Credit cards

Earn up to $1,3001 in value

with the Scotiabank Passport® Visa Infinite* Card. This includes up to 40,000 bonus Scene+TM points2 and waiving the annual fee for your first supplementary card.1

Browse by credit card category

Featured credit cards

TRAVEL AND LIFESTYLE

Scotiabank Passport® Visa Infinite* Card

Earn up to $1,3003 in value in the first 12 months, including up to 40,000 bonus Scene+ points.4

Annual fee

$150

Purchase interest rate

20.99%

Cash advance rate

22.99%

You could earn Up to 3X the points5

TRAVEL AND LIFESTYLE

Scotiabank Gold American Express® Card

Earn up to $7501 in value in the first 12 months, including up to 40,000 bonus Scene+ points.2

Annual fee

$120

Purchase interest rate

20.99%

Cash advance rate

22.99%

You could earn Up to 6X the points6

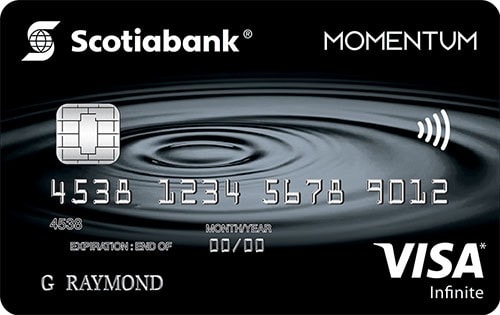

CASH BACK

Scotia Momentum® Visa Infinite* Card

Earn 10% cash back on all purchases for the first 3 months (up to $2,000 in total purchases).7 Plus, pay no annual fee in your first year.7

Annual fee

$120

Purchase interest rate

20.99%

Cash advance rate

22.99%

You could earn Up to 4% cash back8

Find the right card for you

Use our tools to compare credit cards, calculate your potential rewards, and more.

Calculate your rewards

Enter your monthly spending to calculate your potential rewards.

Explore credit options

Tell us about your spending and borrowing needs and we'll help find the credit solution that's right for you.

Credit card resources

What is a credit card and how do they work?

5 minute read

What credit score do you need for a credit card?

5 minute read

New to Canada? Here's how to get a credit card

5 minute read

Frequently asked questions

Get to know your card

Savings and reward potential in first 12 months includes welcome offer value, first year point earn potential, foreign transaction fee and airport lounge savings as of October 25, 2024:

$300 in travel rewards (30,000 bonus Scene+ points) for new Scotiabank Passport Visa Infinite Card clients who spend $2,000 within the first 3 months;

$100 in travel rewards (10,000 bonus Scene+ points) when you spend $40,000 annually on your Account each year (12-months);

$50 supplementary card annual fee waiver on the first supplementary card for new Scotiabank Passport Visa Infinite Card clients;

$137 in foreign transaction fee savings based on average first year annual foreign spend per account (save the 2.5% foreign transaction fee markup typically charged by othercard issuers);

$399 in first year point earn potential (30,000 Scene+ points) on everyday purchases based on average annual spend per account with an average spend of 20% in 2X accelerator categories;

$359 value with a complimentary Visa Airport Companion Program Membership that includes 6 lounge passes (based on ‘Preferential’ membership valued at approx. CAD$359/USD$259). Currency conversion as at October 25, 2024.

Potential First Year Value = up to $1,345

Actual offers, savings and rewards earned will depend on individual card usage and eligibility for applicable offers. Conditions apply.

Offer Description and Conditions: The 30,000 Bonus Scene+ Points Offer (the “Offer”) applies only to new Scotiabank Passport Visa Infinite credit card accounts (“Accounts”) that are opened between January 3, 2025 and July 1, 2025 subject to the conditions below. Offer may be changed, cancelled or extended at any time without notice and cannot be combined with any other offers.

Plus, as a Scotiabank Passport Visa Infinite credit cardholder you are always eligible to earn an annual 10,000 Scene+ point bonus when you spend at least $40,000 in everyday eligible purchases annually on your Scotiabank Passport Visa Infinite account. Conditions apply - see below for further details.

