ECONOMIC OVERVIEW

- With limited data or events on the regional calendar next week, our economists in Colombia and Chile do a deep dive on a key topic in their respective countries.

- In Colombia, the team outlines the drivers of inflation in the months ahead, and in Chile our economists provide their view on what to expect from the tax and pension reforms processes and the path to a new Constitution.

- The year has started out on the wrong foot in Peru amid violent protests and an uncertain political outlook. How protests evolve next week will be a major focus of ours as we try to gauge the economic damage caused by disruptions, and look for clues on the political path ahead.

- Colombian retail sales and industrial production, Peruvian unemployment and GDP, and Mexican retail sales are the data highlights.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, and Peru.

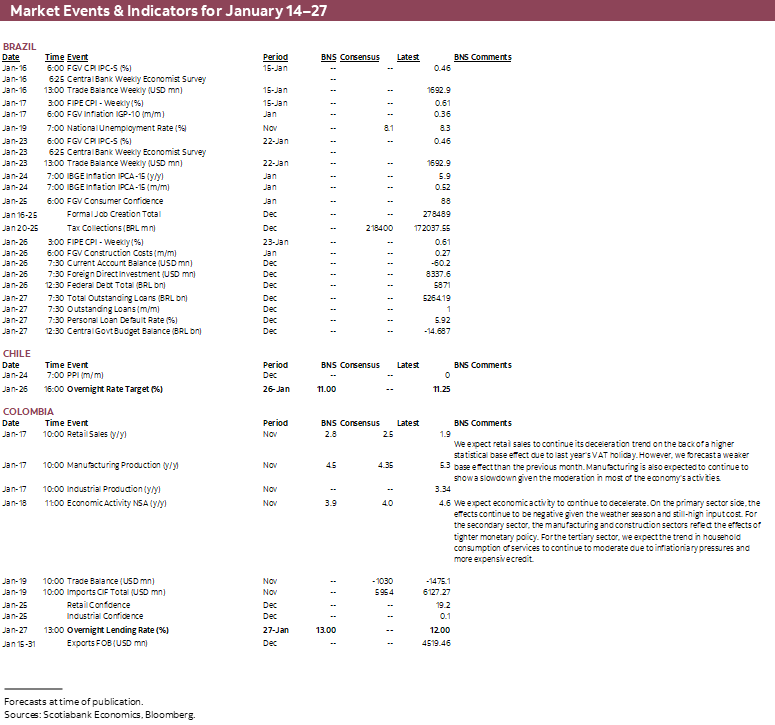

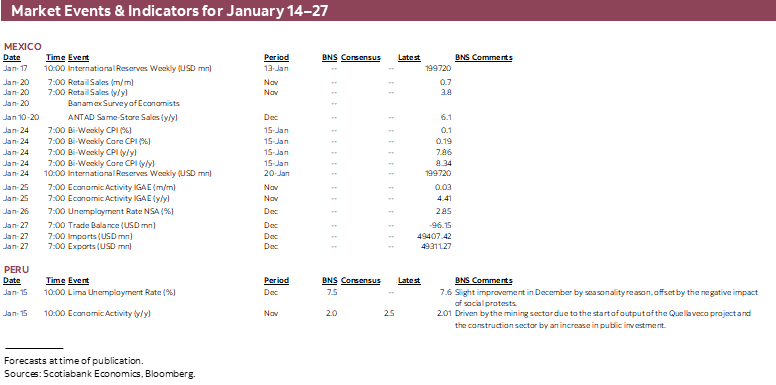

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period January 14–27 across the Pacific Alliance countries and Brazil.

ECONOMIC OVERVIEW: PERU UNREST THE FOCUS; COLOMBIAN INFLATION AND CHILEAN REFORMS DEEP-DIVE

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- With limited data or events on the regional calendar next week, our economists in Colombia and Chile do a deep dive on key topics in their respective countries.

- In Colombia, the team outlines the drivers of inflation in the months ahead, and in Chile our economists provide their view on what to expect from the tax and pension reforms processes and the path to a new Constitution.

- The year has started out on the wrong foot in Peru amid violent protests and an uncertain political outlook. How protests evolve next week will be a major focus of ours as we try to gauge the economic damage caused by disruptions, and look for clues on the political path ahead.

- Colombian retail sales and industrial production, Peruvian unemployment and GDP, and Mexican retail sales are the data highlights.

