ECONOMIC OVERVIEW

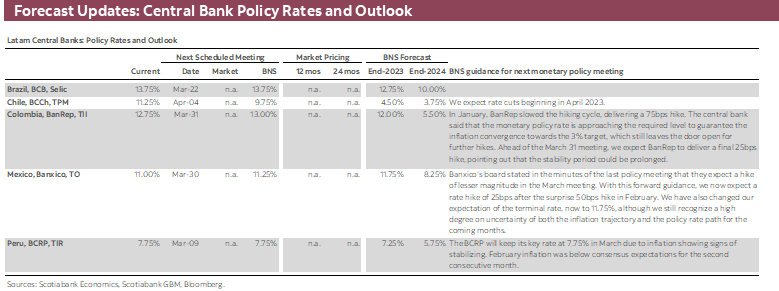

- Colombia, Chile, Mexico, and Brazil release inflation data next week that will help us refine our expectations for additional hikes, or even possible cuts, in coming months in the Latam region.

- Peru’s BCRP is expected to leave its policy rate unchanged at its announcement on Thursday, after it unexpectedly paused at its first meeting of 2023. Still, we think rate cuts will wait amid stubbornly high inflation.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period March 4–17 across the Pacific Alliance countries and Brazil.

Chart of the Week

ECONOMIC OVERVIEW: REGIONAL INFLATION DATA AND BCRP DECISION

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- Colombia, Chile, Mexico, and Brazil release inflation data next week that will help us refine our expectations for additional hikes, or even possible cuts, in coming months in the Latam region.

- Peru’s BCRP is expected to leave its policy rate unchanged at its announcement on Thursday, after it unexpectedly paused at its first meeting of 2023. Still, we think rate cuts will wait amid stubbornly high inflation.