30,000 Bonus Scene+ Point Offer Description and Conditions: To qualify for the 30,000 bonus Scene+ points (the “30,000 Point Bonus”), you must have at least $2,000 in eligible purchases posted to your new Account within the first 3 months of the Account open date. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

10,000 Annual Bonus Scene+ Point Conditions: As a Scotiabank Passport Visa Infinite credit cardholder you can earn an annual Scene+ point bonus starting at 10,000 Scene+ points (“the Annual Point Bonus”) when you make at least $40,000 in eligible purchases annually on your Account each year (12-months). Annual period starts from the Account open date and resets every 12 months thereafter. You will earn 2,000 bonus Scene+ points for every additional $10,000 in eligible purchases thereafter in that same year, after the $40,000 annual spend has been reached. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

Point Bonus Fulfillment: The applicable point Bonus(es) will be credited within approximately 8 weeks after qualifying for a Bonus, provided the Account is open and in good standing. For Joint Accounts with a Primary Borrower and Co-borrower, the applicable point Bonus will be credited as follows: (i) the 30,000 Point Bonus and Annual Point Bonus will be credited to the Scene+ account linked to the Account of the borrower that completed the last transaction to meet the qualifying amount of eligible purchases (i.e., $2,000 or $40,000) in the appropriate time frame (i.e., first 3 months or first 12 months). If a supplementary cardholder completes the last qualifying transaction to meet the qualifying amount of eligible purchases for the 30,000 Point Bonus or the Annual Point Bonus, the applicable point Bonus will be credited to the Primary Borrower’s Scene+ account linked to the Account. Points can be transferred between Primary and Co-Borrower or Supplementary Cardholder’s Scene+ accounts by contacting Scene+. The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account. All other terms and conditions of the Program Terms continue to apply during the Offer period.

Offer Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank business credit cardholders are also eligible for the Offer.

Savings and reward potential in first 12 months includes welcome offer value, first year point earn potential, foreign transaction fee and airport lounge savings as of October 25, 2024:

$300 in travel rewards (30,000 bonus Scene+ points) for new Scotiabank Passport Visa Infinite Card clients who spend $2,000 within the first 3 months;

$100 in travel rewards (10,000 bonus Scene+ points) when you spend $40,000 annually on your Account each year (12-months);

$50 supplementary card annual fee waiver on the first supplementary card for new Scotiabank Passport Visa Infinite Card clients;

$137 in foreign transaction fee savings based on average first year annual foreign spend per account (save the 2.5% foreign transaction fee markup typically charged by othercard issuers);

$399 in first year point earn potential (30,000 Scene+ points) on everyday purchases based on average annual spend per account with an average spend of 20% in 2X accelerator categories;

$359 value with a complimentary Visa Airport Companion Program Membership that includes 6 lounge passes (based on ‘Preferential’ membership valued at approx. CAD$359/USD$259). Currency conversion as at October 25, 2024.

Potential First Year Value = up to $1,345

Actual offers, savings and rewards earned will depend on individual card usage and eligibility for applicable offers. Conditions apply.

Offer Description and Conditions: The 30,000 Bonus Scene+ Points Offer (the “Offer”) applies only to new Scotiabank Passport Visa Infinite credit card accounts (“Accounts”) that are opened between January 3, 2025 and July 1, 2025 subject to the conditions below. Offer may be changed, cancelled or extended at any time without notice and cannot be combined with any other offers.

Plus, as a Scotiabank Passport Visa Infinite credit cardholder you are always eligible to earn an annual 10,000 Scene+ point bonus when you spend at least $40,000 in everyday eligible purchases annually on your Scotiabank Passport Visa Infinite account. Conditions apply - see below for further details.

