ECONOMIC OVERVIEW

- With the regional inflation prints behind us, we now look ahead to GDP releases in Colombia, Chile, and Peru, and Banxico’s uncertain rate decision as the main events of the Latam week ahead.

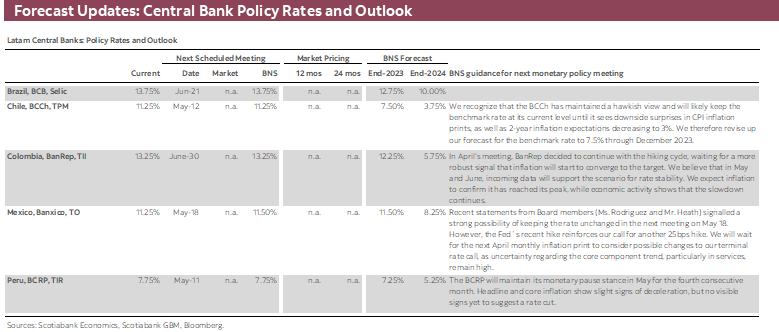

- On the whole, Latam central banks are likely feeling optimistic that their policy tightening to date and declines in commodity prices are working towards bringing inflation towards target. But we’re not so sure that Banxico and BanRep policymakers are ready to leave rates unchanged, and rate cuts elsewhere may have to wait a bit longer.

- Despite core inflation declining only recently, we think Banxico will choose to pause next week for the first time in the hiking cycle, with this bet partly buoyed by dovish comments in April by Gov Rodriguez.

- Colombian and Chilean Q1 GDP should show an improved print from end-2022, but recent data suggest that this undersells greater underlying economic weakness. In the case of Colombia, it would prompt no more hikes from BanRep, whereas for Chile, the BCCh would be more comfortable in kicking off the easing cycle soon.

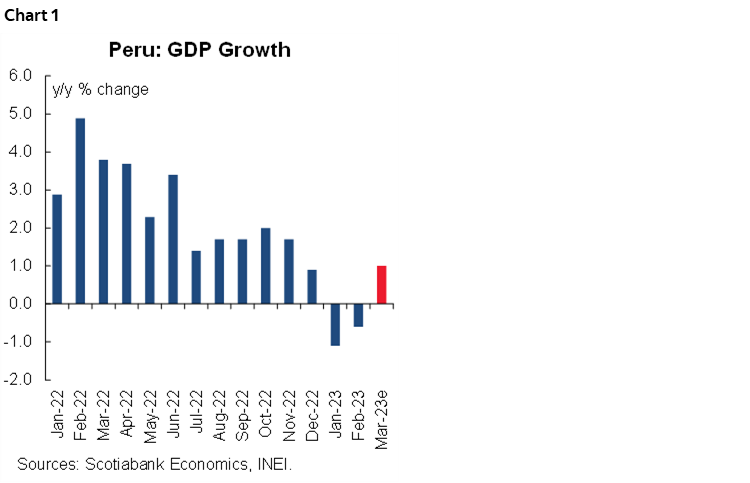

- Peru’s GDP data for March should show the first y/y increase of 2023, after the contractions due to social unrest. Still, we expect only a slight increase in GDP as the country did not yet return to normality at the end of the quarter.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Mexico and Peru.