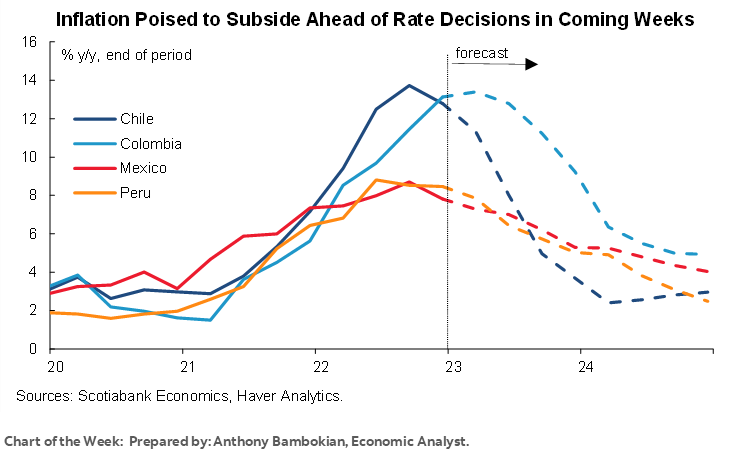

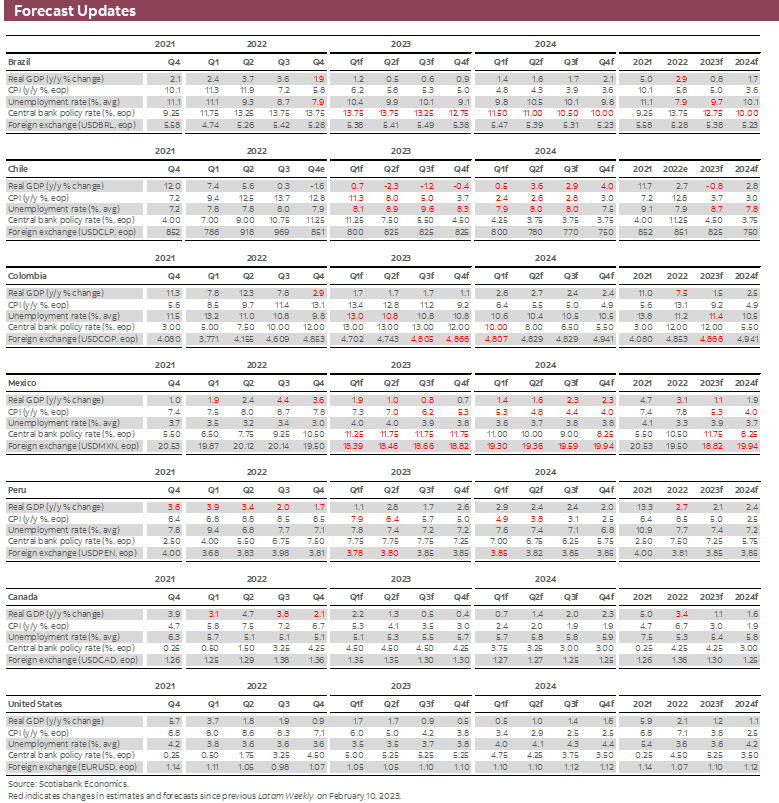

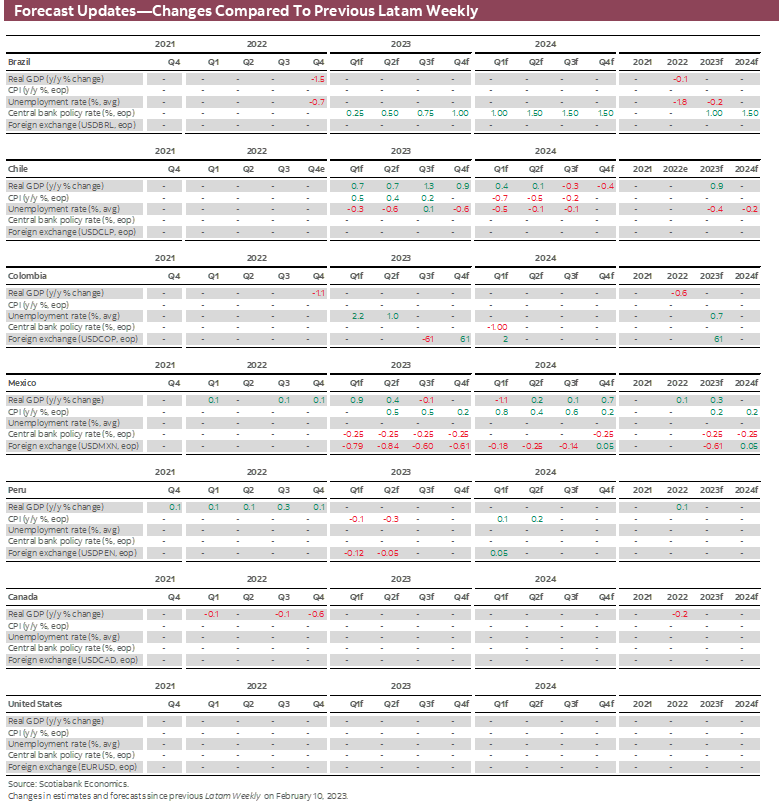

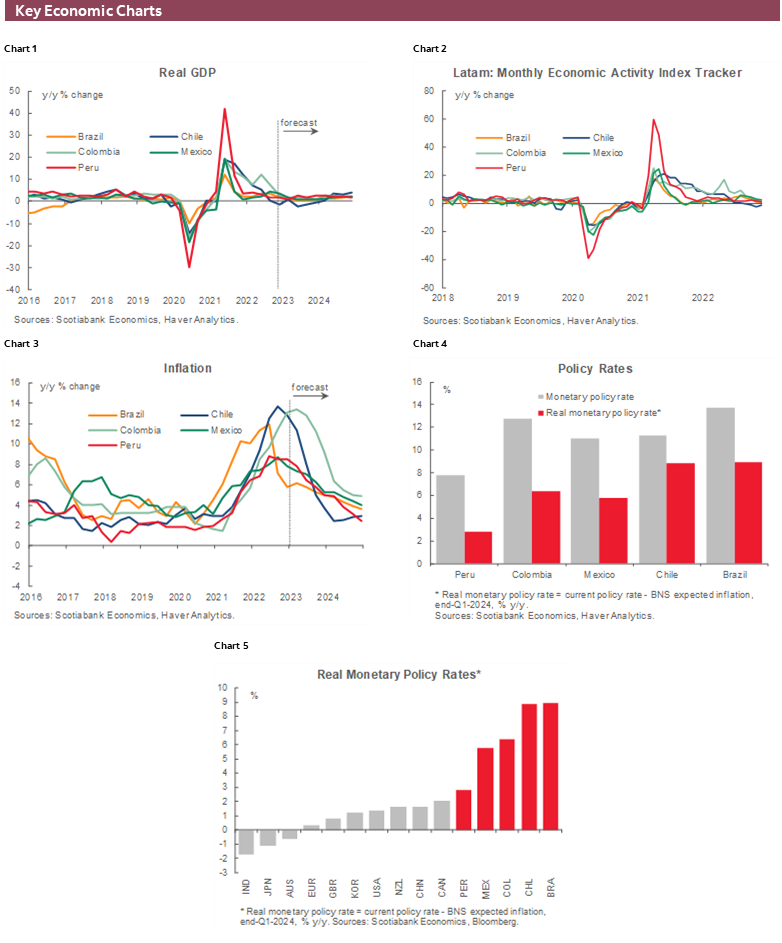

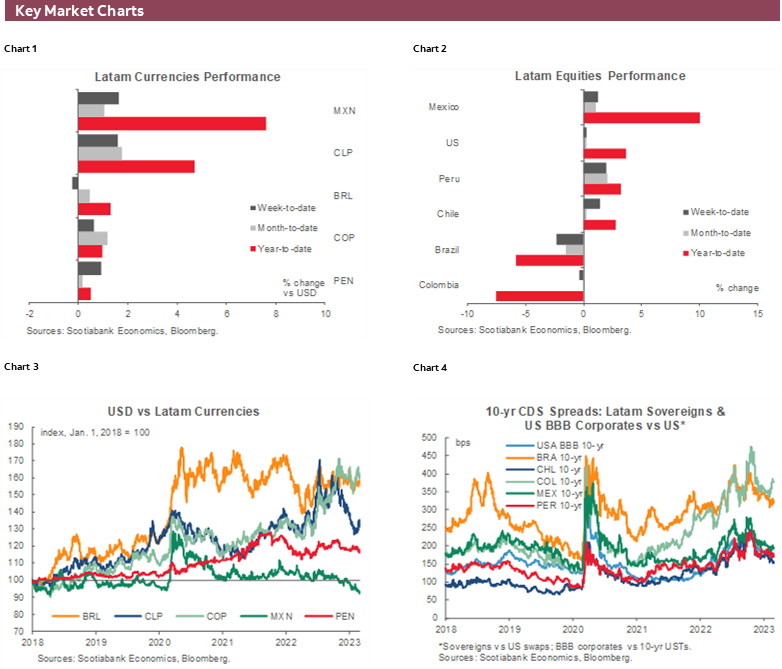

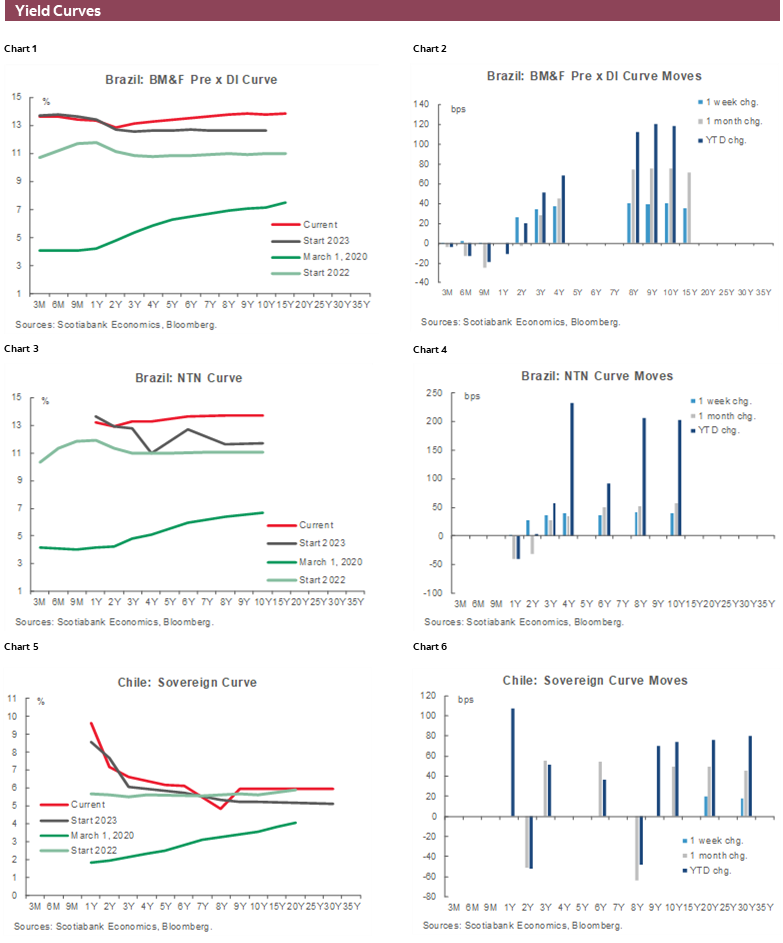

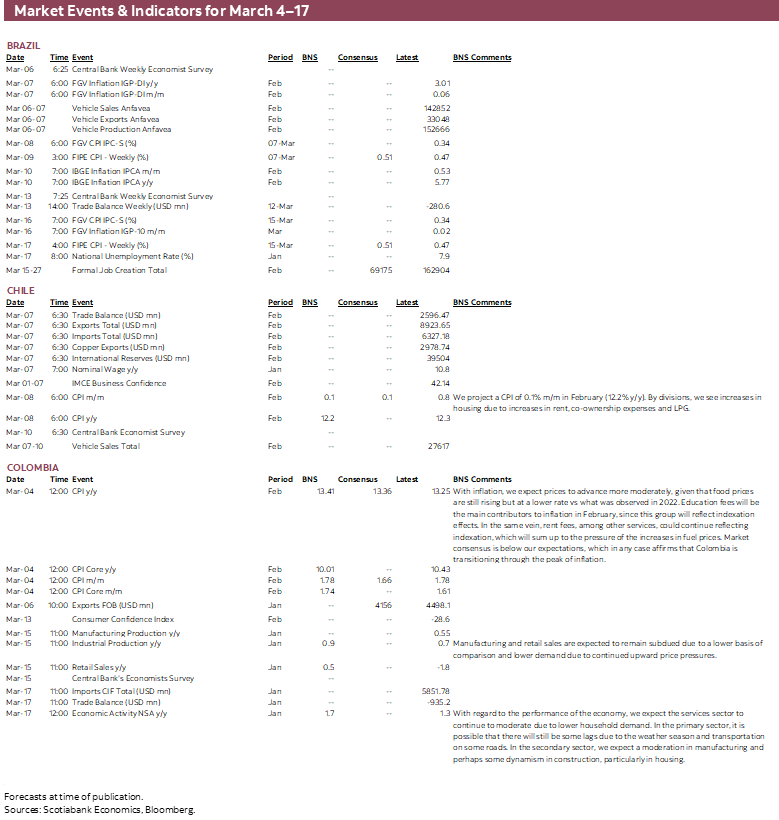

We’re fully on inflation watch next week in Latin America, with prices data due for release over the next few days from Colombia, Chile, Mexico, and Brazil. The early part of 2023 was expected to see continued declines in inflation that would justify pauses or the end of hiking cycles across some major economies, both in the DM and EM spaces.