30,000 Bonus Scene+ Point Offer Description and Conditions: To qualify for the 30,000 bonus Scene+ points (the “30,000 Point Bonus”), you must have at least $2,000 in eligible purchases posted to your new Account within the first 3 months of the Account open date. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

10,000 Annual Bonus Scene+ Point Conditions: As a Scotiabank Passport Visa Infinite credit cardholder you can earn an annual Scene+ point bonus starting at 10,000 Scene+ points (the "Annual Point Bonus”) when you make at least $40,000 in eligible purchases annually on your Account each year (12-months). Annual period starts from the Account open date and resets every 12 months thereafter. You will earn 2,000 bonus Scene+ points for every additional $10,000 in eligible purchases thereafter in that same year, after the $40,000 annual spend has been reached. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

Point Bonus Fulfillment: The applicable point Bonus(es) will be credited within approximately 8 weeks after qualifying for a Bonus, provided the Account is open and in good standing. For Joint Accounts with a Primary Borrower and Co-borrower, the applicable point Bonus will be credited as follows: (i) the 30,000 Point Bonus and Annual Point Bonus will be credited to the Scene+ account linked to the Account of the borrower that completed the last transaction to meet the qualifying amount of eligible purchases (i.e., $2,000 or $40,000) in the appropriate time frame (i.e., first 3 months or first 12 months). If a supplementary cardholder completes the last qualifying transaction to meet the qualifying amount of eligible purchases for the 30,000 Point Bonus or the Annual Point Bonus, the applicable point Bonus will be credited to the Primary Borrower’s Scene+ account linked to the Account. Points can be transferred between Primary and Co-Borrower or Supplementary Cardholder’s Scene+ accounts by contacting Scene+. The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account. All other terms and conditions of the Program Terms continue to apply during the Offer period.

Offer Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank business credit cardholders are also eligible for the Offer.

Rates and Fees: The current annual fee is $150 for the primary card, $0 for the first additional card and $50 for each additional card thereafter (including those issued to co-borrowers and supplementary cardholders).

The current preferred annual interest rates for this Account are: 20.99% on purchases and 22.99% on cash advances (including balance transfers and cash-like transactions). All rates, fees, features and benefits are outlined in the Application Disclosure Statement and are subject to change.

You are awarded three (3) Scene+ Points for every eligible $1.00 purchase made at Sobeys, Safeway, IGA, Foodland, Foodland & Participating Co-ops, FreshCo, Chalo! FreshCo, Thrifty Foods, Rachelle Béry, Les Marchés, Voilà by Sobeys, Voilà by Safeway and Voilà par IGA locations charged and posted to the Scotiabank Passport Visa Infinite Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores.

You are awarded two (2) Scene+ Points for every eligible $1.00 purchase on all other grocery (not listed above), dining, entertainment, and daily transit purchases charged and posted to the Scotiabank Passport Visa Infinite Account (the earn rates for each of the above categories and merchants are referred to as the “Accelerated Earn Rates”). See below for the Spend Threshold that applies to this Accelerated Earn Rate.

You are awarded one (1) Scene+ Point for every $1.00 in all other purchases of goods and services charged to the Scotiabank Passport Visa Infinite Account (the “Regular Earn Rate”).

Spend Threshold for the Accelerated Earn Rate (Scotiabank Passport Visa Infinite Accounts only):

You will earn the Accelerated Earn Rate on the first $50,000 in purchases made on your Scotiabank Passport Visa Infinite account (the “Account”) annually at the following: purchases made at merchants classified in the Visa credit card network as: Grocery Stores and Supermarkets; Eating Places and Restaurants, Drinking Places, Fast Food Restaurants; Entertainment including Motion Picture Theatres, Theatrical Producers, Ticket Agencies, Bands, Orchestras, Miscellaneous Entertainers; Railroads, Local and Suburban Commuter Passenger Transportation, including Ferries, Passenger Railways, Taxicabs and Limousines, Bus Lines, Transportation Services (Not Elsewhere Classified). Some merchants may sell other products/services or are separate merchants who are located on the premises of these merchants, but are classified by the credit card network in another manner, in which case this added benefit would not apply. The annual spend calculation for the $50,000 maximum threshold is calculated annually from January 1st to December 31st each year. You will earn 1 point per $1 on purchases made on the Account after the 2 points per $1 / $50,000 annual spend maximum is reached and on all other purchases made on the Account. Scene+ points are only awarded on purchases. Scene+ points are not awarded for cash advances, balance transfers, Scotia® Credit Card Cheques, payments, returns, refunds or other similar credits, fees or interest or other charges. All dollar amounts are in Canadian currency unless otherwise stated.

