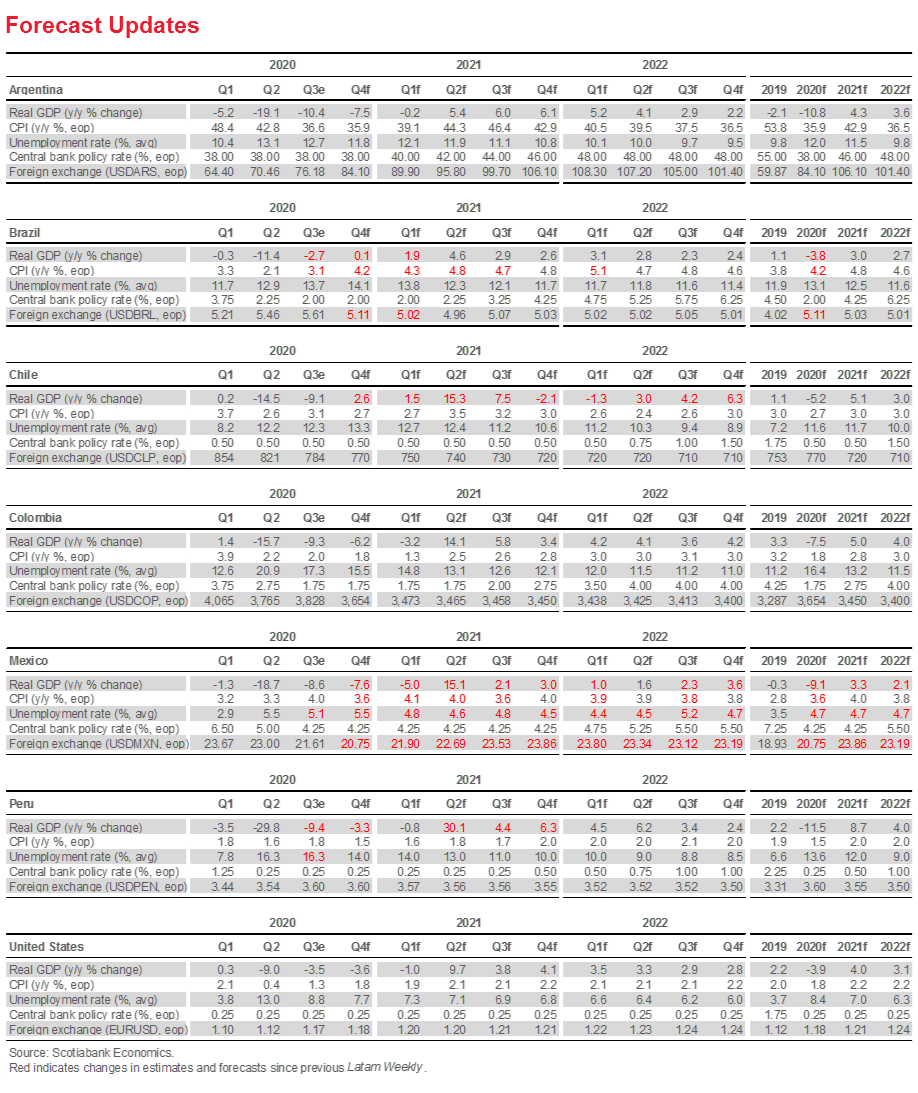

FORECAST UPDATES

In Mexico, detailed Q3 GDP and H1-November inflation data led to forecast revisions that include a slightly deeper contraction in economic activity in 2020, a milder rebound in 2021, and softer price pressures to end this year. In contrast, our projected forecast for the 2020 contraction in Brazil has been pared from -5.3% y/y to -3.8% y/y and end-2020 inflation has been pushed up from 2.8% y/y to 4.2% y/y.