Despite warnings from central bankers on the bumpy path on the inflation horizon, markets headed into late-2022 with perhaps too much optimism around the end of hiking cycles. Wake-up calls from strong macroeconomic data—that suggest there may be more inflationary pressures in the pipeline—has lifted rate expectations in markets. In the US, this has translated into a higher implied terminal rate after a blockbuster payrolls increase and a recovery in PMI surveys. Global market watchers may keep to a cautious tone throughout most of the week until the release of US nonfarm employment on Friday, with ADP jobs and JOLTS job openings acting as an appetizer on Wednesday.

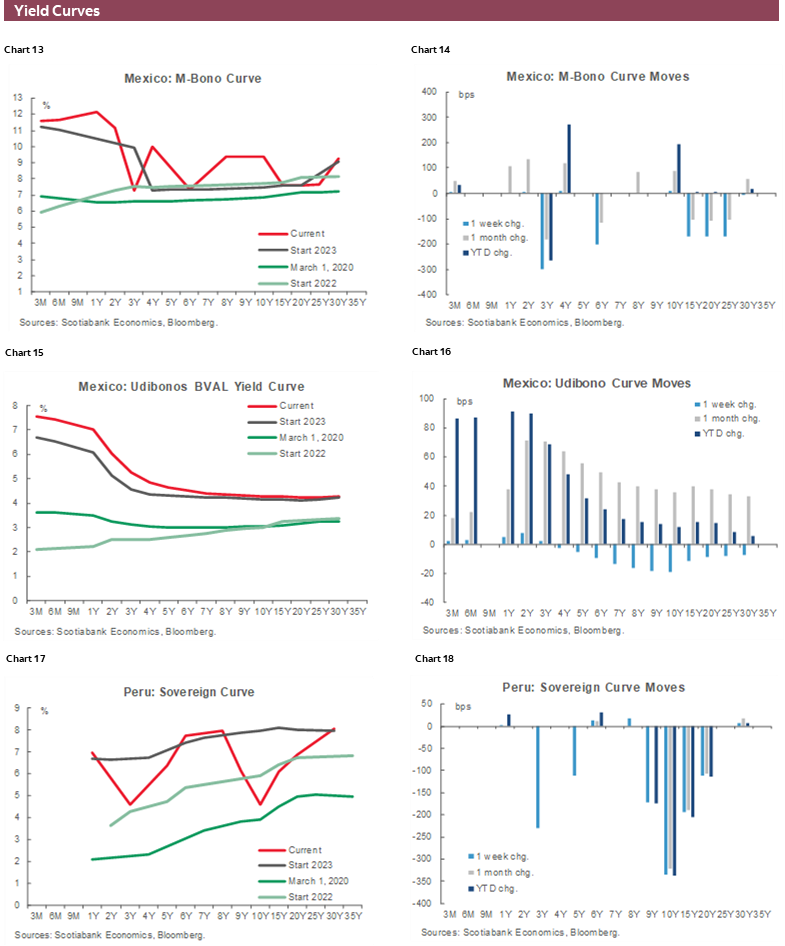

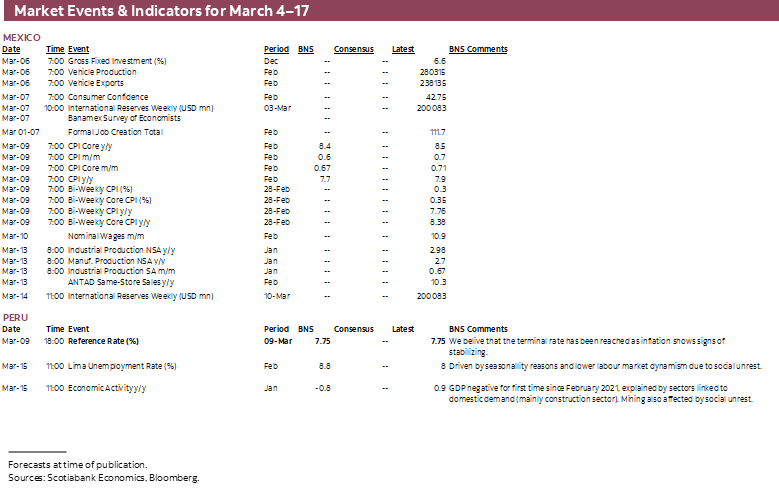

Banxico saw elevated core inflation in January and erred on the side of caution with a half-point hike in early-February, as the minutes to the meeting published earlier this week showed. The slight softening in H1-Feb inflation (headline and core) is but a hint of softer prices growth that the bank will hope will be confirmed by full-month data out on Thursday. Still, despite the surprise 50bps hike, Banxico will likely prefer to slow to a 25bps click in late-March with a lot of work being done already and also after showing its firm commitment to bringing inflation lower.

Aside from inflation data, we're paying close attention to the electoral/political backdrop in Mexico as AMLO pushes to weaken the power of the country’s elections authority and as we near the start of the official campaign period for the EdoMex governorship election in early June (see Mexico section).

