and ISMs, and Eurozone inflation, among others.

Colombia’s BanRep will publish its Monetary Policy Report on Tuesday, with the minutes to Friday’s policy decision (after the publication of this report) due on Wednesday. At writing, our expectation is that the bank will not act rashly in the face of the latest bout of political risk and pressure on the COP—due to the unexpected resignation of FinMin Ocampo— choosing to leave its policy rate unchanged after a cumulative 1,125bps in hikes in the cycle.

We’ll keep an eye on the intensity of marches around the country on Monday (Colombia’s labour day) as well as statements from new FinMin Bonilla over the week. His comments since being appointed on Wednesday seem to us rather reasonable, and not a significant deviation from the policies of his predecessor. At the margin, his expectation that Colombia will start cutting rates in H2-23 may represent a more dovish stance than Ocampo’s; note that Ocampo will still be present at Friday’s BanRep decision.

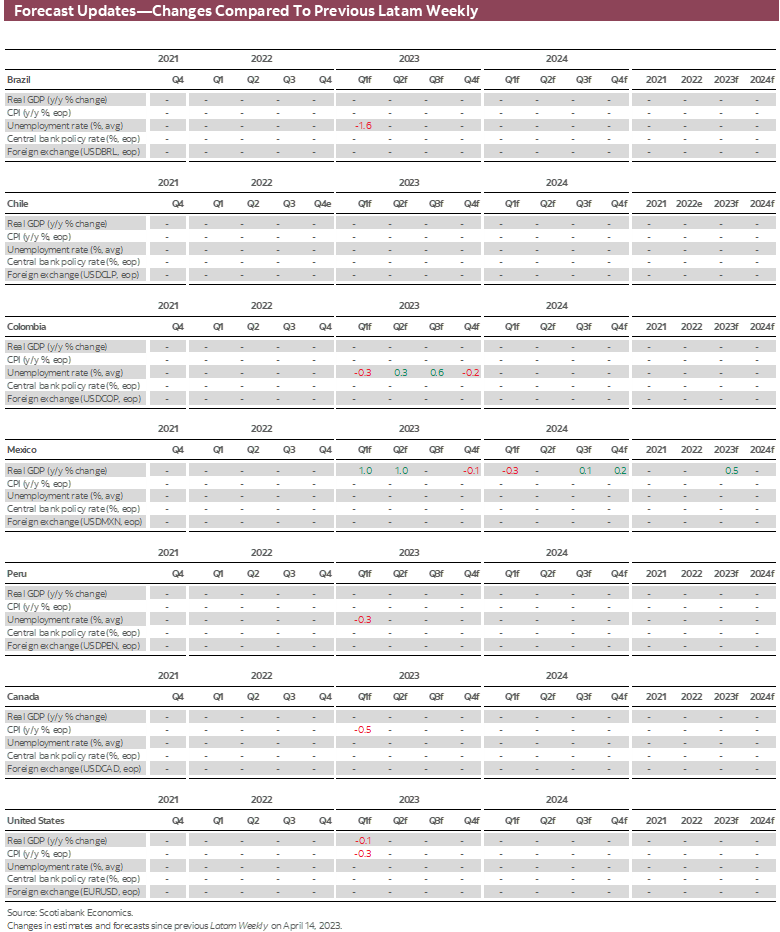

Next Friday’s release of April CPI will inform the outlook for BanRep’s policy rate. The team anticipates that headline inflation will decline to 13.2% (above the Bloomberg and BanRep survey medians of 12.93% and 12.96%, respectively), thus marking a peak in inflation in March (13.34%). The end of the ascent in inflation will be welcome news for policymakers, but the deceleration towards target will be slow—prompting rate stability for a number of months in Colombia. The team discusses their outlook for the CPI print and its implication in today’s report.