With limited data or events on the regional calendar next week, our economists in Colombia and Chile do a deep dive on key topics in their respective countries.

In Colombia, the team outlines the drivers of inflation in the months ahead as the country closed out 2022 as the only Pacific Alliance economy where inflation hadn’t peaked. On Tuesday and Wednesday, the country publishes retail sales, manufacturing and industrial production, and economic activity data for November that should still show robust growth—in spite of steep interest rates (and we expect 100bps more from BanRep).

In the case of Chile, the tax and pension reform processes as well as the rewriting of the country’s Constitution will be key events to watch. Our economists provide their view on where negotiations may encounter roadblocks and where the Boric Administration will likely have to settle for less versus their initial, ambitious, goals.

The year has started out on the wrong foot in Peru amid violent protests and an uncertain political outlook. November GDP data due on Sunday will show a stale picture of the country’s economy as social and political disruptions had a large economic effect last month, but also note that the start of Operations at the Quellaveco mine will paint a more positive picture of the Peruvian economy than is broadly evident. December data will eventually show us the economic shock of the protests following Castillo’s impeachment early in the month. How protests evolve next week will be a major focus of ours as we try to gauge the economic damage caused by disruptions, and look for clues on the political path ahead.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Structural Reforms and Constitutional Process

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

AMBITIOUS TAX REFORM, WITH SEVERAL DOWNWARD ADJUSTMENTS TO ITS REVENUE TARGET

Boric’s economic program targeted an increase in tax revenues of 5% of GDP to be reached over six years (relative to around 21% pre-pandemic). A few months later, the Minister of Finance teed up a Tax Reform (TR) that would aim for 4–5% in GDP in additional tax collection. Finally, the first bill that was presented by Boric’s government in July 2022 penciled in a goal of 4.1% of GDP, but subsequent adjustments before and after the September 2022 Constitutional plebiscite reduced that objective to 3.5% of GDP. Although the collection target is still very ambitious, our main concern is the cost commitment that this entails.

The mining royalty bill should be approved soon. The text is one of a handful of bills that comprise the TR delivered to Congress last year (instead of a single document). The bill is currently under discussion in Senate, but should be approved before the legislative recess in February. With this, 0.6% of GDP would be collected as copper mining would face a combined/all-in tax rate of around 40%, higher than the current one of 35%, though not a dramatic increase that would significantly hinder investment flows to the sector. The increase in personal taxes is also at an advanced stage in Congress. The remainder of new tax revenues expected would come from taxes on high income earners, eliminating tax integration related to corporate taxes and the claiming of credits by shareholders, and corrective taxes (diesel and so-called healthy taxes) that are unlikely to be approved or, if so, will require major modifications. In a best case scenario, these initiatives combine for around 2% of GDP. The rest would come from reducing evasion and avoidance.

In our view, the big question is the ability, even with greater powers of the Internal Revenue Service, to significantly reduce evasion and avoidance. Currently, tax evasion and avoidance in Chile is not very different to the OECD average, which is why we see it as very difficult to achieve further reductions. If the revenue target is not achieved, which is highly probable, then we must necessarily work with a different scenario in terms of long-term debt over GDP in Chile in case the Pension Reform is approved as was delivered to the Congress. In that case, if the government has an objective of around 40% of gross debt over GDP, we must move to the ceiling of the threshold, that is, 45% of gross debt over GDP by 2026/2027. Unless, obviously, the Pension Reform is modified.

What are the key dates for the tax reform then? In January we would have approved the Mining Royalty bill. In Q3-2023, the tax reform should be approved in its totality but with relevant adjustments that will very likely lower the long-term collection objective.

PENSION REFORM WILL HAVE A COST OF AROUND 1.5% OF GDP IN REGIME

According to the government, the main goal of the Pension Reform (PR) is to increase pensions for current and future retirees, with emphasis on women, through three mechanisms: (1) An increase in the Universal Guaranteed Pension (PGU), which will be financed via public funds obtained through the Tax Reform; (2) The provision of a new social security pension, financed by employers but ultimately paid by the employee; (3) A decrease in commissions and improvements in the returns obtained through the individual capitalization component.