Colombian CPI data will be first out the gate over the weekend while the country’s inflation rate remains the last to peak among the countries we cover in the region. The team in Bogota, and economists surveyed by Bloomberg, expect year-on-year inflation to tick marginally higher in what should be the zenith of prices growth, coming in at 13.4% y/y (from 13.25% in January). The beginning of a clear downtrend may not come until a few months from now, however, given lingering pressures on prices (e.g., indexation practices). Weak economic data released in recent weeks, however, tee up a final BanRep hike of 25bps later this month, according to our economists (see Colombia section).

In Chile, the team anticipates that prices will only marginally increase m/m while ticking slightly lower year-on-year in February (see Chile section). They feel the stronger CLP should have resulted in reduced prices in tradable goods. Our economists have also revised their 2023 GDP growth estimates higher in today’s Weekly on the back of stronger than expected data to start out the year.

Lula’s team will hope that inflation in Brazil resumes a clearer trajectory lower as was pre-empted by mid-month data that showed a decent deceleration to its slowest year-on-year pace since March 2021. The country’s Finance Minister Haddad and Planning Minister Tebet spoke on various occasions this week on the government “doing its part” on inflation to motivate the BCB to cut rates soon; other, more radical politicians like Workers’ Party president Hoffmann said BCB Gov Campos Neto should be fired or quit for not getting in line with the ‘project’. A decline in Brazilian GDP in the fourth quarter will also likely see political pressure ramp-up on the BCB to ease policy (though a rate cut on March 22 is highly unlikely). However, if Lula’s team instead leans into increased spending (notwithstanding tight finances) to tackle soft growth, the BCB will likely wait longer before a first cut. Haddad is expected to soon announce a new fiscal framework proposal for Brazil that will likely replace the much-hated by Lula spending cap. It’s become a game of chicken between the BCB and government, and so far it appears Campos Neto’s board is showing no signs of yielding.

Peru has already released inflation data for February, which came in softer than expected on Wednesday, but this does not mean the Peruvian calendar is bare of key events with the BCRP’s policy announcement scheduled for Thursday. Now, the BCRP has already paused its hiking cycle, so the focus will be on how long it intends to leave its policy rate at 7.75%. The country’s economy may fare a bit better, as well, as the intensity of protests against Congress and Pres Boluarte has died down. The team in Lima discusses the impact of these on the Peruvian economy in early-2023 in today’s weekly as the country enters a ‘new normal’.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Upwards Revision to our 2023 GDP Projection to -0.8%

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

BETTER-THAN-EXPECTED START TO ECONOMIC ACTIVITY IN 2023

So far this year, the labour market and economic activity have positively surprised market expectations. Most recently, job creation and monthly GDP growth in January confirmed that in 2023 it will decline less than expected by the consensus and the central bank. In our view, the main factors behind the good performance of economic activity are: (1) a better start to the year with a positive handover effect; (2) stronger than expected labour market resilience; (3) an improvement in terms of trade explained by a significant increase in the price of copper; (4) the fast execution of public spending since late 2022 that would have continued in early 2023; (5) a political scenario that would lead to a moderation in the structural reforms under negotiation and a constitutional process (constitutional council) where we anticipate a political balance of forces similar to the one observed in the current Senate. With this, we revise upwards our 2023 GDP projection from -1.7% to -0.8%.

INFLATION OF TRADABLE GOODS WILL FINALLY BEGIN TO EASE

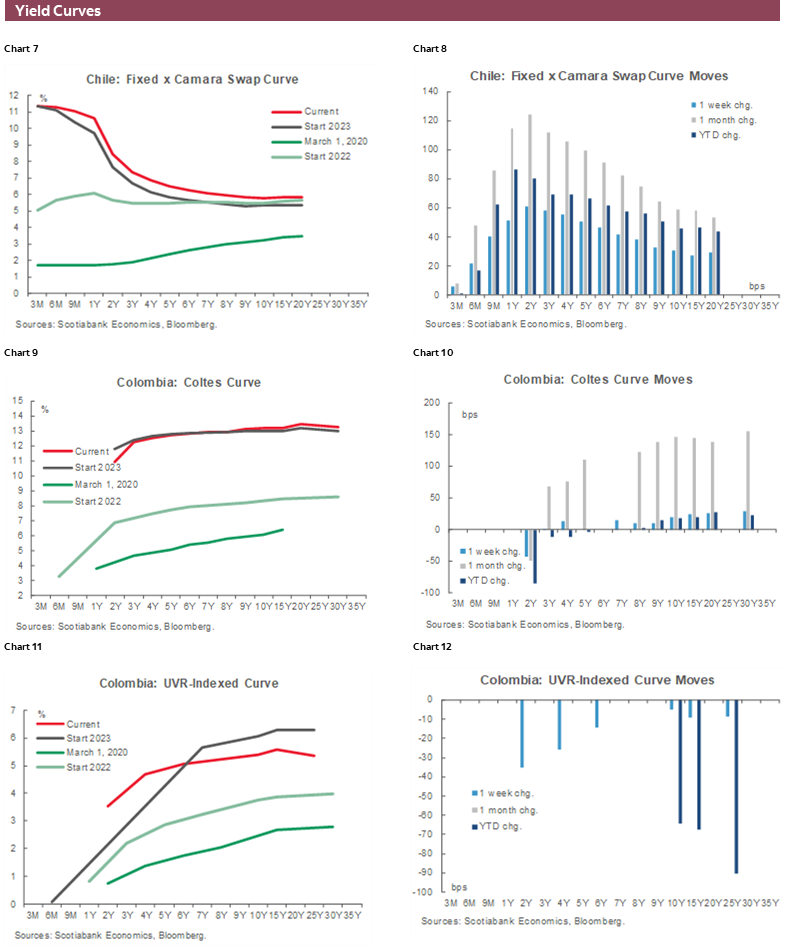

We project a CPI increase of 0.1% m/m in February (12.2% y/y). By divisions, we see increases in housing due to rising rents, co-ownership expenses and natural gas. In the same vein, restaurants and hotels will continue to reflect second round effects. The appreciation of the CLP would have finally generated declines in a number of tradable prices in February, through (at least) decreases in gasoline, new cars, air transportation and packages tours.