ECONOMIC OVERVIEW

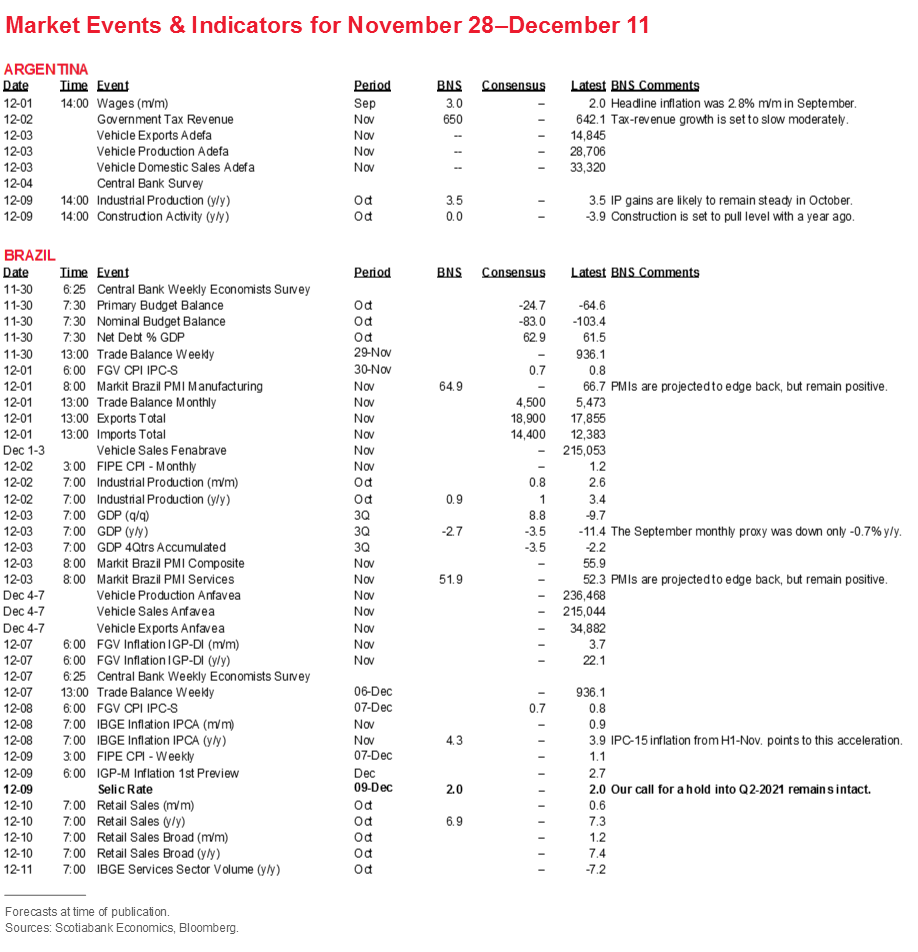

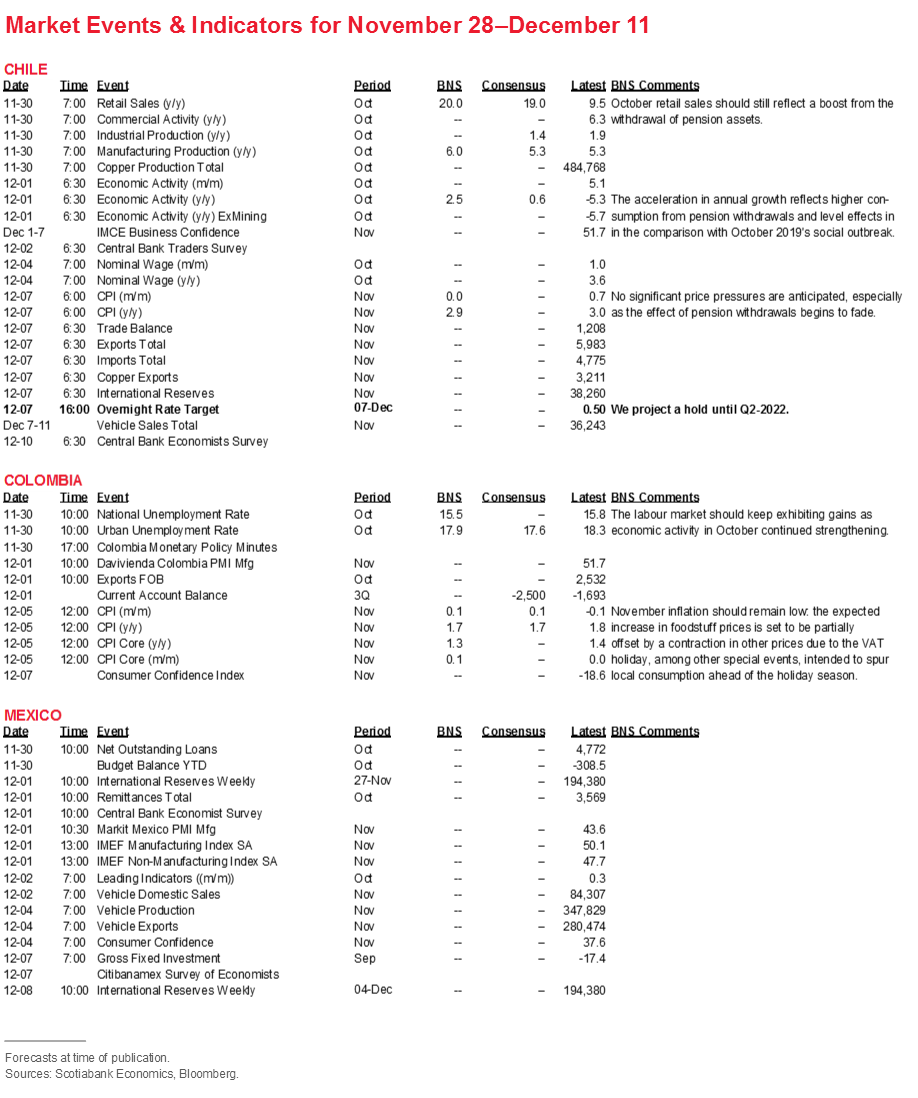

We take stock of progress on the post-lockdown recovery and then look ahead to the publication of the minutes from the BanRep’s hold on November 27, as well as the forthcoming monetary-policy decisions by central banks in Chile (Dec. 7), Brazil (Dec. 9), and Peru (Dec. 10).

COUNTRY UPDATES

Concise analysis of recent events and guides to the fortnight ahead in the Latam-6: Argentina, Brazil, Chile, Colombia, Mexico, and Peru.

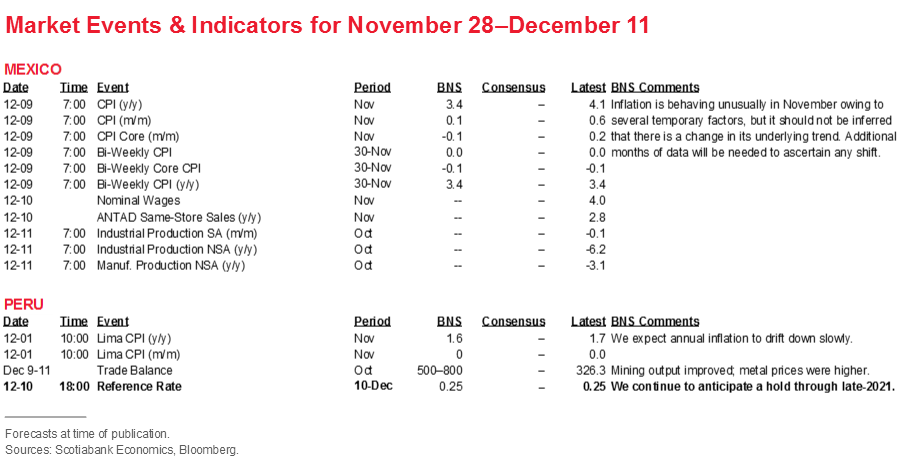

MARKET EVENTS & INDICATORS

Risk calendar with selected highlights for the period November 28–December 11 across our six major Latam economies.

Economic Overview: Real-Economy Recovery

Brett House, VP & Deputy Chief Economist

416.863.7463

Scotiabank Economics

brett.house@scotiabank.com

Forecast updates see our outlook for Mexico soften a touch, while we’ve pushed up growth and inflation projections for Brazil.

With the exception of Argentina, the Latam-6 economies have managed to re-open more than 90% of their economies, but the rebound in activity hasn’t been felt evenly across sectors

Central banks in Colombia, Chile, Brazil, and Peru are set to keep extending their existing holds on their policy rates. Data releases over the next two weeks should show inflation moderating further everywhere but Brazil.

WHERE WE STAND: FORECASTS AND COVID-19

While our forecast revisions remain parsimonious in this edition of the Latam Weekly, with our views largely settled on 2020 and well into 2021, two substantial changes have been introduced to our projections in the Forecast Update on p. 2:

- In Mexico, detailed Q3 GDP and H1-November inflation data led to forecast revisions that include a slightly deeper contraction in economic activity in 2020, a milder rebound in 2021, and softer price pressures to end this year; and

- In contrast, in Brazil, our projected forecast for the contraction in 2020 GDP has been pared from -5.3% y/y to -3.8% y/y and end-2020 inflation has been pushed up from 2.8% y/y to 4.2% y/y.

Tweaks to the GDP growth profile in Chile following the publication of Q3-2020 data were limited to fine-tuning, with the annual projections for 2020 and 2021 unchanged.

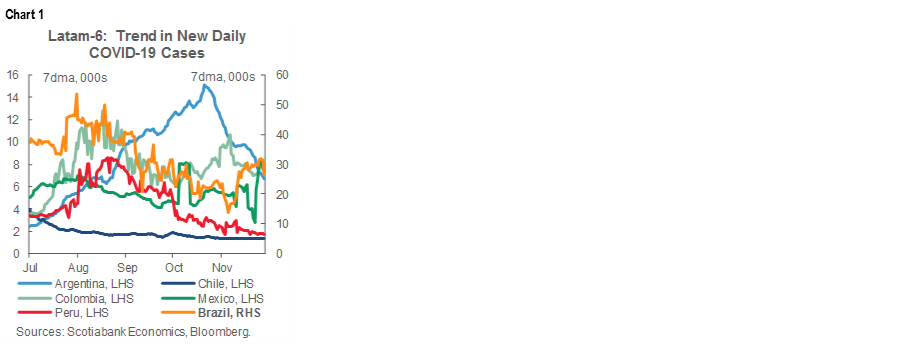

In COVID-19 developments, Latam continues to fade a bit from the spotlight as governments pursue the outer stages of economic re-opening and new case incidence numbers surge elsewhere. Per-capita new case numbers in the four Pacific Alliance countries (i.e., Chile, Colombia, Peru, & Mexico) are only an eighth of those in the US and half of those in Canada. Argentina is steadily bringing its southern-winter surge down (chart 1), but new incidences in Brazil and Mexico, where controls have always been loosest in the region, are on a new path upward (chart 1, again).

LEVELS OF RECOVERY

With the exception of Argentina, the Latam-6 economies have managed to re-open more than 90% of their economies, but the rebound in activity hasn’t been felt evenly across sectors.

- Monthly GDP numbers are below end-2019 by no more than about -7% y/y in any of the Latam-6, with Brazil’s total economic activity readings nearly fully restored to pre-pandemic levels.