The PR bill is maintaining individual savings and protecting personal property for the 10.5% mandatory contribution. An employer contribution fund with the 6% additional contribution will go toward a social security fund, which will improve pensions for everyone. The current private pension fund managers (AFPs) will be abolished. New private investment managers will be created, as well as a public alternative. Customer service for pension fund members, the collecting of contributions, account statements, and pension payments will be centralized under a non-profit public institution. Therefore, pension fund members will have the option of choosing between a public investment manager or private players to manage their savings.

The reform replaces Programmed Withdrawal with a new pension option called “Life Annuity with inheritance”. People will therefore be able to choose between a simple life annuity (which grants a survivor’s pension) and a life annuity with an inheritance option which would pay out a lower pension but allow an inheritance to be left under the same terms as Programmed Withdrawal.

The current AFPs will be abolished. However, there will be a role for private-sector players to participate as investment managers, and a public alternative will be created to increase competition. The role of these investment managers will focus on where they can add the most value for pension fund members: investing the funds and generating better returns.

What are the main concerns regarding the pension fund reform? The reform creates a public entity for the payment of pensions, which may have the advantage of economies of scale, but could bring with it a loss of know-how of the current AFPs. The AFPs have enormous knowledge and systems for this process. Will a public entity be capable of handling hundreds of separate accounts, dispensing millions of pension payments, and incorporate the best technological systems in a reasonable time? Much if not all of the additional mandatory contribution will be used to increase pensions immediately. In some cases, replacement rates would be reached; that is, the pension paid on the remuneration of the last 36 previous months would be greater than 100% of income earned during that period. In this context, the level of committed solidarity of current generations, as well as high replacement rates, is a valid concern.

What is the legislative timeline for the pension fund reform? For starters, the approval of a pension reform process in Congress has not yet been obtained. We believe that goal will not be achieved until March. After this hurdle is cleared, intense negotiations will take place on the separation of the additional contribution, the role of the public entities that would be created, the role of the current AFPs, and the increase in pensions proposed by the government, among other issues. Everything indicates that the promises to increase pensions would be significantly reduced, which would also have consequences for the Tax Reform, since we must remember that both reforms are closely linked. In our opinion, it is unlikely that a pension reform (in any form) will be approved prior to July.

CONGRESS APPROVED THE BILL THAT KICKSTARTS A SECOND ATTEMPT TO REWRITE THE CONSTITUTION

On Wednesday, January 9, Congress passed a bill that allows the writing of a new Constitution. With this, the Constitutional Council will begin its work in June and must deliver the draft Constitution by November. A mandatory referendum will then be held on December 17, 2023. Although a bipartisan agreement was made for a new Constitution, this is yet to be ratified in Congress, but there is a high chance that it will over the next few days.

The new boundaries of the political agreement have been widely rejected by parties in the left. particularly the communist party. That is the first symptom of political moderation. Then, 50 councilors will be chosen under an electoral district system that is very favourable to centre-right political parties. Likewise, party lists will be formed where everything indicates that the communist party will have to join forces with the Broad Front party (Frente Amplio). That is, the moderate leftist parties will go on a separate list and could even look for parties in the centre, such as the new party in formation (Democrats). In our view, this new system makes it highly probable that the centre-right parties will achieve a percentage very similar to the one they have in Congress, which would be enough to block any extreme proposals. Recall that the quorum needed to block a proposal has changed from 33% to 40% but, given that the independents must go on party lists with a district distribution very similar to that of the Senate, we believe that the probabilities are quite inclined towards the centre-right obtaining 20 councilors.

Our view is that the market has internalized a lower probability of a far-left constitution. This has been reflected in the behaviour of the FX market and sovereign rates. We also can’t rule out that if political negotiations between May and November struggle, the constitutional proposal will be rejected. We believe that this scenario is of a low probability if, as expected, of the 50 councilors confirmed to the board at least 20 of them are from right-wing parties.

Colombia—Will Inflation Peak Sooner?

Sergio Olarte, Head Economist, Colombia

+57.1.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

María Mejía, Economist

+57.1.745.6300 (Colombia)

maria1.mejia@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.1.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

By the end of 2022, Colombia was the only PAC country where inflation hadn’t peaked. Headline inflation ended last year at 13.12% y/y, the highest level since March 1999, and before the inflation targeting framework was officially established in Colombia. Meanwhile, core inflation continues to point north and is too close to 10%. Therefore, markets wonder if BanRep can get to a ceiling in its hiking cycle soon. In our opinion the level of the terminal rate will depend on how harshly economic activity decelerates in 2023 and if, finally, headline inflation touches a peak.

