ECONOMIC OVERVIEW

- Following the recent flood of Latam inflation data and the BCRP’s rate decision yesterday (see Latam Daily), we head into mid-March facing a generally quiet data and events calendar in the region. Across the four Pacific Alliance countries, there was not one that saw stronger than expected inflation in February data released over the past couple of weeks.

- To guide our outlook for Peru’s economy and monetary policy, the country’s releases of GDP and unemployment figures on Wednesday will be the data highlight of the week in the region. The team estimates that GDP in Peru contracted by 1.4% y/y in January (as estimated by Velarde) owing to the economic disturbance of social unrest during the month.

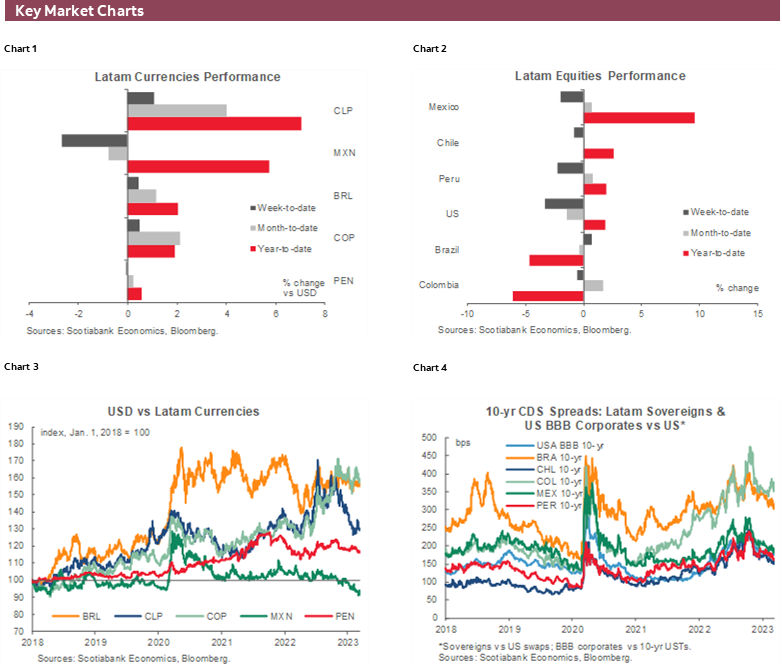

- The release of US inflation data on Tuesday and the ECB’s decision on Thursday may ultimately crowd out domestic market narratives in Latam, however, after anxiety over the Fed’s terminal rate and its next hike size troubled traders in recent days.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, and Peru.