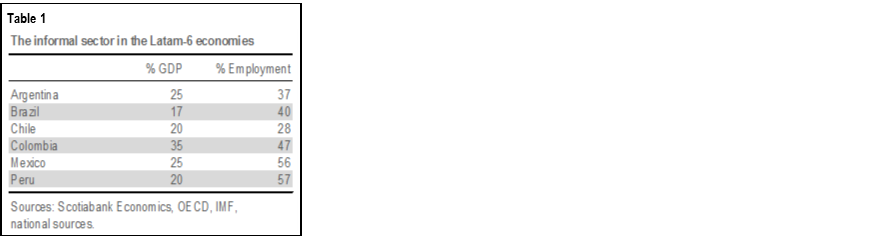

- Manufacturing has fully recovered in Argentina, Brazil, and Mexico, but remains down from pre-pandemic levels by between -5% and -10% in Chile, Colombia, and Peru (chart 2).

- Retail sales remain much more impaired and average only about 75% of pre-COVID-19 levels across the Latam-6 (chart 3). The retail sector is the most severely impaired in Argentina at 59% of pre-pandemic levels owing to still-intensive lockdowns.

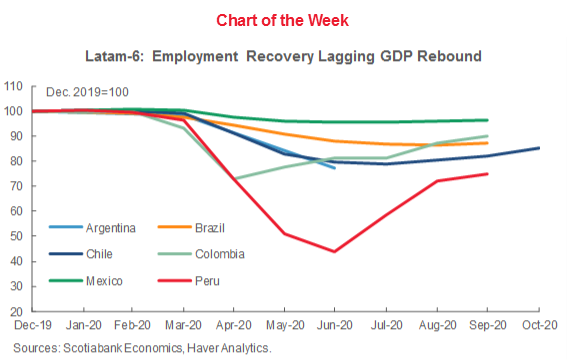

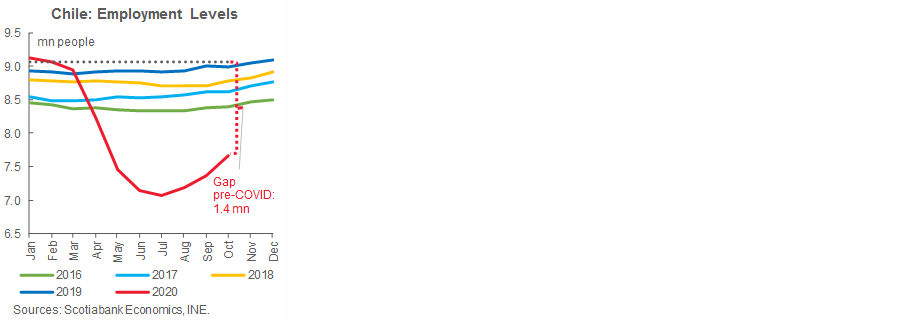

- Employment levels average only 86% of end-2019 numbers in those countries, ex-Argentina, where monthly labour-market data are available (chart 4). Labour-intensive hospitality, tourism, and entertainment sectors, where physical distancing is difficult, account for most of the gap between the recovery in GDP and manufacturing on the one hand, and softer data in retail sales and employment.

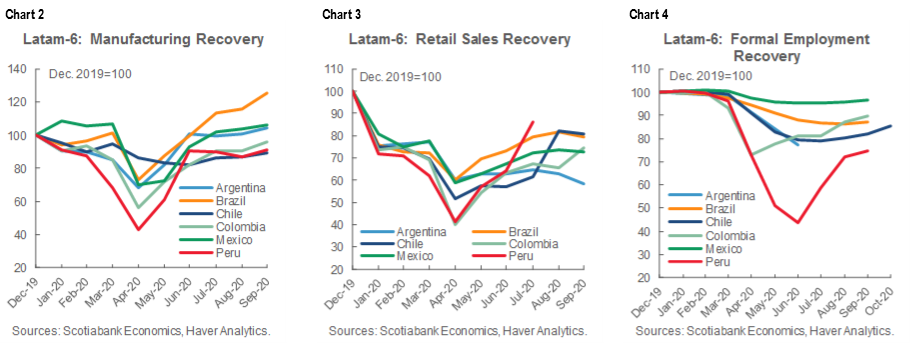

High levels of informality, particularly in Mexico and Peru, further complicate both the recovery and public efforts to support workers and households (table 1).

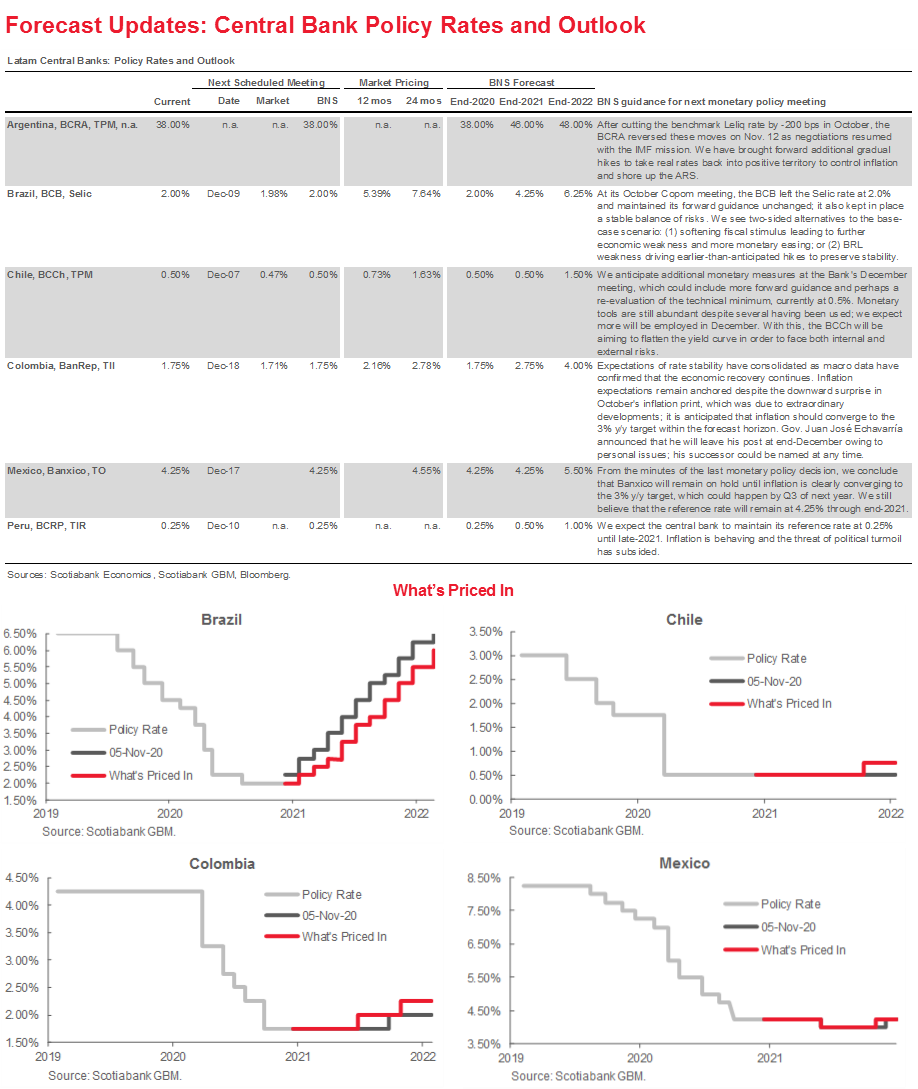

CENTRAL BANKS: HOLDING OUT THE YEAR

Central bank activity is backloaded into the coming fortnight. The publication of the BanRep minutes on Monday, November 30 is the only major scheduled monetary-policy risk event in the week ahead. We expect the following week to be marked by another set of rate holds in Chile (Dec. 7), Brazil (Dec. 9), and Peru (Dec. 10).