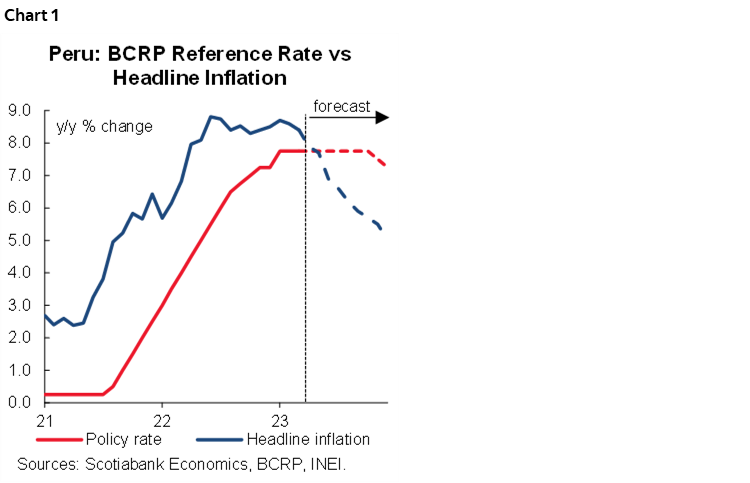

Peruvian markets will reopen from the long weekend with Monday’s April Lima CPI data at hand (see Peru section). We project that inflation will slow to (just) below 8% after spending the past twelve months above this level. This breakthrough may have come sooner were it not for disruptions from social unrest (and their impact on prices) following former President Castillo’s removal by Congress. Next week’s print is not quite a placeholder, since the one-year-low is an important feat, but a sequence of convincing declines in inflation is needed before sounding the all-clear on this front. For now, we expect that the BCRP will keep its rate at 7.75% through the second and third quarters