MARKET EVENTS & INDICATORS

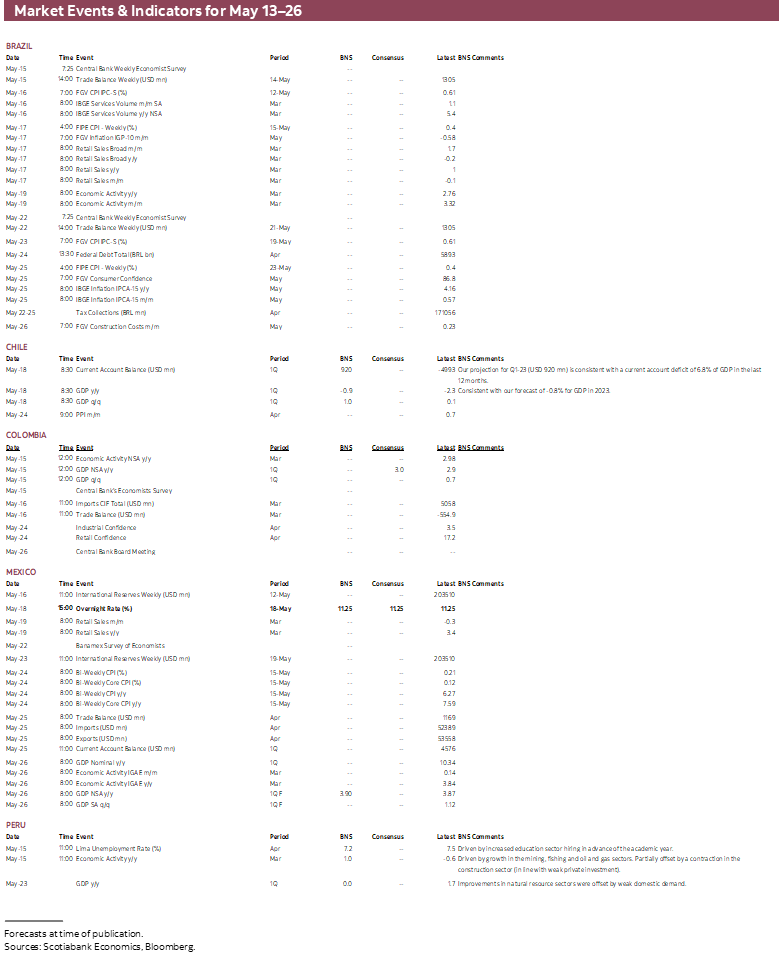

- A comprehensive risk calendar with selected highlights for the period May 13–26 across the Pacific Alliance countries and Brazil.

Chart of the Week

ECONOMIC OVERVIEW: UNCERTAIN BANXICO DECISION; CHILE, COLOMBIA, AND PERU GDP

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- With the regional inflation prints behind us, we now look ahead to GDP releases in Colombia, Chile, and Peru, and Banxico’s uncertain rate decision as the main events of the Latam week ahead.

- On the whole, Latam central banks are likely feeling optimistic that their policy tightening to date and declines in commodity prices are working towards bringing inflation towards target. But we’re not so sure that Banxico and BanRep policymakers are ready to leave rates unchanged, and rate cuts elsewhere may have to wait a bit longer.

- Despite core inflation declining only recently, we think Banxico will choose to pause next week for the first time in the hiking cycle, with this bet partly buoyed by dovish comments in April by Gov Rodriguez.

- Colombian and Chilean Q1 GDP should show an improved print from end-2022, but recent data suggest that this undersells greater underlying economic weakness. In the case of Colombia, it would prompt no more hikes from Banrep, whereas for Chile, the BCCh would be more comfortable in kicking off the easing cycle soon.

- Peru’s GDP data for March should show the first y/y increase of 2023, after the contractions due to social unrest. Still, we expect only a slight increase in GDP as the country did not yet return to normality at the end of the quarter.

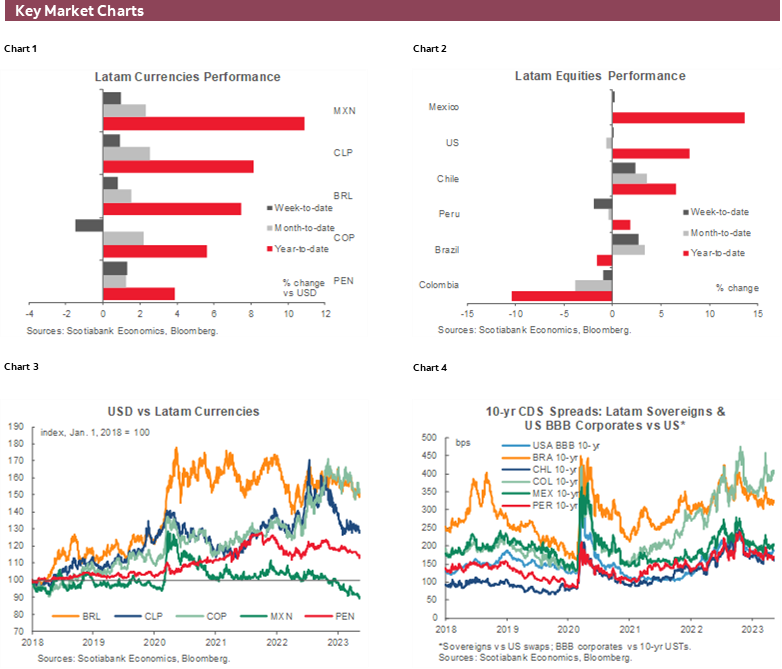

With the regional inflation prints behind us, we now look ahead to GDP releases in Colombia (Q1), Chile (Q1), and Peru (March), and Banxico’s uncertain rate decision as the main events of the Latam week ahead. Retail sales and other monthly economic activity prints in some of the countries in the region are also worth keeping an eye on.