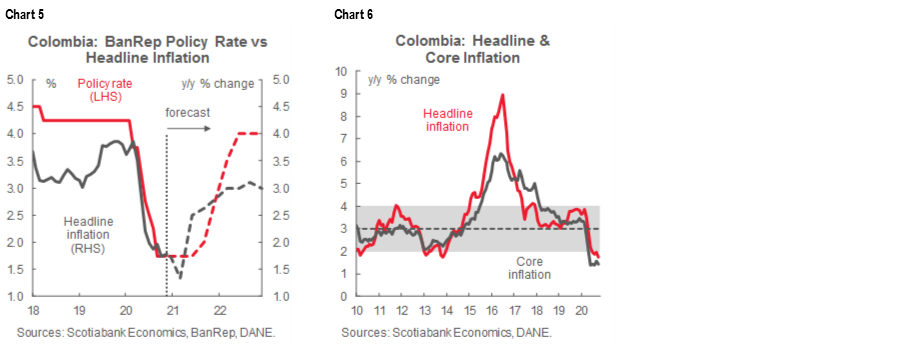

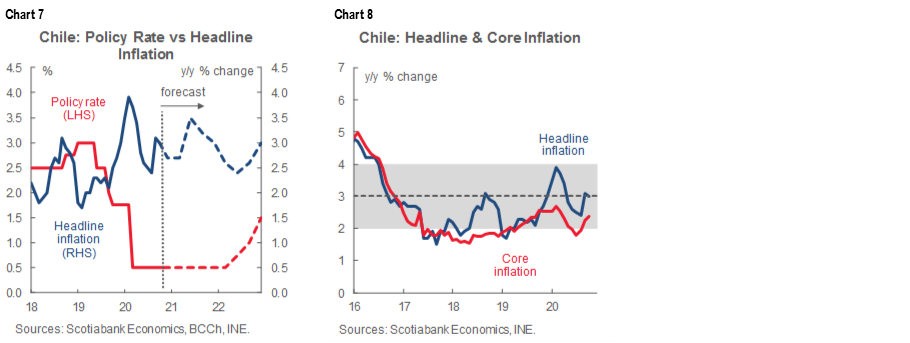

- Colombia. Following the BanRep Board’s unanimous decision to hold its headline policy rate at 1.75% on Friday, November 27 (chart 5), the minutes from the meeting will be published on Monday, November 30. In an unusually short statement, the Board noted that the economic recovery is proceeding in line with its forecasts and that inflation expectations remain grounded, but that the labour market remains a concern. No alteration was made to the Board’s “wait-and-see”, data-dependent stance and the 3% y/y inflation target was reaffirmed for next year, as is customary at the November monetary-policy meeting in order to comply with regulatory mandates; no indication was given on renewal of the NDF program. In the press conference, Gov. Echavarria emphasized that future decisions will hinge, unsurprisingly, on inflation, which remains below the bottom of the target range (chart 6) and growth dynamics. He noted his expectation that policy rates would remain unchanged over the coming months and underscored that the BanRep has already cut its key policy rate relatively aggressively compared with other Latam central banks. With -250 bps in rate reductions since March 1, only Banxico has cut more with -275 bps in easing, but real rates remain positive in Mexico. We continue to expect the BanRep to remain on hold until Q3-2020; similarly, markets are also pricing a first hike at that point (see What’s Priced In on p. 3).

- Chile. The BCCh Board will deliver its next monetary-policy decision on Monday, December 7, where our team in Santiago, the consensus of analysts, and market pricing anticipate another hold at 0.5% (chart 7). However, we do expect a more dovish tone in the Board’s forward guidance, given that we project the recent spike in inflation to be transitory (chart 8), and a possible revisiting of the 0.5% technical minimum. The December Monetary Policy Report follows on Wednesday, December 9, where we expect to see the BCCh upgrade its GDP growth forecasts to reflect the impulse from the imminent second round of pension-fund withdrawals. The minutes of the December 7 rate decision are due to be published on Wednesday, December 23. Our Chile economists expect the BCCh to stay on hold until Q2-2022, but markets are pricing a first hike in late-2021 (see p. 3).

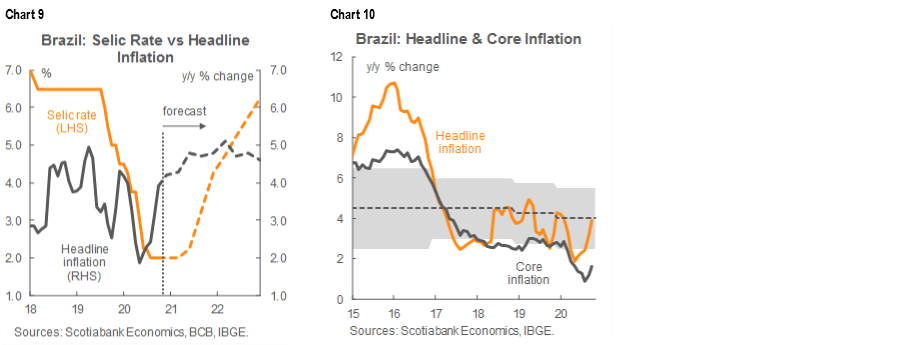

- Brazil. The BCB’s Copom is next scheduled to meet on Wednesday, December 9, where our Brazil economist expects the Selic rate to be held at 2.00% for a fourth meeting in a row (chart 9). In view of the boost to our growth and inflation projections in the Forecast Update on p. 2, we no longer see a strong chance of additional easing at this stage, but as we acknowledge in the Central Bank table on p. 3, there is a material risk that hikes could be brought forward earlier than the first move we anticipate in Q2-2021 in an effort to shore up the BRL and respond to rising inflationary pressures (chart 10). While markets are also pricing a hold on December 9, they do anticipate a first hike in Q1-2021. Following its usual calendar, the minutes from the Copom’s meeting are due to be published on Tuesday, December 15.

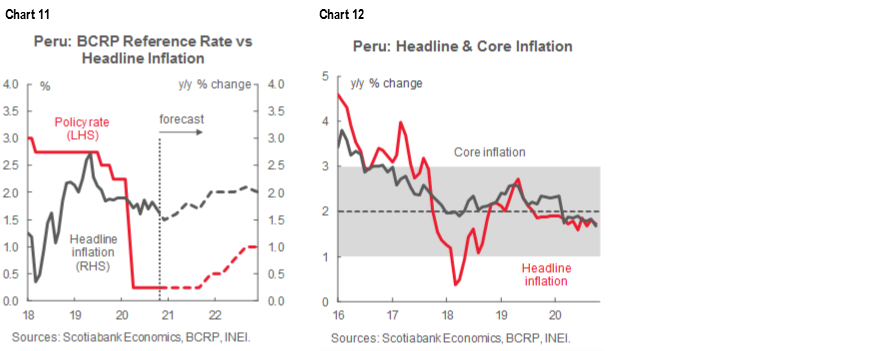

- Peru. The BCRP Board will make its last planned rate decision for 2020 on Thursday, December 10, where we expect the headline policy rate to be held again at 0.25% (chart 11). The meeting is likely to be uneventful, with the BCRP focused on efforts to mitigate volatility in the PEN and ensure major sectors of the economy continue to be able to access adequate liquidity. We expect below-target inflation (chart 12) to soften only marginally further into the end of the year.

MACRO DATA: INFLATION SLOWING A TOUCH MORE EVERYWHERE BUT BRAZIL

- Argentina. Second-tier data will likely just confirm that the recovery held on to its gains in October and November, and lost a bit of pace. September wage gains (Dec. 1) are likely to match recent 3% m/m inflation prints and add to the authorities’ stabilization challenges.

- Brazil. Q3 GDP (Dec. 3) should see economic activity up substantially from -11.4% y/y in Q2 to -2.7% y/y, while we expect monthly IPCA inflation (Dec. 8) to accelerate from 3.9% y/y in October to 4.3% y/y in November.

- Chile. October sectoral data (Nov. 30) and the IMACEC GDP proxy (Dec. 1) are expected to reflect boosts from the pension withdrawals, while November inflation (Dec. 7) is projected to edge down to just below the 3% y/y BCCh target.