You are awarded six (6) Scene+ Points for every eligible $1.00 CAD purchase made at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry, and Co-Op locations charged and posted to the Scotiabank Gold American Express Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores.

You are awarded five (5) Scene+ Points for every eligible $1.00 CAD purchase on all other grocery (not listed above), dining, and entertainment charged and posted to the Scotiabank Gold American Express Account. You are awarded three (3) Scene+ Points for every eligible $1.00 CAD purchase in gas, public transit and select streaming services purchases charged and posted to the Scotiabank Gold American Express Account (the earn rates for each of the above categories and merchants are referred to as the “Accelerated Earn Rates”). You are awarded one (1) Scene+ Point for every $1.00 in all other purchases of goods and services charged to the Scotiabank Gold American Express Account (the “Regular Earn Rate”).

You will earn the accelerated Scene+ Points (6X, 5X or 3X as applicable) under the Scene+ program if you make purchases in Canadian currency only. For purchases that are made in foreign currency, you will only earn 1 Scene+ Point for every $1 charged to the Scotiabank American Express® credit card once that foreign currency has been converted into Canadian dollars.

Merchant classifications – American Express network Purchases must be made at merchants classified through the American Express network with a Merchant Category Code (“MCC”) that identifies them in the American Express network in the “grocery”, “dining”, “entertainment”, “gas”, “streaming service” or “transit” category. Purchases at merchants where these categories are not their primary business do not qualify. Some merchants may (i) provide other goods or services; or (ii) have separate merchants located on their premises that may not be classified with an MCC under the Accelerated Earn Rate categories and such purchases will not earn the Accelerated Earn Rate as applicable. The Accelerated Earn Rates for the Scotiabank Gold American Express Card applies to the first $50,000 in purchases charged to the Scotiabank Gold American Express Account annually at merchants qualifying for the Accelerated Earn Rate, calculated annually from January 1st to December 31st each year. Once you exceed the applicable annual spend threshold, you will continue earning points at the Regular Earn Rate of one (1) Scene+ Point per $1.00 in purchases charged and posted to the Scotiabank Gold American Express Account. Eligibility: Only purchases earn Scene+ Points. Cash advances (including Balance Transfers and Cash-Like Transactions), fees, interest or other charges, returns, refunds or other similar credits to your Account do not qualify for Scene+ Points. Scene+ Points will not be posted to an Account that is not in good standing when purchases are made or when a statement is issued, or if the Account is not open when a statement is issued. See your Scene+ Points terms at www.scotiabank.com/sceneplus for full program details. All dollar amounts are in Canadian currency unless otherwise stated.

Offer Description and Conditions: The 10% Cash Back and First Year Annual Fee Waiver (the “Offer”) applies only to new Scotia Momentum Visa Infinite credit card accounts (“Accounts”) that are opened, and any additional Account cards issued, between March 3, 2025 and October 31, 2025 subject to the conditions below. We will waive the annual fee for the primary card and each additional card on the Account for the first year only. All other terms and conditions of the Program Terms continue to apply during the Offer period. Offer may be changed, cancelled or extended at any time without notice and cannot be combined with any other offers.

10% Cash Back Offer Description and Conditions: You will earn 10% cash back on the first $2,000 in eligible purchases you spend on your new Account within the first 3 months of the Account open date (the “Promotional Period”). Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers and cash-like transactions), interest, fees or other charges. After the Promotional Period, you will earn regular cash back on eligible purchases at the regular cash back rate (the “Cash Back Program Rate”) described in the Scotia Momentum Visa Infinite Cash Back Program Terms and Conditions (the “Program Terms”). The 10% cash back rate for any category is made up of the sum of: (i) the regular Cash Back Program Rate (variable by categories as set out under the Program Terms); and (ii) a “Cash Back Bonus Rate”.