MARKET EVENTS & INDICATORS

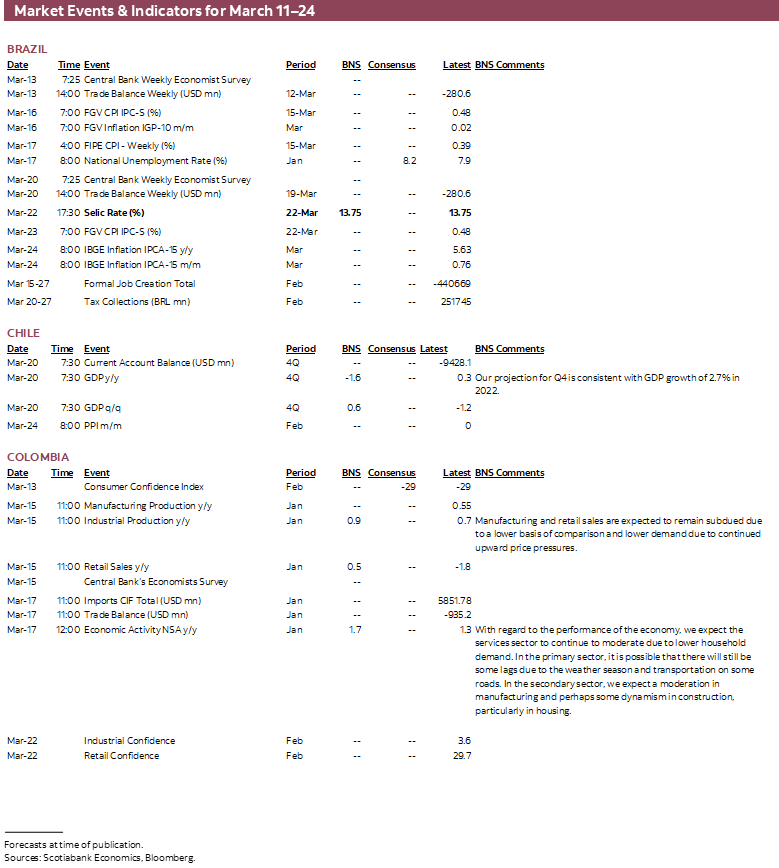

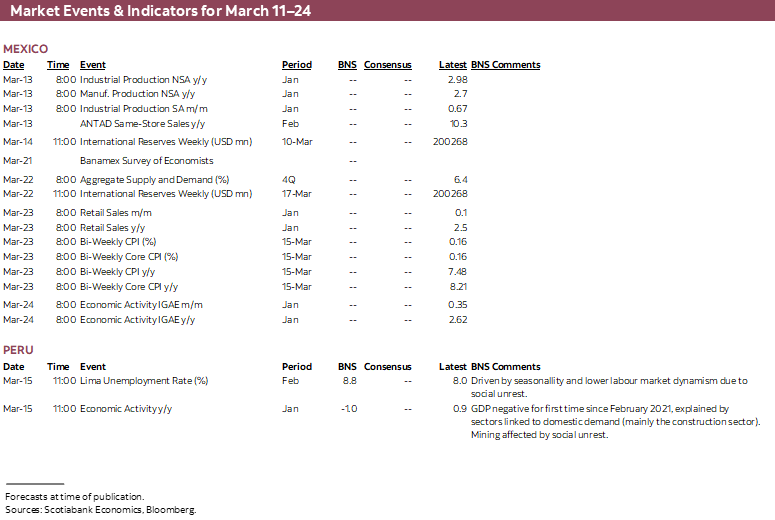

- A comprehensive risk calendar with selected highlights for the period March 11–24 across the Pacific Alliance countries and Brazil.

Chart of the Week

ECONOMIC OVERVIEW: PERU IN THE REGIONAL SPOTLIGHT WHILE GLOBAL MARKETS WATCH US CPI

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- Following the recent flood of Latam inflation data and the BCRP’s rate decision yesterday (see Latam Daily), we head into mid-March facing a generally quiet data and events calendar in the region. Across the four Pacific Alliance countries, there was not one that saw stronger than expected inflation in February data released over the past couple of weeks.

- To guide our outlook for Peru’s economy and monetary policy, the country’s releases of GDP and unemployment figures on Wednesday will be the data highlight of the week in the region. The team estimates that GDP in Peru contracted by 1.4% y/y in January (as estimated by Velarde) owing to the economic disturbance of social unrest during the month.

- The release of US inflation data on Tuesday and the ECB’s decision on Thursday may ultimately crowd out domestic market narratives in Latam, however, after anxiety over the Fed’s terminal rate and its next hike size troubled traders in recent days.

Following the recent flood of Latam inflation data and the BCRP’s rate decision yesterday (see Latam Daily), we head into mid-March facing a generally quiet data and events calendar in the region. The release of US inflation data on Tuesday and the ECB’s decision on Thursday may ultimately crowd out domestic market narratives in Latam, however—after anxiety over the Fed’s terminal rate and its next hike size troubled traders in recent days.