Of interest to those in the EM space, but also in terms of broad geopolitical and energy implications, Turkey’s presidential election over the weekend is a must-watch. Polls show a tight contest that may result in an end to Erdogan’s presidency that began in 2014.

Global markets also have a full slate of data to monitor, notably Canadian and Japanese CPI, and UK and Australian jobs, as well as a parade of G10 central bank speakers that will talk their book against their latest decisions—as is usually the case. US debt ceiling negotiations will also permeate the market mood while regional banking sector risks may continue to drive market volatility.

To recap recent developments on the CPI front in April, Peru’s and Brazil’s data exceeded economists’ forecasts but with continued progress. Lima inflation fell under 8% for the first time since April 2022 and Brazil’s rate fell to the low 4% area with more progress expected ahead. Chile’s and Colombia’s figures showed a more benign inflation picture, with the former’s inflation rate dropping into single digits (a first since March 2022) at 9.9% while the latter’s deceleration to 12.82% from 13.34% suggests that inflation in Colombia has finally peaked. Mexico’s data came roughly in line with estimates, and the 6.25% y/y headline pace represents its lowest since October 2021.

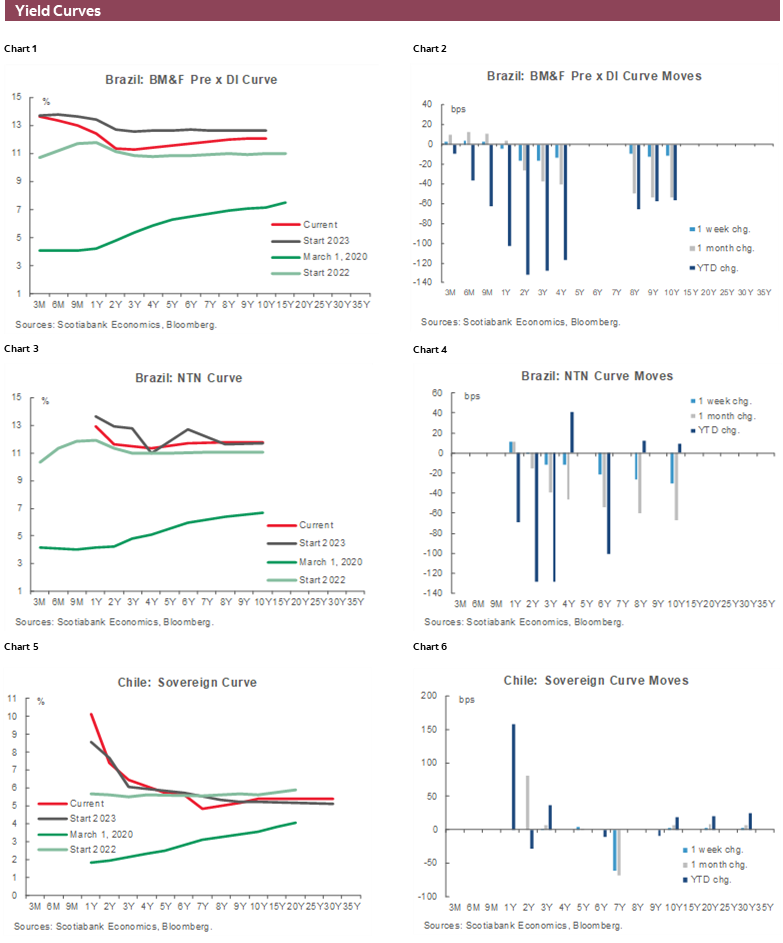

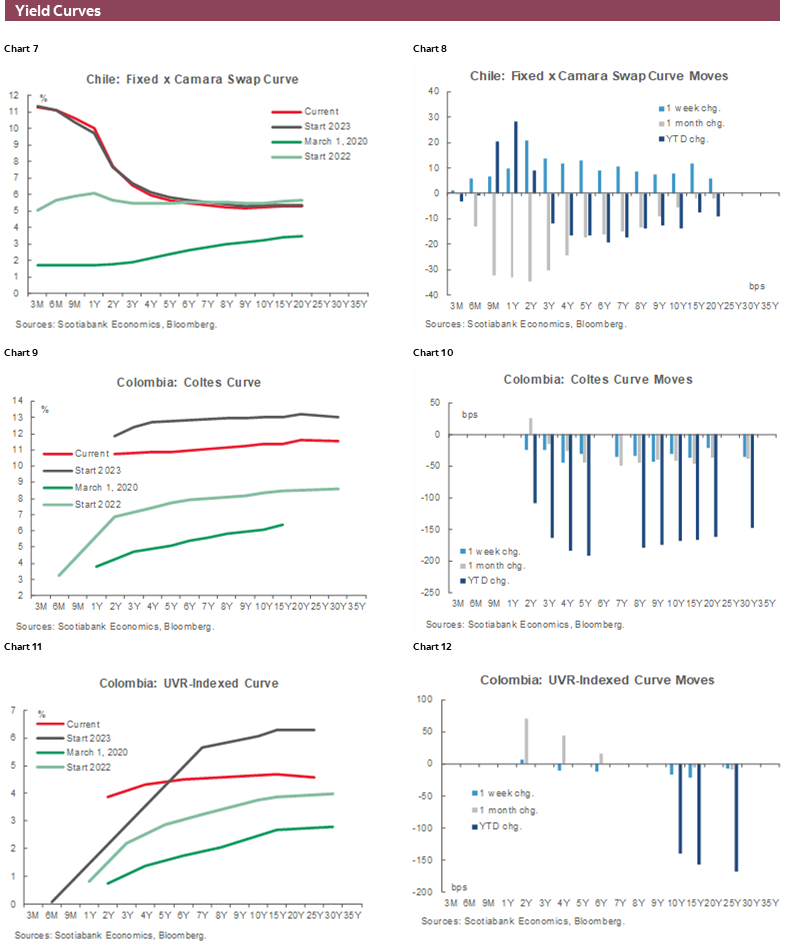

On the whole, Latam central banks are likely feeling optimistic that their policy tightening to date and declines in commodity prices are working towards bringing inflation towards target. Caution abounds, however, as inflation remains well above target across the region, and core price pressures remain sticky with limited certainty that these will ease quickly. Hikes to-date have seemingly been enough for BCCh and BCRP officials, while the BCB may have already cut were it not for the risk that fiscal policy would act against their price goals.

We’re not so sure that Banxico and BanRep policymakers are ready to leave rates unchanged. Unfortunately, both of these central banks have surprised us recently. In February, Banxico’s board voted to hike by 50bps against a practically universal expectation that they would lift rates by 25bps. Economists (including us) rushed to adjust our view of how high the bank would take its overnight rate after this hawkish surprise. BanRep was also mostly expected to stay put at its rate decision last week, but instead chose to hike 25bps and delivered this with a hawkish statement that opened the door to more increases.