Cash back earned under this Offer will be credited to your Account in 2 instalments so long as your Account is open and in good standing at time of payout of each:

1. Bonus Cash Back: The amount earned under the Cash Back Bonus Rate will be credited to your Account within approximately 7 months from the Account open date; and

2. Regular Cash Back: The amount earned under your regular Cash Back Program Rate will be credited to your Account according to the regular cash back payment schedule as set out under the Program Terms.

The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account.

EXAMPLE: If the Regular Cash Back Program Rate for the Groceries and Recurring Payments category is 4% then the Cash Back Bonus Rate will be 6% for that category so that you will earn a total of 10% on the amount of all eligible everyday purchases in that category during the Promotional Period. If you make $2,000 in eligible everyday purchases in the Groceries and Recurring Payments category, your cash back earnings will be credited to your Account as follows:

(1) the Cash Back Bonus earnings of $120 (6% x $2,000) (which will not be tracked on your monthly statements), will be credited to your Account within 7 months from the Account open date, and (2) the Regular Cash Back earnings of $80 (4% x $2,000) (which will be tracked on your monthly statements), will be credited to your Account as per the regular cash back payment schedule (i.e., November).

Annual Fee Waiver Offer Description and Conditions: We will waive the annual fee for the primary card and each additional card issued before October 31, 2025 on the Account for the first year only.

Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank business credit cardholders are also eligible for the Offer.

Rates and Fees: The current annual fee is $120 for the primary card and $50 for each additional card (including those issued to co-borrowers and supplementary cardholders). The current preferred annual interest rates for the Account are: 20.99% on purchases and 22.99% on Cash Advances. All rates, fees, features and benefits are outlined in the Application Disclosure Statement and are subject to change.

Offer Description and Conditions: The 5,000 Bonus Scene+ Points Offer (the “Offer”) applies only to new Scotiabank American Express credit card accounts (“Account”) opened between November 1, 2024 and July 1, 2025 and is subject to the below terms and conditions. To be eligible for 2,500 bonus Scene+ points (the “2,500 Point Bonus”), you must have at least $250 in eligible purchases posted to your new Account in the first 3 months of the Account open date. To be eligible for an additional 2,500 bonus Scene+ points (the “Additional 2,500 Point Bonus”), you must have at least $1,000 in eligible purchases posted to your new Account in your first 3 months of Account open date. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

Point Bonus Fulfilment The applicable point Bonus(es) will be credited to the Scene+ account within approximately 8 weeks after qualifying for a Bonus, provided the Account is open and in good standing. For Joint Accounts with a Primary Borrower and Co-borrower, the applicable point Bonus will be credited as follows: (i) the 2,500 Point Bonus and Additional 2.500 Point Bonus will be credited to the Scene+ account linked to the Account of the borrower that completed the last transaction to meet the qualifying amount of eligible purchases (i.e., $250 or $1,000) in the appropriate time frame (i.e., first 3 months). If a supplementary cardholder completes the last qualifying transaction to meet the qualifying amount of eligible purchases for the 2,500 Point Bonus or the Additional 2,500 Point Bonus, the applicable point Bonus will be credited to the Primary Borrower’s Scene+ account linked to the Account. Points can be transferred between Primary and Co-Borrower or Supplementary Cardholder’s Scene+ accounts by contacting Scene. The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account. All other terms and conditions of the Program Terms continue to apply during the Offer period. Offer may be changed, cancelled or extended without notice at any time and cannot be combined with any other offers.

Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank business credit cardholders are also eligible for the Offer.

Rates and Fees: There is currently no annual fee for the primary card and no fee for each additional card (including those issued to co-borrowers and supplementary cardholders).

The current preferred annual interest rates for the Account are: 19.99% on purchases and 22.99% on cash advances (including balance transfers and cash-like transactions).

All rates, fees, features and benefits are outlined in the Application Disclosure Statement and are subject to change.

You are awarded three (3) Scene+ Points for every eligible $1.00 purchase made at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry, and Co-Op locations charged and posted to the Scotiabank American Express Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores.