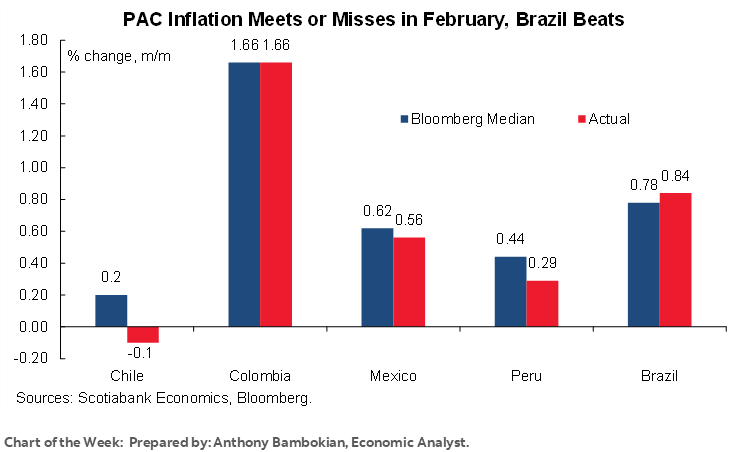

Across the four Pacific Alliance countries, there was not one that saw stronger than expected inflation in February data released over the past couple of weeks. This should be of comfort for the region’s central banks in the hope of reaching their policy goals after a period of highly elevated inflation.

Colombia’s data precisely matched the median month-on-month forecast (unlike the others, which missed) but the marginal increase in the year-on-year pace from 13.25% to 13.28% suggests that February may have marked the peak in inflation in the country—the last one in the region to reach this milestone. Still, BanRep will likely face double-digits prices growth until the final quarter of the year, to a great degree owing to indexation effects. With this in mind, we think the central bank will still roll out another hike at month-end, but a weakening economy should prompt a downshift to a 25bps pace (from 75bps at its previous decision) with wait-and-see guidance on whether it will hike again.

A weaker than expected reading in Mexican CPI data published yesterday saw markets reduce their expectations for Banxico rate hikes (and saw lower yields across the curve) and now a 50bps move looks a fair bit less likely than a 25bps increase. Fed Chairman Powell also spoke on the possibility of a half-point increase earlier this week, leaving some wondering whether Banxico would match that. However, before this idea could pick up steam, the sharp re-pricing of Fed March hike bets in the past couple of days coupled with the softer than expected core inflation print leaves us where we started; Banxico will shift to a lower hiking pace after hawkishly surprising at its latest decision.

Peru’s central bank responded to the lower than forecast February inflation reading (which also missed in January data) with a second rate pause at its policy decision yesterday. We think the current 7.75% represents the terminal rate for the BCRP, despite an openness to moves in either direction expressed in the statement, and the focus will now turn to how much longer the Velarde-led bank will hold its policy rate without cutting. We think the bank will wait until the final quarter of the year to reduce its policy rate by 50bps across two meetings.

In Chile, headline inflation fell below 12% for the first time since May 2022, and the 0.1% decline month-on-month represented the first negative print in over two years. The data miss and decline led the team in Santiago to believe that two-year-ahead inflation expectations would converge towards 3% in the results of the BCCh survey published today—and so they did. Analysts, however, expect a rate hold from the central bank at the next two meetings, while our economists project the start of the cutting cycle next month. The government’s response to the surprising failure of its tax reform bill in the lower house this week is a key development to monitor over coming days and weeks.

To guide our outlook for Peru’s economy and monetary policy, the country’s releases of GDP and unemployment figures on Wednesday will be the data highlight of the week in the region. The team estimates that GDP in Peru contracted by 1.4% y/y in January (as estimated by Velarde) owing to the economic disturbance of social unrest during the month. Though the economy should fare better in February, it may not be until data for the current month that we get a ‘cleaner’ read of the underlying state of the economy—with the added support of stimulus programmes (see Peru section). Industry-level data in Colombia released the same day will also catch our eye, particularly retail sales to gauge the state of household consumption. Mexico also publishes industrial production data and ANTAD retail sales.