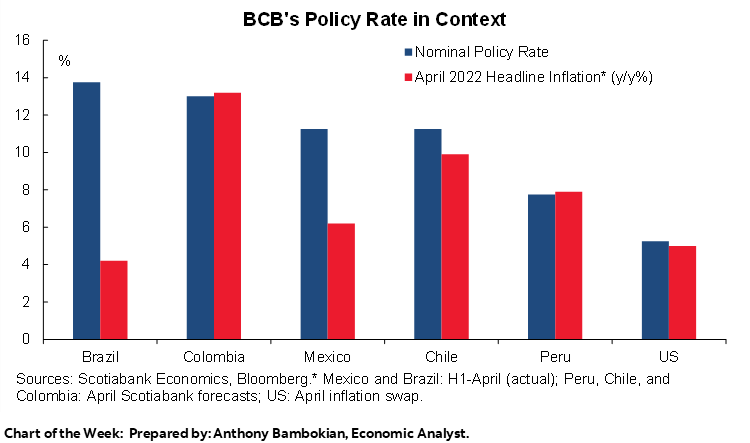

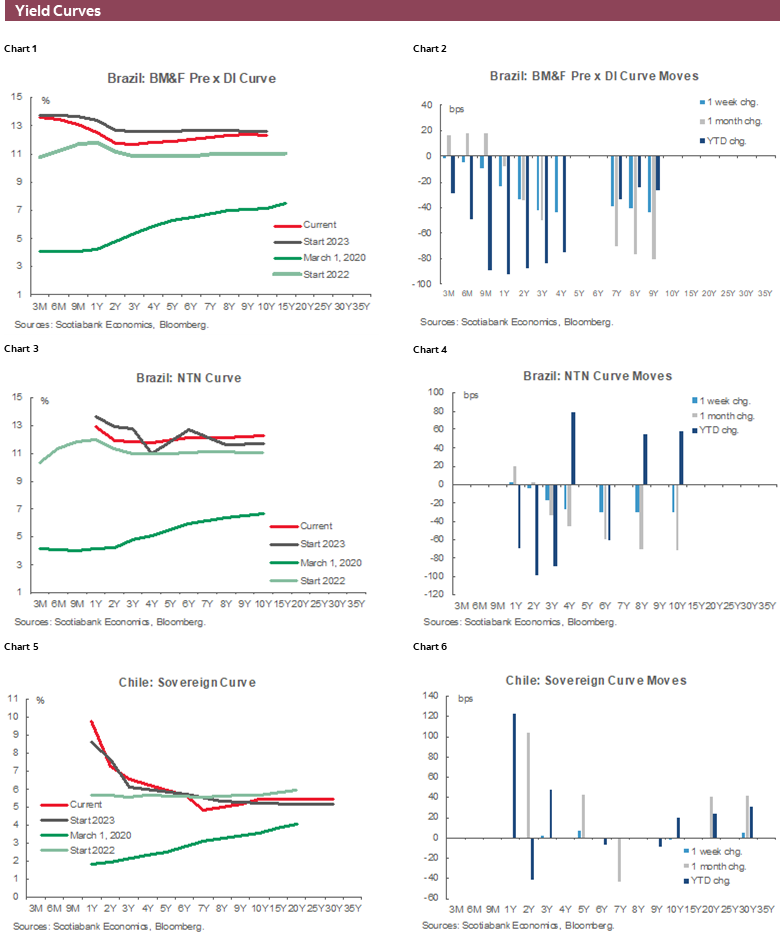

Brazil’s central bank has a tough communications challenge at Wednesday’s decision. Earlier this week, mid-April inflation continued a steep decelerating path (from 5.4% to 4.2%), which translates into a real policy rate of ~9.50%—the highest it’s been since mid-2007. Of course, the government's fiscal plans remain an important challenge to the central bank, as the uncertainty around additional spending (as well as the impact that this uncertainty has had on the BRL) have likely pushed out the start of the easing cycle. Campos Neto alluded to this issue in Congress this week, saying that they're waiting for how this matter evolves and its implications on inflation, because the BCB does want “a sustainable decline in rates”. The country’s economy also blew past estimates for growth in February, according to data published this morning that showed a3.3% y/y expansion (vs a 1.1% median), and BCB president Campos Neto maintains that core inflation remains much too high—high enough to likely keep guidance little changed on Wednesday, and see more pressure from the Lula administration to lower rates.

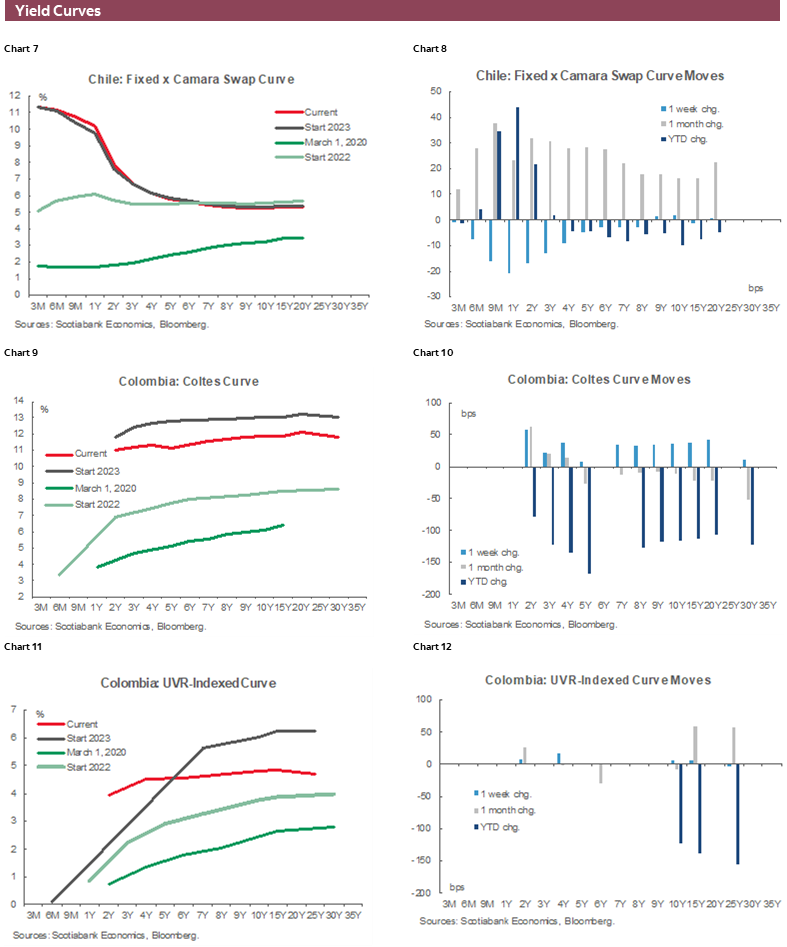

Chilean and Mexican calendars also have some important data to digest. We start out the local trading week with Chilean economic activity for March that is expected to show a 1% y/y contraction (the sixth of the past seven months), which would reflect the impact of the BCCh’s hiking rally to an 11.25% overnight rate. This is still better than we had maybe anticipated, an economy that we thought would be under greater strain in 2023, opening the door to aggressive rate cuts from the BCCh at one of its January or April decisions (both were rate holds). Elevated wages growth is also a piece of the puzzle that has prompted a more hawkish stance from the bank, and March data scheduled for publication on Friday should show another double-digit year-on-year increase. Next weekend's Constitutional Council elections will be key. The group of 52 councillors will be tasked with continuing work on Chile's new constitution ahead of the presentation of a draft in November (see Latam Insights)