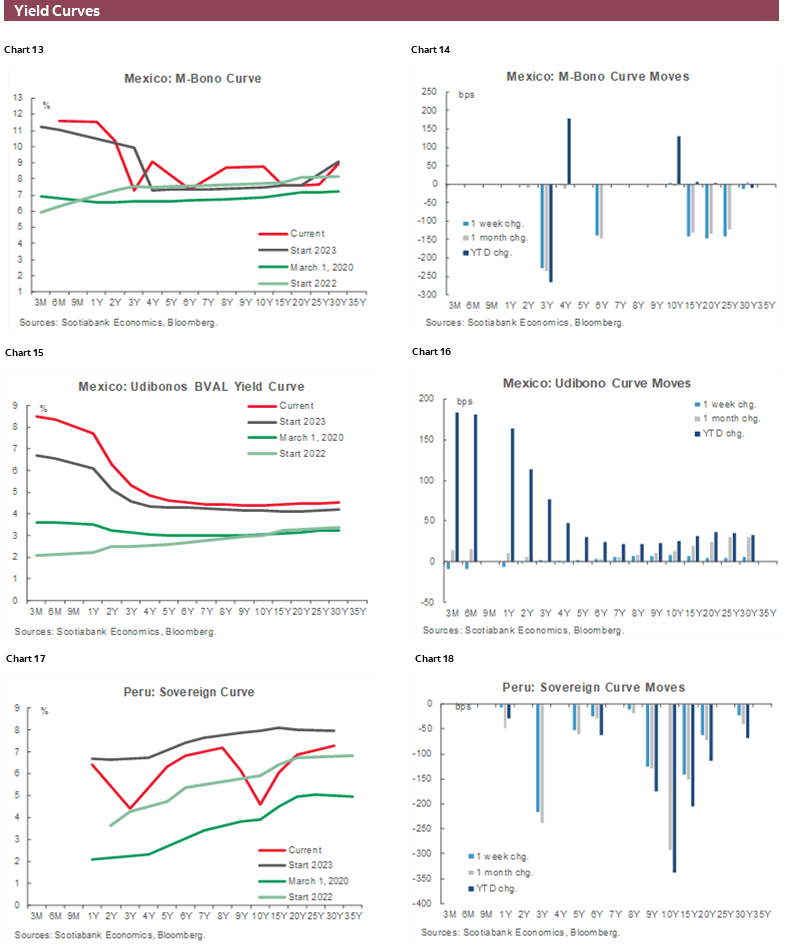

Our team in Mexico City was fairly confident that Banxico would hike again at next Thursday’s policy announcement. Yet, decent-enough inflation data and another Banxico curveball has pushed the team to now expect the first rate pause of the cycle next week. A few weeks ago, Gov Rodriguez Ceja said in Senate testimony that they will evaluate at their next decision whether to stop the hiking cycle, at an 11.25% terminal rate. As noted previously, Mexican inflation is on a constructive trajectory in headline and core terms, but we’re worried that one single decline in services inflation is not enough evidence to call the end of rate hikes; maybe Banxico will feel the same way and choose to hike again.

Economists favour a rate pause (23 of 32 in the latest Citibanamex survey), and market are even more convinced of this with only a few residual basis points priced in. From that sense, there may be more upside risks in Mexican rates from the decision. We’ll also watch language around whether resuming hikes is a possibility, mirroring guidance from other central banks in the region once their hiking cycles stopped (though none has had to resume tightening). In today’s weekly, the Mexico City team also presents an overview of what may follow the Supreme Court’s decision to overturn part of President AMLO’s electoral reform.

BanRep’s board members will watch Monday’s Q1 GDP print for a signal that the country’s economy is responding to their 13.25% policy rate. The team in Colombia forecasts a 3.5% y/y increase in output for the quarter—so that wouldn’t do it in terms of evidence of a decelerating economy after a 2.9% expansion in Q1. However, the Q1 reading is boosted by base effects given a steep deceleration in Colombian GDP growth in Q1-22 will now fall out of the interannual comparison. What’s more, data for March suggest that activity has noticeably slowed (see retail sales data), teeing up a weak hand-off from Q1 to Q2; March economic activity data is published alongside the GDP print. Our Bogota economists project that GDP growth will decelerate sharply to around 0.5% in each of Q3 and Q4, which should eventually prompt a rate reduction in Q4. Recently-appointed FinMin Bonilla, who is now part of the BanRep board, has said that policymakers may start discussing rate cuts in the second half of the year. We’ll get the view of economists in the BanRep survey results out on Monday, as well, while another weak imports print on Tuesday would support our case for a rate hold at the next rate decision with a lot of data between now and the June 30 announcement.

Like in Colombia, Chilean GDP for Q1 should also improve from its Q4 reading, but this improvement still leaves the year-on-year growth rate in the red. The Santiago team projects a contraction of about 1% after the large 2.3% decline in Q4 and think this decline will be followed by two more quarters of negative growth, i.e. a full year of contraction. This weakness is bound to push the BCCh towards rate cuts in mid-year, in our opinion, starting with a 25bps cut at the June decision. The bank’s decision this evening will help us refine our bets for the start and the pace of hikes in the quarters ahead.

We forecast a 1% y/y increase in Peruvian GDP in March in data due for release on Monday, based on preliminary industry-level figures and cement sales. The Lima team argues that this is certainly a low growth rate, but after two months of negative prints it is welcome news and would show a path towards normality for the country’s economy after the disruptions from protests—with GDP likely remaining little changed over the full quarter. Other March data out in the region this week include Brazil economic activity, retail sales in Mexico and Brazil, and Peru unemployment among other, more second tier, releases.