In Brazil, we’ll pay attention to unemployment figures but the main thing to watch will be the trickle of information surrounding Haddad’s fiscal plan (to replace the current spending cap rule) which is due to be delivered to President Lula next week. Austerity measures in response to a breach of public debt goalposts is one item that is reportedly included in the current form of the proposal—and an item that will likely not sit well with Lula. On the other hand, improved fiscal credibility and signs that the administration is not looking to spend with largesse may prompt the BCB to look more favourably at a rate cut in coming months. Yet, the beat in inflation data published today, with elevated rates of underlying inflation, will throw a spanner in the works for the board led by Campos Neto who looks set to keep highly restrictive rates on hold for a while longer—with no change expected later this month.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Government Suffers from the Rejection of the Tax Reform; Inflation Convergence Underway

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

AFTER REJECTION IN THE HOUSE, THE GOVERNMENT WILL PROBABLY HAVE TO SEPARATE THE TAX REFORM TO SEEK ITS APPROVAL IN CONGRESS

On Wednesday, March 8, the Lower House rejected—in general terms—the tax reform bill delivered by the government in July 2022, which intends to collect 3.5% of the GDP in the next 4 years, mainly to finance the pension reform. The bill needed 78 votes in favour to be approved by the chamber of deputies, reaching only 73 due to the rejection of some parliamentarians of the People’s Party (Partido de la Gente) and the absence of eight members in the Lower House, three of them from government parties. Now, the government has the possibility to insist with the initiative by entering the bill in the Senate. However, in our opinion, it is likely that the government will separate the tax reform bill and seek the approval of the issues that generate consensus, such as the measures to reduce tax evasion and avoidance, and continue discussing separately some proposals that generate concern among lawmakers. All in all, as we mentioned some weeks ago (see our Latam Weekly), the tax reform will require important modifications to be approved in Congress, which would occur no earlier than Q3-2023. In consequence, the tax reform should be approved with relevant adjustments that will very likely lower the long-term collection objective.

INFLATION CONVERGENCE UNDERWAY; SECOND-ROUND EFFECTS WILL DISAPPEAR SOON

Also, on Wednesday, March 8, the INE released February CPI data, showing a 0.1% m/m decline (11.9% y/y), sharply below market survey expectations (Economic Expectations Survey: +0.4%; Financial Traders Survey: +0.3%), forwards (+0.3%) and consensus expectations (0.2%), although closer to our 0.1% m/m projection. With this, CPI fell for the first time in more than two years (since November 2020).

We have a different read than consensus regarding inflationary persistence. For many, this is explained by specific factors linked to the exchange rate. We partly agree. However, both the negative CPI that will be transmitted to short-term indexed products (like rents), as well as the still strong multilateral appreciation of the peso, would lead to a faster inflation landing than estimated by the market. The last month to reflect indexation effects (through educational services) will be March, and the overall prices basket will have to deal with relevant negative impacts coming from several food and other exchange rate-linked products. We reiterate our 2023 annual inflation projection of 3.7%.

Peru—A Glimpse at Post-Protests Peru

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

The summer of protests in Peru appears to be ending. But the aftermath of the protests will linger. We await January GDP figures to be released on March 15. Julio Velarde, the presiding Board Member of the BCRP, has already suggested that January GDP will show a 1.4% y/y decline. We were hoping that the decline in GDP would not be this great, but would not be surprised if it is. February GDP should fare better, but not as well as it should. Growth will be low if not nil. It won’t be until March that we can hope for economic indicators that will not be materially contaminated by unrest. March should be the first month in which we shall be able to see what “normal” monthly growth looks like.

What will help to an extent is public spending, which has the potential to be quite the silver lining in 2023. At least, the government seems intent on making it so. In its three months in office, the cabinet has launched three stimulus programs, one that is an all-encompassing program linked to the 2023 budget, called Con Punche Peru (with a PEN5.9bn price tag), and two which focus on special concerns, namely, a sector and a region that were most impacted by the protests (Con Punche Turismo is designed to support tourism, and Con Punche Puno is geared towards the Puno region). In addition, the government requested, and obtained, special powers to legislate on issues to promote investment—particularly, we understand, in large infrastructure projects, and overall private investment. Perhaps mining as well.