- Colombia. Q3 current account data (Dec. 1) are likely to show a wider deficit, but November inflation (Dec. 5) is set to remain below the BanRep target range at 1.7% y/y.

- Mexico. Bank credit (Nov. 30) leads off a busy week of secondary data releases ahead of both H2-November and the whole month’s inflation prints (Dec. 9) the following week. While our team in CDMX expects an idiosyncratic slowdown from 4.1% y/y in October to 3.4% y/y in November, they don’t see this as a sign of a broader deflationary trend—at least yet.

- Peru. November inflation (Dec. 1) is expected to drift down slowly to our 1.5% y/y projection, while the October trade balance (Dec. 9 to 11) should improve on higher mining output and metals prices.

USEFUL REFERENCES

R. Chang, J. Hong, K. Varley, “The Best and Worst Places to be in the Coronavirus Era”, Bloomberg, November 24, 2020: https://www.bloomberg.com/graphics/covid-resilience-ranking/?sref=VvJhl47t

COUNTRY UPDATES

Argentina—Full of Expectations

Brett House, VP & Deputy Chief Economist

416.863.7463

brett.house@scotiabank.com

Three key sets of expectations are driving developments in Argentina’s economy and these are unlikely to change through the end of the year and into 2021.

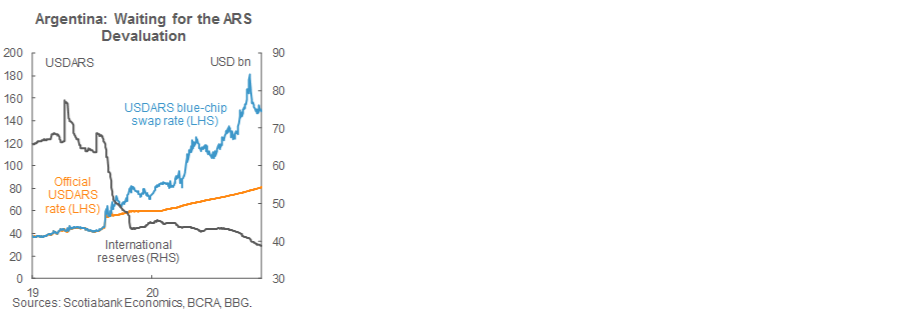

First, as we’ve argued extensively over the last few months, we’re not alone in expecting an ARS devaluation at some point in the remainder of 2020 or early in 2021. Recently monthly export numbers imply that producers have held back shipments abroad in the anticipation of a windfall from a significantly weaker ARS, as we noted in our November 26 Latam Daily. Although the blue-chip swap rate has pulled back from the extreme USDARS 180.73 level it hit on October 22 to USDARS 148.69 on November 27, it remains 54% weaker than the official USDARS 81.06 exchange rate (first chart). While we’ve programmed only a gradual depreciation in the official ARS over the coming months (see the Forecast Table on p. 2), this projection does not yet incorporate agreement on a set of policy measures to unlock new financing from the IMF. Despite various evolutions in the IMF’s thinking, particularly on fiscal policy where the Fund’s Managing Director is currently warning against too little rather than too much stimulus, it’s hard to imagine a scenario under which the release of financing under a new EFF arrangement won’t require an alignment of Argentina’s FX markets and, hence, a devaluation in the official Argentine peso.

Second, neither we nor the consensus of analysts expect quick agreement on a new IMF program. The IMF staff statement issued when the mission left Buenos Aires on November 20 made for bleak reading: despite initial talks in September and October, it appears that little progress was made during the Fund’s visit on crafting a consensus around a package of policy reforms to stabilize the economy. As a result, we’re unlikely to see a conclusion to these negotiations until well into Q1-2021.

Third, inflation expectations are unanchored and are unlikely to budge until talks on a Fund program are wrapped up. Inflation expectations in the BCRA’s survey of market analysts, which remained elevated through end-October (second chart), have had no reason to change in the next update of the Relevamiento de Expectativas de Mercado (REM) for end-November that is due on Friday, December 4.

In the meantime, Tier-2 economic prints are the main entries in the risk calendar at the back of this report for the first half of December. With headline inflation in September clocking in at 2.8% m/m, we expect wage growth in the month to hit 3.0% m/m in data due for release on Tuesday, December 1. Although Economy Minister Guzman has indicated confidence in the country’s fiscal accounts through his promise not to draw on the BCRA for financing in November and December, we expect growth in tax revenue numbers out on Wednesday, December 2, to show a slowing in monthly gains. Industrial production levels likely remained steady from September to October, which implies annual growth of 3.5% y/y when INDEC releases its monthly numbers on Wednesday, December 9. Construction activity, which has lagged the recovery in other sectors, is forecast to pull level in October with numbers from a year ago.

Brazil—Continued Underperformance on the Health Front and in Markets as Economy Claws Back to Pre-Pandemic Levels

Eduardo Suárez, VP, Latin America Economics

52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

Brazil’s capacity to rebound from the COVID-19 shock on different fronts has been remarkably uneven.

In health terms, the country accounts for over 10% of global fatalities according to Johns Hopkins data and is ranked second globally by total COVID-19-related deaths. After a decline in the incidence of new cases in September, we have seen a spike back up to an incidence rate of around 40k new COVID-19 cases reported daily.

From a financial markets standpoint, Brazil’s performance has been among the world’s worst. This overall point is borne out by a range of market pricing:

- Among the world’s 31 most liquid currencies, the BRL (at -28% YTD) has been the worst performer by a 4-percentage point margin;

- Brazil’s 5-year CDS spread has widened 65 bps YTD, among the largest increases across major emerging markets;

- In fixed-income markets, the 5-year point of the DI curve has widened close to 100 bps YTD, while 10-year yields have increased by around 140 bps YTD; and

- The main market where the country has done fairly well is equities, where the Bovespa has dropped only -5% YTD, which is comparable to the performance of Mexico’s IPC and Peru’s BVL, but much better than the performance of Colombia’s Colcap (-24% YTD) and Chile’s SLCT (-11.3% YTD).

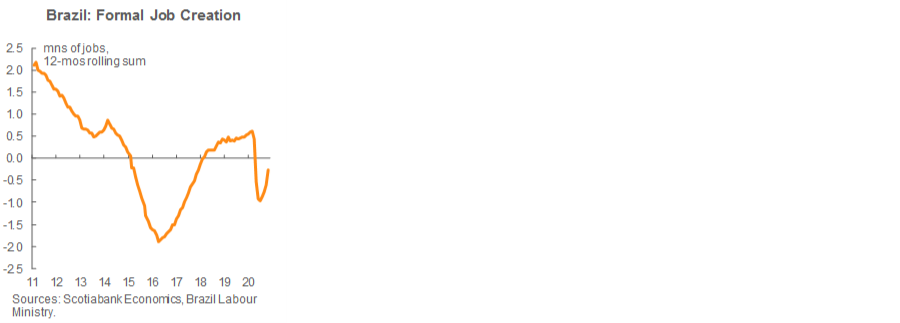

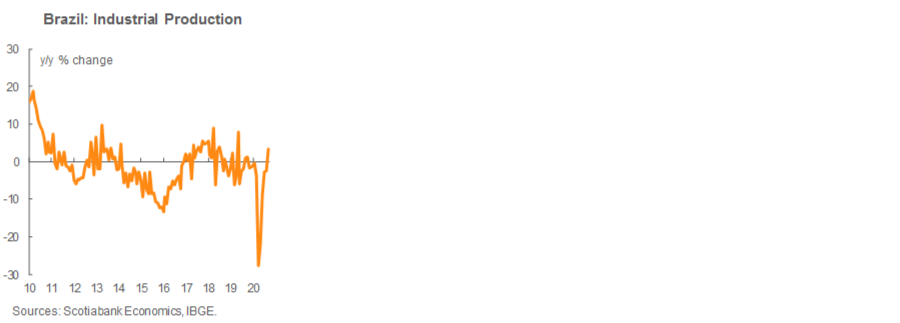

On the economic front, Brazil has experienced a strong economic recovery—one of the fastest in all of Latin Americqa. Employment has recouped about three-quarters of the formal jobs lost at the peak of the COVID-19 employment shock and industrial production is back in positive territory on a year-on-year basis, up 3.4% y/y in September. We expect these gains to pull back a bit to 0.9% y/y in October (see Market Events & Indicators at the back of this report). Brazil’s Q3 GDP data, which are due to arrive on Thursday, December 3, are projected to improve further from the -11.4% y/y result in Q2 to -2.7% y/y.