Colombia—The Economic Slowdown and Negotiations in the Political Agenda

Sergio Olarte, Head Economist, Colombia

+57.1.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

María Mejía, Economist

+57.1.745.6300 (Colombia)

maria1.mejia@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.1.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

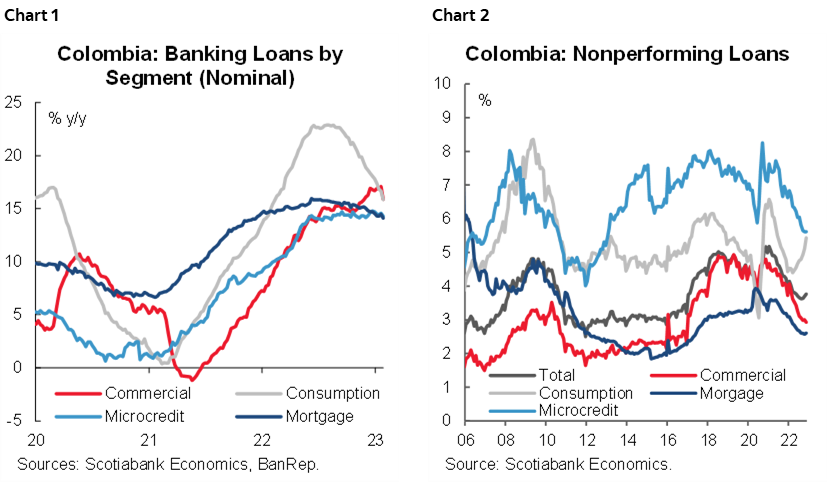

Recent weeks have shown a moderation in macroeconomic indicators. Economic growth for 2022 and the employment figures for January showed that the economy started to slow down earlier and faster than expected, which would lead to a faster closing of the positive output gap. Coincident indicators show that private consumption is moderating. According to various surveys, there is evidence that micro-spending is decreasing and that households are overweighing primary versus leisure expenses. From a borrowing perspective, credit growth is also in a decelerating path (chart 1), especially for consumer credit, reflecting a combination of lower credit demand and a more moderate lending appetite given non-performing loans are clearly increasing (chart 2). That said, the economic slowdown affirms our expectation that BanRep is reaching the end of the hiking cycle and will deliver a final hike of 25 bps to take the monetary policy rate to 13.00%.

In terms of inflation, despite not yet reaching a peak, expectations are stabilizing, indicating that in Q1-2023 Colombia will move past the higher expected levels. For February’s inflation print, the market expects 1.67% m/m and 13.27% y/y, suggesting that inflation in Colombia finally peaked, although will likely hover around this high for a while. At Scotiabank Economics, the expectation is 1.78% m/m and 13.41% y/y.

All of the above reaffirms the expectation that the end of the hiking cycle is closer. The discussion will now turn to how long higher rates will last. In that regard, economic indicators will be key.

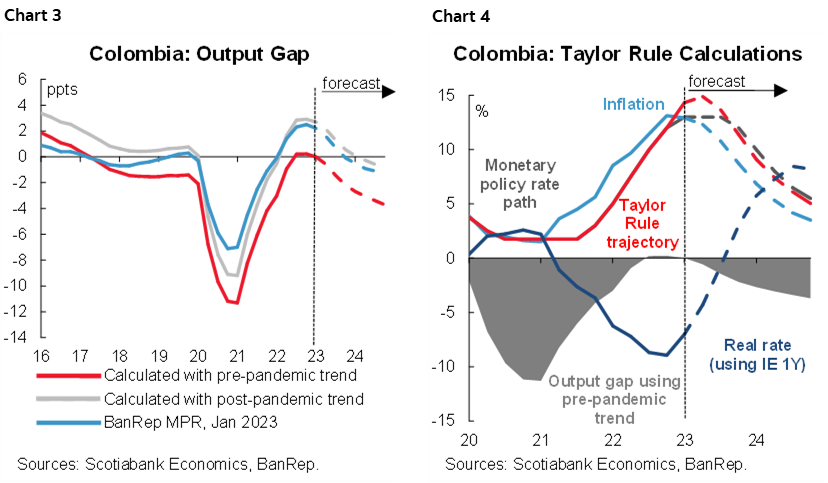

According to Scotiabank Economics calculations, recent economic indicators point to a less positive output gap than BanRep’s calculation. In fact, if we calculate the output gap assuming that potential output doesn’t fall after the COVID-19 episode, we find that the output gap is, in fact, currently neutral (chart 3). However, the effect of having a lower output gap vs BanRep’s expectation doesn’t imply a lower terminal rate. Instead, it would mean early interest rate cuts since inflation remains at its highest levels in the inflation-targeting era. The Taylor rule exercise shows that incorporating a more neutral output gap, the suggested monetary policy path is 50bps lower vs our base case scenario (chart 4).