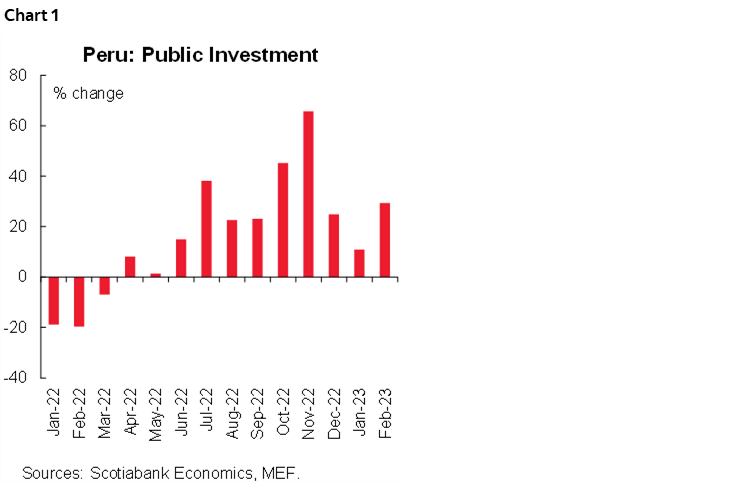

One could argue that the results of all this “punching” are already being seen. In February, there was a spike in public investment, quite against expectations. Overall public investment was up a significant 29% y/y (chart 1) (preliminary figures by the Ministry of Finance figures, which may differ from BCRP figures, to be released next week). The breakdown by type of government is even more interesting. National government investment was up a huge 65% y/y, in February. The magnitude was unexpectedly high, but was within the realm of the imaginable. What is much more interesting is that regional government investment rose 20.9% y/y in February, and local government investment fell only 2.0%. This was not expected because precedent has it that whenever there is change in regional and local authorities, as occurred in January, investment plummets for nearly a year. This certainly occurred in January, when regional public investment fell by 29.8% and local government investment declined by 57.4%. This makes the turnaround in February all the more impressive. We can only hope that it reflects a successful policy as announced by the MEF to provide managerial support to regional and local authorities to bolster their spending capabilities.

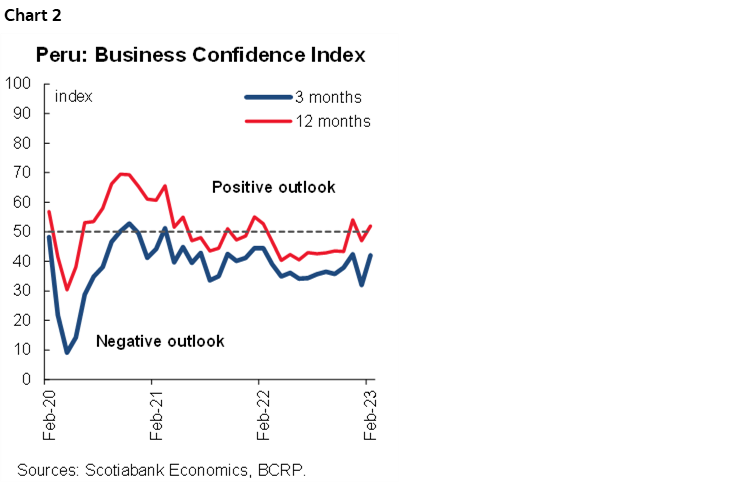

Another sign that the times are changing is that on March 9, the government lifted the State of Emergency in Lima, which has been quite immune to major protests for some time now. There are still roadblocks in Puno, the focal point of unrest, but at last count, there were only 18, compared to over 120 in various regions of the country at the height of the protests in January. Even though uncertainty over elections continues, the return to a greater sense of normality in day-to-day life, and the evident improvement in State management capabilities, is starting to stimulate an improvement in business confidence (chart 2). The three-month outlook is once again in positive territory. Public institutions are operating with normality and regularity, and the rule of law is slowly and quietly returning, in fits and starts, perhaps, but enough to generate a sensation of increasing stability throughout much of the business community. The question, of course is will it last.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.