The next Copom decision on the Selic rate is due on Wednesday, December 9. We expect the BCB to keep its benchmark policy rate on hold at 2.00% into Q2-2021.

Chile—Employment Recovery Begins; Second Withdrawal of Pension Assets Moves Forward in Congress; Upward Bias to 2021 GDP

Jorge Selaive, Chief Economist, Chile

56.2.2939.1092 (Chile)

jorge.selaive@scotiabank.cl

Carlos Muñoz, Senior Economist

56.2.2619.6848 (Chile)

carlos.munoz@scotiabank.cl

These have been quiet weeks in terms of economic data releases. On Wednesday, November 18, national accounts for the third quarter were published. The Chilean economy was -9.1% y/y smaller in Q3-2020 compared with the same quarter a year ago. On a positive note, the data confirmed that in Q3 the economy began its path toward recovery following the drop of -14.5% y/y during the second quarter’s lockdown. Sequential growth accelerated from Q2’s -13.5% q/q sa to 5.2% q/q sa, beating survey expectations of 4.9% q/q sa. Third quarter growth was explained by a rebound in household spending, fueled by the withdrawal of pension funds and the government’s measures to support family incomes.

Given the latest figures, we have introduced an upward bias to our forecast for GDP growth in 2021, which we currently maintain at 5.1% y/y (see Forecast Table, p. 2). The two rounds of pension-fund withdrawals will end up being equivalent to a possible 13% of GDP, which is one of the highest (if not the highest) levels of pandemic support for families anywhere in the world. On top of this, one also has to add the fiscal package worth 12% of GDP.

The second withdrawal of pension assets is set to be approved in a few days by Congress. After the bill proposed by members of the Opposition was approved by a vast majority in the Chamber of Deputies, the Government proposed its own bill that feature more restrictions, especially for high-income individuals. On Thursday, November 26, the Opposition’s bill was rejected in the Senate while the Government’s bill was passed, with the condition that high-income pension contributors will have to pay taxes on withdrawals according to the current tax system. The discussion of the Government’s bill in the Chamber of Deputies’ Labour Committee should begin on Monday and the debate in the whole Chamber would follow on Wednesday or thereafter. The Government aims to enact the bill quickly so that withdrawn funds can be in contributors’ pockets by Christmas. Our estimates indicate that the lower bound of total withdrawals would be USD 6 bn and the upper bound would be USD 15 bn, with taxes paid on drawings by high-income earners.

On Friday, November 27, employment data for October was released. The unemployment rate decreased again, reaching 11.6% in the August–October moving quarter, a positive surprise against our expectations. This was explained by a greater increase in employment than in the workforce during a month favoured by a rebound in demand and the re-opening of the economy. The re-opening process is doing its expected work in terms of job creation. In fact, at the sectoral level, the greatest job gains are coming from commerce and construction, and not only from self-employment, but also with solid creation of salaried employment.

The fortnight ahead will bring some important data and events. First, on Monday, November 30, we will receive sectoral activity data for October. Our Scotiabank Chile transactions data point to retail sales being up 20% y/y in October after September was up 9.5% y/y. We anticipate that this jump was fueled by the withdrawal of pension assets and the low basis of comparison with last year, considering that in October 2019 we experienced the social outbreak in Chile. Manufacturing production should be up around 6% y/y in October. Next, on Tuesday, December 1, we will get the monthly GDP data for October, where we expect to see a rise of 2.5% y/y, the first annual increase since February. With more than 90% of the economy re-opened, we forecast a strong pick-up in non-mining activity (our projection: 2.5% y/y) and a decline of -1% y/y in mining activity. The October print will be the first instance where the central bank will publish the disaggregation of the monthly GDP proxy, with differentiated numbers on mining, manufacturing, commerce, services, and other goods.

On Monday, December 7, the INE will publish November’s CPI data, where we expect a null monthly variation, which would imply an annual inflation rate of 2.9% y/y, down slightly from 3.0% y/y (0.7% m/m) in October. That same day, during the afternoon, the BCCh’s December monetary-policy meeting will take place followed by the publication of the Monetary Policy Report on December 9. We expect a more stimulative bent to the Board’s forward guidance and perhaps a re-evaluation of the technical minimum rate which is currently estimated at 0.5%. While the central bank may indicate an upward adjustment in GDP for 2021, this would be largely explained by the new withdrawal of assets from the pension funds, which should not generate relevant traction in employment or investment growth and implies only transitory impacts on consumption and inflation. In this context, the central bank should treat the recent high inflation prints as temporary phenomena fueled by the pension withdrawals.

Over recent months, we have learned more about the passing and permanent economic impact of the pandemic. As the months have gone by, it has become increasingly apparent that there will be long-lasting effects, including high unemployment. While the outlook does remain uncertain, we do have a somewhat clearer picture of the future state of the labour market. A sharp bounce-back in jobs is unlikely and it will take time to return to where we were before the pandemic. Moreover, monetary easing is likely to get more traction today than it would have when widespread restrictions were in place.

Colombia—Fiscal Accounts Are One of the Main Concerns for the Outlook

Sergio Olarte, Head Economist, Colombia

57.1.745.6300 (Colombia)

sergio.olarte@co.scotiabank.com

Jackeline Piraján, Economist

57.1.745.6300 (Colombia)

jackeline.pirajan@co.scotiabank.com

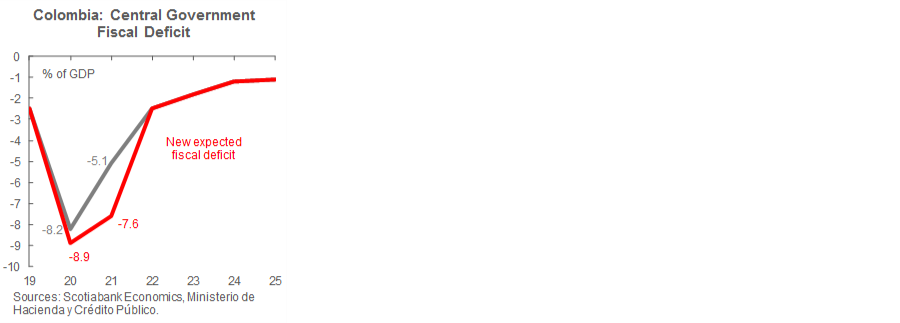

One of the most important side effects of the pandemic is that governments worldwide have had to increase debt in a very significant way due to countercyclical expenditures and the shortfall in tax revenues resulting from reduced economic activity. Colombia has not been an exception, with debt increasing on the back of lower tax collections. In fact, the debt-GDP ratio is expected to rise to 66% owing to both higher debt and lower economic activity. Therefore, among the most significant challenges that the Colombian government faces in the next couple of years is finding a way to support the economic recovery while keeping markets calm regarding the need for fiscal stabilization.