Regarding the GDP scenario, we expect a healthy soft-landing in economic activity in 2023. Private consumption grew above its long-term trend in 2022, but in 2023 we anticipate a moderation in spending capacity due to a challenging context of high inflation and higher rates. On the investment side, we project a gradual recovery but still sitting below pre-pandemic levels. That said, economic growth would oscillate in 2023 between 1.2% and 1.8%.

Alongside the above projections, in the case of inflation we see four different effects to analyze this year:

1. International prices and bottlenecks have eased recently, which bodes well to imported goods prices and inputs into production relating to global prices;

2. However, FX depreciation can partially offset the effect of better international prices. Although we do not anticipate stronger depreciation than we saw during the last quarter of 2022, the risks are tilted toward a weaker peso due to still high domestic and international uncertainty around domestic structural reforms (i.e., pension reform) and global economic activity;

3. Indexation effects and the normalization of gasoline prices will make it more difficult for headline inflation to decelerate as fast as we have seen in global goods inflation. More than 60% of the CPI basket is affected by indexation effects, either past inflation (13.12%) or minimum wage increments (16%); and,

4. An extraordinarily high statistical base effect will benefit lower inflation in 2023, especially in food prices.

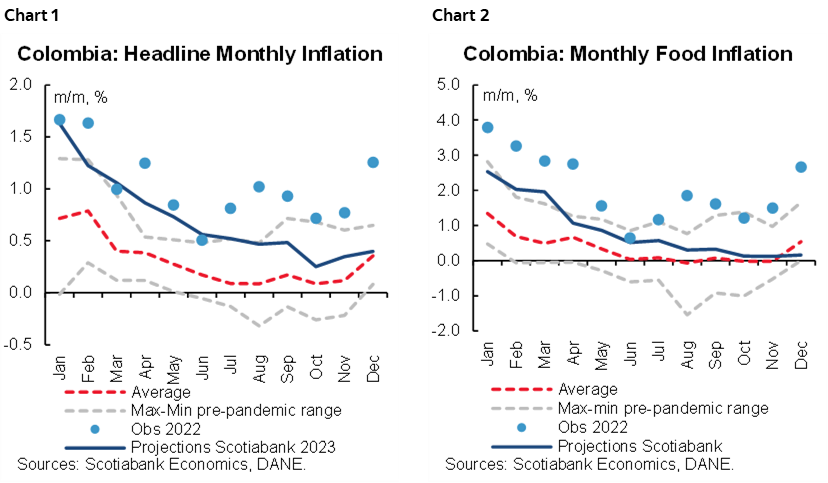

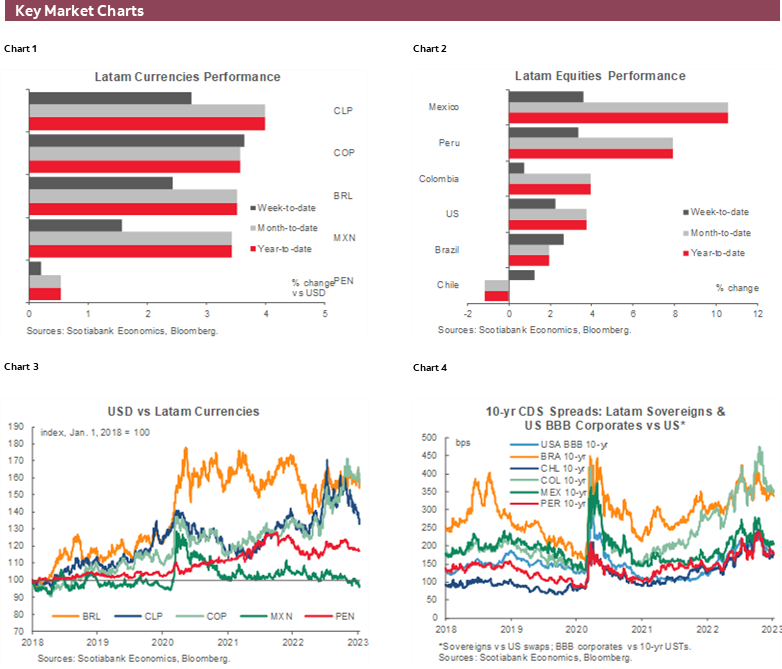

The fourth effect is the most important in anticipating that inflation in Colombia is reaching a peak. In 2022 Colombia showed atypically high inflation figures. In fact, on average monthly headline inflation during 2022 was 0.32ppts higher than the maximum observed between 2009–2019 (charts 1 and 2), which means that even if 2023 monthly inflation comes in around its highest in “normal times”, inflation would still decelerate by almost four percentage points by December 2023.