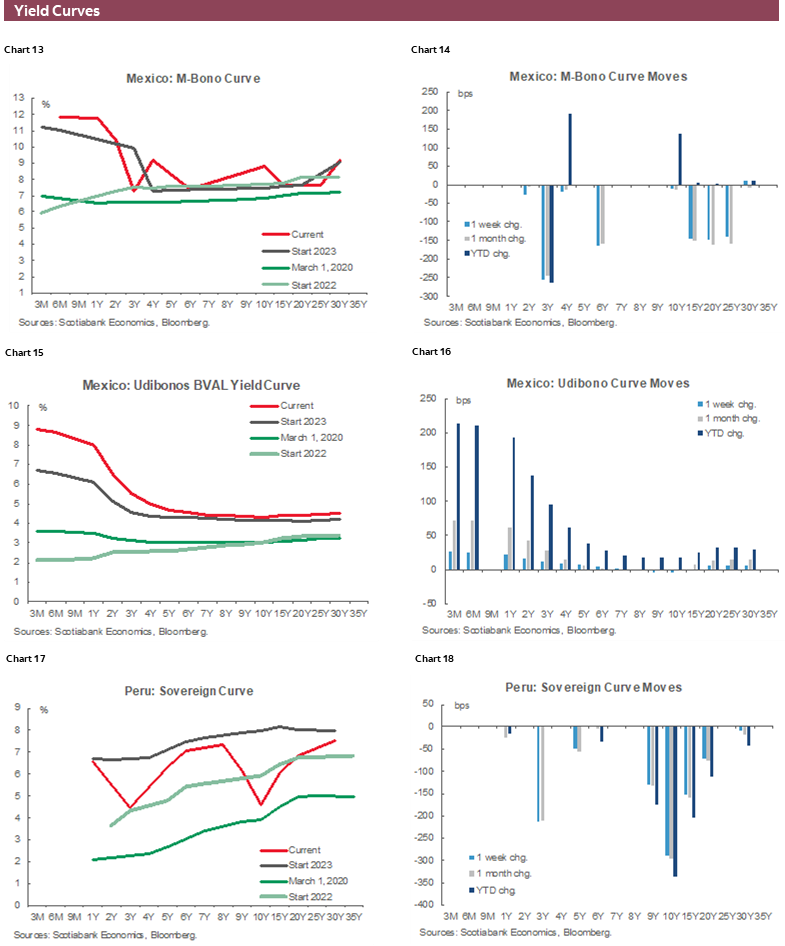

In Mexico, the past week’s releases of H1-Apr CPI and Q1 GDP are difficult to match in terms of market relevance, but March unemployment rate data (Thursday) and Friday’s Citibanamex survey results are certainly worth a look. The continued softening in inflation shown in H1-Apr CPI data and comments by Banxico Gov Rodriguez to Mexican lawmakers earlier this week—noting that they will discuss whether the time is right to stop rate hikes—point to high odds that the median economist surveyed will now support a pause. The April 20 survey results showed that 17 of 32 respondents expected a rate move on May 18; the remainder saw no change. Banxico could justify a rate pause at this point, though we think stubborn core inflation may be reason enough to hike one last time—what the Fed does next week, and what it guides for its upcoming meetings may factor into Banxico’s decision. What’s more, the Q1 GDP print released on Friday (preliminary, without expenditure details) came in much stronger than economists anticipated, at 3.9% y/y (vs 3.3% median). A resilient economy makes a rate hold decision trickier. In today’s Weekly, the team presents the latest developments on the political front, with the presentation of two legislative packages that can impact sectors that operate under concessions or government licenses.

PACIFIC ALLIANCE COUNTRY UPDATES

Colombia—Between Inflation and Politics

Sergio Olarte, Head Economist, Colombia

+57.601.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.601.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

Santiago Moreno, Economist

+57.601.745.6300 Ext. 1875 (Colombia)

santiago1.moreno@scotiabankcolpatria.com

According to surveys, April inflation data out next Friday could finally confirm that prices growth has peaked. This time the possibility of seeing headline inflation decreasing is higher since there is an atypically high statistical base effect in food inflation: monthly food inflation of 2.75% m/m twelve months prior is expected to be replaced by a lower number (Scotiabank Economics forecast: 0.91% m/m). However, core inflation may continue pointing north, reflecting significant indexation effects and gasoline price adjustments. This time Scotiabank Economics has the highest call with a 1.16% m/m inflation forecast vs. the 0.89% economist consensus; we skewed our projection to the upside since some utility fees in Bogota saw significant increases.

Reaching an inflation peak was an awaited milestone for Colombia. However, from this point inflation convergence will likely be slow. We expect inflation to remain above double digits through most of 2023, which could prevent BanRep from discussing rate cuts. Additionally, ending 2023 with still-high inflation triggers again indexation effects for 2024, which is why inflation remains above the target range over a two-year horizon.