PACIFIC ALLIANCE COUNTRY UPDATES

Mexico—What’s Next After the Supreme Court Blocked AMLO’s Plan B? Banxico’s Tough Decision

Eduardo Suárez, VP, Latin America Economics

+52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

The Supreme Court voted to overturn the first part of AMLO’s proposed attempt to ‘reform’ Mexico’s electoral system on May 8, deeming the first 2 of 6 proposed legal changes “unconstitutional” (the Court deemed they are not consistent with articles 71 and 72). The so called “Plan B”, proposed after his first attempt failed, sought to reduce the salaries, and budgets of autonomous agencies, affecting not only the electoral authority (INE), but also the Supreme Court and Banxico, among others. The plan would also reduce the workforce of Mexico’s electoral institute, remove the current head of the INE, reduce the staff to organize elections, and eliminate the professional service within the INE (professional career civil servants), and affect the electoral court system.

The Supreme Court has already blocked several legal initiatives submitted by the President, including reforms to the energy & power sector, and the political system. After this latest blow, AMLO stated that the Court is blocking his proposals to protect judges’ privileges, affecting the will of the people (he also made direct references to the pensions, salaries, security costs, etc. of judges). As a response to the court’s autonomy, he said he will send proposed amendments on the way Supreme Court justices are designated. Currently, the President proposes 3 candidates to each seat, and the Senate must choose between the candidates. AMLO’s proposal will be that Supreme Court Justices are chosen by direct vote from the population. In addition, in his so called “Plan C”, he will seek to boost his party’s share of the Legislative branch in the elections on July 2024, giving him a window in September–December of the same year, to pass an aggressive package of Constitutional reforms (in July 2024 Mexicans will vote to reconstitute the full Senate and Congress, as well as President and some governors, but while the new president takes office in December, Congress gets reconstituted in September). In addition, the Senate majority Leader, Ricardo Monreal (Morena), stated he will consider a political trial against the judges who his party has accused of acting against the will of the people.

Following the last CPI print, Banxico is now expected to leave rates on hold (only about 4% odds of an additional 25bps hike are currently priced), and to start cutting rates within the coming six months. Although inflation is now on a declining path since the start of the year— including core merchandise inflation, core-services inflation only started falling one month ago. We think the decision within Banxico will essentially be the risk reward between:

a. how much economic damage can an additional 25bps do to growth.

b. with labour markets very tight (unemployment at an all-time high, and real wages at high and accelerating levels), what are the odds that we haven’t yet anchored core services inflation on the way down (labour costs are more relevant for services than for merchandise)?

With this debate in mind, we anticipate that the base case is Banxico will decide to hold and bet that policy settings are already tight enough to bring inflation down. However, we would not be surprised if there are dissenters in the decision.

Peru—March GDP Growth Poised to be Weak, But Positive

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

On Monday, May 15, GDP growth figures for March will be released. We expect 1.0% GDP growth, in year-on-year terms. We base the figure on preliminary numbers that have already been released for resource sectors (mining, agriculture, fishing, oil & gas), as well as cement demand. Before the recent release of this data, we had been expecting March GDP growth to be a bit higher, at 1.5% y/y.

The 1.0% growth figure for March, if ratified, will be low, no doubt, but would still represent the first positive growth register of the year, after declines of 0.6% in February and 1.1% in January.

March was not quite a return-to-normal month in terms of economic activity. It’s true that protests had weakened significantly by March, allowing sectors such as mining (the figure has already been pre-released, and was up 9.3% y/y) and commerce (which we expect growth at over +2% y/y) to recover. However, growth would have been impacted to some extent by adverse El Niño related heat, heavy rains and flooding. Agriculture, in particular, is likely to have declined. Cement sales also point to a sharp decrease in construction GDP. This is not new, construction GDP fell 10.9% y/y in January–February, and March construction GDP should by in this same vicinity. Political turbulence and the turn-over in authorities affected construction have added to high interest rates and, more recently, adverse weather, to affect construction rather severely. Given our expectations for March, we maintain our forecast of nil GDP growth for Q1 2023.

Job market figures for three-month February–March–April will also be released on Monday. We don’t expect much change in the current level of unemployment to March, which was 7.5%. The unemployment figure is less relevant for Peru than it might be for other countries, given the high level of underemployment in the country. Thus, one tends to follow jobs growth, especially in the formal sector. This has been declining but was still at a moderately good level of 4.1% y/y to March, down from 4.6% in February and 4.8% in January. We expect the declining trend to continue in April.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.