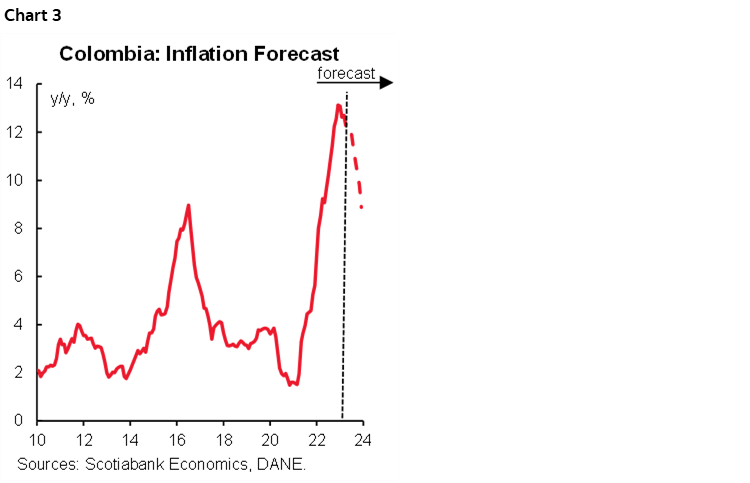

Our models, after incorporating indexation effects, lower international prices, and a relatively stable currency show that monthly inflations will remain high (average of 0.70% m/m), but on average, will be lower than in 2022 (average of 1.03% m/m). That said, statistical base effects will be the main reason inflation stabilizes early in 2023 but are not enough to see a stronger convergence toward the target range. We project inflation to average 11% in 2023, closing at 8.88% in December from its highest point in one of January or February (chart 3).

That said, by the end of the year, Colombia will be the PAC country with the highest deviation from the central bank inflation target.

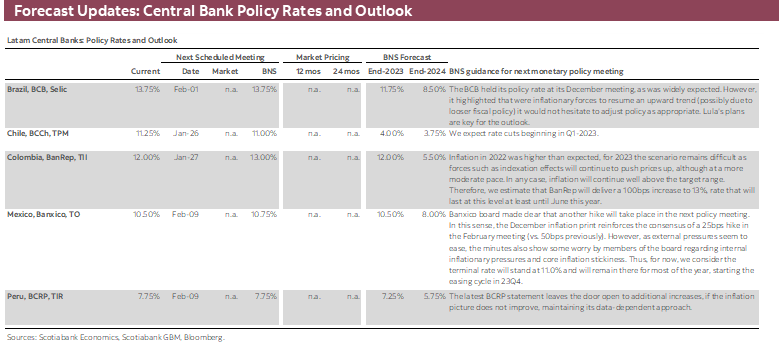

Therefore, we still see one more hike to BanRep’s monetary policy rate in January to 13%, keeping that extraordinarily high rate until at least October 2023. Rate cuts would start later in 2023, closing the year at 12%, and at 5.5% in December 2024, when headline inflation will hover around 5%, but inflation expectations will return to target.

Peru—Not the Best Start for 2023

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

This is not the best start to the year for Peru. The country finally has a government that is capable, but the protests, while still contained to the south, continue to be violent and are not abating, which could conceivably open the door to more political change.