In that sense, the Monetary Policy Report out on Tuesday will guide the balance of risks on the monetary policy horizon. In previous reports, we noticed that the central bank staff were more hawkish than the board. This time a hawkish position from the staff may imply that high rates could last for longer than usual.

On the political front, the Government is falling short in reaching a consistent consensus with traditional parties. Changes in cabinet could delay the discussion of the reform agenda for H2-2023, which is not good timing since in H2 Congress will be more focused on regional elections campaigns. For now, the political noise reminds us that Colombian assets should continue pricing in a risk premium. According to our fundamental FX macro model, this premium is around 350 pesos, which is compatible with a USDCOP level of between 4,650 – 4,700 pesos.

Mexico—Following a Trend Seen Elsewhere in LATAM, Mexico Proposed Changes to Sectors that Operate Under Concessions and Licences

Eduardo Suárez, VP, Latin America Economics

+52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

Over the past month, the Mexican government proposed two legislative packages that can impact sectors that operate under concessions or government licenses. The first proposal only affects mining and in its initial form would have shortened concessions from 50 years to 15 years, tighten regulation on water use, and would require companies to give back 10% of their profits to communities where they operate. The reform also changes the possible reasons for concession termination from 1) the holder abandoning the project, 2) changes in the use of the land where the concession was granted, and 3) judicial resolutions, to instead 1) not paying corresponding contributions for 2 consecutive years, 2) not developing the project as agreed upon, 3) ecological damage, 4) not having the necessary permits, 5) not meeting the requirements on waste disposal, 6) not complying with water regulation and requirements.

This proposal was ratified by the Lower House of Congress on April 21 and must be now approved by the Senate. However, as part of the approval the proposal was somewhat watered down, and now contemplates cutting concessions to 30 years instead of the original 15, and allows for concessions to be extended for up to two additional 25 year periods. If the bill is passed in the Senate and then signed into Law by the President, some companies could appeal it in the courts given that these are legal changes rather than constitutional amendments. There have also been some concerns expressed by Canadian authorities, as the northern nation is an important investor in Mexico’s mining sector.

The second proposal, from March 24th, which is referred to as the Administrative Reform, deals with public sector concessions, licenses as well as government procurement. The bill has a far reaching scope, seeking to modify a total of 23 laws. However, some of the key elements that can affect the private sector include:

- It allows the government to resort to direct adjudication of contracts without going through the open bid process and allows it to go directly to international procurement without first going through domestic bidding.

- It establishes the concept of “exorbitant compensation” for new contracts, which allows the government to set a maximum compensation for contract terminations, even when arbitration establishes a higher compensation. In cases where contract termination is for the public good, a compensation can be foregone altogether.

- The proposal allows the government to start public works without the need to go through expropriation processes when the project in question is considered urgent for the public good.

This proposal is also a legal reform, which means it requires only a simple majority, but not being a constitutional reform also means it could be appealed in the court system.

Peru—Inflation is (Finally!) Poised to Break Below 8%... Maybe

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Inflation data for April will be published on May 1st. The key prices that we track point to a monthly inflation of around 0.58%, which would have 12-month inflation decline to 7.99% (chart 1). This rounds out to 8.0% of course, but the key items that we track account for only a subset of total prices that determine inflation, and do not cover the full month, so there is a chance that inflation may drop a bit further, enough to be more evidently below 8.0% (or not). What gives us a tad more hope that this will be the case is that Finance Minister Alex Contreras came out on Wednesday April 26th stating that he expects inflation for April to be below 8.0% as well. This is not something we envision him saying if he wasn’t sufficiently sure that this would be the case.

Of course, there’s not much mathematical difference between 8.0% and just under. However, breaching 8.0% is psychologically important, and could affect market consensus regarding when the BCRP might reverse policy and begin lowering its reference rate. Note that inflation has been above 8.0% for exactly one year, since April 2022.

Regardless of the exact number, yearly inflation in April is likely to decline from 8.4% in March, and continue trending down to our forecast of 5.0% by year end. For now, we continue to maintain that the BCRP will keep its rate at 7.75% through the second and third quarters, then begin lowering it in the fourth quarter, to 7.25% at year-end 2023, and 5.25% at end- 2024.

FinMin Contreras also stated that he no longer expects GDP growth of 3.1% for 2023, and has lowered its forecast to 2.5%. This is closer to our forecast of 1.9%, which we will not be changing.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.