Additionally, you are awarded two (2) Scene+ Points for every eligible $1.00 purchase all other grocery (not listed above), dining, entertainment, gas, daily transit and select streaming services charged and posted to the Scotiabank American Express Account (the “Account”) (the earn rates for each of the above categories and merchants are referred to as the “Accelerated Earn Rates”). You are awarded one (1) Scene+ Point for every $1.00 in all other purchases of goods and services charged to the Scotiabank American Express Account (the “Regular Earn Rate”).

Merchant classifications – American Express network Purchases must be made at merchants classified through the American Express network with a Merchant Category Code (“MCC”) that identifies them in the American Express network in the “grocery”, “dining”, “entertainment”, “gas”, “streaming service” or “transit” category. Purchases at merchants where these categories are not their primary business do not qualify. Some merchants may (i) provide other goods or services; or (ii) have separate merchants located on their premises that may not be classified with an MCC under the Accelerated Earn Rate categories and such purchases will not earn the Accelerated Earn Rate as applicable.

The Accelerated Earn Rates for the Scotiabank American Express Card applies to the first $50,000 in purchases charged to the Scotiabank American Express Account annually at merchants qualifying for the Accelerated Earn Rate, calculated annually from January 1st to December 31st each year. Once you exceed the applicable annual spend threshold, you will continue earning points at the Regular Earn Rate of one (1) Scene+ Point per $1.00 in purchases charged and posted to the Scotiabank American Express Account.

Eligibility: Only purchases earn Scene+ Points. Cash advances (including Balance Transfers, Scotia† Credit Card Cheques and Cash-Like Transactions), fees, interest or other charges, returns, refunds or other similar credits to your Account do not qualify for Scene+ Points. Scene+ Points will not be posted to an Account that is not in good standing when purchases are made or when a statement is issued, or if the Account is not open when a statement is issued. See your Scene+ Points terms at www.scotiabank.com/sceneplus for full program details

Offer Description and Conditions: The Introductory 2.99% Balance Transfer Rate Offer (the “Offer”) applies only to eligible cash advances (including balance transfers and cash-like transactions) (collectively “Cash Advances”) subject to the conditions below. This introductory rate applies if the new Account is opened between March 3, 2025 and October 31, 2025 and will continue for 6 months from date of Account opening (the “Promotional Period”). After the Promotional Period, the promotional 2.99% interest rate on any Cash Advances (including any amount of those Cash Advances that remain unpaid after the Promotional Period ends) will increase to the preferred interest rate on Cash Advances (currently 22.99%). There is no balance transfer fee applicable to Cash Advances made during the Promotional Period.

This Offer is subject to any available limit for Cash Advances on your Account. This Offer cannot be used for any Scotiabank account including to transfer a balance from another Scotiabank account, or to make a payment or deposit to another Scotiabank account. Offer may be changed, cancelled or extended at any time without notice and cannot be combined with any other offers.

Losing your promotional rate: If we don’t receive the minimum payment on your Account by the payment due date on your statement, two times in any consecutive 12-month period, you will lose the benefit of this promotional rate Offer and the interest rates that apply on any unpaid balance will increase to the standard annual interest rates that apply to your Account (currently 24.99% on purchases and 27.99% on Cash Advances). All other terms and conditions of the Program Terms continue to apply during the Offer period.

How we apply payments: Your payment cannot be applied to the balance(s) of your choice. In general, if you make a payment that exceeds the minimum payment on your statement, we will apply your payment on a proportionate basis among each group of billed charges on your Account. We group charges based on the interest rate that applies to the group of charges. See your credit card agreement for more information about how we apply payments to your Account.

Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank business credit cardholders are also eligible for the Offer.

Rates and Fees: The current annual fee is $39 for the primary card and $15 for each additional card (including those issued to co-borrowers and supplementary cardholders). The current preferred annual interest rates for the Account are: 19.99% on purchases and 22.99% on Cash Advances. All rates, fees, features and benefits are outlined in the Application Disclosure Statement and are subject to change.