All in all, economic activity data is becoming more relevant to kick off the discussion of potential rate cuts in the future. For now, we affirm our expectation that the first cut will come in the last quarter of 2023 to close the year at 12%, as a result of lower inflation expectations but also amid weaker economic activity.

In the political field, two weeks have passed since the formal presentation of the health reform proposal. As expected, political negotiations on that topic have been harder than in the case of tax reform. Traditional parties agreed on the necessity of a health reform and some of the goals, such as increasing regional coverage and improving primary attention. However, those parties disagree with the government’s approach in reaching those objectives.

On the fiscal front, the initial health reform proposal looks unsustainable, according to the Ministry of Finance. According to each party’s initial declaration to Congress their political position, more than 70% of Congress was considered part of the governing coalition, but support for the government’s reform diminishes considerably given that the Liberal Party (14 seats in the Senate and 32 in the House), Conservatives (10 and 25 seats, respectively), and La U (10 and 15 seats, respectively) have said that they don’t agree with the health reform proposal. The initial coalition that pointed to a 71.2% support for Petro’s government in the Senate and 77.6 % in the lower chamber (House) falls to 38.8% and 37.2%, respectively.

These developments showed, again, that institutions in Colombia work and that radical changes are less likely to have a Congress with still-high dominance of traditional parties. The next important discussion is expected with the labour reform; we cannot rule out that the government will again deploy a strategy of starting the discussion with a radical proposal to then negotiate after towards a more moderate reform.

Mexico—The Political Calendar is Heating Up, and Should Become Red-Hot over the Coming 17 Months

Eduardo Suárez, VP, Latin America Economics

+52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

Mexico’s electoral calendar should heat-up as we head into the summer, and into next year. Last weekend marked the second major mobilization by civil society in opposition to President Lopez Obrador’s proposed changes to electoral law. Among other measures, the proposed changes—which follow an earlier failed attempt at Constitutional Reform—seek to cut funding to the National Electoral Authority (the INE), arguing that elections in Mexico cost too much. AMLO’s proposal has already been approved by the Legislative arm, but is expected to be challenged in courts by the opposition, and will likely end up being discussed at the Supreme Court level.

According to the head of the INE (Lorenzo Cordova) if the entity’s budget is cut, it would be forced to dismiss around 6,000 workers, which some argue could impact the INE’s capacity to properly run an election—including training polling station workers. Following the protests, the discussion over AMLO’s proposed reform and demonstrations aimed against it, the issue seems to have turned international—with last week seeing a spat between AMLO and the US State Department.

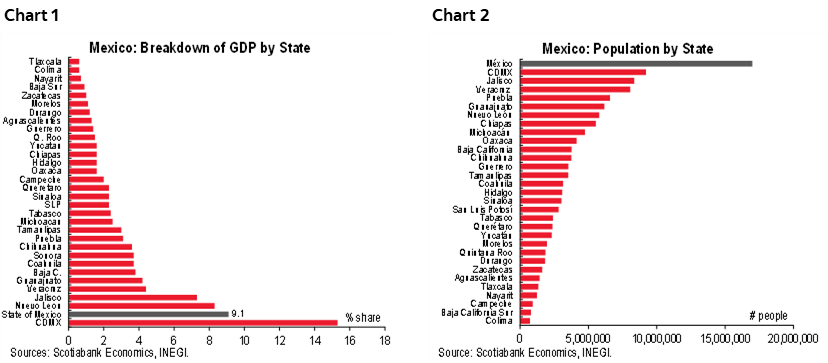

The State of Mexico, where governor and local legislature elections are scheduled for June 4th, is often seen as a practice run for the Presidential elections (scheduled for July 2024). The State of Mexico accounts for almost 10% of Mexico’s GDP (chart 1), and trails only Mexico City in its economic importance. In terms of population, the State of Mexico is the largest in the country, with almost 17mn inhabitants (chart 2). This makes the state a critical “laboratory” for Federal elections.

At this point in time, the candidates for governor of the State of Mexico are expected to be:

- Delfina Gomez: AMLO’s former Education Minister, who is running in the Morena-PT-Green Party Coalition.

- Alejandra del Moral: Running for the PAN-PRD-PRI coalition (the incumbent Governor is Alfredo del Mazo from the PRI).

- Juan Zepeda: Expected to represent the MC.

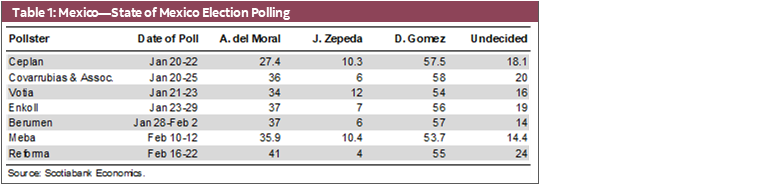

As we head into the election’s official start, Morena’s candidate appears to be ahead by somewhere between 10–15 percentage points (table 1), but it’s worth noting that although the race for EdoMex kicked off on January 14th with pre-campaigning the formal campaign period takes place April 3–May 31st.