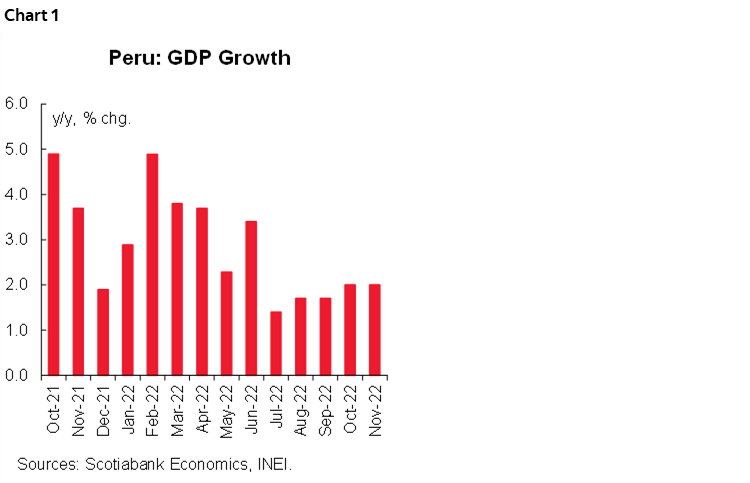

The protests will start to have a material impact on GDP beginning in December. But not on November GDP, which will be released on Monday, January 16. We expect monthly GDP growth of 2% y/y, similar to October (chart 1). This is low, considering that November will register a greater positive impact from the new Quellaveco copper mine.

December is, perhaps, more worrisome. Based on indirect information, such as (low) Christmas season sales, the protests could shave as much as one percentage point from growth in December.

January will also be a difficult month. It will not only be the first full month of the Boluarte presidency, but also for the newly elected local and regional authorities. The protests, then, are likely to make what would already have been a weak month even weaker. The south, where the protests are concentrated, is a region with abundant mining activities. We understand that roads used by operators, including Las Bambas, Constancia (Hudbay) and Antapaccay (Glencore), have been blocked for over a week. Output has not been affected much, but will be if the roads are not unblocked soon.

Markets continue to react with significant calm to the political environment. The PEN, in particular, has performed in line with regional currencies rather than moving with domestic events. Our 2023 (eop) FX forecast for the PEN has become mildly misaligned with the eop view for the USD (DXY at 101) and copper price forecast (USD3.80/lb), and we are adjusting it to 3.80, from 3.95.

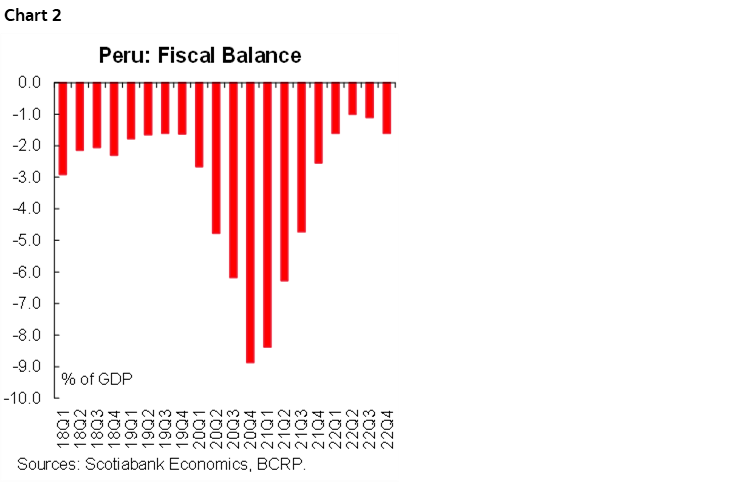

We are also lowering our 2023 fiscal deficit forecast from 2.4% of GDP to 1.7%. The 2022 fiscal deficit, released on January 12, came in at a low 1.6% of GDP (chart 2), on low government spending. The change in authorities at the regional, local, and now also national level that has taken place this year is likely to continue to cause underspending in 2023.

The protests provide clear downside risks to our growth forecasts for 2023.

To end on a positive note, there are two potential upsides as well. One is that the year has begun with very high metal prices. Both copper (USD4.08/lb on January 12) and gold (USD1,898/oz) are above average 2022 levels (USD4.01/lb and USD1,804/oz, respectively). The second factor in our hopeful thinking resides in recent government announcements to reactivate stalled infrastructure projects, including road projects that were halted for no reason during the Castillo Regime and can be restarted very quickly.

The Ministry of Finance also announced a PEN5.9bn Plan (Con Punche Perú) aimed to reinforcing and accelerating public spending, especially in the first half of 2023. The plan mostly involves spending that is already in the 2023 budget. The new component, interestingly enough, involves the reconstruction of public buildings and infrastructure destroyed during the protests. Assuming the protesters let that happen.

From a broader perspective, the Boluarte regime promises to represent a return of proper State management, as well as better relations with congress, the press, independent institutions and the business community, if not with much of Peru’s polarized public opinion.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.