Offer Description and Conditions: The 5% Cash Back and Introductory 0% Balance Transfer Rate Offer (the “Offer”) applies only to new Scotia Momentum No-Fee Visa credit card accounts (“Accounts”) that are opened between March 3, 2025 and October 31, 2025 and is subject to the below terms and conditions. All other terms and conditions of the Program Terms continue to apply during the Offer Period. Offer may be changed, cancelled or extended at any time without notice and cannot be combined with any other offers.

5% Cash Back Offer Conditions: You will earn 5% cash back on the first $2,000 in eligible purchases you spend on your new Account within the first 3 months of the Account open date (the “Promotional Period”). Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers and cash-like transactions), interest, fees or other charges. After the Promotional Period, you will earn regular cash back on eligible purchases at the regular cash back rate (the “Cash Back Program Rate”) described in the Scotia Momentum No-Fee Visa Cash Back Program Terms and Conditions (the “Program Terms”). The 5% cash back rate for any category is made up of the sum of: (i) the regular Cash Back Program Rate (variable by categories as set out under the Program Terms); and (ii) a “Cash Back Bonus Rate”.

Cash back earned under this Offer will be credited to your Account in 2 installments so long as your Account is open and in good standing at time of payout of each:

1. Bonus Cash Back: The amount earned under the Cash Back Bonus Rate will be credited to your Account within approximately 7 months from the Account open date; and

2. Regular Cash Back: The amount earned under your regular Cash Back Program Rate will be credited to your Account according to the regular cash back payment schedule as set out under the Program Terms.

The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account.

EXAMPLE: If the Regular Cash Back Program Rate for the Groceries and Recurring Payments category is 1% then the Cash Back Bonus Rate will be 4% for that category so that you will earn a total of 5% on the amount of all eligible everyday purchases in that category during the Promotional Period. If you make $2,000 in eligible everyday purchases in the Groceries and Recurring Payments category, your cash back earnings will be credited to your Account as follows:

(1) the Cash Back Bonus earnings of $80 (4% x $2,000) (which will not be tracked on your monthly statements), will be credited to your Account within 7 months from the Account open date, and (2) the Regular Cash Back earnings of $20 (1% x $2,000) (which will be tracked on your monthly statements), will be credited to your Account as per the regular cash back payment schedule (i.e., November).

Introductory 0% Balance Transfer Rate Offer Description and Conditions: The Introductory 0% Balance Transfer Rate Offer (the “Rate Offer”) applies only to eligible cash advances (including balance transfers and cash-like transactions) (collectively “Cash Advances”) subject to the conditions below. This introductory rate applies if the new Account is opened between March 3, 2025 and October 31, 2025 and will continue for 6 months from date of Account opening (the “Promotional Period”). After the Promotional Period, the promotional 0% interest rate on any Cash Advances (including any amount of those Cash Advances that remain unpaid after the Promotional Period ends) will increase to the preferred interest rate on Cash Advances (currently 22.99%). A balance transfer fee of 2% of the amount of each Cash Advance transferred or made during the Promotional Period applies (minimum fee of $5.00). This Rate Offer is subject to any available limit for Cash Advances on your Account. This Rate Offer cannot be used for any Scotiabank account including to transfer a balance from another Scotiabank account, or to make a payment or deposit to another Scotiabank account.

Losing your promotional rate: If we don’t receive the minimum payment on your Account by the payment due date on your statement, two times in any consecutive 12-month period, you will lose the benefit of this promotional Rate Offer and the interest rates that apply on any unpaid balance will increase to the standard annual interest rates that apply to your Account (currently 24.99% on purchases and 27.99% on Cash Advances). All other terms and conditions of the Program Terms continue to apply during the Offer period.

How we apply payments: In general, if you make a payment that exceeds the minimum payment on your statement, we will apply your payment on a proportionate basis among each group of billed charges on your Account. We group charges based on the interest rate that applies to the group of charges. Your payment cannot be applied to the balance(s) of your choice. See your credit card agreement for more information about how we apply payments to your Account.

Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank business credit cardholders are also eligible for the Offer.

Rates and Fees: There is currently no annual fee for the primary card and no fee for each additional card (including those issued to co-borrowers and supplementary cardholders). The current preferred annual interest rates for the Account are: 19.99% on purchases and 22.99% on Cash Advances. All rates, fees, features and benefits are outlined in the Application Disclosure Statement and are subject to change.