President Lopez Obrador’s approval rate remains high, at around 63%, with disapproval having risen marginally to around 24%, based on the various polls tracked by Oraculus.mx. Note that AMLO’s approval sits as the highest four years into a president’s term relative to any of Mexico’s last five presidents, but it’s within 10 percentage points of the approval rates enjoyed by 3 of the last 4 (Fox, Calderon, and Zedillo, with Peña Nieto’s approval being materially weaker at this point into his term). Mexico’s presidential terms last six years, with no re-election being allowed. A poll conducted by Enkoll in mid-February (reported here by Infobae) shows that if the election were to take place then, Morena would enjoy a 30+ percentage point preference over the second strongest party (the PAN); voter intentions sit at 54% for Morena, vs 22% for the PAN, 13% for the PRI, and 6% for the MC). At this point, it seems likely that we will see coalitions being formed for 2024, potentially a Morena-Green-PT alliance and a PRI-PAN-PRD alliance, while the MC party (which currently governs the important states of Nuevo Leon and Jalisco) being somewhat of a wild-card to participate in a coalition.

Peru—The Meaning and Measure of Normality

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Protests are waning, but not ending. Elections are increasingly likely to be held in 2026, as originally scheduled, with all the usual uncertainty regarding candidates and outcomes. The government is settling down to actually govern—a novelty in recent years—though few are taking notice as political turbulence continues to monopolize daily press coverage and public opinion commentary. Welcome to normality in today’s Peru.

Markets continue to take political events in their stride. Peruvian assets have followed regional dynamics in global markets, rather than domestic noise. The exchange rate has strengthened of late, and breached resistance at 3.80, falling into the mid-3.70s.

One thing we can get used to, for a few months anyway, is the BCRP reference rate remaining at 7.75%. The BCRP surprised us and markets when it did not hike in early-February. It will be no surprise, however, when it once again keeps its rate steady at its policy meeting next week. In fact, we do not expect a rate change until Q4-2023. At the same time, the outlook for inflation is starting to become clearer. The fact that inflation remained stable rather than rise, coming in at 8.65% in February versus 8.66% in January was a relief. After hovering between 8.0% and 8.8% since mid-2022, we are now more comfortable with our expectation that inflation will dip below the 8% level by April, and possibly as soon as March.

Growth data for the first quarter, on the other hand, will reflect the impact of protests. January GDP data will be released in mid-March, and it won’t be pretty. Finance Minister Alex Contreras has stated that in January 2023 political unrest hit GDP in the amount of PEN1.8bn (USD480mn). If so, and the source is credible, this would mean nearly negligible growth for the month.

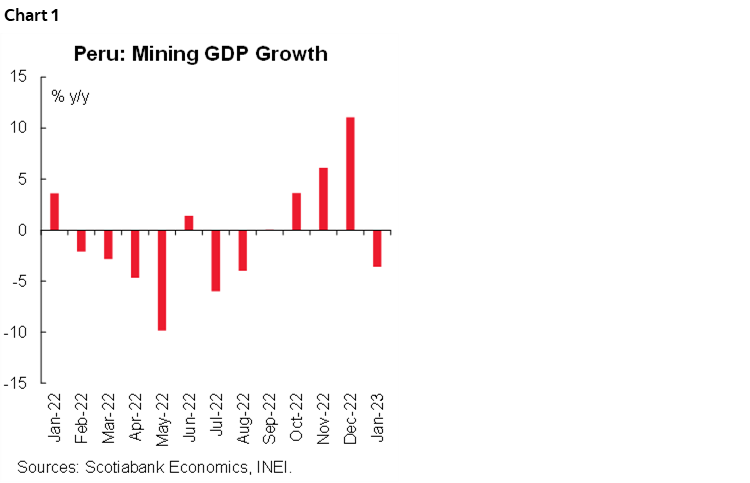

Early indicators for January published on March 1 point in this direction. Mining declined 3.6% y/y in January (chart 1). Output in every major metal aside from iron declined. Two metals are worth highlighting as indicative of the problems that the protests have caused. Tin output fell 63% y/y in January. Peru has one major tin mine, San Rafael, operated by Minsur and located in Puno. In January, Minsur acquiesced to requests by local leaders to shut down operations in solidarity with the protests. The other metal where trouble was evident is copper, with output down 1.6% y/y. Under normal conditions, this could be chalked up to normal monthly fluctuations. However, what it reflected in January is that new output from Quellaveco was not able to counter the decline in production at other mines. Among them, Las Bambas.

Of equal, if not greater, concern, cement demand plunged 15% y/y in January. Construction is being hit on a number of fronts, which include a slowing economy, higher interest rates, and, to some extent, the impact of the protests on housing and infrastructure investment in the Peruvian south.

Minister Contreras had mentioned the impact of unrest on growth as a preamble to statements that he gave about measures to stimulate the economy. This includes the PEN5.9bn (USD1.6bn) Con Punche Peru program. Congress recently gave the government special legal powers to promote stimulus measures. It is our understanding that some of the impact will become apparent beginning in February. We will pay particular attention to the impact of stimulus measures on the economy going forward. Hopefully, this will prove to be the happier side of normality.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.