During the last month, Fitch and S&P maintained their investment grade (IG) ratings for Colombia, which added some confidence to markets in terms of fiscal sustainability. However, they also kept a negative outlook and conditioned Colombia’s future IG status on tax reform that generates enough resources in the medium-term to start to reduce or at least stabilize the debt-GDP ratio. In fact, recently the Ministry of Finance strongly underscored the need to pass a substantial tax reform as soon as in H1-2021 while, at the same time, it increased the already-high fiscal deficits projected for this year and 2021. This year, the fiscal deficit is projected to be equivalent to -8.9% of GDP instead of the -8.2% under previous forecasts, and next year -7.6% instead of -5.2%.

Therefore, next year’s tax reform must be structurally focused on generating additional revenues despite a weak economic environment in a pre-electoral year. The Congressional Tax Committee has already said that it will focus on fighting evasion, which on the VAT alone amounts to around 7 ppts of GDP. In fact, it indicated that the reform will concentrate on indirect taxes (i.e., VAT) instead of usual reform measures that seek to increase corporate and personal taxes. But the key question remains, how can any unpopular tax reform be passed next year? We would note the following:

- First, the pandemic has shown that transfers to low-income populations through the financial system are possible. Thus, increases in VAT can be partially compensated with direct transfers to low-income individuals, making the VAT less regressive;

- Second, the Opposition in Congress may support reform because it would be able to use it against the current administration in the 2022 Presidential elections; and

- Third, there’s an appeal to getting the reform done in 2021 so that the new President will not have to start his or her term by passing similar measures.

However, the tax reform is unlikely to be enough to stabilize Colombia’s fiscal accounts; GDP growth is also needed. According to calculations by the public service, -1 ppt of lower GDP growth reduces tax revenues by -1.37 ppts; thus, the recovery in economic activity is crucial for the fiscal accounts. Currently, official GDP forecasts anticipate growth of -6.8% y/y for 2020 and 5% y/y for 2021. We think that these assumptions are credible for now. Having said this, if, due to a second COVID-19 wave, the government implements new quarantines or mobility restrictions, the GDP outlook would be brought down.

There is, unfortunately, little room to move on the expenditure side: close to 85% of the annual fiscal budget is inflexible. Therefore, it’s very difficult to reduce the deficit through cuts in discretionary spending.

Given its limited room to maneuver, we think that the Government will take advantage of the small window the international credit-rating agencies have given to Colombia to pass a tax reform package in 2021. In the same vein, the authorities will make all efforts to avoid again closing down the economy in order to ensure sound fiscal accounts next year.

Mexico—Some Surprises on the Macro View

Mario Correa, Economic Research Director

52.55.5123.2683 (Mexico)

mcorrea@scotiacb.com.mx

In a very busy week just past, there were many indicators and relevant events that provided valuable inputs to reassess the performance of the Mexican economy. First, inflation presented some unusual behaviour in the first half of November, with the general Consumer Price Index (CPI) increasing by only 0.04% 2w/2w, which was the lowest reading for a similar period on record, and the core index falling by -0.11% 2w/2w. With these results, annual inflation descended abruptly from 4.09% y/y in the 2nd half of October to 3.43% y/y in the 1st half of November, back into the target range defined by Banco de Mexico, while core annual inflation descended from 3.96% y/y to 3.68% y/y. Inflation in this period is usually high due to a seasonal increase in electricity tariffs and in fruits and vegetables. This year, a reduction in gasoline prices tamed the energy component of inflation, while fruits and vegetables prices fell -3.28% y/y. In addition to these effects, non-food merchandise prices saw a decline of -0.69% y/y, which could be explained by the unusual “good weekend” program of promotions to boost sales. Since there were many atypical factors that produced this sharp decline in inflation, we cannot conclude yet that there is a change in the trend of price dynamics.

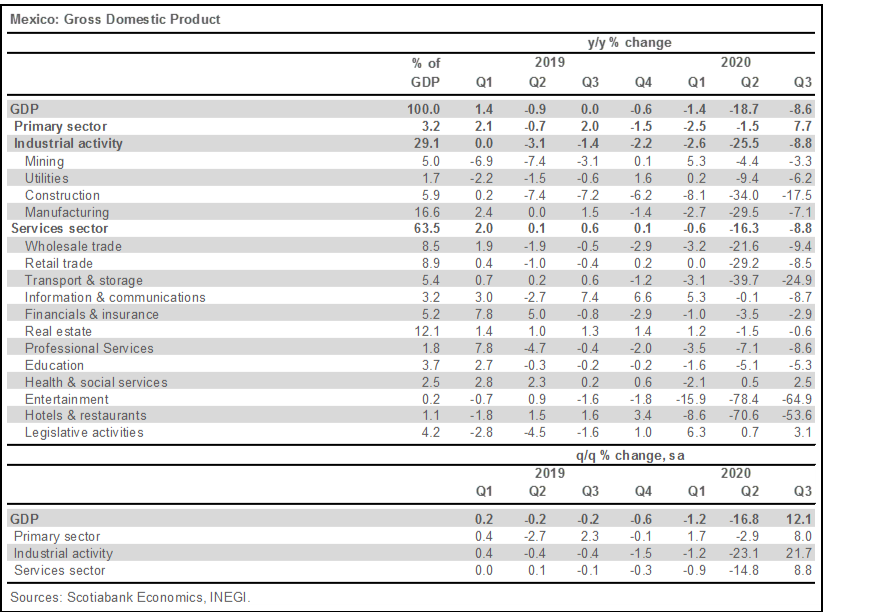

We also received the detailed figures on Gross Domestic Product (GDP) in Q3, which were very much in line with the advance reading provided by INEGI a few weeks ago (see the table). The numbers depicted a rebound at contrasting speeds from the bottom recorded in Q2 due to COVID-19 confinement; while industry grew 21.7% q/q sa, services increased by 8.8% q/q sa. Within the services sector, there were also mixed results across sub-segments, with some of them recovering relatively quickly, such as commercial activities, and some deteriorating, like media and information services and professional services. Other sectors such as entertainment, restaurants and hotels, and transportation services, remained seriously impaired.

Banco de Mexico published two key documents this past week—its Quarterly Report and the minutes of the last monetary-policy decision on November 12. The Quarterly Report is a very comprehensive document that provides Banxico’s detailed analysis of the performance of the economy, but the key element in this report is the update of the Bank’s macroeconomic forecasts. A novelty for this edition is that the Banxico staff provided once again a central scenario for GDP growth, instead of the three scenarios presented in previous reports. In this central scenario, the Bank forecast GDP growth for 2020, 2021, and 2022 at -8.9% y/y, 3.3% y/y, and 2.6% y/y, respectively. It is worth noting that with these numbers, by the end of 2022, around 60% of 2020’s economic loss will be recovered, and two more years of reasonable growth will be required to return to the production levels of 2019. Banxico warns that there is still a lot of uncertainty to the economic forecasts, so for 2021 they provide a range between 0.6% y/y and 5.3% y/y for expected growth. On the other hand, the expected inflation path was adjusted to slightly higher levels, so Banxico staff expect that by the end of 2021 inflation will close at 3.3% y/y instead of 2.9% y/y in the previous report.

The minutes of the November 12 monetary-policy decision presented some surprises, especially because the dissenting vote was not from whom it was expected, Gerardo Esquivel, but from Jonathan Heath. In the usual characterization of the Board members, the most dovish side of the spectrum was occupied by Mr. Esquivel, and Mr. Heath was considered also dovish, but closer to the center. On the hawkish side, Mr. Guzman and Mrs. Espinosa were grouped together while Governor Diaz de Leon was in the middle. Since the previous minutes were released, we noted that voting intentions appeared to be changing and that a pause in easing could take place. We can conclude that Mr. Diaz de Leon was the decisive vote for the Board’s hold on November 12 and Mr. Esquivel’s vote to maintain the rate was a surprise. It is worth mentioning that at the time the Board made its decision, its members had a good idea of how inflation in the first half of November was shaping up and that there could be a significant drop in annual price growth. The minutes revealed that the Board was inclined to act prudently after many inflation surprises on the upside and would hold at the present stance until the Bank can confirm that inflation is converging to the 3.0% y/y target. This means that the abrupt descent of inflation in November is not enough to trigger a new cut in the reference interest rate. Even if the first half of December presents tamed inflation numbers, that may not be enough to indicate a converging trend towards the target; hence, we think that the Board will maintain the reference interest rate at the present level. We should note that we forecast that there will be a significant spike in annual inflation in Q2 of 2021 owing to level effects from the COVID-19-related lockdown imposed this year. In light of this, we think the Board will hold the reference interest rate unchanged at the present level throughout all of next year.