Offer Description and Conditions: The 5,000 Bonus Scene+ Points Offer (the “Offer”) applies only to new Scotiabank Scene+ Visa credit card accounts (“Account”) opened between March 3, 2025 and October 31, 2025 and is subject to the below terms and conditions.

To be eligible for 2,500 bonus Scene+ points (the “2,500 Point Bonus”), you must have at least $250 in eligible purchases posted to your new Account in the first 3 months of the Account open date. To be eligible for an additional 2,500 bonus Scene+ points (the “Additional 2,500 Point Bonus”), you must have at least $1,000 in eligible purchases posted to your new Account in your first 3 months of Account open date. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

The applicable point Bonus(es) will be credited to the Scene+ account within approximately 8 weeks after qualifying for a Bonus, provided the Account is open and in good standing. For Joint Accounts with a Primary Borrower and Co-borrower, the applicable point Bonus will be credited as follows: (i) the 2,500 Point Bonus and Additional 2,500 Point Bonus will be credited to the Scene+ account linked to the Account of the borrower that completed the last transaction to meet the qualifying amount of eligible purchases (i.e., $250 or $1,000) in the appropriate time frame (i.e., first 3 months). If a supplementary cardholder completes the last qualifying transaction to meet the qualifying amount of eligible purchases for the 2,500 Point Bonus or the Additional 2,500 Point Bonus, the applicable point Bonus will be credited to the Primary Borrower’s Scene+ account linked to the Account. Points can be transferred between Primary and Co-Borrower or Supplementary Cardholder’s Scene+ accounts by contacting Scene+. The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account. All other terms and conditions of the Program Terms continue to apply during the Offer period. Offer may be changed, cancelled or extended without notice at any time and cannot be combined with any other offers.

Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank business credit cardholders are also eligible for the Offer.

Rates and Fees: There is currently no annual fee for the primary card and no fee for each additional card (including those issued to co-borrowers and supplementary cardholders). The current preferred annual interest rates for the Account are: 20.99% on purchases and 22.99% on cash advances (including balance transfers and cash-like transactions). All rates, fees, features and benefits are outlined in the Application Disclosure Statement and are subject to change.

Regular Earn Rate: You are awarded one (1) Scene+ Point for every $1.00 in all purchases of goods and services charged to the Scotiabank Scene+ Visa Account (the “Account”).

Accelerated Earn Rates: You will earn accelerated earn rates on the following eligible purchases charged to the Account:

Grocery Stores

You are awarded two (2) Scene+ Points for every eligible $1.00 purchase made at Sobeys, Safeway, participating IGA, Foodland, Foodland & Participating Co-ops, FreshCo, Chalo! FreshCo, Thrifty Foods, Rachelle Béry, Les Marchés Tradition, Voilà by Sobeys, Voilà by Safeway and Voilà par IGA locations charged and posted to the Scotiabank Scene+ Visa Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores.

Home Hardware Stores

You are awarded two (2) Scene+ Points for every eligible $1.00 purchase made at eligible Home Hardware, Home Building Centre, Home Hardware Building Centre, Home Furniture locations in Canada and online at homehardware.ca charged and posted to the Scotiabank Scene+ Visa Account. The list of eligible locations may be changed from time to time without notice. See full list of eligible locations across Canada at scotiabank.com/participatingstores.

Cineplex

You are awarded two (2) Scene+ Points for every $1.00 purchase made at Cineplex theaters, the Cineplex App and online at cineplex.com charged and posted to the Account.

Eligibility: Only purchases earn Scene+ Points. Cash advances (including Balance Transfers, and Cash-Like Transactions), fees, interest or other charges, returns, refunds or other similar credits to your Account do not qualify for Scene+ Points. Scene+ Points will not be posted to an Account that is not in good standing when purchases are made or when a statement is issued, or if the Account is not open when a statement is issued. See your Scene+ Points terms at www.scotiabank.com/sceneplus for full program details.

All dollar amounts are in Canadian currency unless otherwise stated.