Trade balance figures for October were released this past Friday, posting a new record surplus of USD 6,224 million as a result of stronger exports and still-weak imports. Total exports grew 2.9% y/y, mainly driven by the strength of auto exports, which gained 12.8% y/y—which more than compensated for the -30.2% y/y drop in oil exports. Total imports, on the other hand, contracted -13.8% y/y, presenting across-the-board declines in its main components. Consumption-goods imports were down -31.0% y/y while capital goods imports fell -18.3% y/y, signaling that private consumption and investment—the main internal engines for economic activity—started Q4 with concerning weakness that suggests that the economy is not getting traction after the rebound of Q3.

The broader balance of payments figures for Q3 were also released, posting a strong surplus of USD 17,498 mn in the current account and a deficit of USD -10,745 mn in the financial account. These results reflected a weak economy and some concerns on the part of financial investors. Notably, direct foreign investment into Mexico saw the weakest reading since 2009, at only USD 2,437 mn; portfolio investment experienced an outflow of USD -1,730 mn.

Please note that we have made some adjustments in our macroeconomic forecasts on p. 2. The changes incorporate the recent surprise in inflation, a much more positive tone in global financial markets that has provided some support to the MXN, and some adjustments to the GDP path that will be material for Q1 and Q2 of 2021, but present smaller changes for whole year growth.

The next two weeks will be packed with information, with many indicators for October that will give us a better view of how the economy started Q4, including financial activity, public finances, remittances, and industrial activity. We also receive some more lagged, but especially relevant, indicators, such as internal private consumption and gross fixed investment for September. For November, we will receive the whole-month’s inflation figures, consumer confidence and auto industry reports. There will also be a new Banco de Mexico Survey, which will likely present key adjustments in inflation forecasts. Finally, Banxico’s Financial Stability Report will be relevant to assess the state of the financial system and how the recession is impacting banks so far.

Peru—The Economy Returns to the Forefront as Politics Settle Down

Guillermo Arbe, Head of Economic Research

51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Someone looking at recent news from Peru could well think that the country never experienced the whirlwind of political turbulence that took place in the first half of November. We’ve picked up on two contrasting market views on Peru. One is of concern, as the country seems to be in a constant state of political turmoil. The other is of grudging applause, as Peru always seems able to come back with an acceptable outcome and its economy intact. The source of this contradiction may reside in the fact that Peru’s political institutions can be weak, but its economic institutions are quite strong.

Meanwhile, attention has shifted back to normal events, such as elections and the economy. The new Finance Minister, Waldo Mendoza, seems to view his mandate as having two parameters: (1) policy continuity, and (2) prudent fiscal management. Both came together this week when Min. Mendoza visited Congress to advocate for the approval of the fiscal budget for 2021. The USD 51 bn budget (3.2% greater than 2020) was originally submitted by the Vizcarra regime, and the Sagasti government seems to have no intention of modifying it. The budget includes an authorization to increase debt in 2021 by up to USD 12 bn (PEN 44 bn).

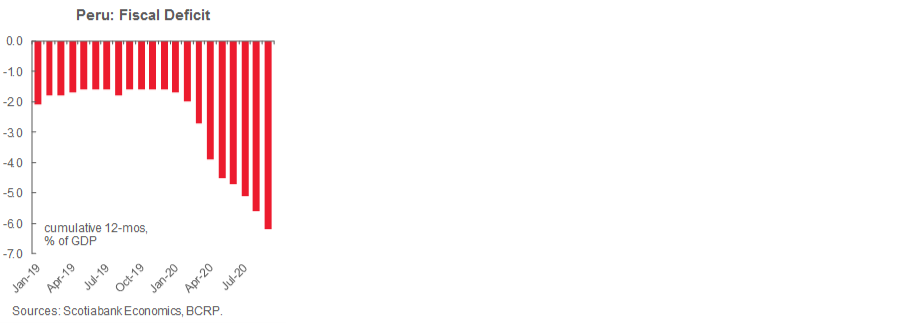

The Ministry of Finance (MEF) is expecting a fiscal deficit equivalent to -10.7% of GDP in 2020 and -6.2% in 2021. Both are higher than our forecasts of -8.7% and -5.0%, respectively. The difference is that we are less confident in the ability of the government to increase spending as much as it would like; the trend so far this year is closer to our forecast. The fiscal deficit in the four quarters to Q3-2020 came in at -6.2% of GDP. Note, however, that there is room for optimism, as both the MEF forecast and our own are based on metal price expectations that appear quite conservative when compared to their trends over the past few months.

Given its fiscal needs, the government issued USD 4 bn in global bonds, including, for the first time ever, USD 1 bn in century bonds (at 3.23%). The bid-to-cover ratio was 3.8x. Considering its magnitude, interest rates and the maturities, the issue underscored the extent to which markets continue to value Peruvian assets. S&P added to the positive sentiment this week by maintaining both its “BBB+” rating and its neutral outlook, something which was far from a given only a week ago.

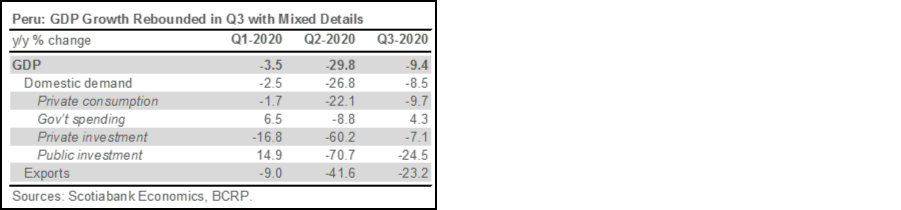

The BCRP released Q3-2020 GDP numbers on Monday, November 23. GDP contracted -9.4% y/y in Q3, although this included a significant 30% month-on-month increase on its front end. The breakdown makes the fourth quarter look promising. Private sector investment fell -7.1% y/y, which was a surprisingly strong rebound from -60% y/y in Q2. This should carry into Q4. Furthermore, public investment, which contracted -24.5% y/y in Q3-2020, is finally adding to growth, rising 6.6% y/y in October, and an expected 25.7% y/y in November. Exports, which fell -23.2% y/y in value in Q3, should also improve, as copper mining output returns to pre-COVID-19 levels, and fishing surpasses last year’s dismal season. At the same time, COVID-19 has subsided significantly, and the economy is nearly completely unlocked.

External accounts for Q3, as reported by the BCRP, were strong. The current account was slightly in surplus (0.5% of GDP), for the second consecutive quarter, and net international reserves (NIR) ended the quarter at USD 72.3 bn, near record levels and up by USD 4.3 bn (6%) in the year-to-date. NIR should jump again in Q4-2020, as the global bond issue in November adds to healthy trade accounts.

Finally, unemployment in Lima ended Q3-2020 at 16.4%; unemployment nationwide was 9.6%. Convention uses Lima as the gauge for unemployment, as the level of informality in the rest of the country is so high. The figure for Lima was disappointing, in that, instead of declining from 16.3% in Q2, it rose slightly. The figures are a bit misleading, however, as jobs actually increased from 2.2 mn to 3.9 mn. The unemployment rate did not fall, because labour force participation rose in slightly more than equal measure.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | pirajaj@colptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.